Japan

Japan

Last updated: February 2024

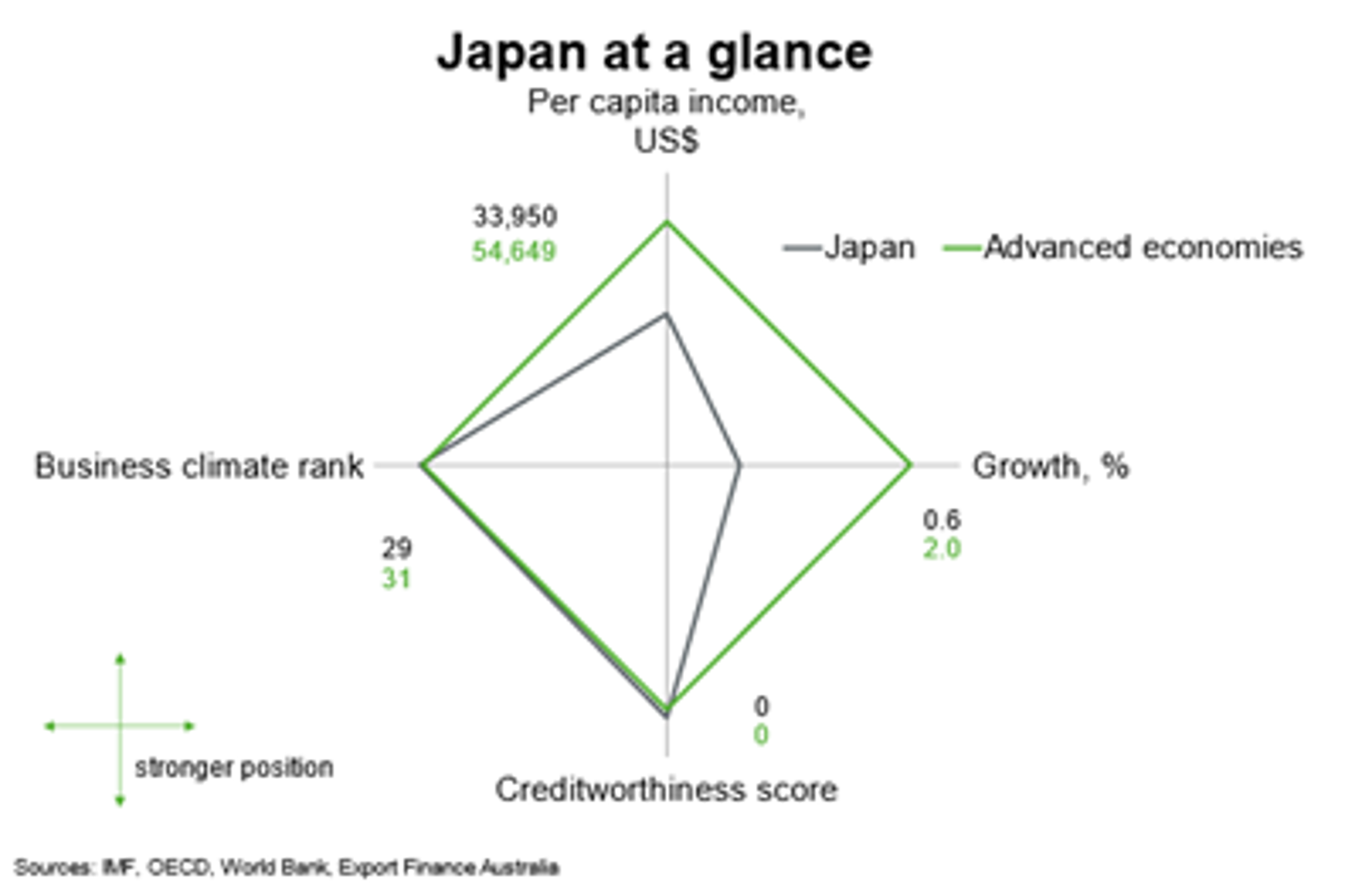

Japan is the 4th largest economy in the world, behind the US, China and Germany. Japan’s per capita incomes are high but below that of other advanced economy peers, while indicators on the business climate and creditworthiness are in line with other advanced economies. Japan significantly lags on GDP growth.

This chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other regional countries.

