Chile

Chile

Last updated: December 2023

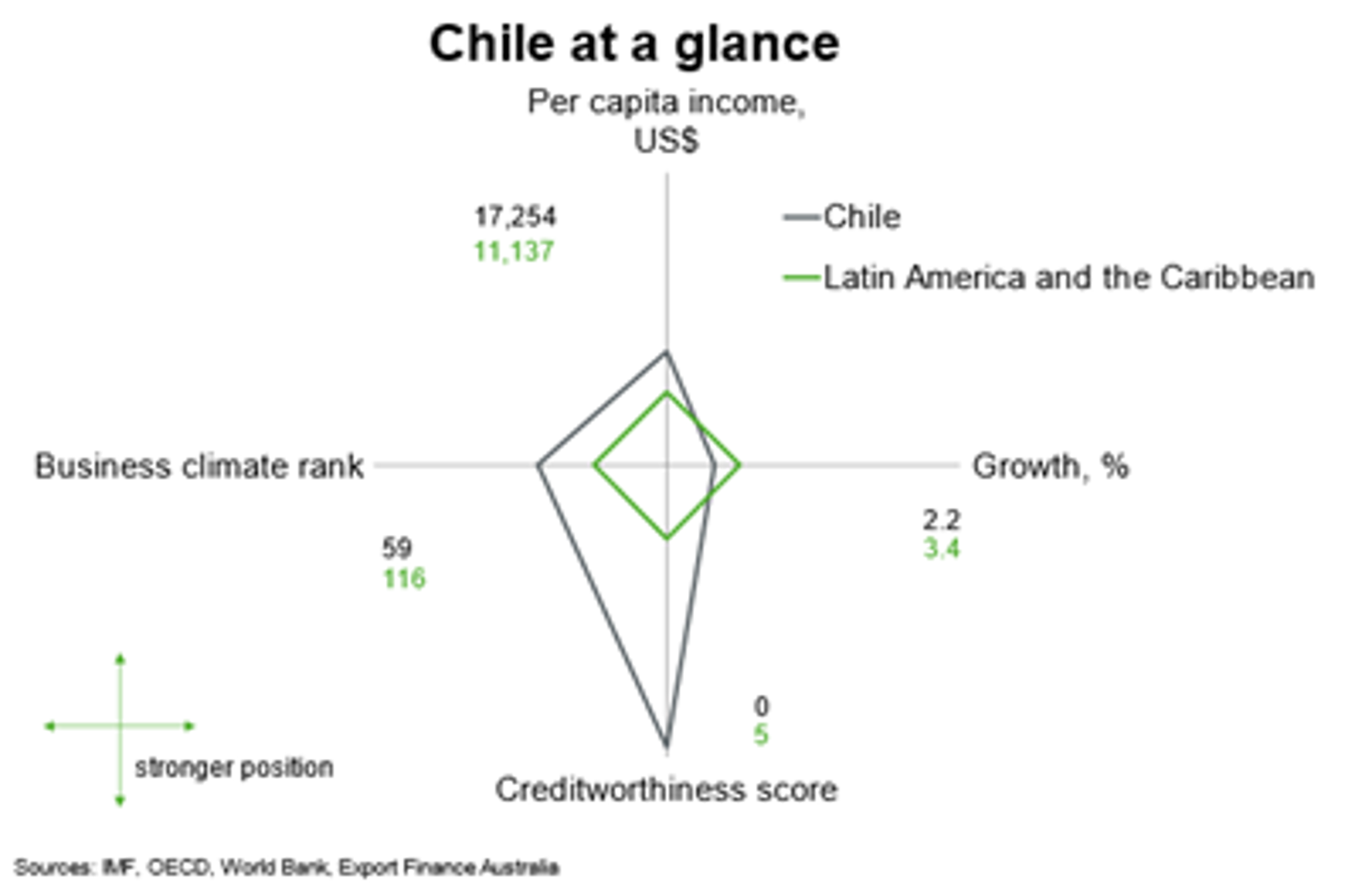

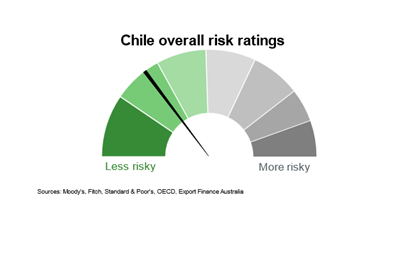

Chile has higher per capita incomes, a stronger business climate rank and creditworthiness score compared to its neighbours in the Latin America and Caribbean region. Growth projections lag behind the region. The minerals sector remains a strong driver of Chile’s economy and export base, but ongoing global uncertainty creates volatility around commodity prices and demand.

