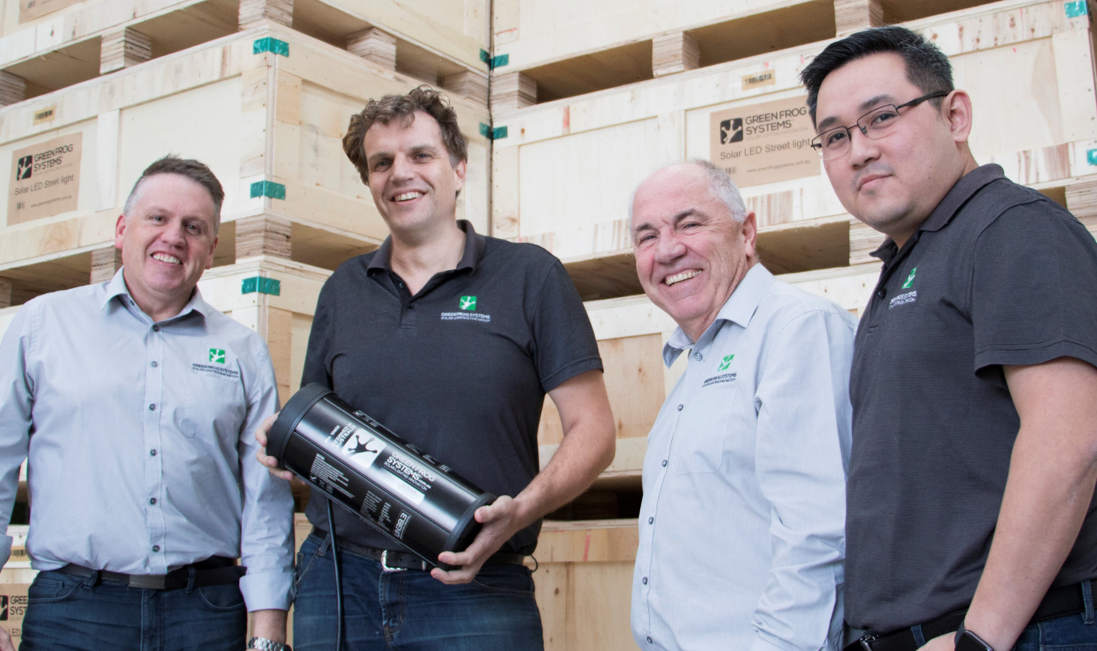

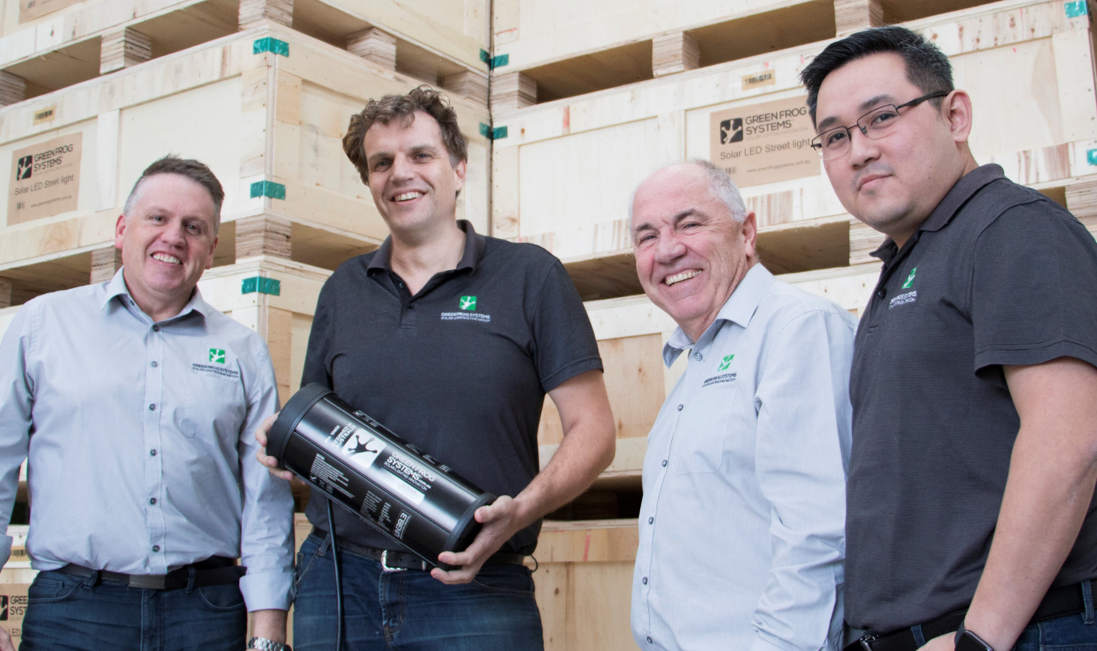

Green Frog Systems

Green Frog Systems is a South Australian-based business that designs and manufactures innovative solar lighting products.

Need

When an international customer approached them with a large order during COVID-19, Green Frog Systems needed financial support to fulfil the order.

Solution

Our Small Business Export Loan allowed Green Frog Systems to buy bulk material upfront and provide their customer with trading terms that managed both parties’ business risks.

Green Frog Systems designs and manufactures innovative solar lighting products, such as kit-form lighting that a layperson can install in under 30 minutes. The South Australian business manages its design and R&D from Adelaide, and uses international engineers, test sites and a global manufacturing supply chain.

Since first exporting to the UAE in 2012, Green Frog Systems has experienced strong international growth. It sells to the lucrative US market, as well as to New Zealand, Hong Kong, the Middle East and the UK.

When an international customer approached them in the middle of the COVID-19 outbreak with a large potential order, Green Frog System’s CEO and Founder, David Wilson, turned to us for support.

“The client couldn’t pay up front and needed trading terms,” David explained.

“Export Finance Australia made it easy for us to borrow money, so I could give the client a decent set of trading terms that managed their COVID-19 risk – as well as ours.”

Export Finance Australia is brilliant. It's a painless, quick way to get a competitive interest rate and get your orders going. I absolutely recommend them.

David Wilson

CEO and Founder, Green Frog Systems

Reduced costs and satisfied customers

Our Small Business Export Loan enabled Green Frog Systems to secure a large forward order in the middle of an economically challenging time. It also meant the business could make bulk material purchases upfront – reducing their costs and boosting its margins.

David worked with our SA and NT Business Development Director, Andrew Perkins, to determine whether his business would qualify for a loan.

“Andrew is fantastic, because he has an incredible understanding of the challenges businesses have, and of his own program,” David said.