Nepal

Nepal

Last updated: December 2023

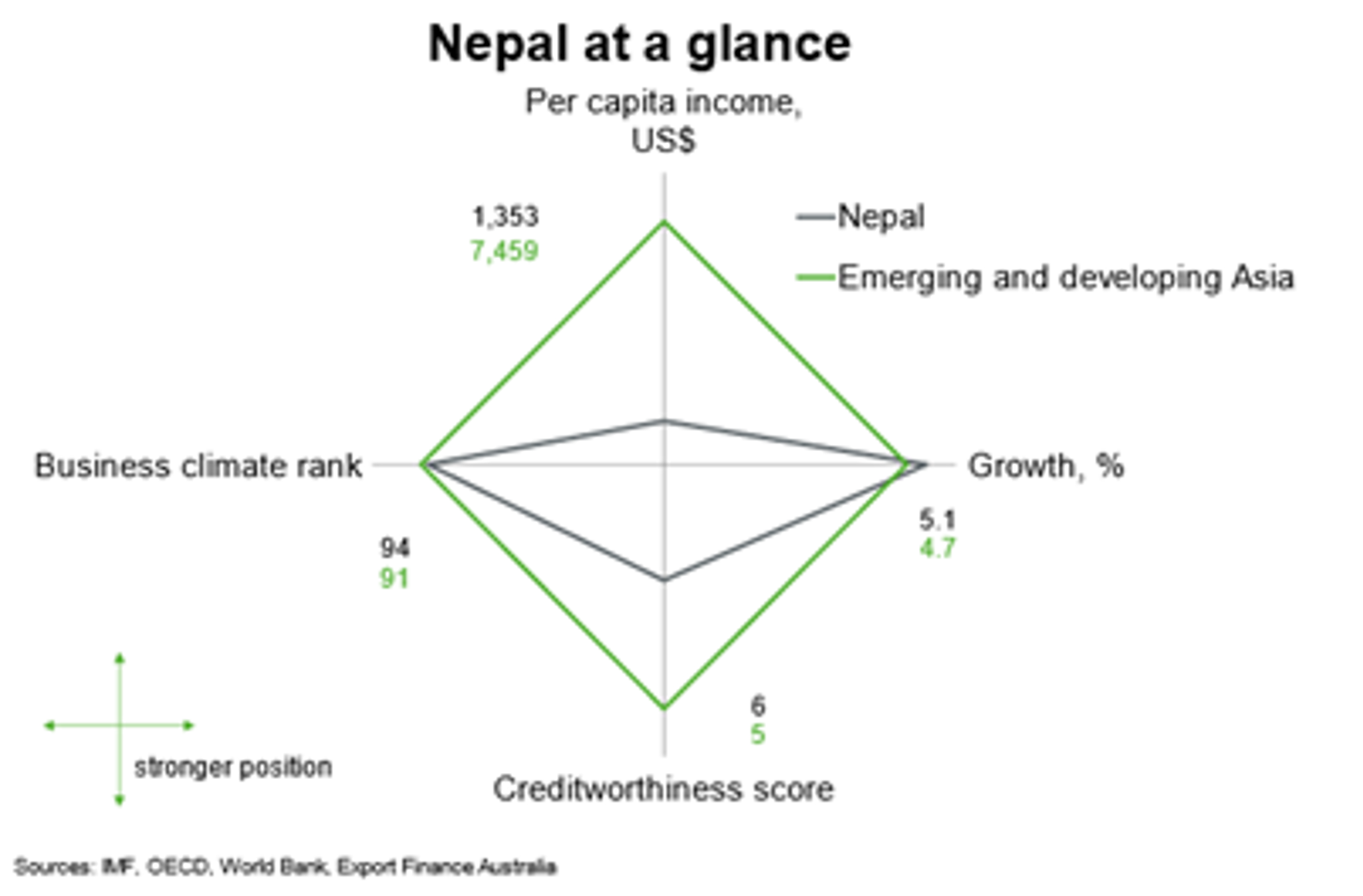

Nepal performs in line with emerging and developing Asia on the indicator of business climate rank, but lags on measures of income and creditworthiness. Growth, on the other hand, slightly outperforms the regional average. Nepal aims to become a middle-income economy by 2030 and high-income one by 2043, as per the country’s latest five-year development plan. Nepal aims to do this by enhancing education and upskilling the workforce to reduce vulnerability to market and sector-specific shocks.