Economic outlook

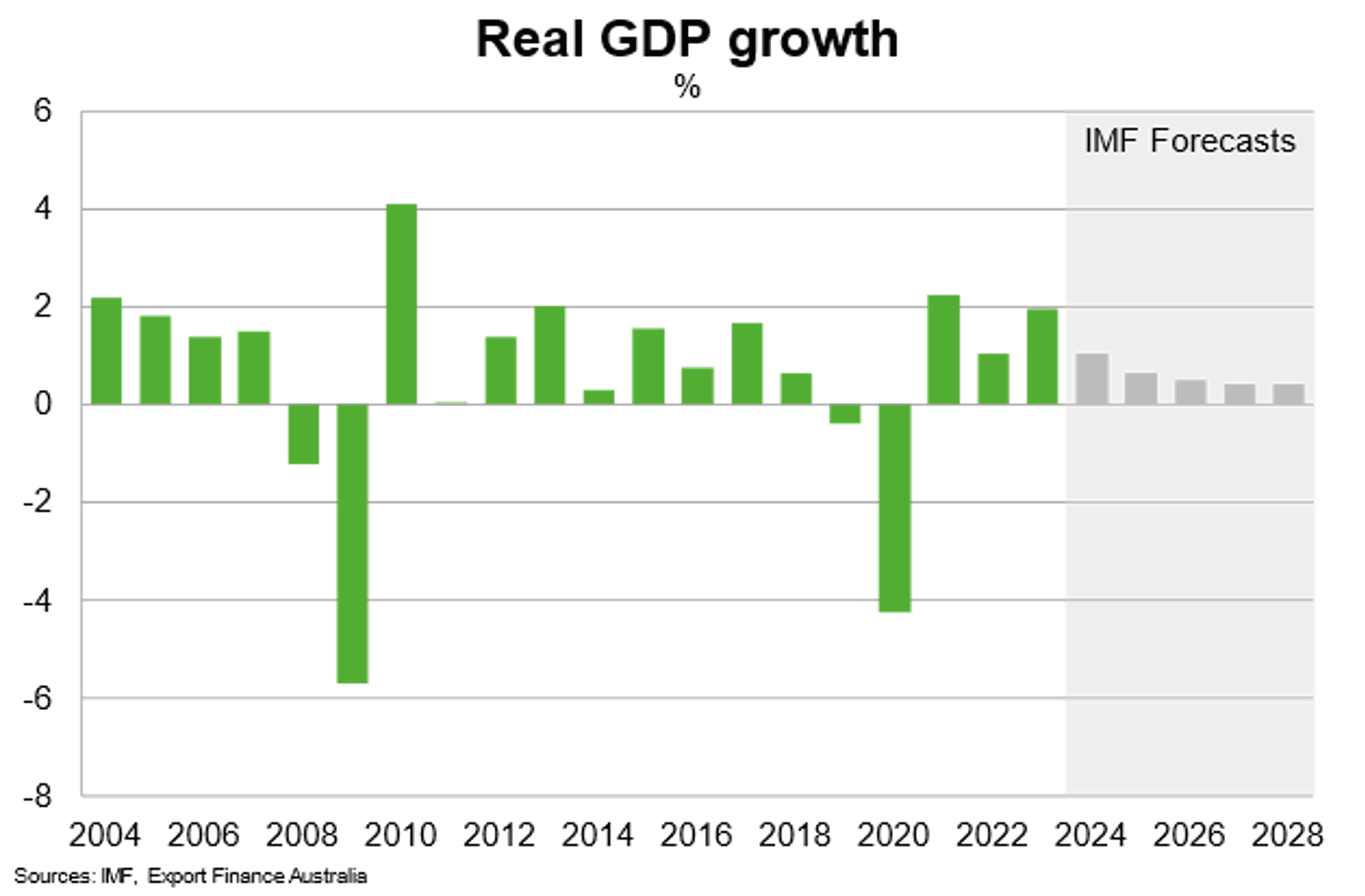

Real GDP grew 1.9% in 2023. The post-pandemic surge in tourism helped boost growth, alongside an extension of government energy subsidies. Rising merchandise exports are supporting the manufacturing sector; a lot of this growth is coming from motor vehicle production and exports, which faced pent-up demand following supply chain disruptions. Consumer spending spending remained sluggish as inflation outpaced wage growth; inflation averaged 3.2% in 2023, whilst wage growth reached 2.3% year-over-year in October.

As tailwinds from the reopening of COVID-19 restrictions reduce and pent-up demand pressures rewind, the IMF expect the economy will grow at a slower pace of 0.9% in 2024. Services exports are likely to continue to grow as international travel furhter recovers, while the oulook for merchandise exports is supported by gradual improvements in external demand and the weak Japanese yen. That said, China’s slowdown suggests pressure on capital goods exports. The Bank of Japan hiked interest rates in early 2024, but is likely to maintain an overall accommodative stance on policy rates. Wage rises and economic stimulus measures are likely to support private consumption and business investment.

Risks to the outlook are mixed. Rising interest rates may help to curb inflation and encourage households to invest. But the potential for upside pressure on the Japanese yen would hurt export competitiveness. Rising interest rates could also raise concerns around debt repayments; Japan’s public debt-to-GDP ratio exceeds 200%. Other risks include a weaker than expected recovery in external demand and further supply chain disruptions. Japanese supply chains and broader economic activity remains vulnerable to climate shocks, as evidenced by the Noto earthquake in January 2024.

Sustaining economic growth has been a long-standing issue for successive Japanese governments and the outlook points to continued economic challenges. The IMF expects long-run growth to average about 0.5% per annum between 2025 to 2028. Demographic pressures continue to pose the greatest economic and fiscal challenge over the longer term. The working population aged 15 to 64 has been declining for a long period of time, a trend that is expected to continue. A shrinking population in the domestic market means Japan will likely continue to pursue growth opportunities overseas, including in Australia.

