India

India

Last updated: February 2024

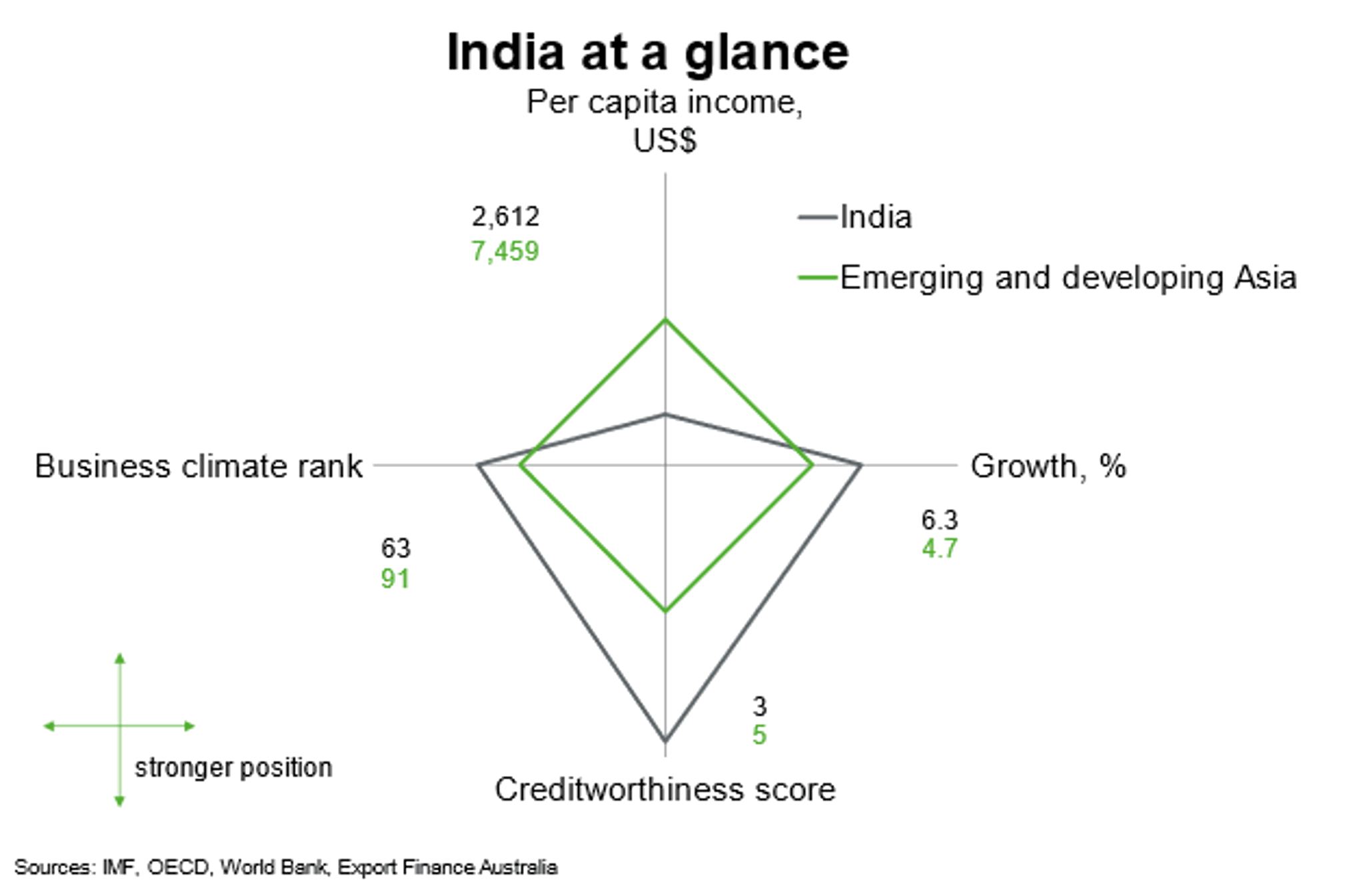

India is the world’s 5th largest economy and most populated country.

The stock market has climbed to be the fourth largest by market capitalisation in early 2024. Economic growth, creditworthiness and business climate indicators are above the emerging and developing Asian average. But per capita income lags most regional peers.

This chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other regional countries.