| The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region. |

Economic outlook

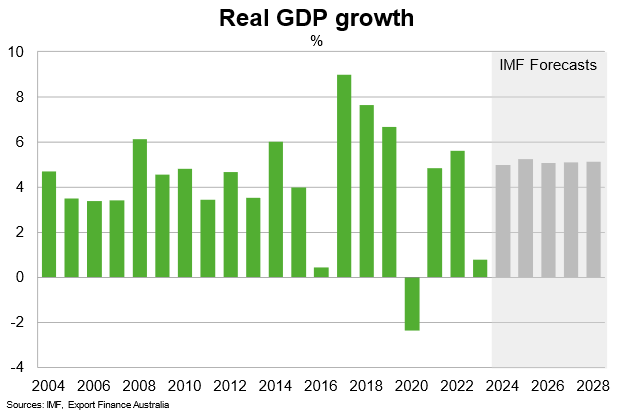

Nepal’s economic growth slowed to an estimated 0.8% in 2023 on the back of monetary tightening, lagged effects from import restrictions and lower government revenue (due to reduced trade activities).

The IMF forecasts growth to accelerate to 5% in 2024 and remain around that rate in 2025. Removal of import restrictions since January 2023 and looser monetary policy will provide the basis for recovery in domestic output and productivity. Government revenue should also rise in line with increased international trade, which is a large contributor to tax revenue. Growth should also receive a boost from further recovery in tourism amid rising international travel demand and increased investment in public infrastructure and hydropower projects. Nepal should continue to receive solid remittances inflows, which account for around 20% of GDP, reflecting near-record migration of Nepalese workers overseas; remittances support household incomes and consumption. Agricultural output, which contributes to one-third of GDP and provides employment for around two-thirds of the total population, is likely to slow in 2024. This reflects the impacts of lumpy skin disease on livestock and low monsoon rainfall and transportation issues, which is likely to result in lower paddy production.

The IMF expects growth to average 5.1% per annum between 2025 to 2028. The IMF approved a US$396 million 38-month Extended Credit Facility arrangement in January 2022 to support long term economic development. The IMF program includes reforms to reduce the cost of doing business and barriers to foreign investment, especially in high-value agricultural products and tourism. Nepal also aims to invest in resilient infrastructure and boost agricultural productivity to address risks related to food security and natural disasters. Joint efforts between the Asian Development Bank and the World Bank to further develop Nepal’s hydropower sector is poised to help strengthen national energy security while fostering power exports over the long term. As of 2019, about 89% of the population has access to electricity, and expanding the electricity sector will contribute to long term economic growth. Demographic pressures, however, pose the greatest economic challenge over the longer term, including an aging population and declining fertility rate.

Risks to the outlook are tilted to the downside. Natural disasters and extreme climate events remain an ever-present risk that could cause structural damage to hydropower infrastructure. Furthermore, high inflation expectations continue to weigh on the outlook; bad weather and ongoing bans on Indian food exports, such as for rice and onions, may contribute to further volatility in commodity prices. On the upside, a sharp fall in commodity prices would help reduce the import bill and ease trade imbalances. But a strong correction in oil prices that lowers demand for migrants in Gulf countries would also weigh on remittances inflows.

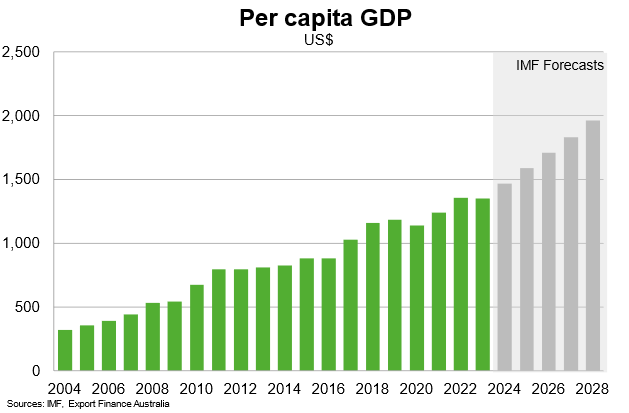

Nepal’s strong past economic performance has steadily lifted incomes. The IMF expects GDP per capita to rise to just below US$2,000 in 2028, from an estimated US$1,400 in 2023. Increased migration of Nepalese workers should continue to support remittance inflows and per capita GDP. Over time, improvements in the quality and inclusiveness of education, through the School Sector Development Program, should bolster incomes.