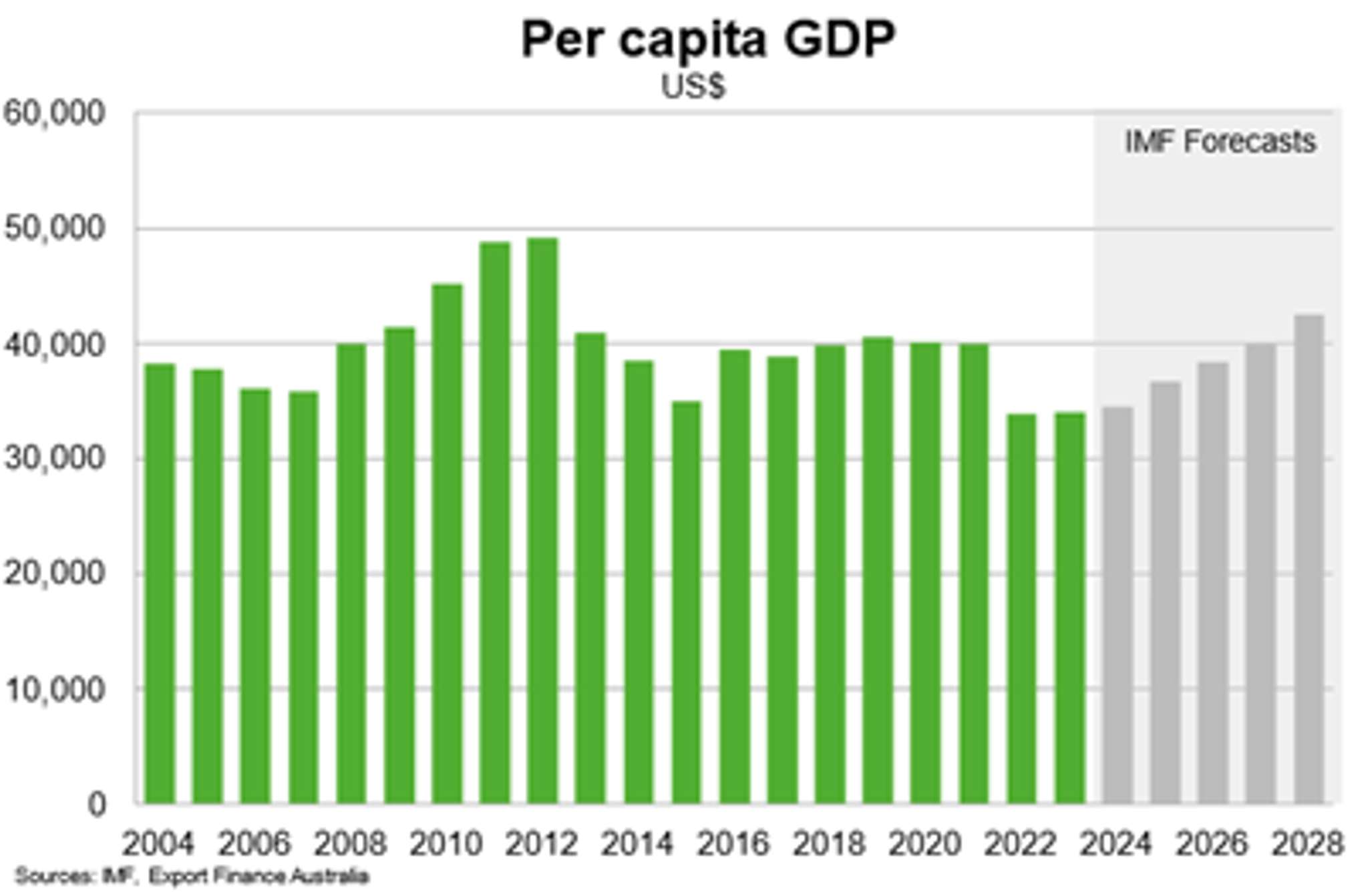

Japan has some of the highest incomes in the world, but GDP per capita has remained stagnant for a long period. GDP per capita is predicted to grow 4.6% per year on average between 2024 and 2028 to reach nearly US$42,500 in 2028, as the economy grows, wages rise and inflation eases. If that outlook materialises, Japanese wages would reach their highest levels since 2012. That said, income inequality remains an issue, as the wealth gap between elderly generations and the youth widens.

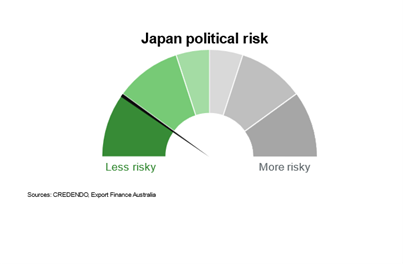

Country Risk

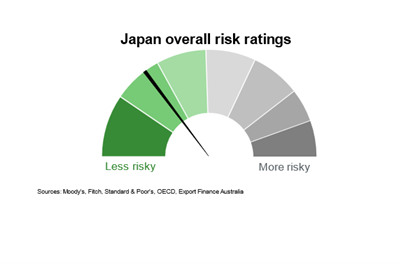

Country risk in Japan is low, suggesting a low likelihood that it will be unable and/or unwilling to meet its external debt obligations. Japan’s high government debt ratio remains a key weight on country risk.