Economic outlook

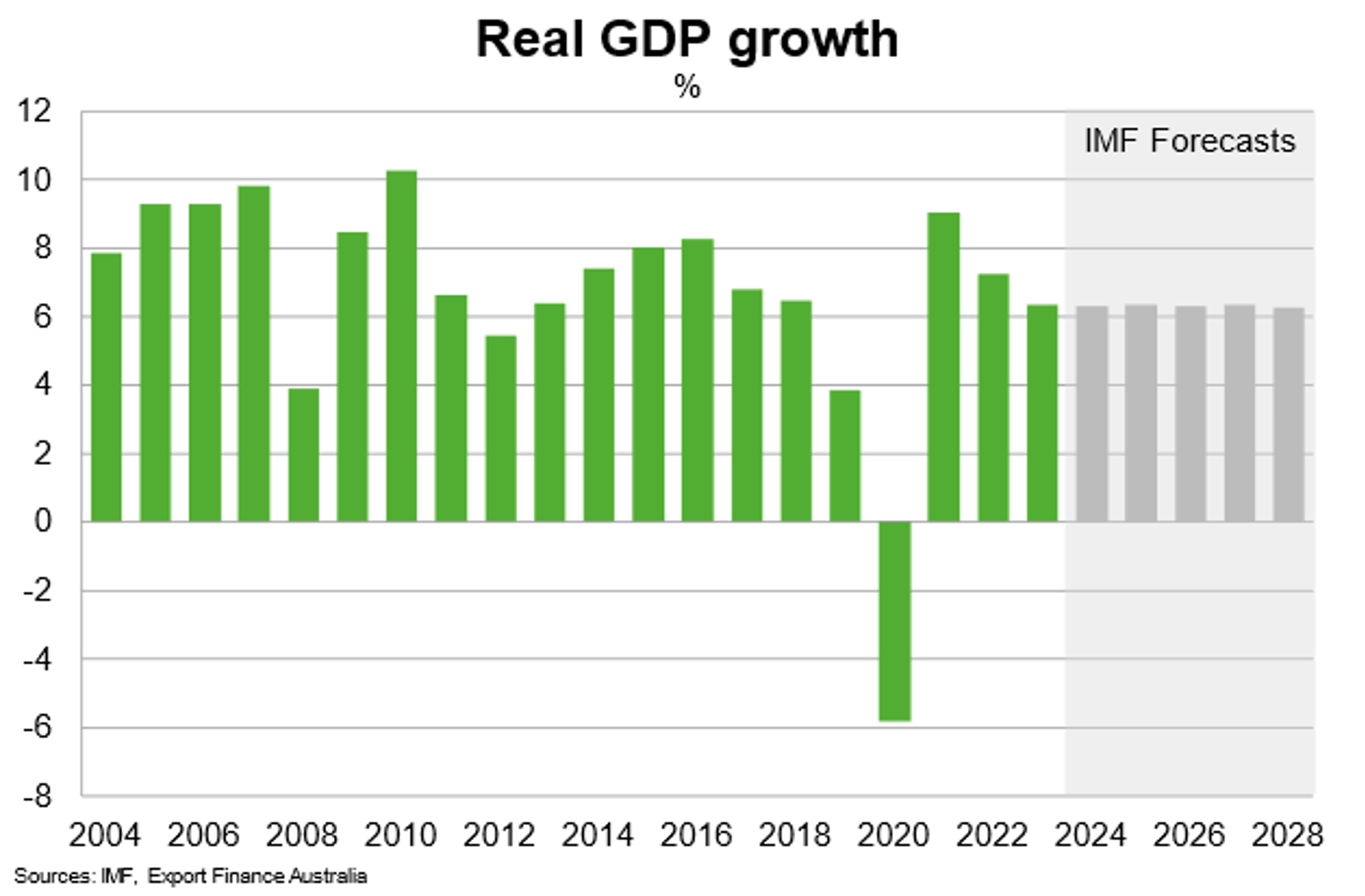

India’s economic growth moderated to a still-strong 6.3% in 2023 from 7.2% in 2022. Growth has been underpinned by resilient domestic demand, including robust public capital expenditure on infrastructure. Fading pent-up demand following the pandemic, tight monetary policy and high inflation due to weather-induced food shortages weighed on consumption. Merchandise trade remained subdued amid waning external demand and agricultural export bans to maintain domestic supplies. But services exports continued to benefit from growing demand for business outsourcing. As a net importer of commodities, in particular crude oil, easing global energy prices have reduced manufacturers input costs.