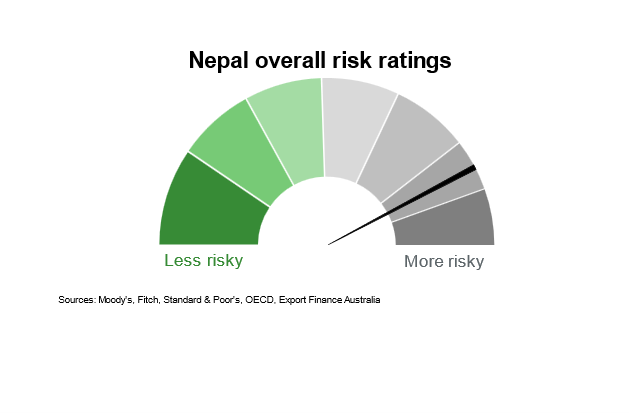

Country risk

Country risk in Nepal is high. The OECD country risk rating is 6. This indicates an elevated risk of Nepal being unable and/or unwilling to meet its external debt obligations. Nepal is not rated by the three major private ratings agencies.

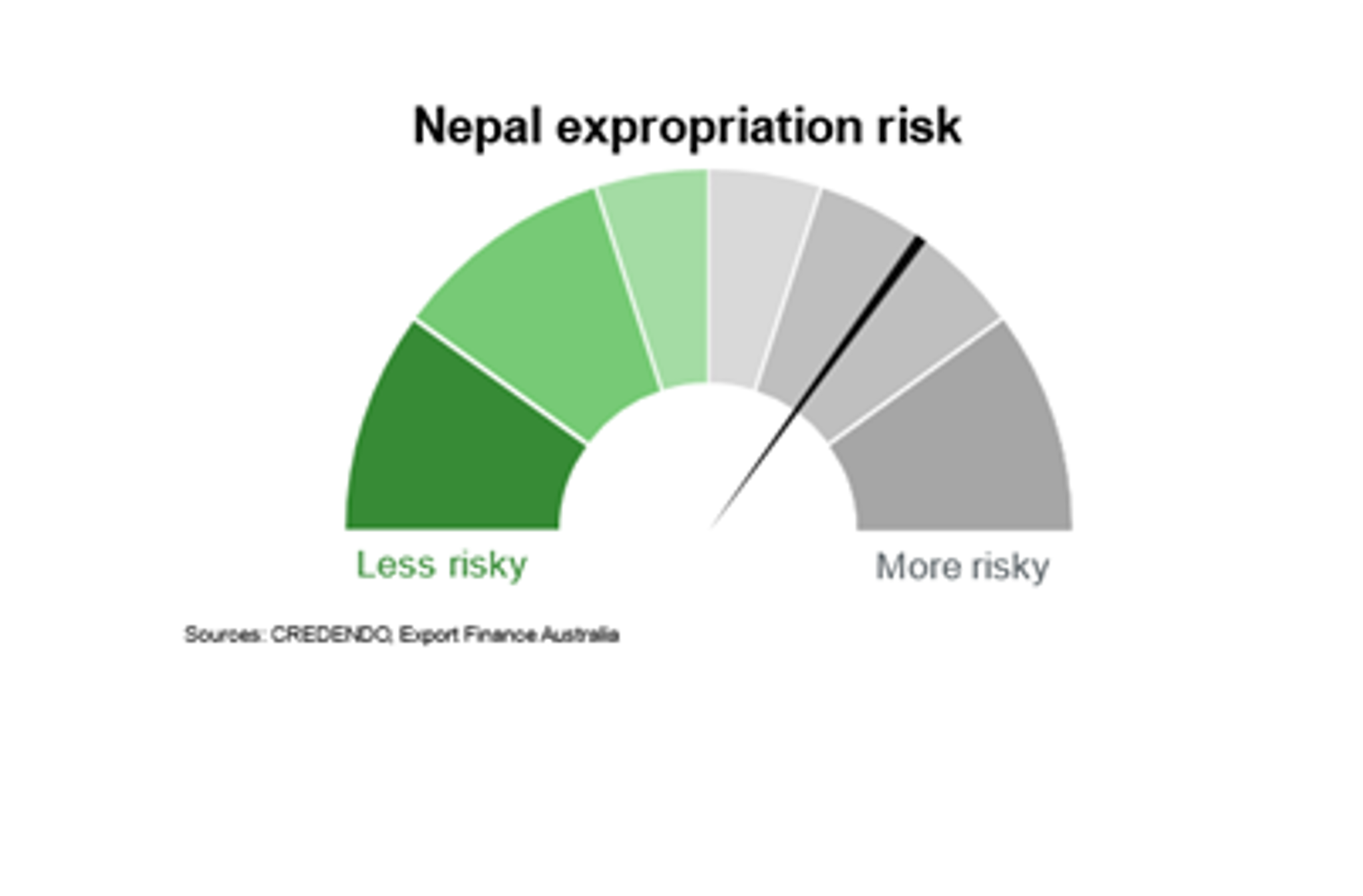

The risk of expropriation in Nepal is moderate to high. The US investment climate statements indicate that companies can be sealed or confiscated if they do not pay taxes in accordance with Nepalese law and bank accounts can be frozen if authorities have suspicions of financial crimes. According to the report, there have been no cases of nationalisation in Nepal.