| The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region. |

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic outlook

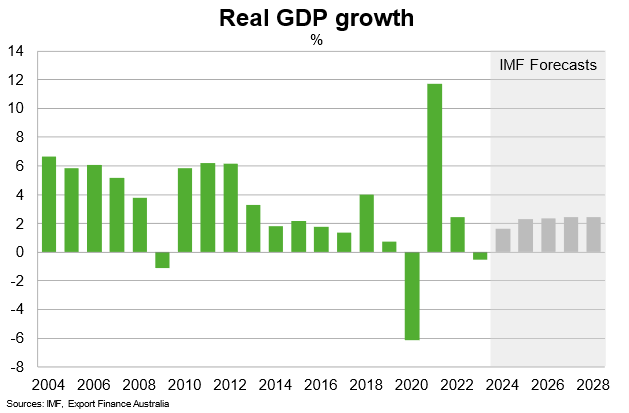

Real GDP contracted 0.5% in 2023 from growth of 2.4% in 2022. That largely reflected weaker domestic demand; investment and consumption suffered due to the unwinding of large stimulus in 2022, high inflation, tighter monetary policy, weak labour market conditions and political uncertainty. On the plus side, a fall in imports and continued demand for minerals helped sustain net exports.

The Chilean economy is well positioned to benefit from the global shift to renewable energy over the coming years, supporting demand for Chilean copper and lithium. The IMF forecasts a return to growth of 1.6% in 2024 on the back of easing global monetary policy and rising real wages due to falling inflation. Recovering business confidence and lower borrowing costs should support stronger fixed investment growth in 2024. Chileans rejected a second constitutional reform in an exit referendum held in December, having also rejected the previous draft constitution in September 2022. President Gabriel Boric has indicated that he would not launch a third process. In general, political polarisation and policy uncertainty will likely remain high as the government aims to pass key reforms (around taxation, pension and greater state involvement in mining) in the opposition-dominated Congress ahead of an election in 2025.

Risks to this outlook are tilted to the downside. Slower than projected growth in China would hurt exports and growth, given China is Chile’s main export market. Climate change events could hurt supply chains in addition to any potential political unrest in the region. In general, an abrupt global slowdown and sharply tighter financial conditions could result in lower and more volatile prices and demand for commodities that hinders Chile’s exports.

The long term outlook is positive. The global shift towards electrification is likely to continue supporting exports of Chilean metals and minerals, employment and tax receipts. Chile has the potential to become a major global player in large-scale clean energy projects due to the abundance of renewable resources. For example, the World Bank approved a US$150 million loan to promote investment in green hydrogen projects in Chile, which if successful will benefit local communities. To enhance living standards and long term economic development, the proposed fiscal pact outlines efforts to increase public expenditure and promote investment. If successful, this could make the economy more inclusive and dynamic.

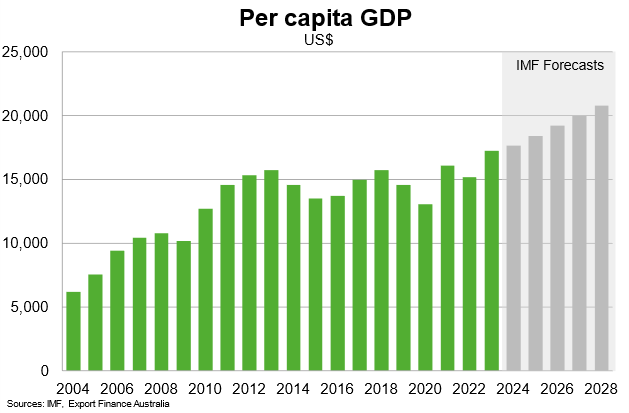

Household incomes have been volatile in the face of the pandemic-induced downturn, tight fiscal and monetary policy and global economic uncertainty. Incomes should strengthen in coming years amid ongoing demand for Chilean metals and minerals and easing fiscal and monetary policy. The IMF expects GDP per capita to increase towards US$21,000 in 2028 from around US$17,000 in 2023.