The IMF forecasts India’s economy to maintain robust growth of 6.5% in 2024 and 2025, as increasing government spending on infrastructure crowds-in private investment. Increased capital expenditure is a primary focus of the 2024-25 interim budget; allocations are 11.1% higher than in 2023-24. This should help increase domestic productive capacity, create jobs and support domestic demand. The absence of tax cuts and social expenditure measures in the budget suggests limited boost for household consumption, and indicates the government remains committed to fiscal consolidation. Public spending on the Mahatma Gandhi National Rural Employment Guarantee Scheme, aimed at providing employment for every rural household, remains a notable feature in the 2024/25 budget. India is poised to continue to benefit from manufacturers looking to diversify their supply chains from China and other countries, given its status as an export hub and investment destination for manufacturing and services. Goods exports are likely to face pressure from a challenging global backdrop, though services are likely to continue to perform well. Without any significant shocks, the OECD predicts interest rate cuts to occur from mid-2024, as inflation eases.

Downside risks to growth include a sharper than expected slowdown in the global economy, higher energy prices that further raise the import bill and delays in fiscal consolidation that worsen the government’s debt burden. A below-normal monsoon season could also hurt agricultural output, raise inflation and lower productivity.

India’s longer-term outlook remains robust. The IMF projects growth to average more than 6% per annum beyond 2025, supported by the government’s reform agenda and ongoing investment in infrastructure that enhances economic development. The government's production-linked incentive scheme offers financial incentives to boost domestic manufacturing, lift foreign direct investment, support labour reform and create a 'bad bank' to manage financial issues. The privatisation of state-owned enterprises through the National Monetisation Pipeline (of public entities) should support the government’s balance sheet while also helping foster higher competitiveness and productivity. In general, India's youthful demographics, burgeoning consumer class, ongoing urbanisation, increasing infrastructure investment and the digitalisation and formalisation of its economy will sustain growth over the longer term. The country’s push towards green energy through solar power also offers growth opportunities in new industries.

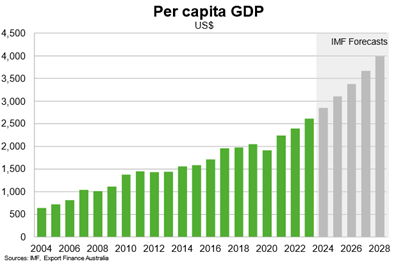

Robust GDP growth over the past couple of years helped GDP per capita rise to around US$2,600 in 2023. Ongoing solid GDP growth and increasing infrastructure development should help create jobs and lift incomes to US$4,000 by 2028, according to IMF projections.