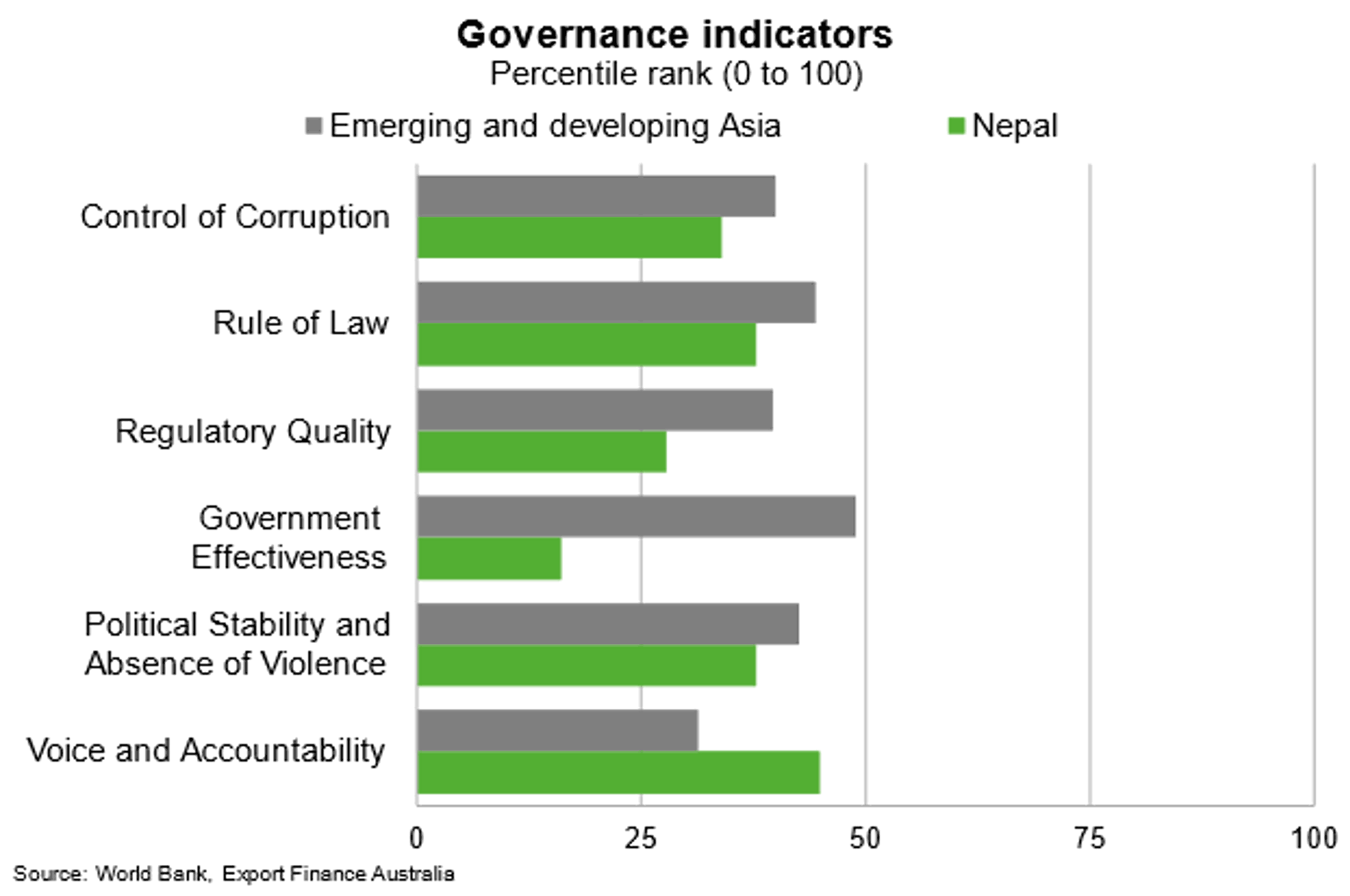

Nepal underperforms the emerging and developing Asian region on most measures of governance. Constraints around the rule of law and perceived corruption hinder the business climate. Nepal performs better on indicators of voice and accountability relative to peers.