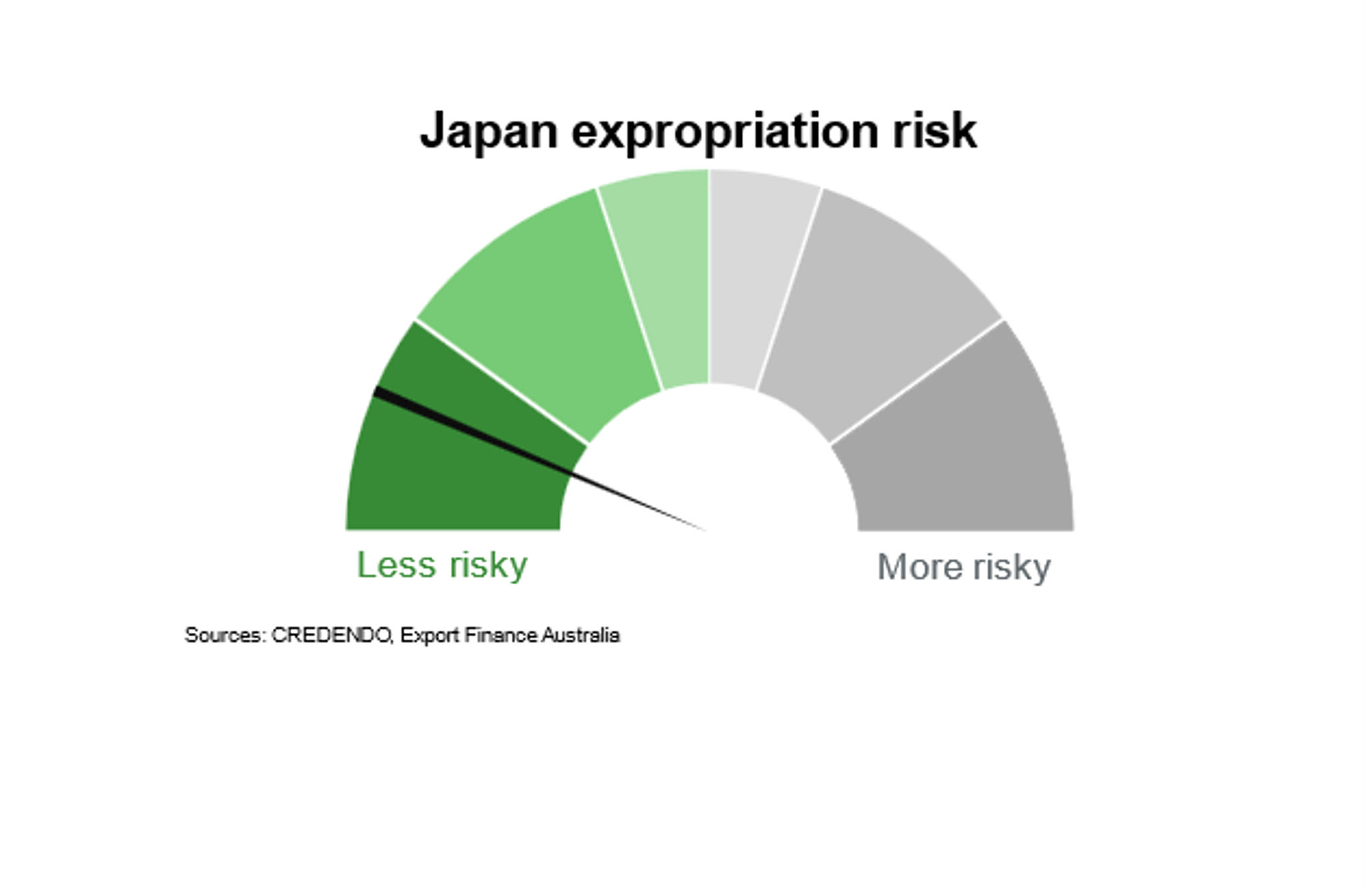

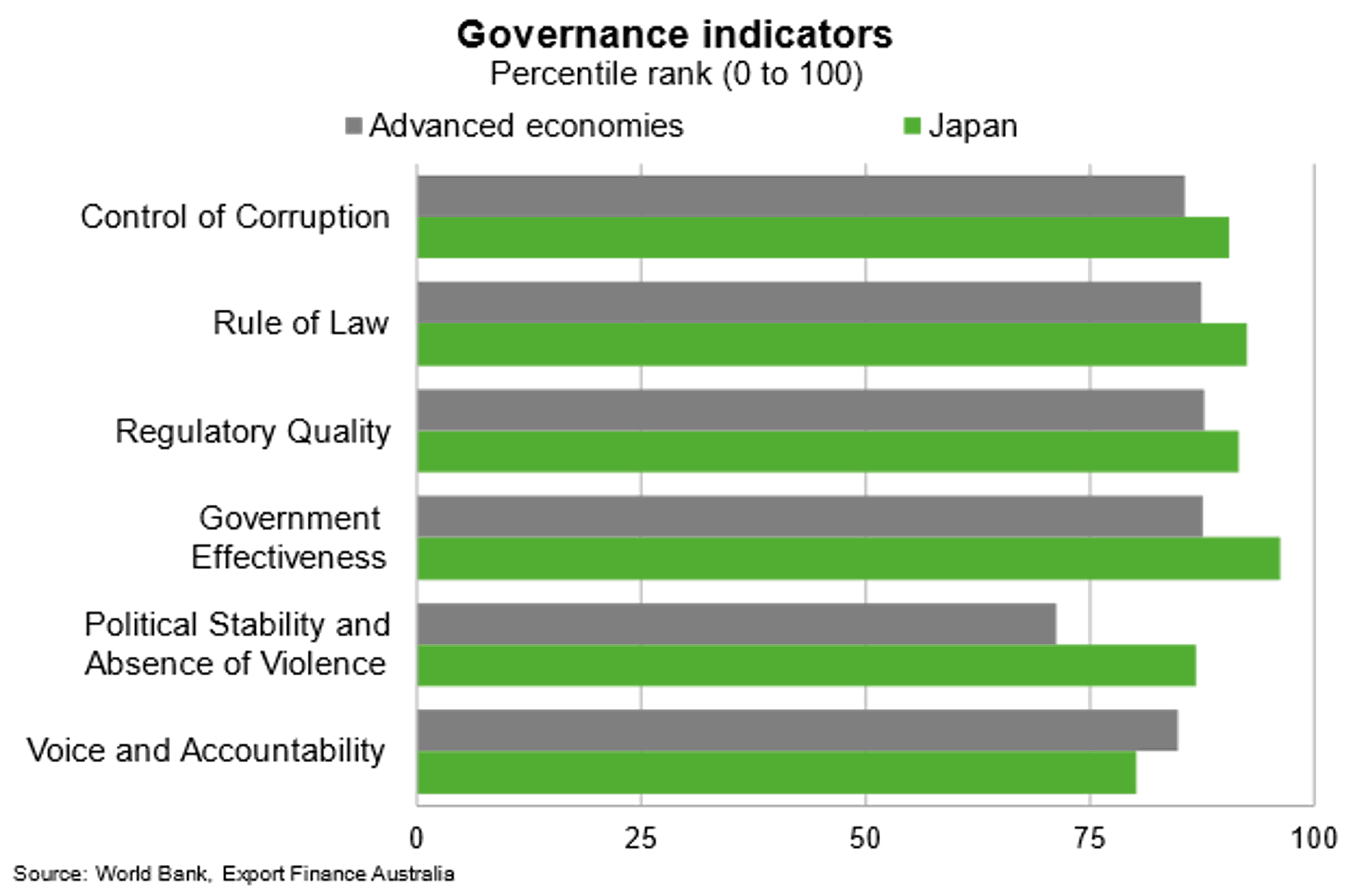

The risk of expropriation in Japan is low, in line with low political risk. Japan scores in the top quartile in all areas of governance.