Country risk

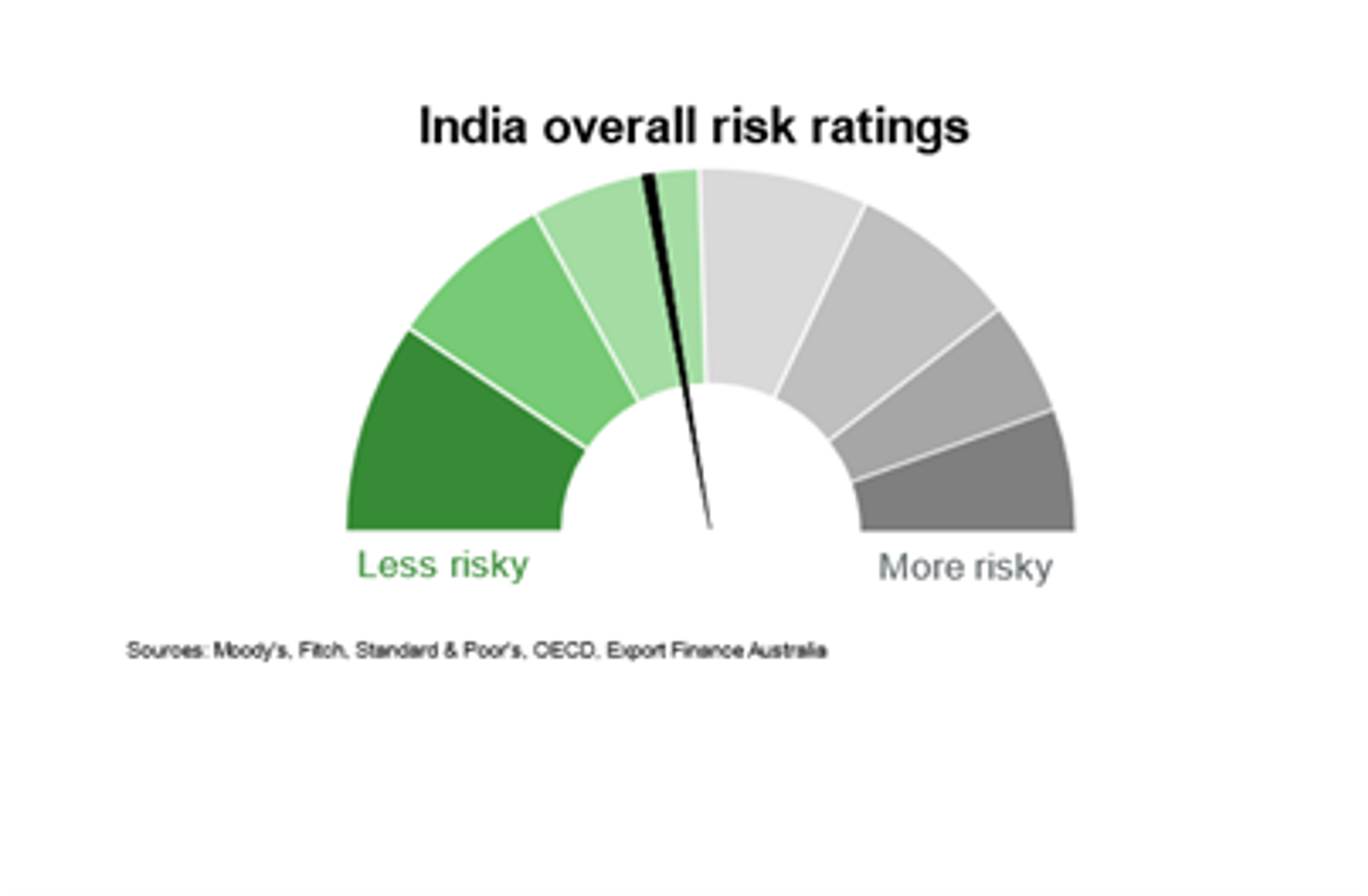

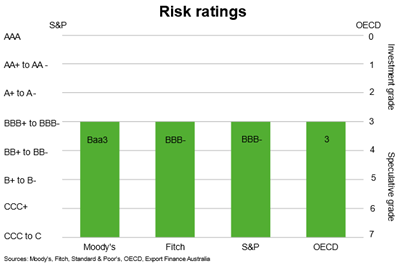

Country risk is low to moderate in India. The OECD country risk grade is 3; comparable with the Philippines, Thailand and Indonesia. This indicates a relatively low to moderate likelihood that India will be unable and/or unwilling to meet its external debt obligations.

The risk of expropriation in India is low to moderate. According to the US investment climate statements, the government does not have expropriation laws in place. But the government has taken several measures, including implementation of transfer pricing, the introduction of a goods and services tax in 2017 and new insolvency and bankruptcy laws to help strengthen business regulations. The Indian government has been divesting from state owned enterprises (SOEs) since 1991, and has committed to continuing to do so, to help raise government revenue without increasing taxes and reduce the role of the government in the economy.