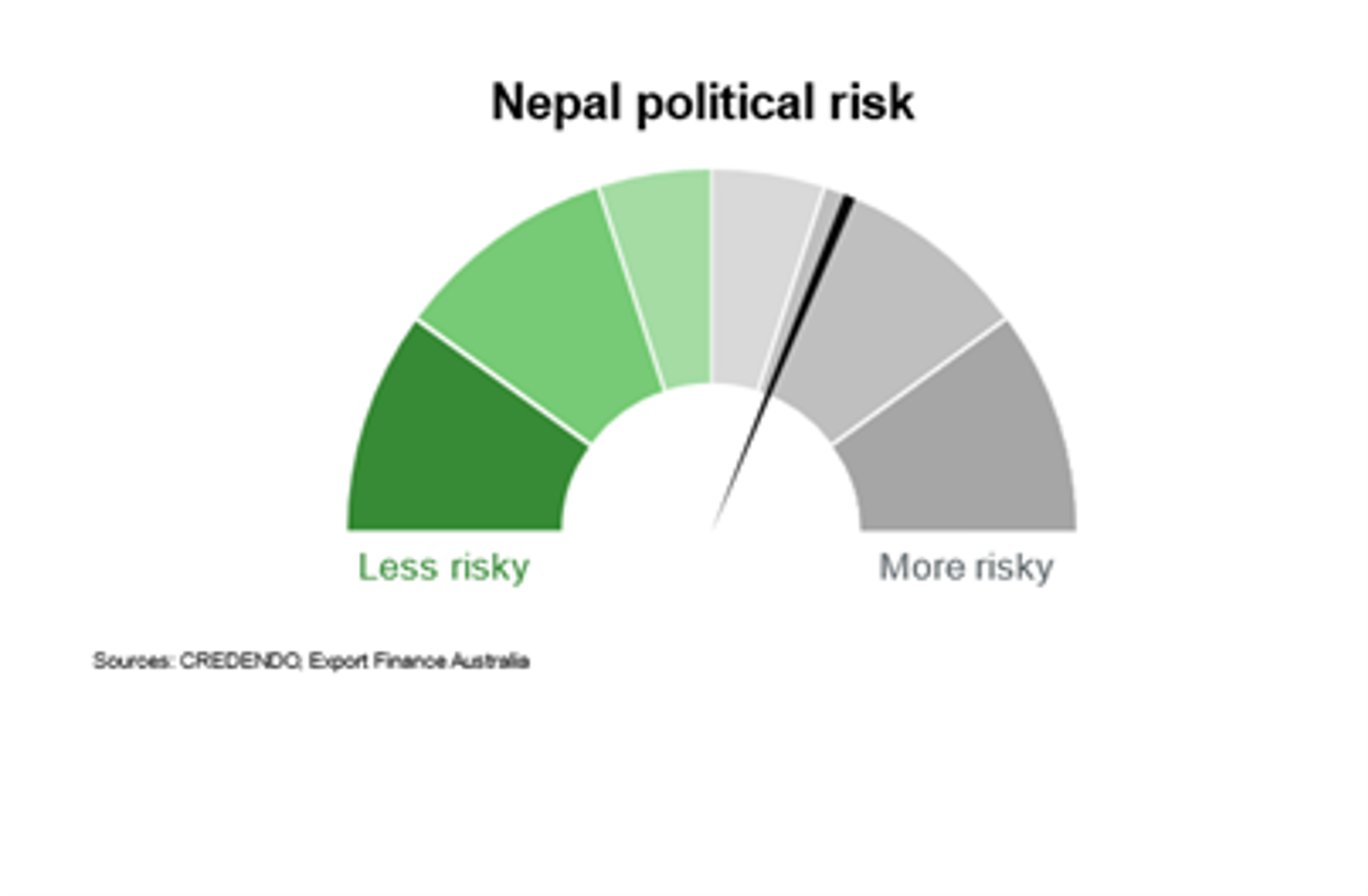

Political risk is moderate to high. Nepal’s political history has been characterised by frequent leadership transitions and coalitions consisting of multiple political parties. Domestic political tensions can challenge policymaking and undermine legislative progress on much-needed structural reforms. Public discontent with the government and cost of living pressures can lead to protests and social unrest.

Bilateral relations

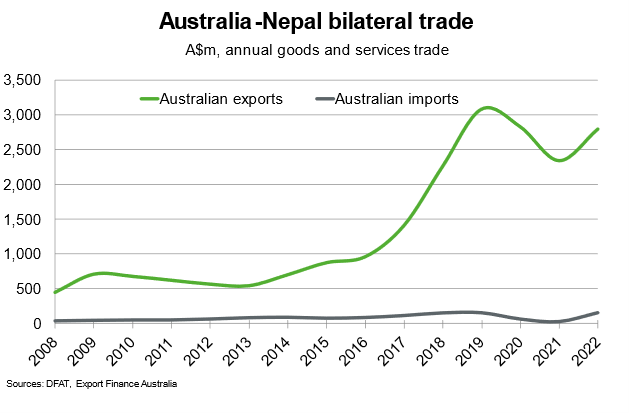

Nepal was Australia’s 37th largest trading partner in 2022. Total goods and services trade amounted to $3 billion in 2022. Education-related travel accounted for around 95% of Australia’s total exports to Nepal in 2022. Nepal’s ongoing efforts to address skills gaps in education and training presents increasing opportunities for Australian vocational education providers. Australia also exports goods such as vegetables, seeds and fruits to Nepal. Australia’s imports from Nepal are minimal.

