Philippines

Philippines

Last updated: January 2024

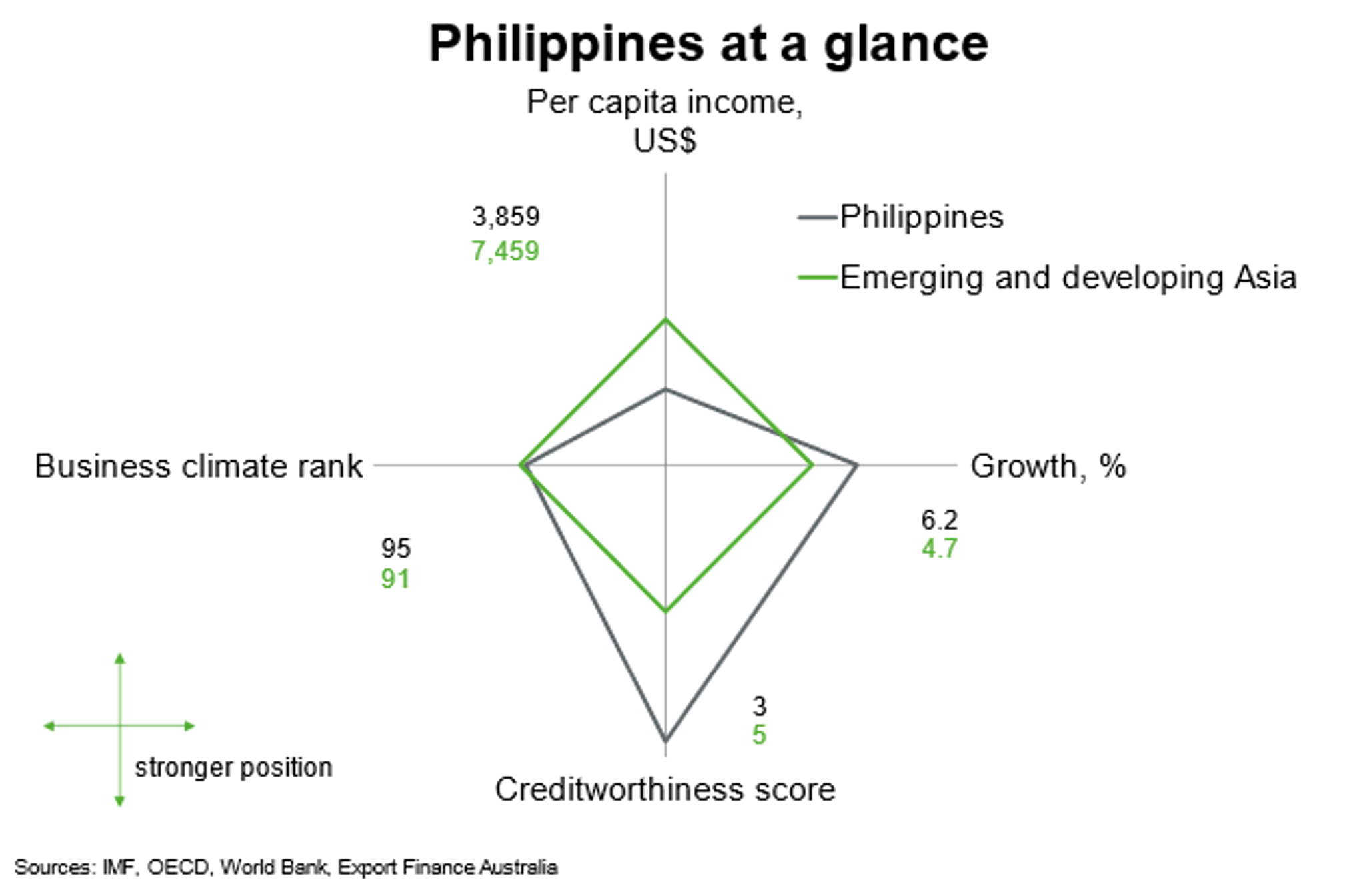

The Philippines was the 4th largest economy in the Southeast Asian region in 2023 after Indonesia, Thailand and Singapore. The Philippines outperforms emerging Asian economies on measures of creditworthiness and GDP growth but is behind its peers on indicators of per capita incomes and the business climate.

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic outlook

A resilient export sector—particularly in tourism and business process outsourcing (BPO)—and strong household consumption amid low unemployment (3.6% in November 2023) and sustained remittance inflows, helped the economy grow 5.3% in 2023. That was slower than the 7% gain in 2022, reflecting domestic and global inflation pressures, higher interest rates and rising global trade restrictions and geopolitical tensions.

Looking ahead, the Philippine economy is expected to grow 5.9% in 2024 on the back of strong private consumption, supported by easing inflation, continued remittances inflows and a steady labour market. Further increases in public spending in areas around socio-economic development and infrastructure investment should support growth in 2024 and beyond. Services exports should continue to recover, as international travel picks up. That said, continued high-interest rates are likely to prevent even faster growth.

Stronger public spending is poised to support growth of 6.3% per annum, on average, from 2025 to 2028 according to IMF forecasts. The 2024 budget supports the implementation of the Philippine Development Plan (PDP) 2023-2028, which is focused on increasing infrastructure, education and health spending; spending on economic services makes up nearly 30% of the budget (6.4% of GDP), primarily related to the Build Better More infrastructure program. Greater infrastructure spending should help enhance the business climate, attract more foreign investment and support productivity. Increased expenditure on education should provide social and economic benefits while improving living standards.

Risks to growth are tilted to the downside. A sharper than expected slowdown in major export markets may weigh more heavily on Philippines export growth, particularly for electronics exports. Climate change and risks to food security persist. The IMF forecasts economic damages could be as much as 13.6% of GDP by 2040

if climate risks are unaddressed, due to productivity losses, damage costs and consequent risks to bank capital adequacy.

Longer term macroeconomic fundamentals remain sound. A large and youthful population and the government’s ongoing commitment to enhancing the investment climate through increasing infrastructure spending should bolster growth potential.

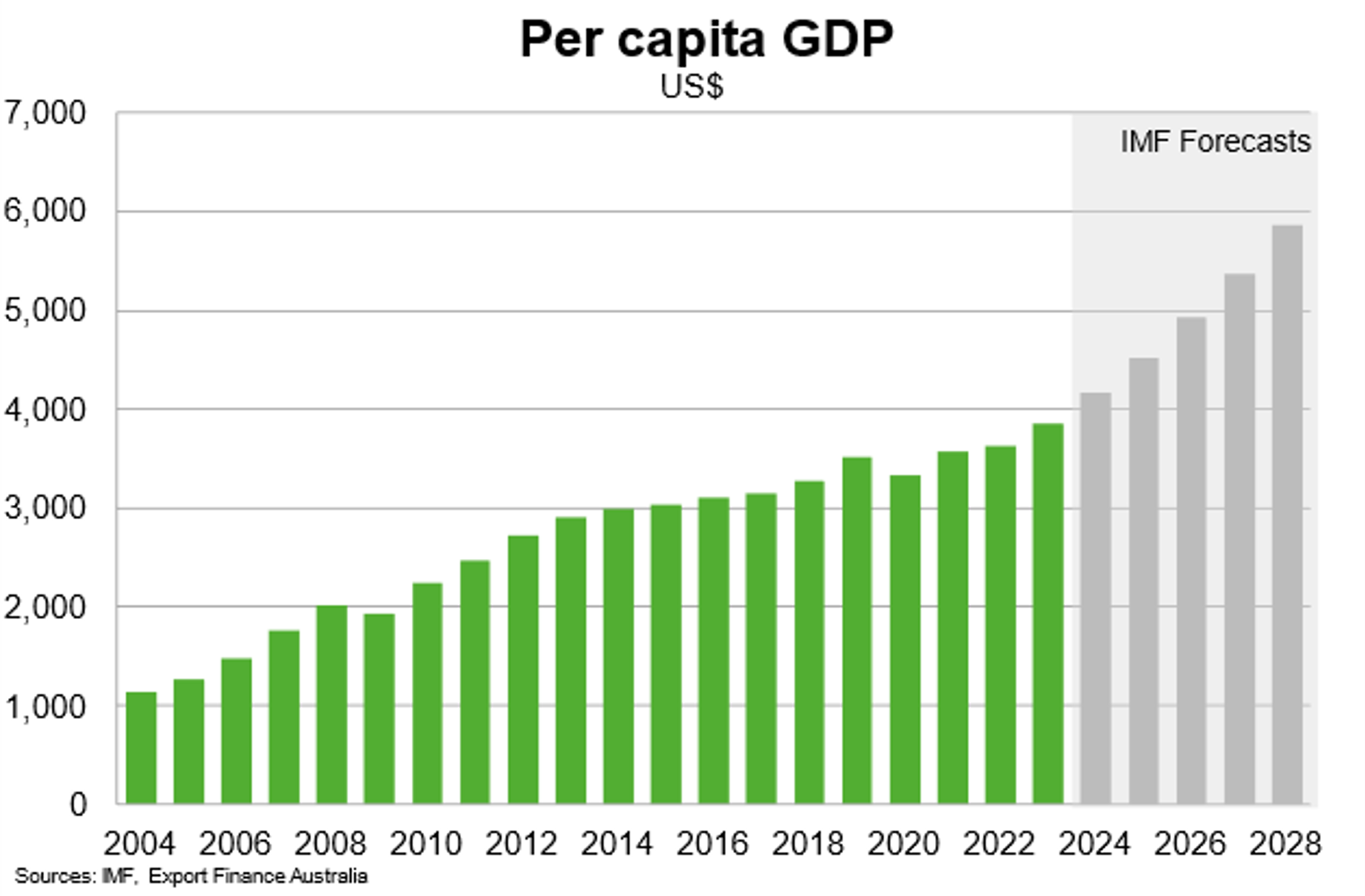

The COVID-19 pandemic interrupted poverty reduction trends, but continued growth in expenditure on socio-economic development helped support a rise in GDP per capita in 2023, a trend that is likely to continue. The IMF projects GDP per capita to rise from an estimated US$3,900 in 2023 to US$5,900 in 2028.

Country Risk

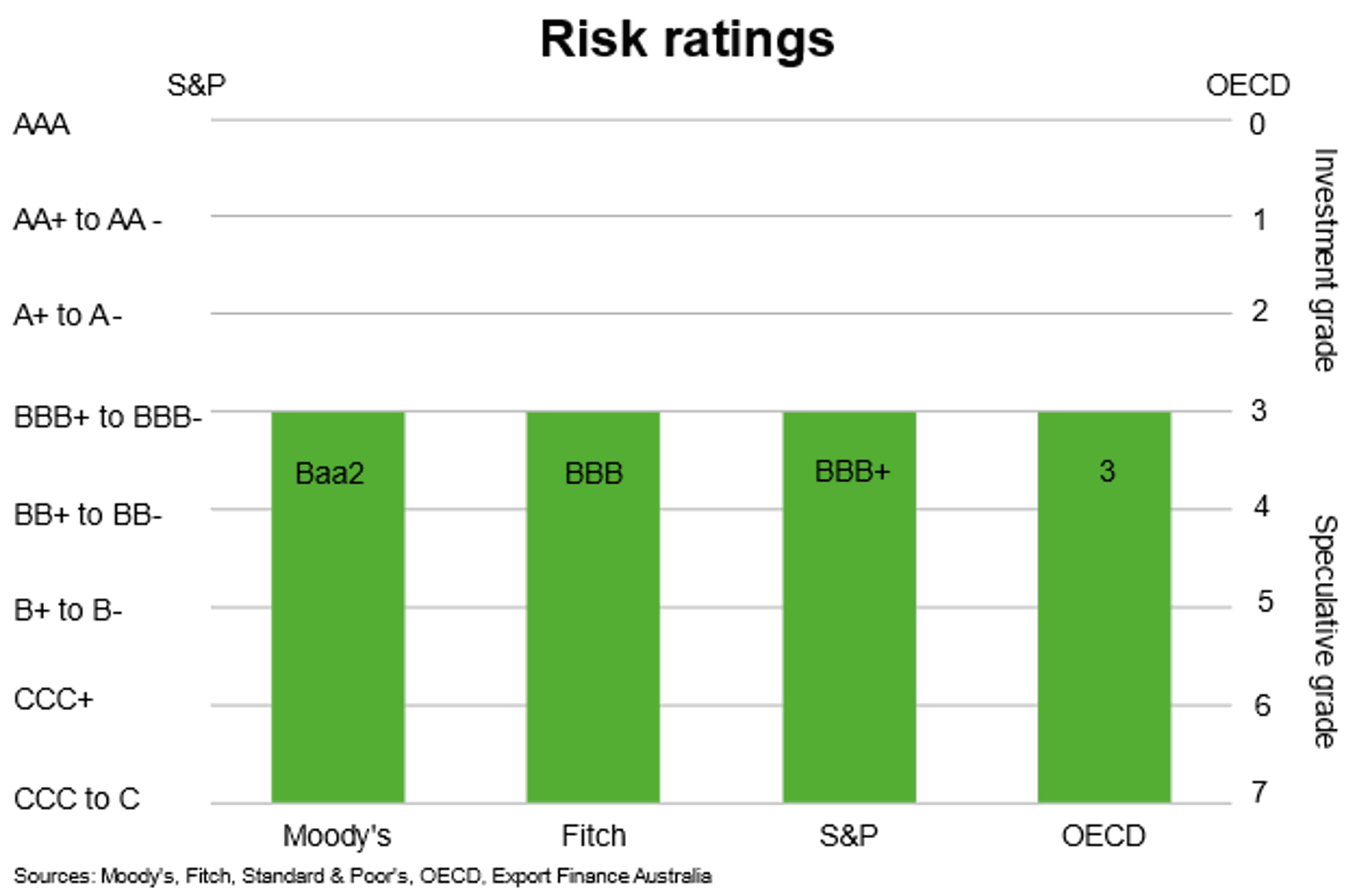

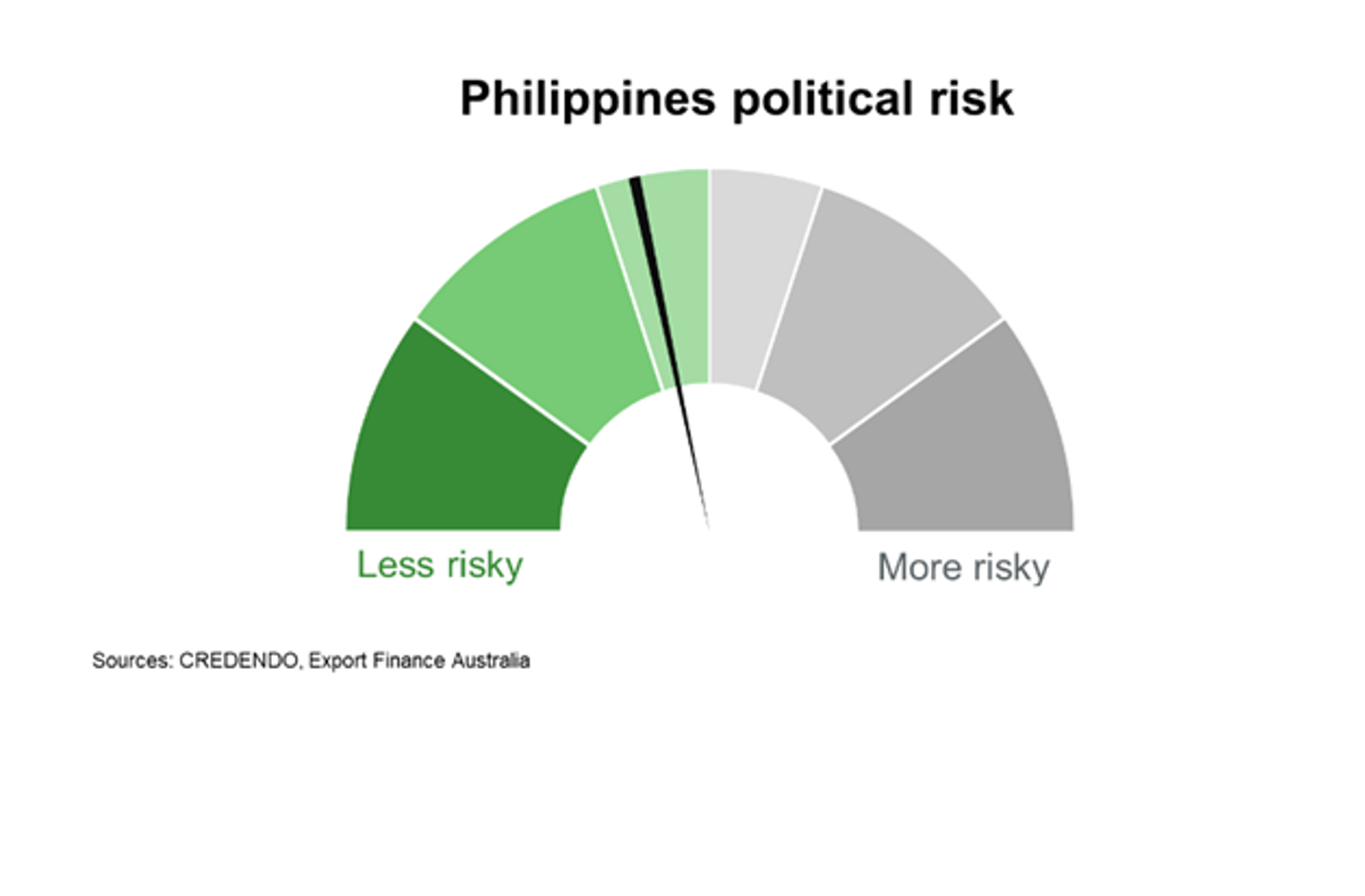

Country risk in the Philippines is low to moderate. The OECD gives the Philippines a country credit rating of 3, which indicates a relatively low to moderate likelihood that this country will be unable or unwilling to meet its external debt obligations.

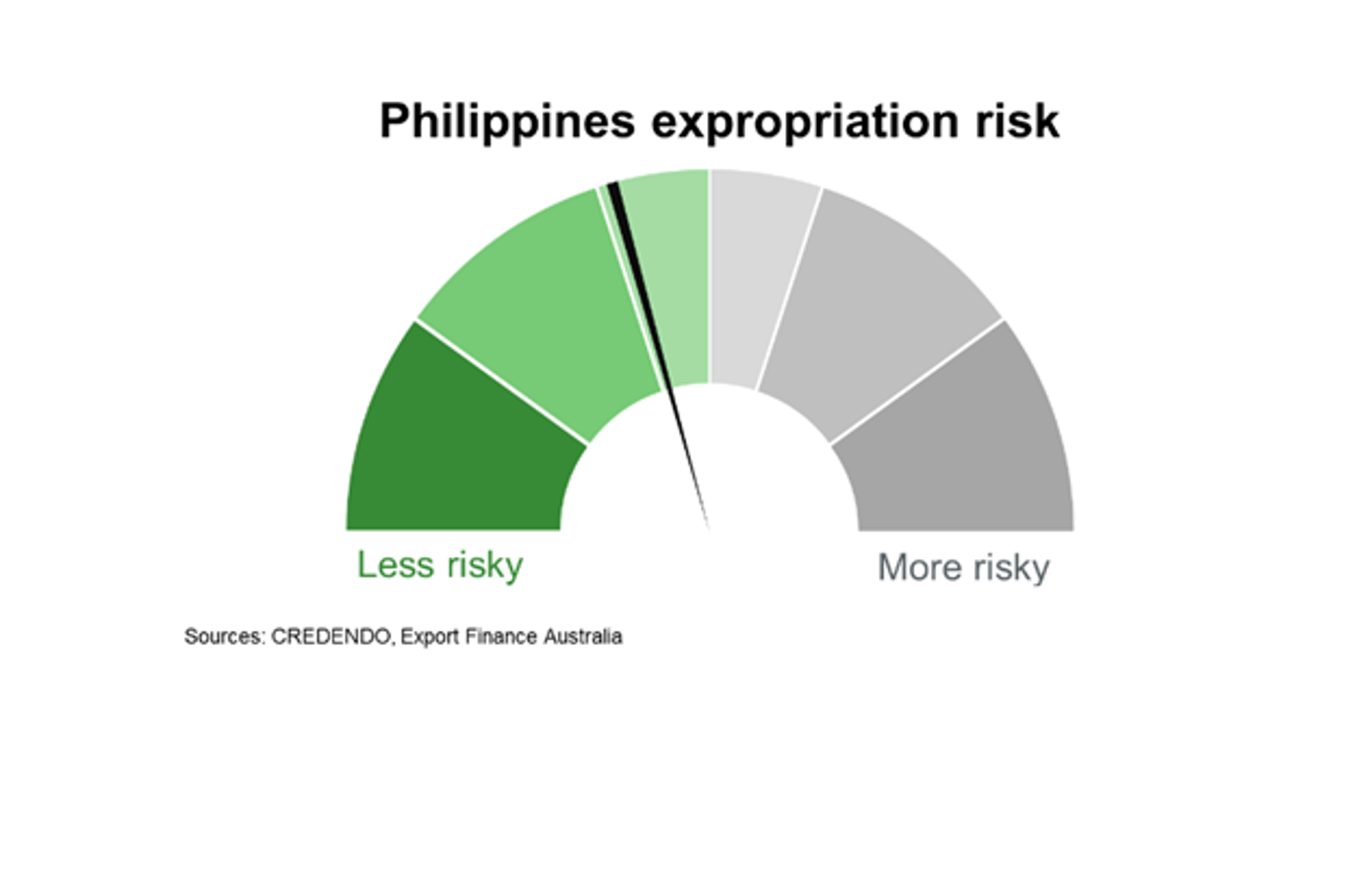

There is low to moderate risk of expropriation in the Philippines. According the US Investment Climate Statements, Philippine law allows expropriation of private property for public use or in the interest of national welfare or defense. That said, foreign investors have the right to receive compensation if their assets are expropriated. There is also the risk that investment contracts can be altered due to changing laws, as highlighted by several mine closures in early 2017 due to changes in environmental regulations.

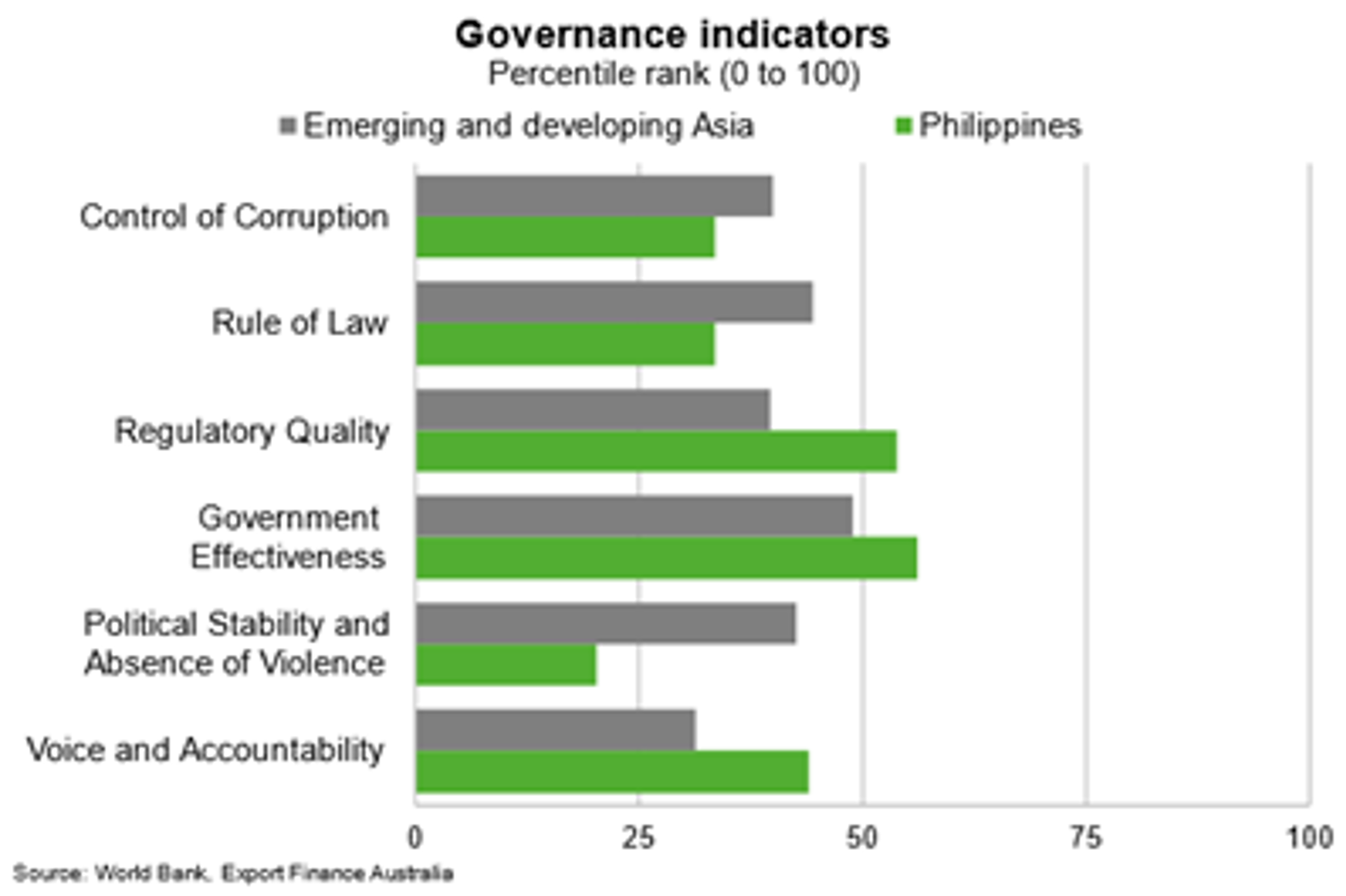

Political risk is moderate. The government is continuing its focus on security and eradicating illegal drugs to enhance the operating environment. The Philippines ranks low on the World Bank’s measure of political stability and absence of violence. But domestic political developments, on their own, have not weighed on economic growth or derailed fiscal reform in the past. Most other governance scores are broadly in line with the emerging Asia average.

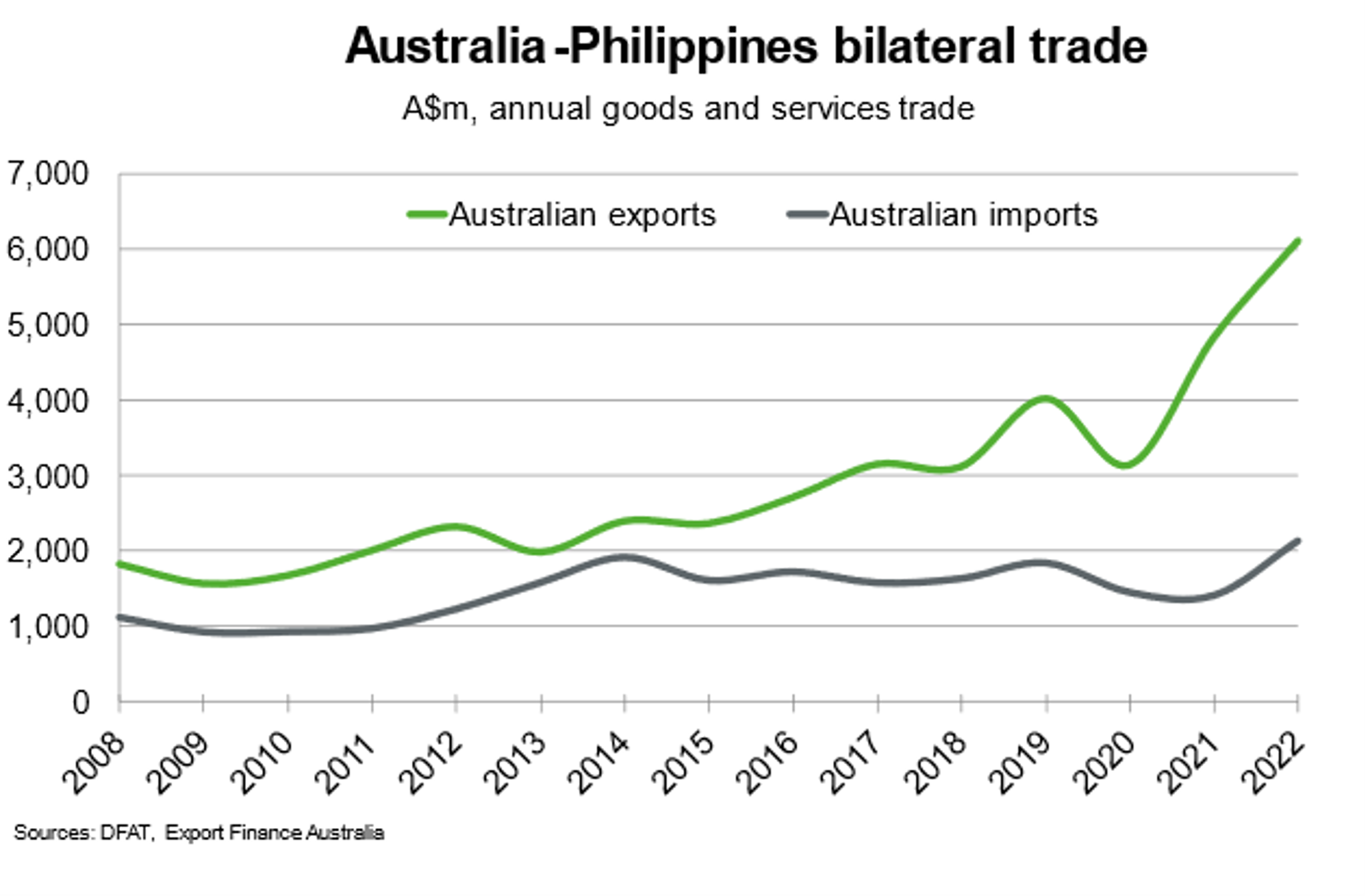

Bilateral Relations

The Philippines was Australia’s 22nd largest trading partner in 2022. Total goods and services trade between Australia and the Philippines rose more than 32% from a year earlier to $8.2 billion in 2022. Goods and services exports consists mostly of wheat, education-related travel, precious metals and ores, beef and barley. Higher Australian wheat exports to the Philippines in 2022 reflected wheat supply issues from the Black Sea into Asia, consequent higher prices amid a broader commodity price rise and record Australian wheat harvests. There exists opportunities for Australian exporters of technology, cybersecurity and big data as e-commerce expands in the Philippines.

Australian imports from the Philippines amounted to $2.1 billion in 2022 and consisted mainly of technology and other business services, telecommunications and ICT services, copper, electrical machinery and parts, computers, office machines and financial services. This represented a 51% increase in imports from 2021.

There are more than 250 major Australian companies that operate in the Philippines, employing more than 41,000 Filipinos in the business process outsourcing, infrastructure, banking, telecommunications, energy, and education sectors. Australia and the Philippines are both members of APEC and are signatories of the Regional Comprehensive Partnership Agreement (RCEP), which entered into force for the Philippines in June 2023. RCEP aims to strengthen economic integration and regional trade, building on existing free trade agreements such as the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA).

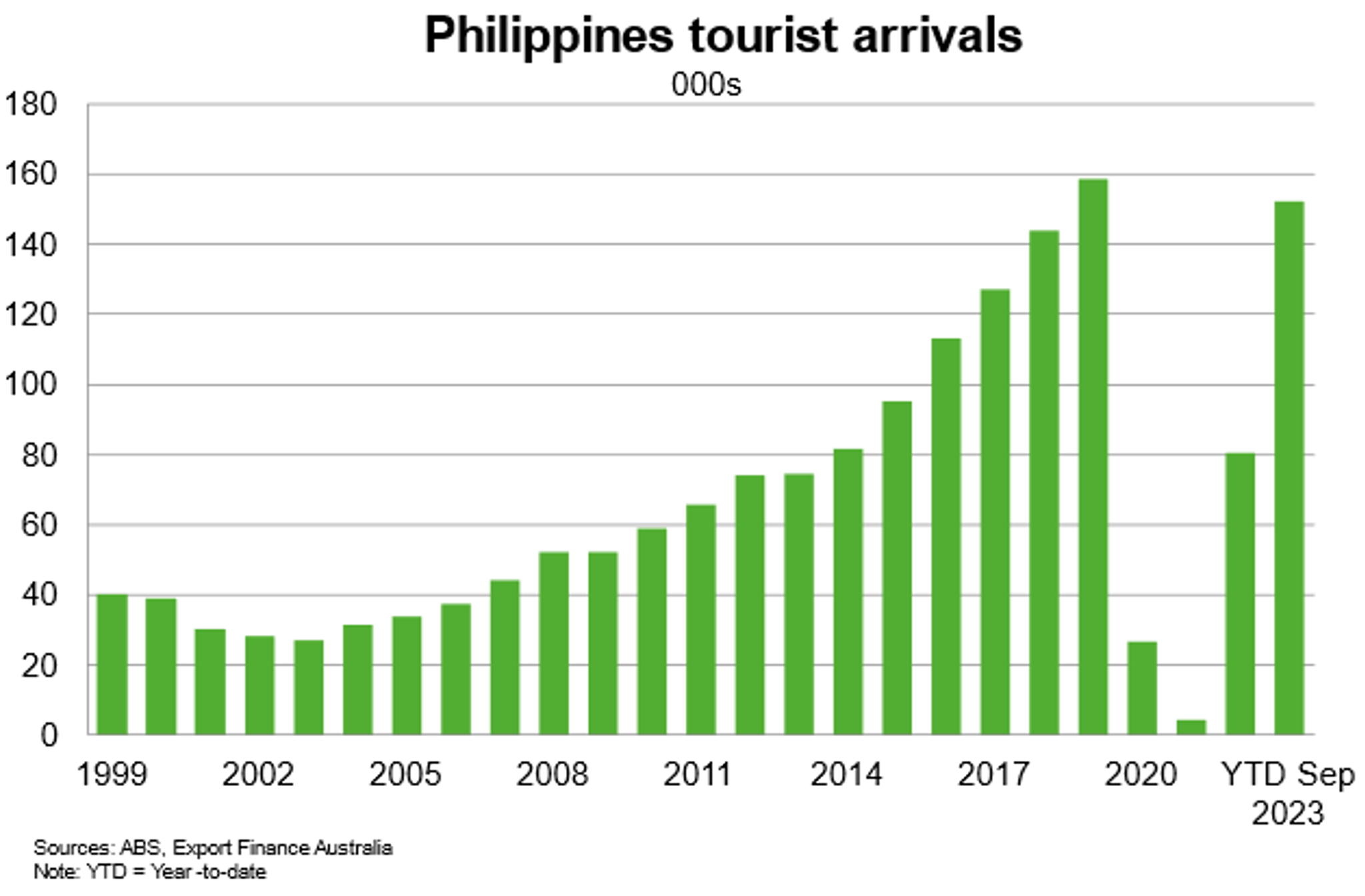

In services, Australia remains a key destination for Filipino students due to strong people links and geographical proximity. Filipino student enrolments have increased alongside easing in COVID-19 pandemic restrictions. Continued implementation of Australia’s development programs and close bilateral ties are also factors facilitating greater Filipino demand for Australian education.

Filipino tourism to Australia recovered further in 2023 but remains slightly below pre-pandemic levels. A competitive Australian dollar and another year of recovery in international travel should support further demand for Australian tourism, and broader services exports in 2024.

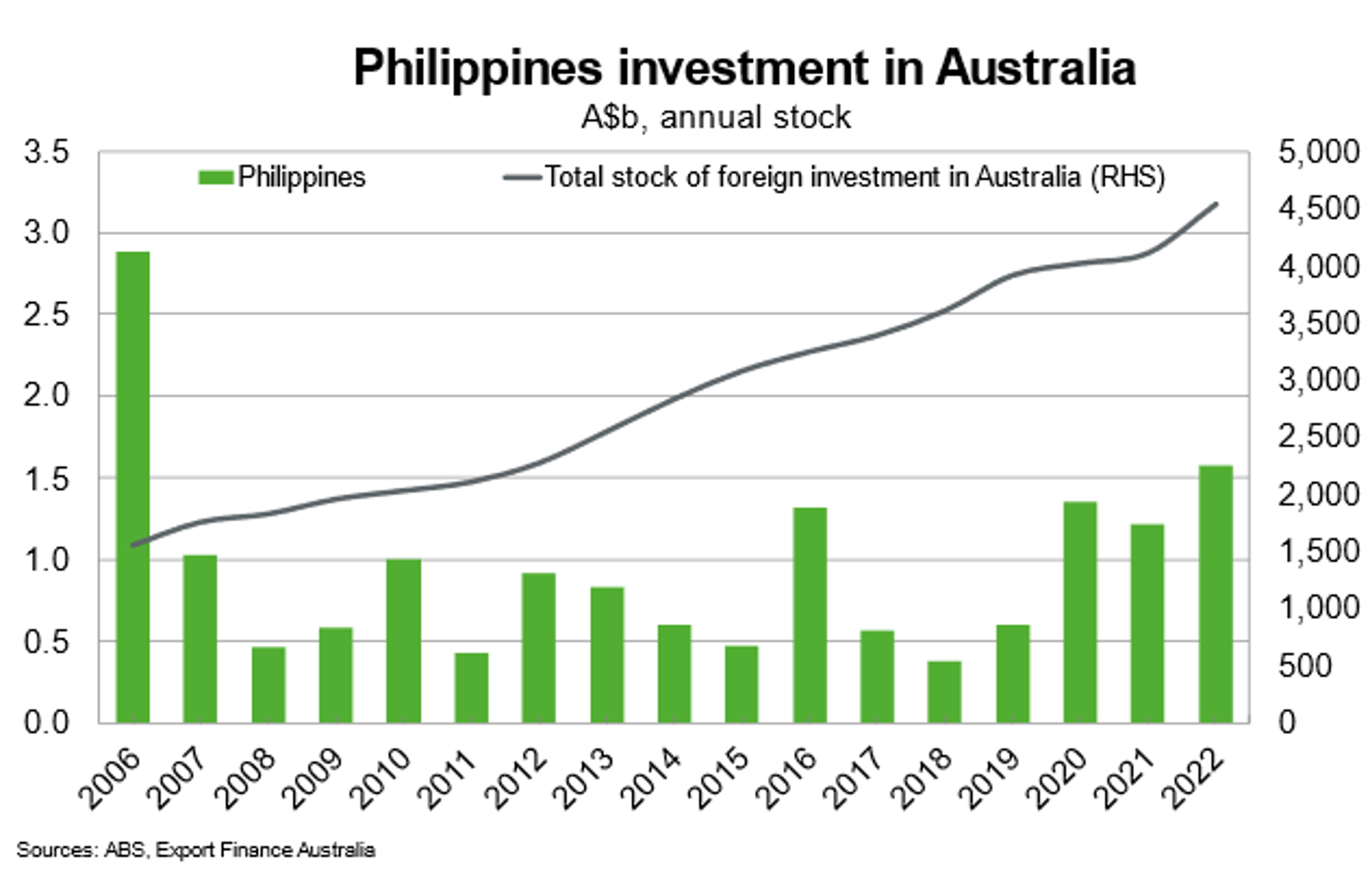

Two-way investment totaled $8.6 billion in 2022. Australia’s proximity to the Philippines and its reputation as a supplier of quality materials and services are important factors enhancing the bilateral trade, economic and investment relationship.

Useful links

Department of Foreign Affairs and Trade

ASEAN-Australia-New Zealand Free Trade Area

Philippines country brief

Austrade