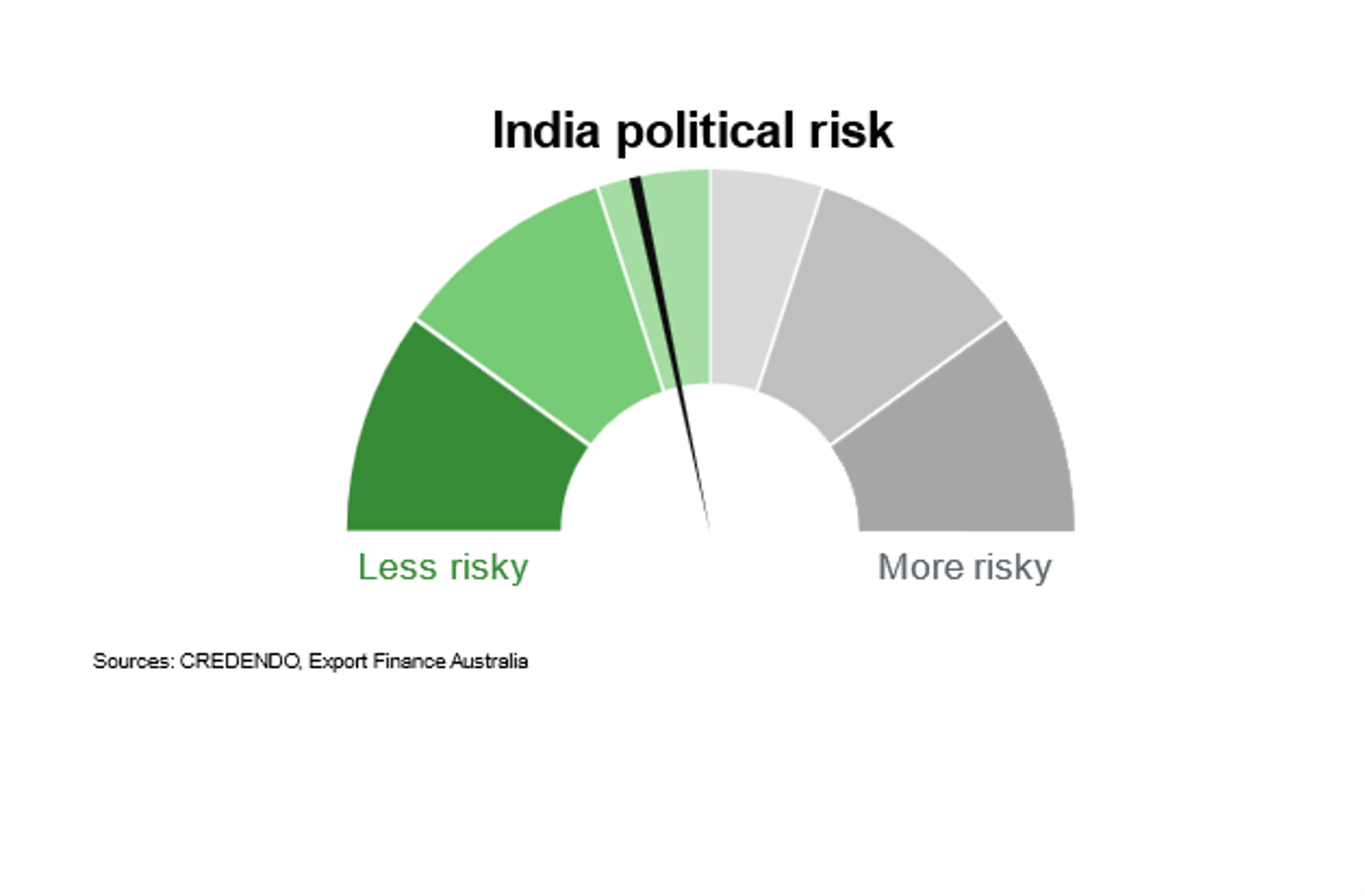

India’s political risk is low to moderate. The domestic political environment remains stable. On the external front, the ongoing Kashmir conflict between India and Pakistan poses military risks, while longstanding border issues with China remain prominent. Such disputes, if they escalate, could weigh on business confidence and foreign investment and undermine economic growth.

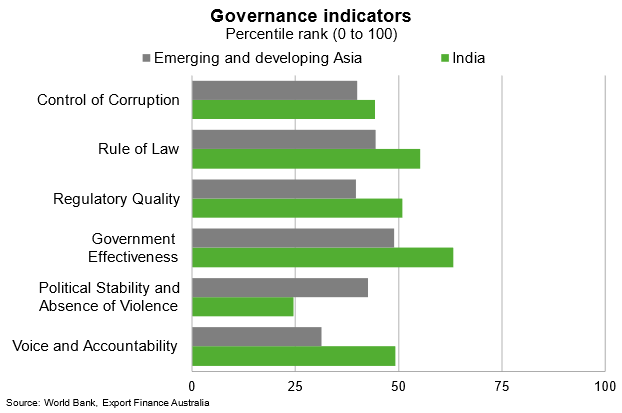

India scores above the emerging and developing Asian averages on all governance indicators, except for political stability and absence of violence.

Bilateral relations

India is Australia’s 6th largest trading partner. Total goods and services trade amounted to $48.4 billion in 2022, up from $34.3 billion in 2021. Australian exports of goods and services contributed the lion’s share, at $34.9 billion. Goods exports are dominated by coal, education related travel, gold, and copper ores and concentrates. Imports from India include refined petroleum, medicaments, telecom and ICT services, technology and other business services and medicines. The continued sharp widening of Australia’s trade surplus with India can be attributed to a rise in demand for, and prices of, Australian energy exports, particularly coal.

The Australia-India Economic Cooperation and Trade Agreement (ECTA) entered into force in December 2022 has, and will continue to, deepen economic and trade links between Australia and India. ECTA enables Australian goods exporters to obtain preferential access to the large Indian market, as tariffs on 96% of exports to India are reduced. Since its enactment, Australian exports of a wide range of products have risen substantially.