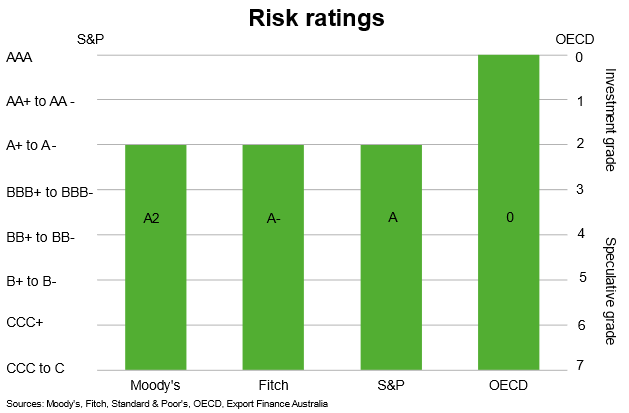

Country risk

Country risk in Chile is low. Chile is unrated by the OECD given its high income status. The three major ratings agencies have investment grade sovereign credit ratings, indicating a high chance the country will be able to meet its external debt obligations.

The risk of expropriation is low. However, the US investment climate states that Chilean law grants the government authority to expropriate property, including property of foreign investors, only on public interest or national interest grounds. The government has not nationalised a private firm since 1973. Expropriations of private land take place in a transparent manner, typically when the purpose is to build roads or other types of infrastructure.

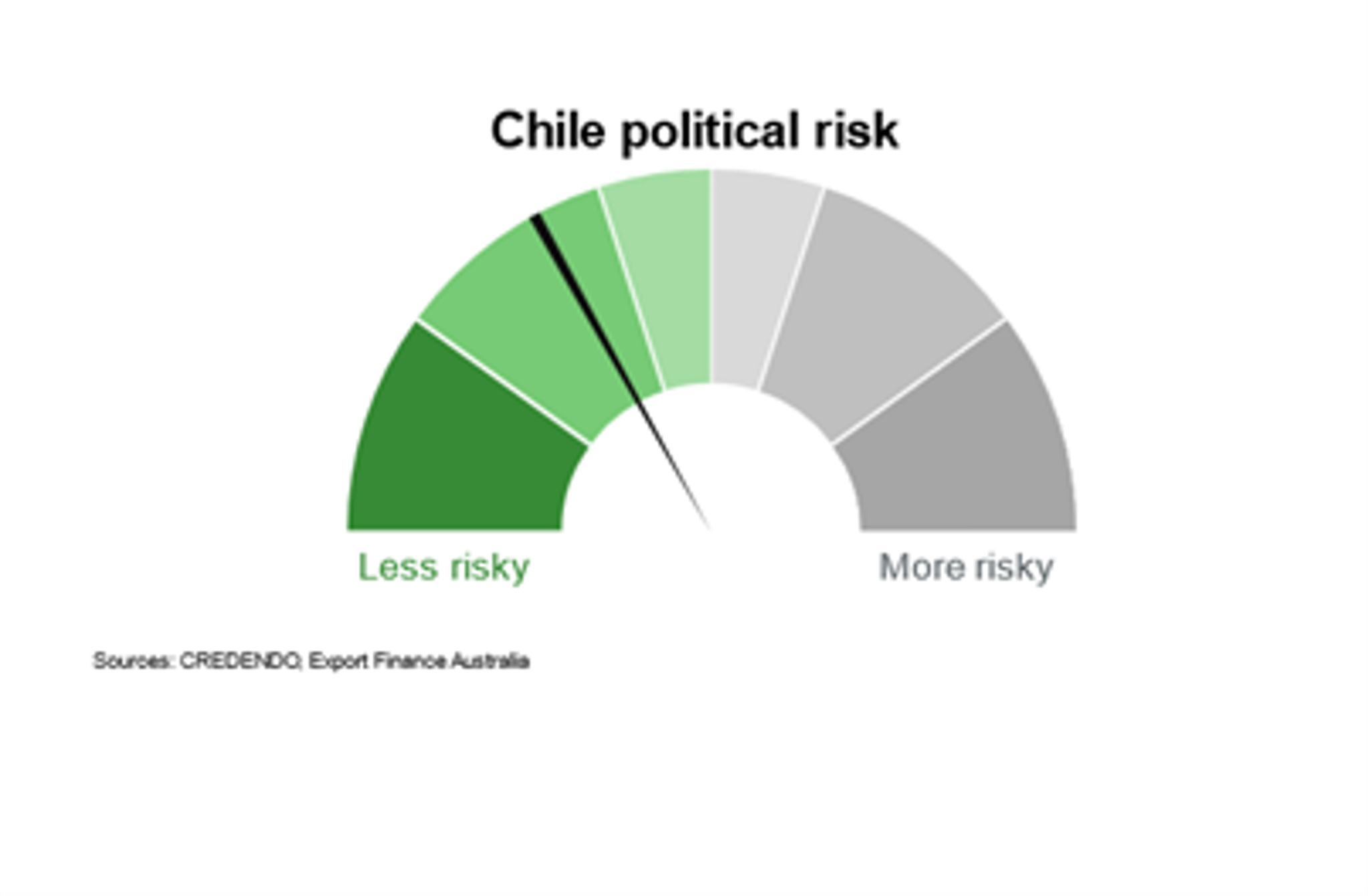

Political risk is low to moderate and includes risks related to elections in 2024 and 2025 and consequent uncertainty in economic reform implementation.