Bilateral Relations

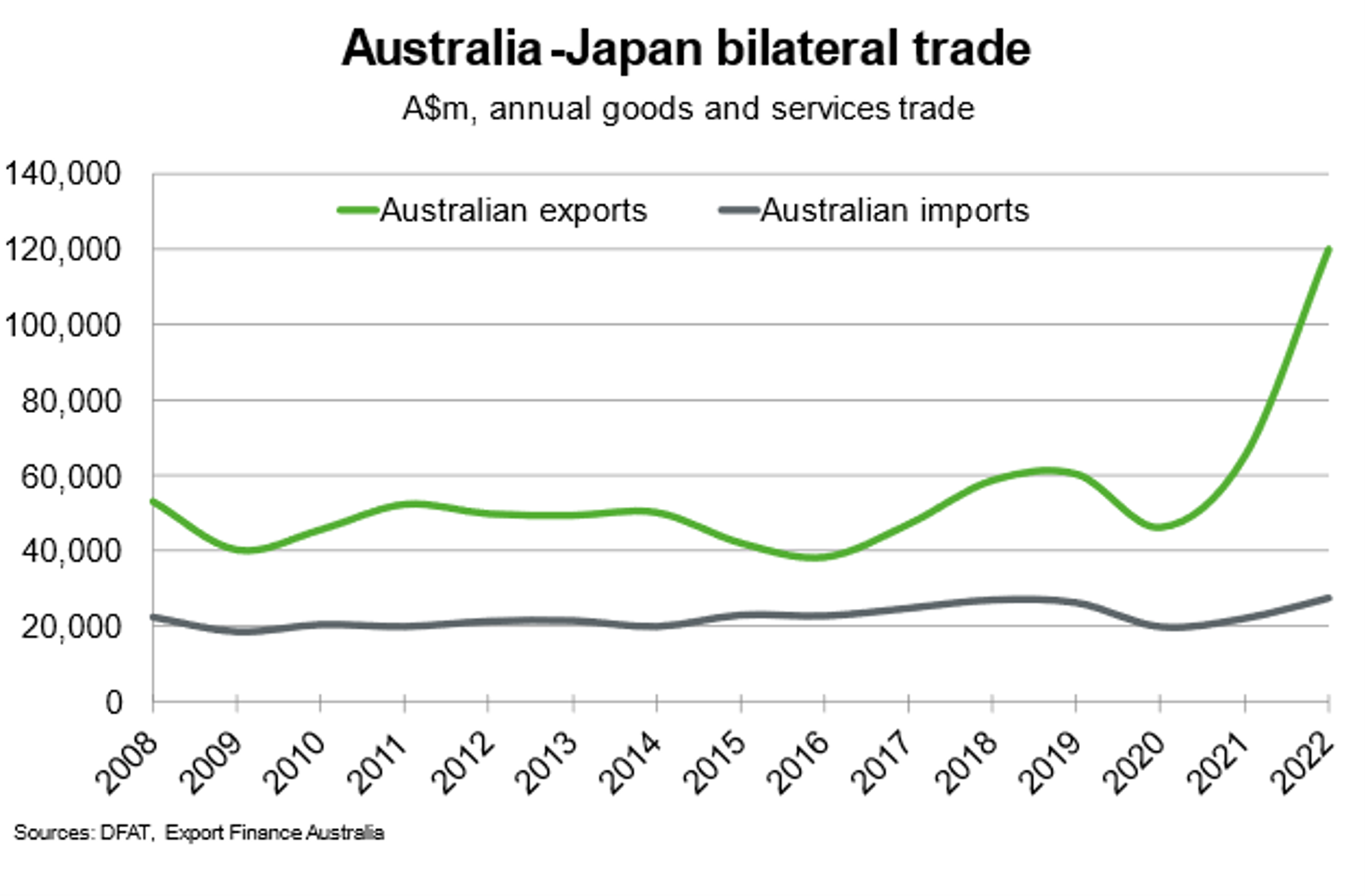

Japan was Australia’s 2nd largest trading partner in 2022, behind China. Total goods and services trade amounted to about $147 billion in 2022, up from around $87 billion in 2021.

Australia and Japan entered a free trade agreement in April 2014, which grants more than 97% of Australian exports preferential treatment in Japanese markets. Australian goods exports to Japan are dominated by coal, natural gas and iron ore. Major Japanese goods imports into Australia include motor vehicles, refined petroleum and civil engineering equipment.

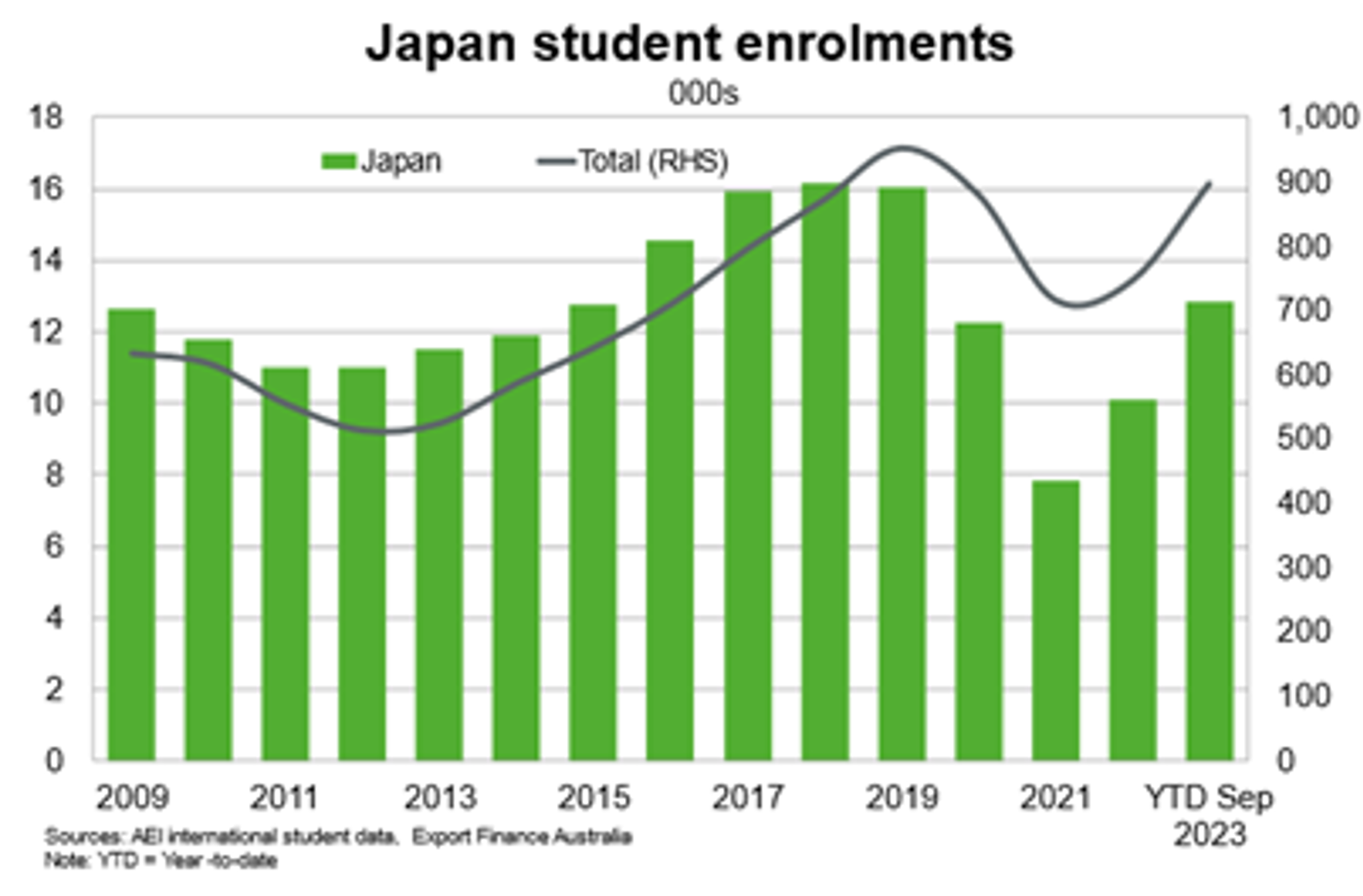

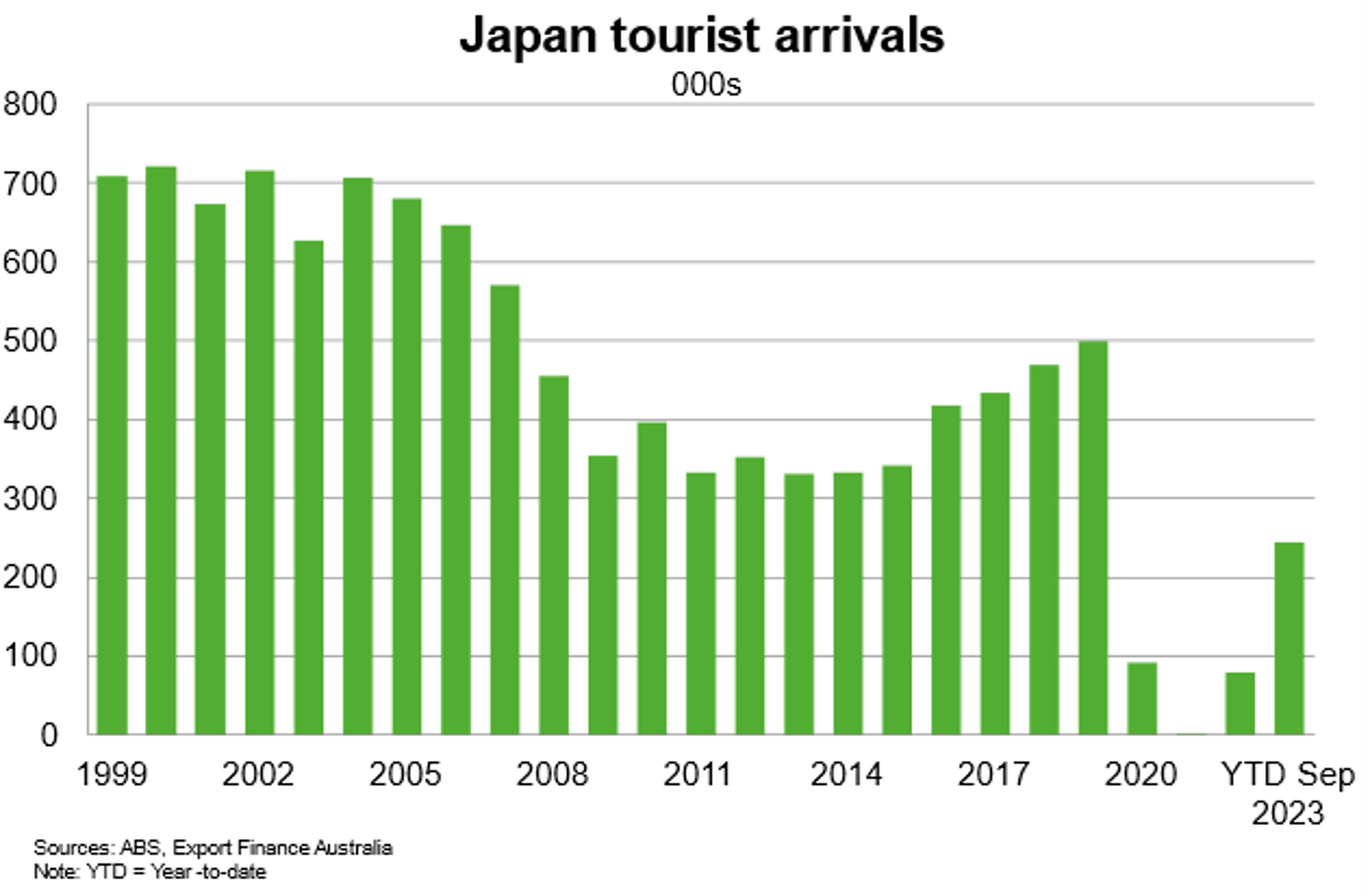

Services exports to Japan totalled $1.3 million in 2022, down from pre-pandemic levels of $2.7 billion in 2019. Japanese student enrolments are growing in line with the broader recovery in the education sector following pandemic restrictions. Tourism’s recovery from the pandemic has been somewhat slower as Japan only opened borders for visa free entry/international travel in October 2022; Japanese tourist arrivals into Australia remain well below pre-pandemic levels. Another year of recovery in international travel should support further demand for Australian tourism, and broader services exports, in 2024.

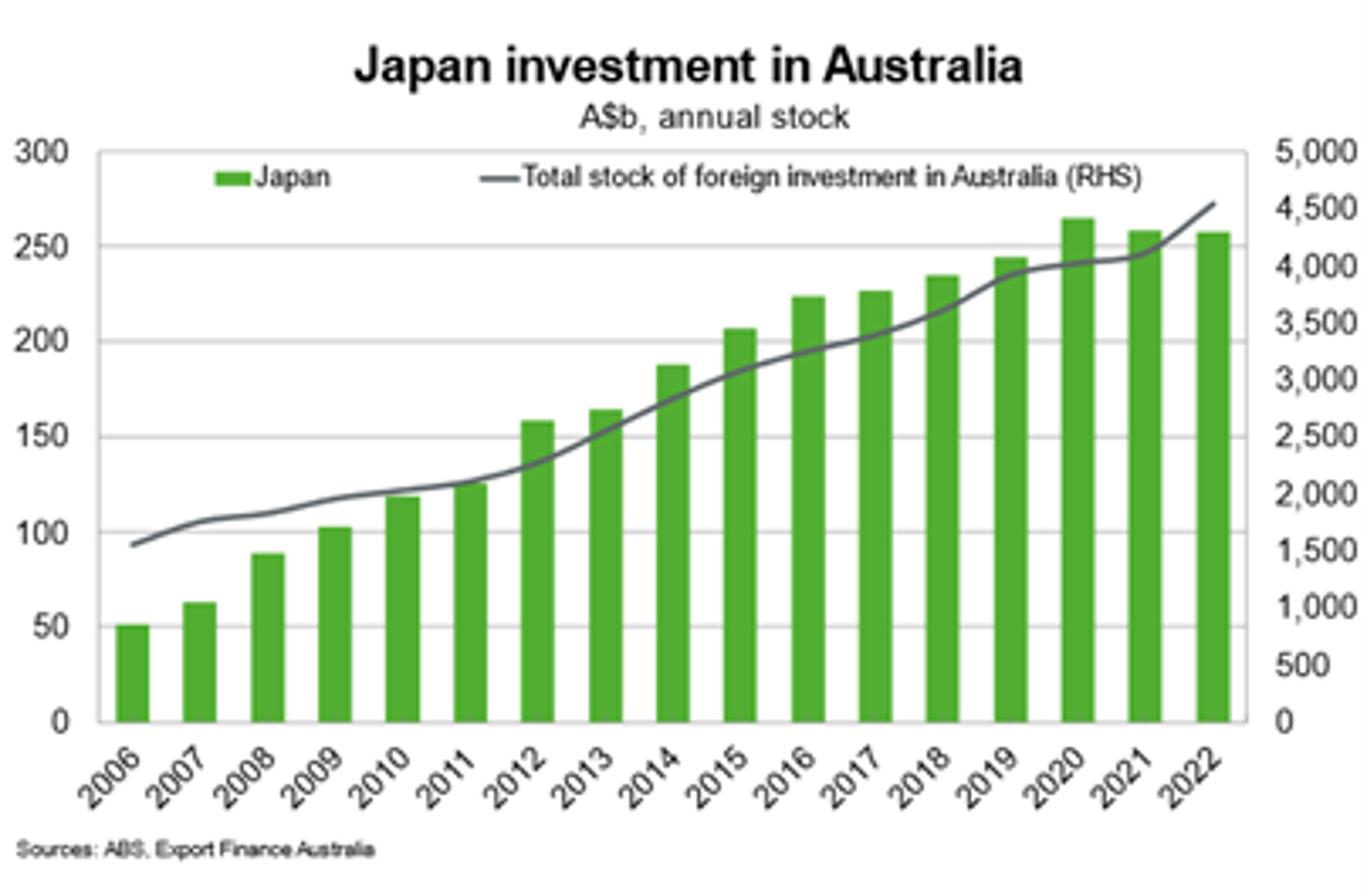

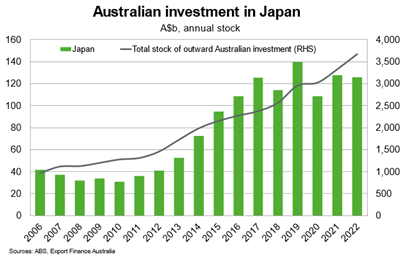

Japan is Australia’s 4th largest source of foreign investment behind the US, UK and Belgium. Japan’s stock of foreign investment is centred predominantly in the resources and energy sectors, such as coal and iron ore. Japanese investment has also enabled the rapid expansion of Australia’s LNG production, particularly the $34 billion Ichthys project located about 220 kilometers off the Western Australian coast. Opportunities exist in supplying the Japanese manufacturing sector with critical minerals including lithium, graphite, vanadium, nickel and cobalt moving forward.