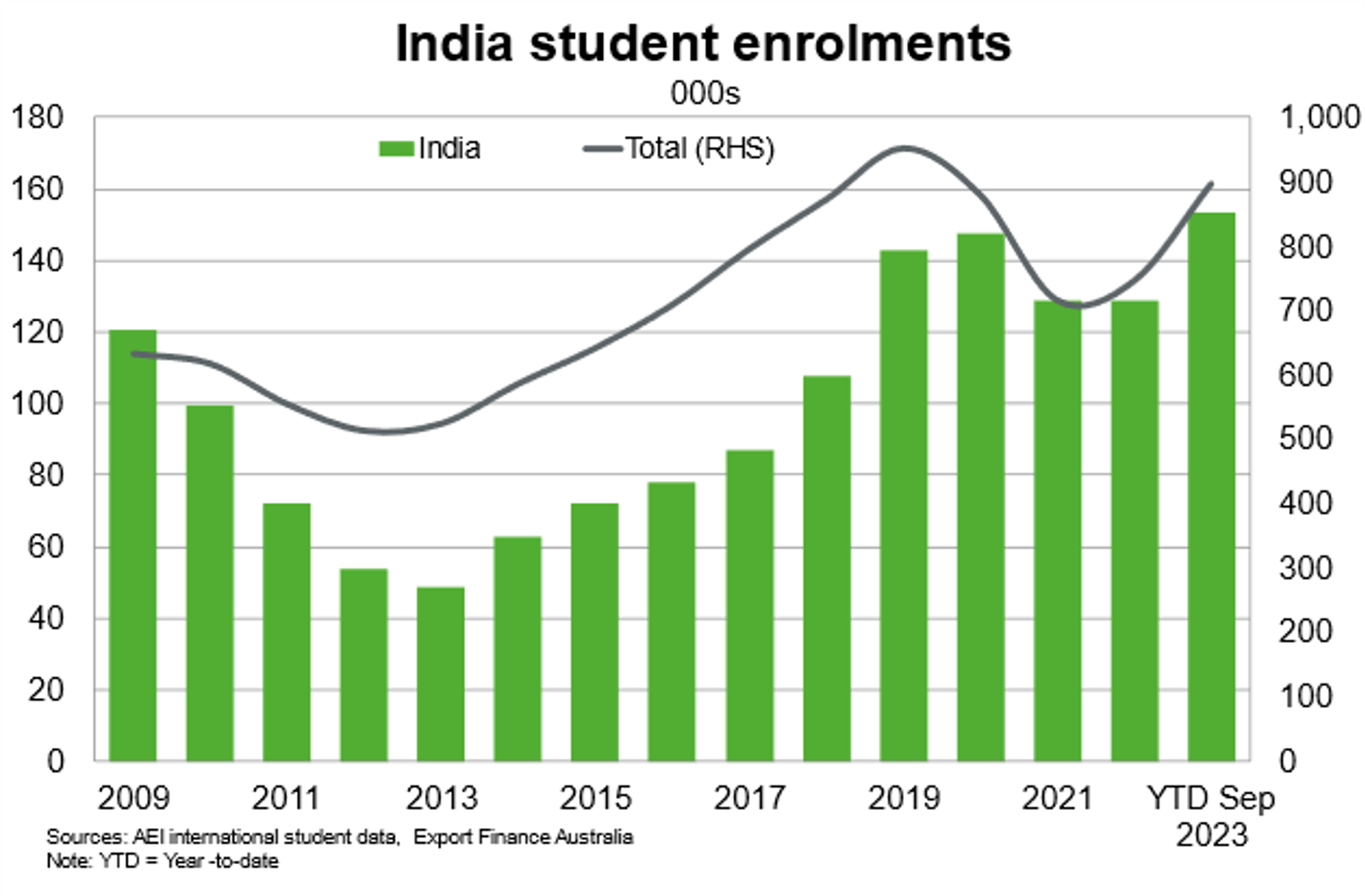

Education is Australia's largest service export to India; Indian students make up the 2nd largest source of student enrolments in Australian universities. The Australian government’s India Economic Strategy to 2035 prioritises education as a flagship sector, by expanding the Indian student base, deepening the research and innovation relationship and creating further platforms for online delivery. This already has, and should continue to, support Indian student enrolments in Australia.

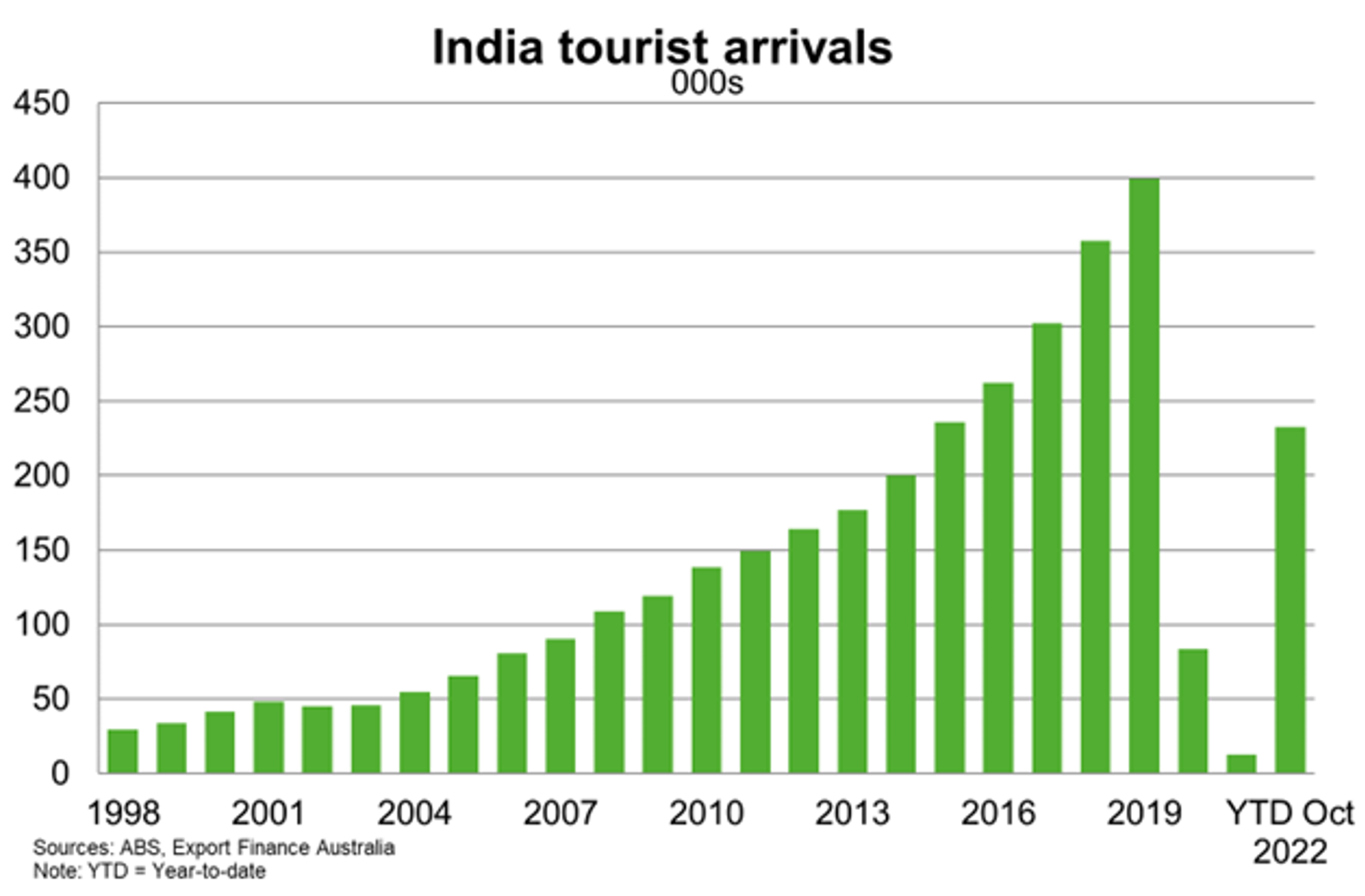

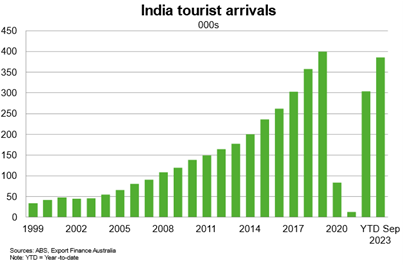

India is also an important source of tourists. Tourist arrivals from India have rebounded strongly toward pre-pandemic levels as international border restrictions have eased. A competitive Australian dollar and another year of recovery in international travel should support further demand for Australian tourism, and broader services exports, in 2024.

India is also an important source of tourists. Tourist arrivals from India have rebounded strongly as international border restrictions have eased. Another year of open international borders, rising Indian incomes, Australia’s geographic proximity, a growing bilateral relationship and close economic and cultural ties with India should support further recovery in tourism ahead.

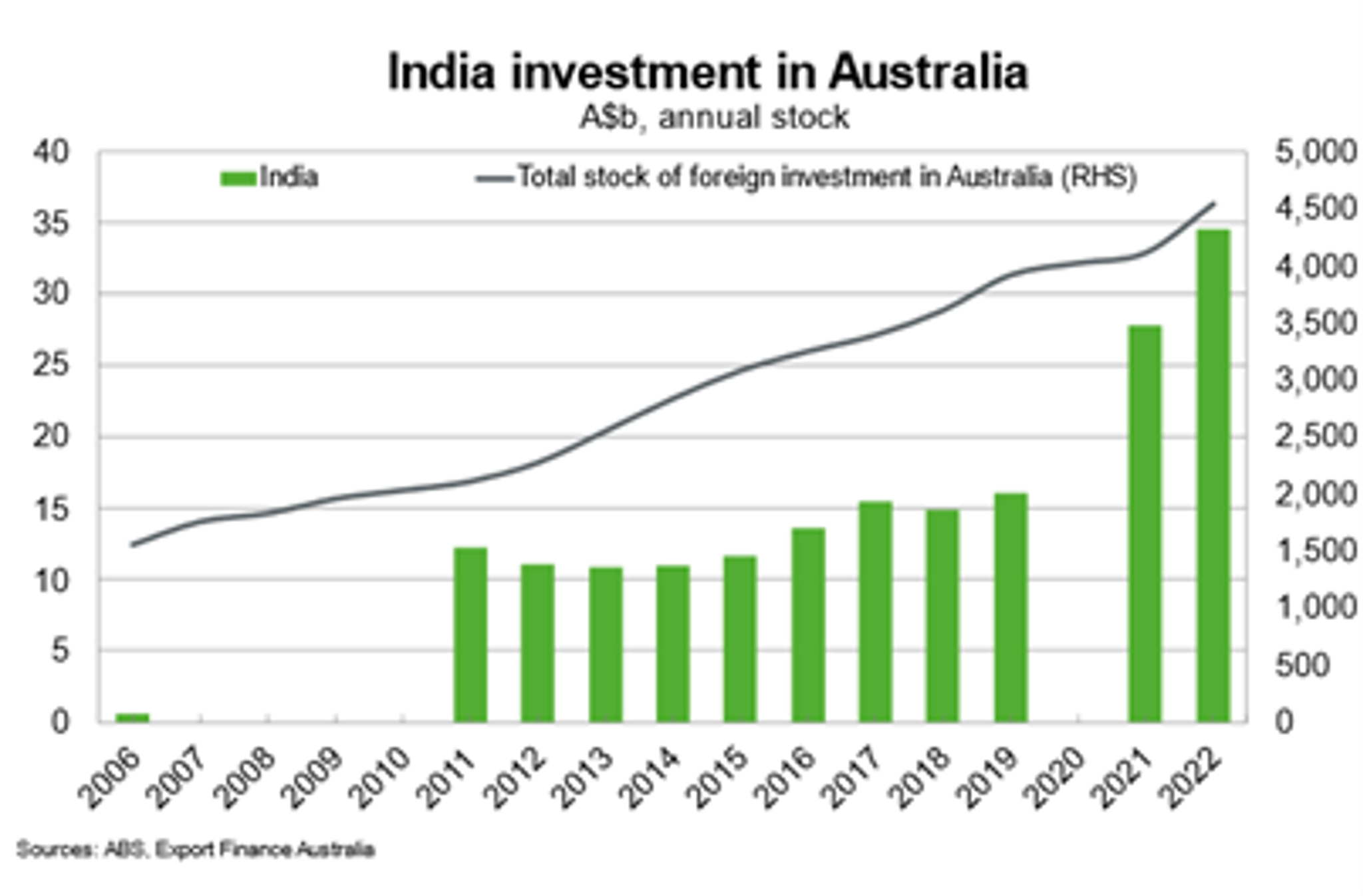

Indian investment in Australia continued to increase significantly, to $34.5 billion in 2022. Indian investment is primarily focused on developing critical minerals (including copper and lithium) to enhance its supply chains for these commodities. On the other side, the stock of Australian investment in India fell to $17.6 billion in 2022 from $19.8 billion in 2021, having oscillated between US$15 billion and US$20 billion since 2018. Australian mining firms such as BHP Billiton, Rio Tinto, and engineering firms such as Snowy Mountains Engineering and CIMIC Group have large operations in India. The Australia India Business Exchange (AIBX) program, a multi-year government program, provides a range of services to support Australian businesses to enter and establish in India. These services include industry specific insights, guidance on doing business in India and assistance in entering India’s online retail market.

Useful links

Department of Foreign Affairs

Australia-India Comprehensive Economic Cooperation Agreement

Austrade