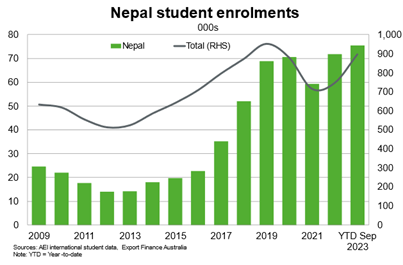

Nepalese students are the third largest source of international student enrolments in Australia; student enrolments reached around 75,000 through September 2023, having increased more than three-fold since 2016. Enrolments held up through the pandemic thanks to remote learning services. Recent strength in Nepalese enrolments is in line with the overall post-pandemic recovery trend. The Australian government’s plans to amend policies that previously boosted international education, alongside high cost of living pressures, could slow the pace of growth in student enrolments moving forward.

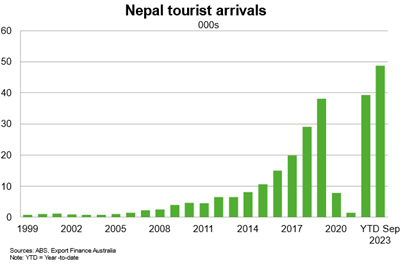

The recovery in Nepalese tourism to Australia has been strong; by September 2023, Nepalese tourism arrivals had surpassed their pre-pandemic level. A competitive Australian dollar and another year of recovery in international travel should support further demand for Australian tourism in 2024.