Chile scores highly on Worldwide Governance indicators of control of corruption, rule of law, regulatory quality, government effectiveness and voice and accountability. Chile outperforms the Latin America and the Caribbean average on most indicators.

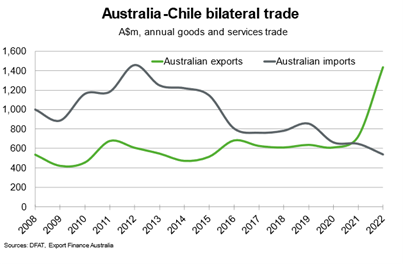

Bilateral relations

Chile was Australia’s 44th largest trading partner in 2022. Total goods and services trade amounted to $2 billion in 2022, up more than 44% from 2021, though a little lower than the peak of $2.1 billion in 2012. The sharp jump in Australian exports to Chile in 2022 reflects in large part higher coal exports. High temperatures and droughts caused by El Nino led to reduced hydropower energy in Chile—the country’s dominant energy source—resulting in higher coal imports to power manufacturing activity. In general, energy shortages and higher global prices in the wake of Russia’s war in Ukraine contributed to higher Australian coal export values.

Major exports to Chile include coal, tools and devices, civil engineering equipment and parts, and mechanical handling equipment and parts. Fruit, ores and concentrates, woods, paper and paperboard, and veneers, plywood and particle boards were Australia’s biggest imports from Chile in 2022.

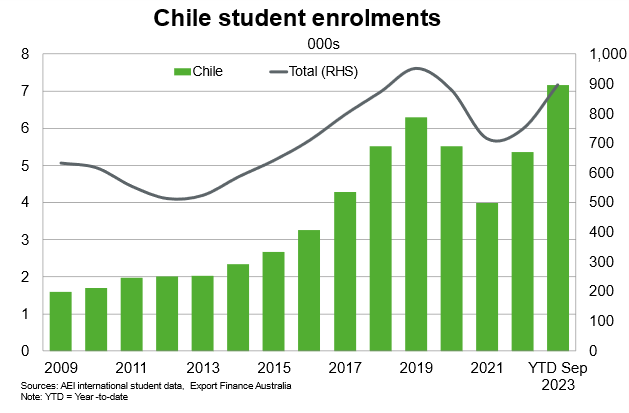

Student enrolments have continued their rebound from 2021 lows of 4,000 to 7,200 year-to-date in September 2023 in line with the trend of increasing total student enrolments following the easing of pandemic restrictions. A sharp rise in students studying English-language courses, or ELICOS, from 14,000 in 2021 to 30,000 through September 2023 is driving Chilean student enrolments in Australia.

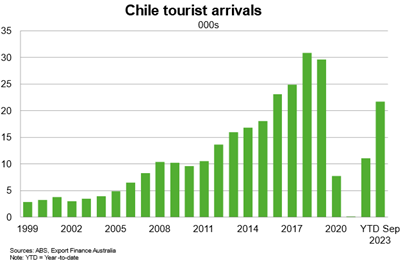

Tourists arrivals from Chile reached nearly 22,000 through September 2023, continuing their recovery from the pandemic, but are still well below peak levels of 30,000 in 2018 and 2019. A competitive Australian dollar and another year of recovery in international travel should support further demand for Australian tourism, and broader services exports, in 2024.

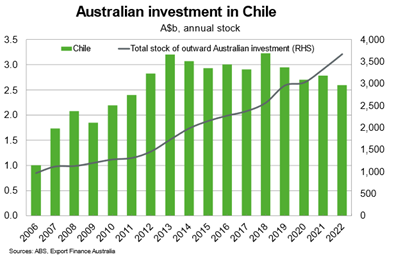

The bilateral investment relationship is dominated by Australian investment in Chile. The stock of Australian investment in Chile totalled $2.6 billion in 2022, led by mining, infrastructure and renewable energy. Australian investment in these sectors is likely to remain high due to the global shift towards net zero global emissions; for example, BHP has announced plans to invest more in Chile’s copper sector. The trade and investment relationship between the two countries is reinforced by the Australia-Chile Free Trade Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership.