Singapore

Singapore

Last updated: February 2024

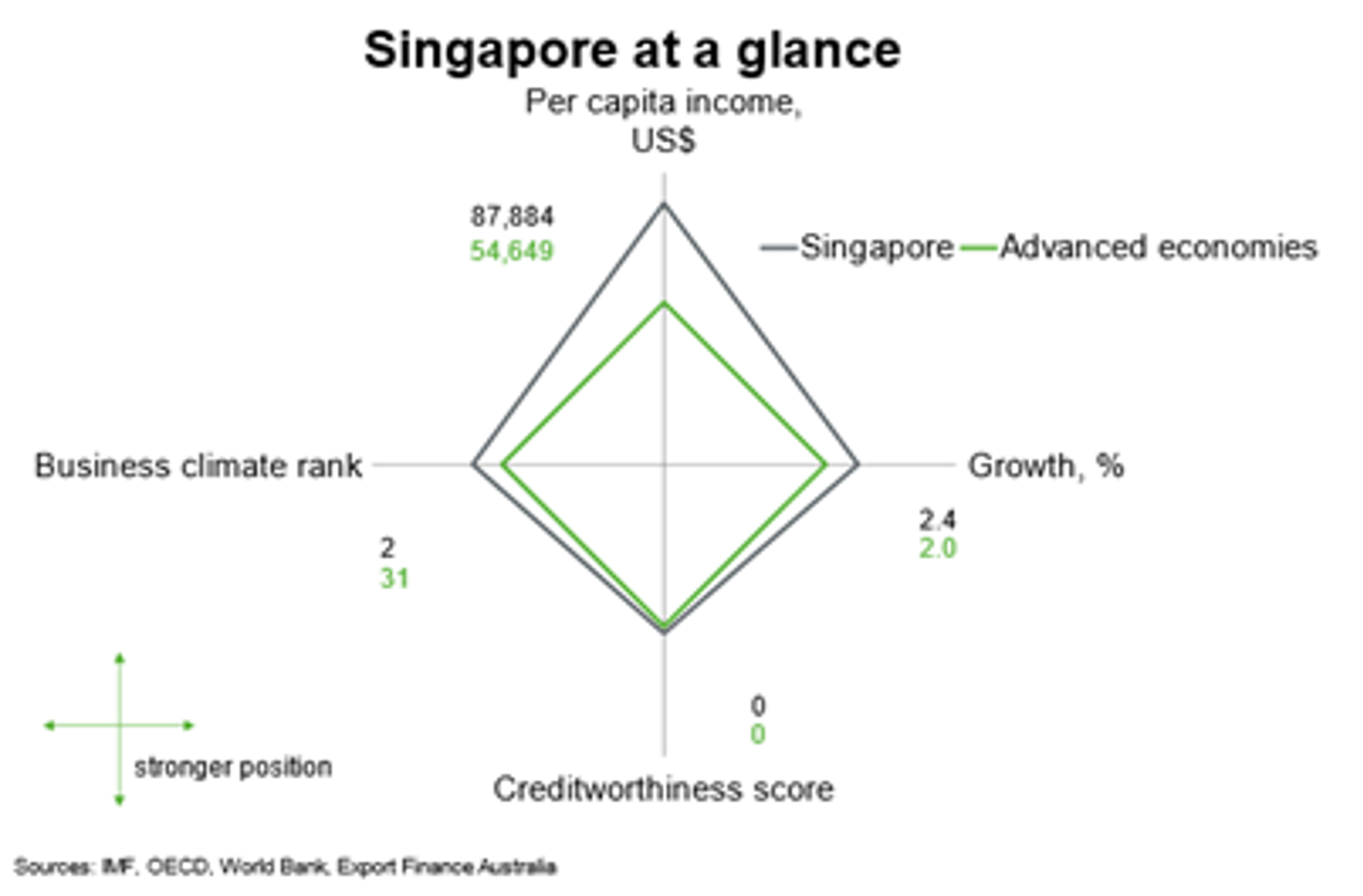

Singapore outperforms advanced economy peers on measures of income and the business climate. Low tax rates and a pro-business environment attract significant foreign direct investment and have helped the country become one of the wealthiest, on a GDP per capita basis, in the world. Creditworthiness is high, as is the case in many advanced economies. Growth prospects are slightly higher than advanced economy peers.

This chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other regional countries.

Economic outlook

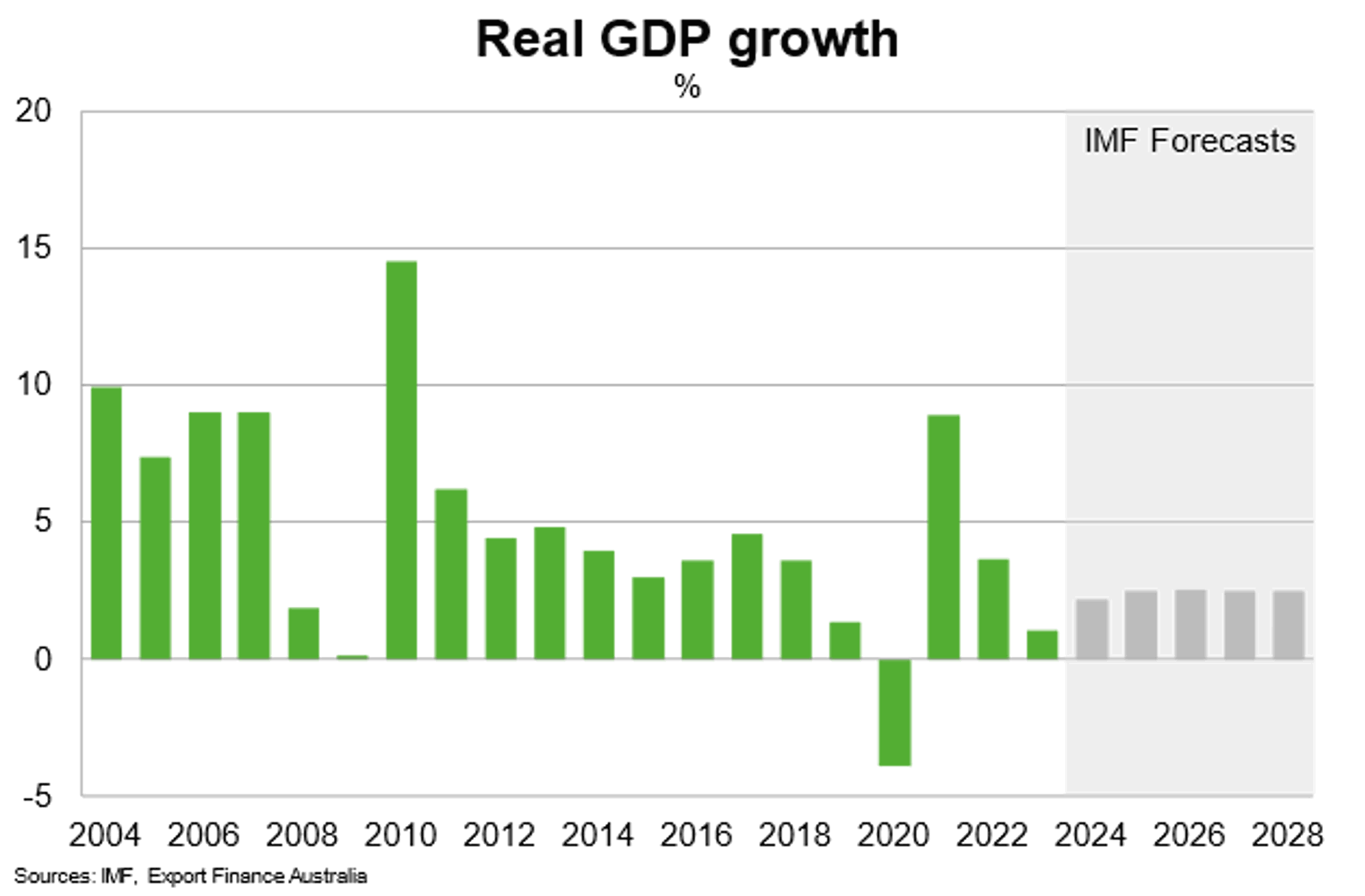

A challenging global environment, cost of living pressures and elevated interest rates weighed on Singapore’s economy in 2023. Real GDP grew 1% in 2023, down from 3.6% in 2022. That said, a rebound in manufacturing towards the end of the year, particularly in the electronics sector, is likely to continue in 2024. In addition, financial services are poised to recover on prospects for easing in global interest rates. Travel-related services, which performed well in 2023, are likely to again grow in 2024 on the back of further recovery in international travel. The IMF forecasts growth to pick up to 2.1% in 2024.

Risks are tilted to the downside and are mostly external. The potential for further supply chain disruptions, geopolitical tensions, and a slower than expected recovery in global economic growth could weigh on external demand for Singapore’s goods and services. In particular, an abrupt slowdown in the Chinese and US economies would weigh on overall growth.

Longer-term challenges include an ageing population and mitigating exposure to environmental risks. But Singapore’s strong fiscal and external buffers and highly effective institutions provide authorities with significant scope to address these cyclical and structural challenges. Singapore’s long-term planning surrounds strategic land use to bolster growth over the longer term.

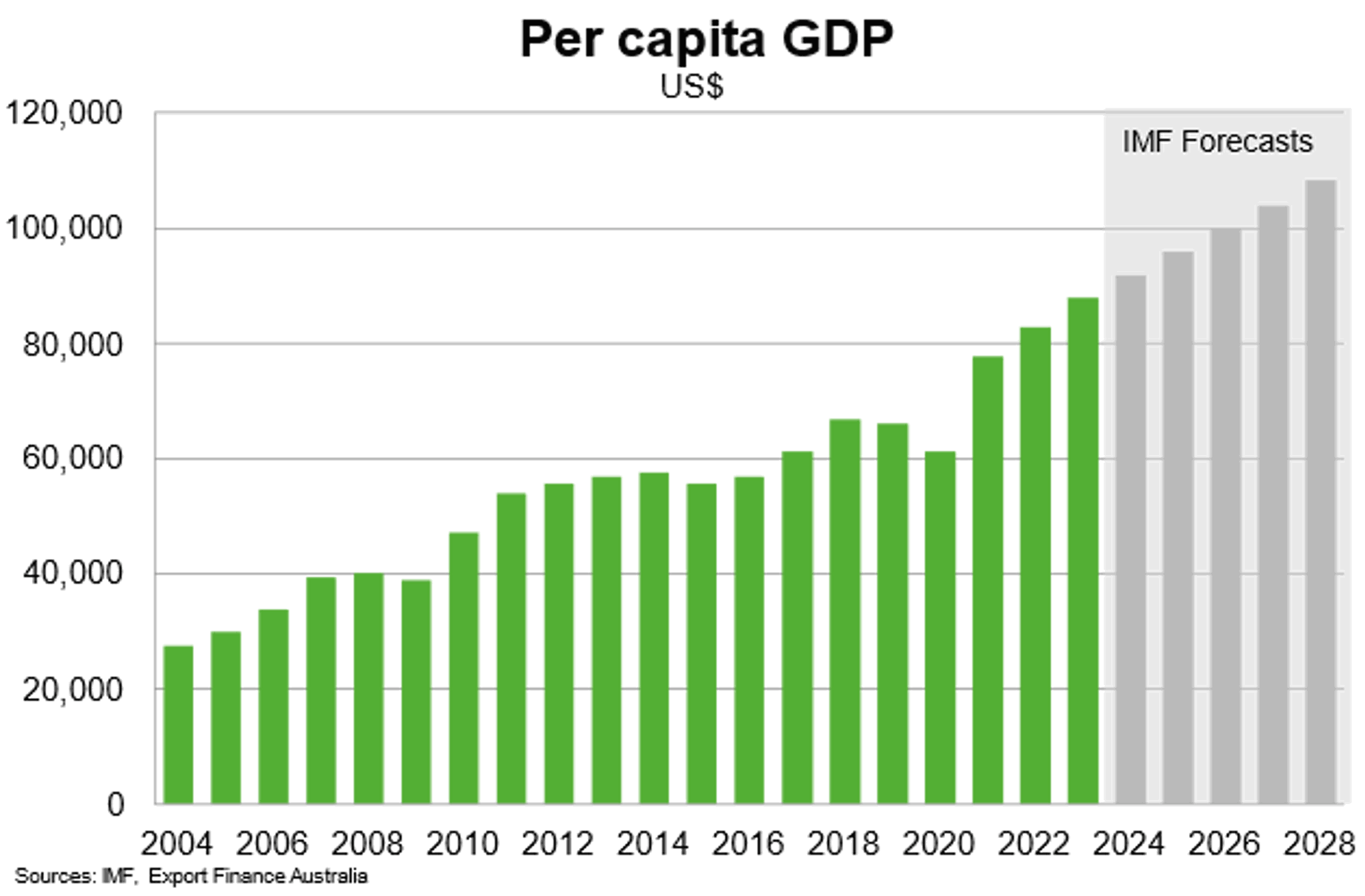

According to IMF data, Singapore’s GDP per capita was the 5th highest in the world in 2023, ahead of Qatar (7th) and the US (8th). The IMF expects per capita GDP to reach US$108,000 in 2028. Authorities’ ongoing plans to invest further in human capital and pursue policies that transition the city-state to a higher productivity and knowledge-based economy will help support income growth.

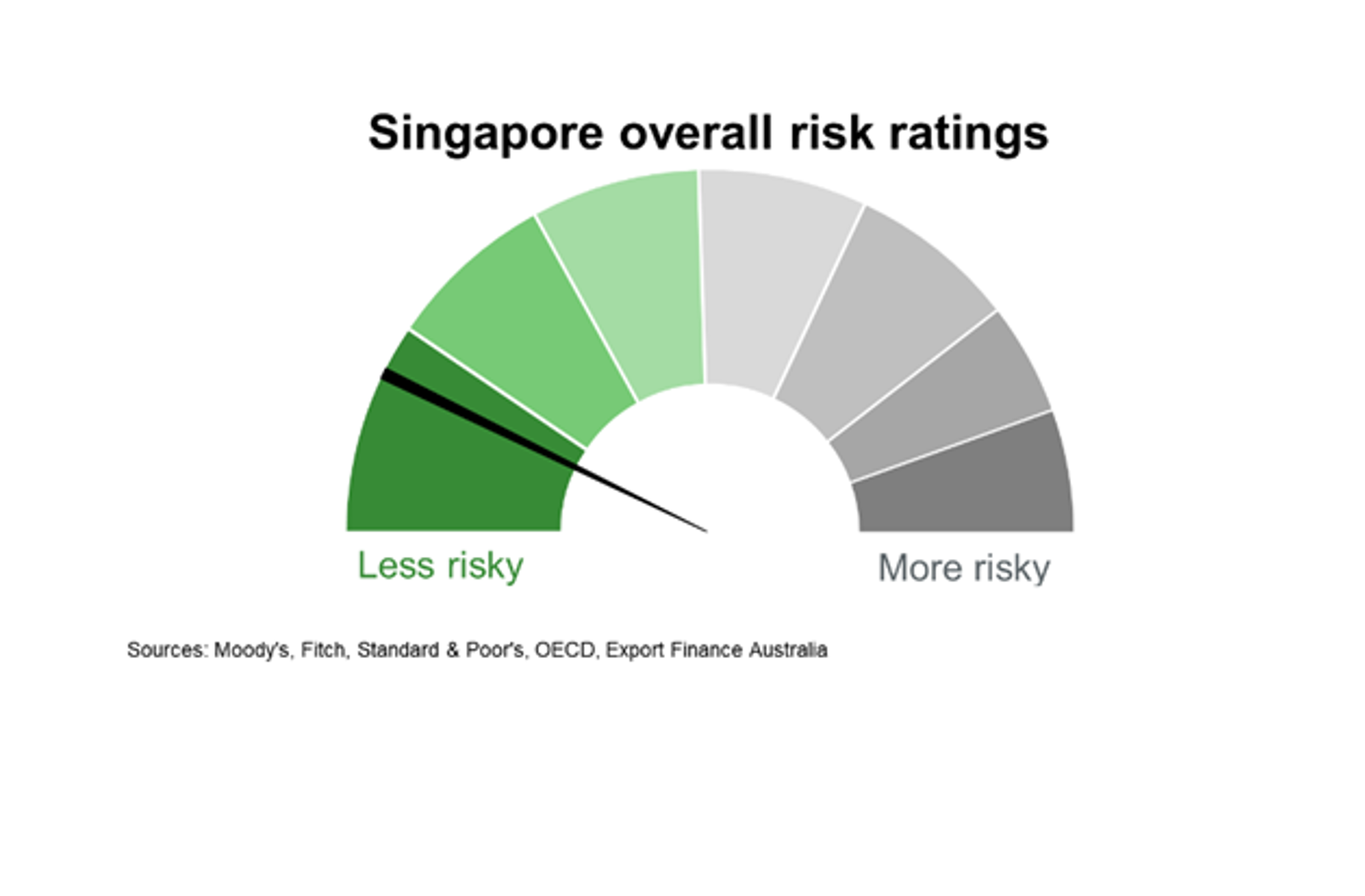

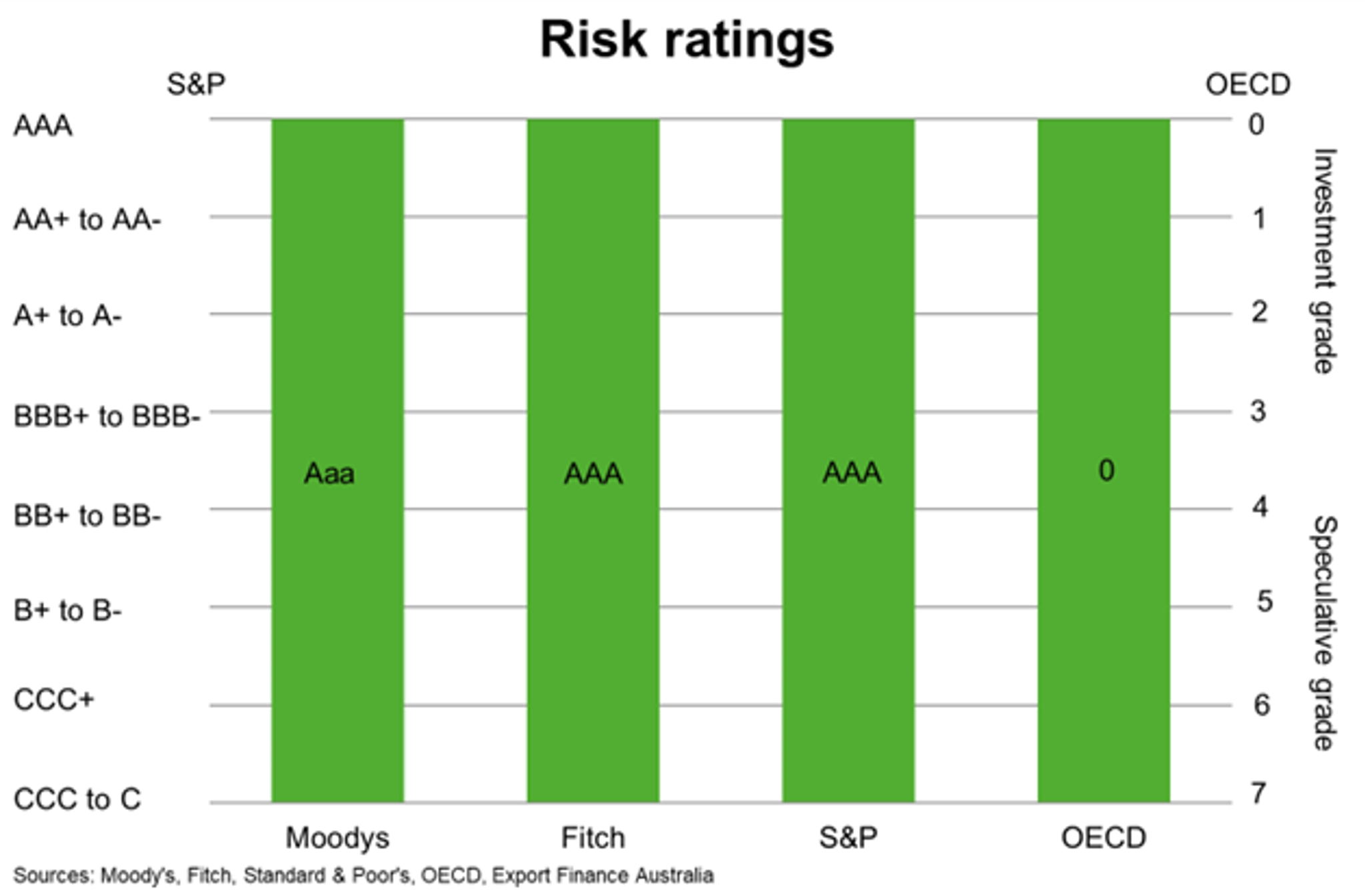

Country Risk

Country risk in Singapore is low, suggesting a relatively low likelihood that it will be unable or unwilling to meet its external debt obligations. Singapore has the highest possible sovereign credit ratings from major private credit rating agencies, and these ratings have been maintained throughout various economic shocks, thanks to the city-state’s large fiscal and external buffers.

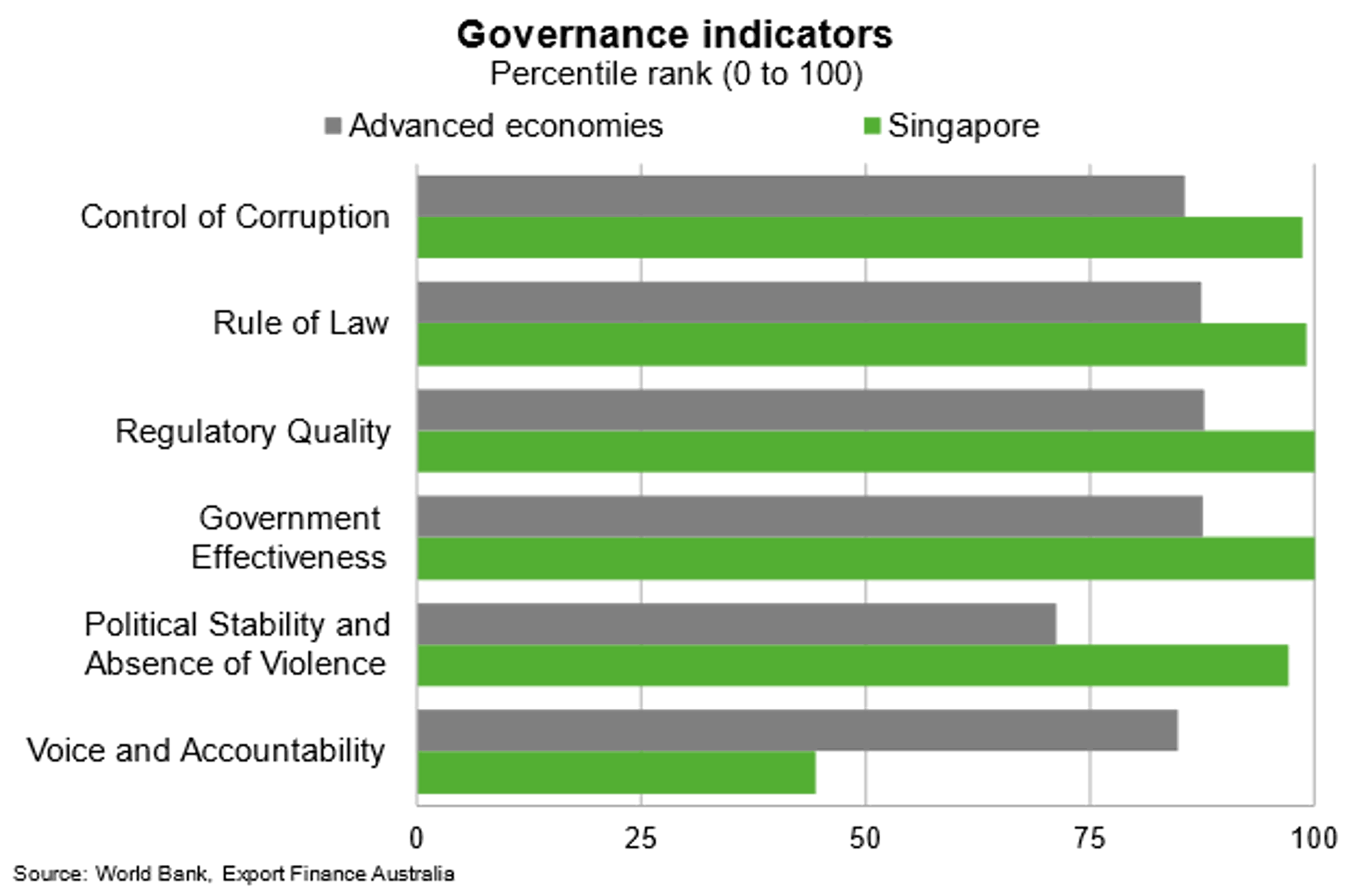

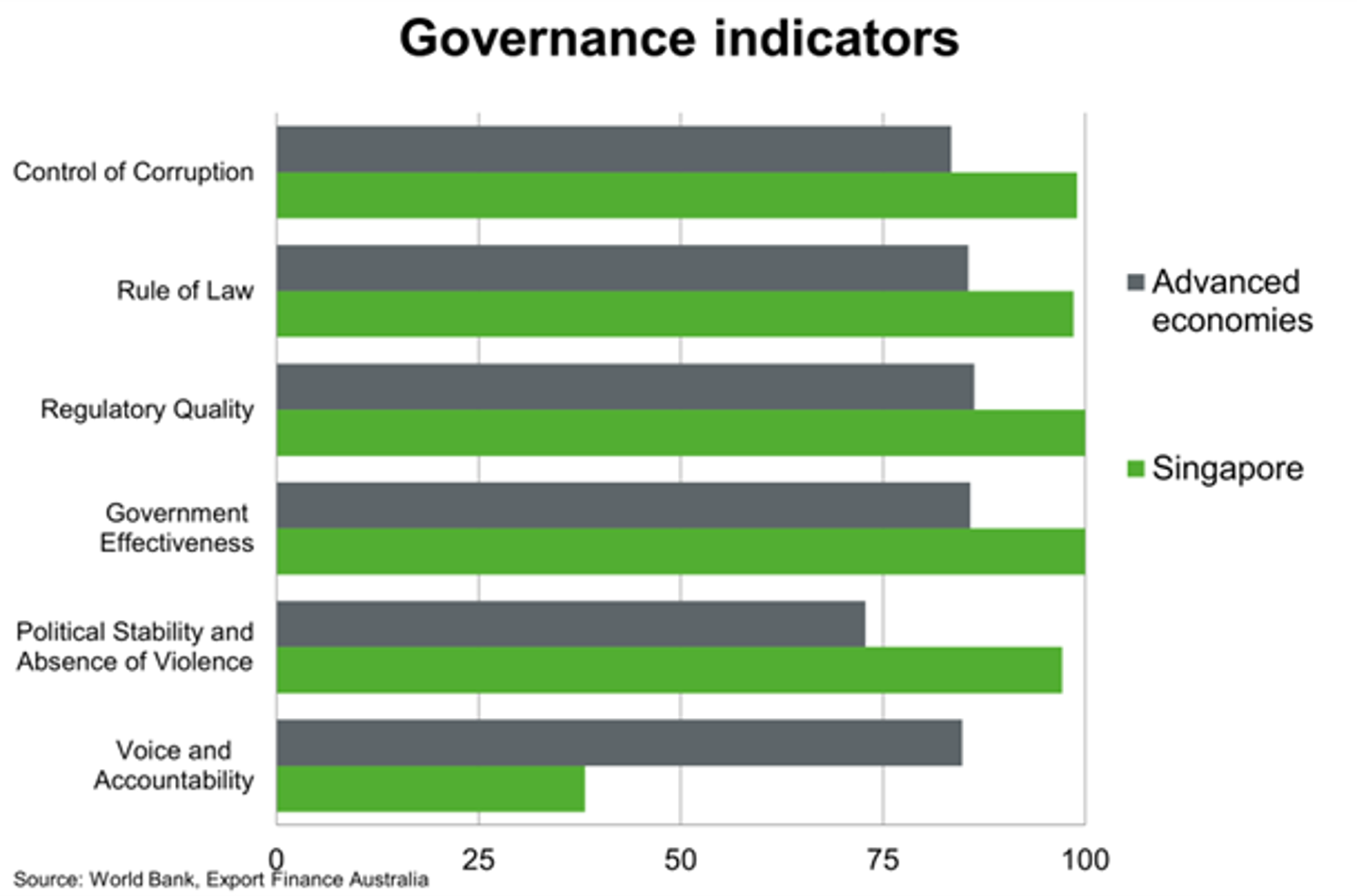

Singapore ranks near the top in most areas of governance, but less so on voice and accountability.

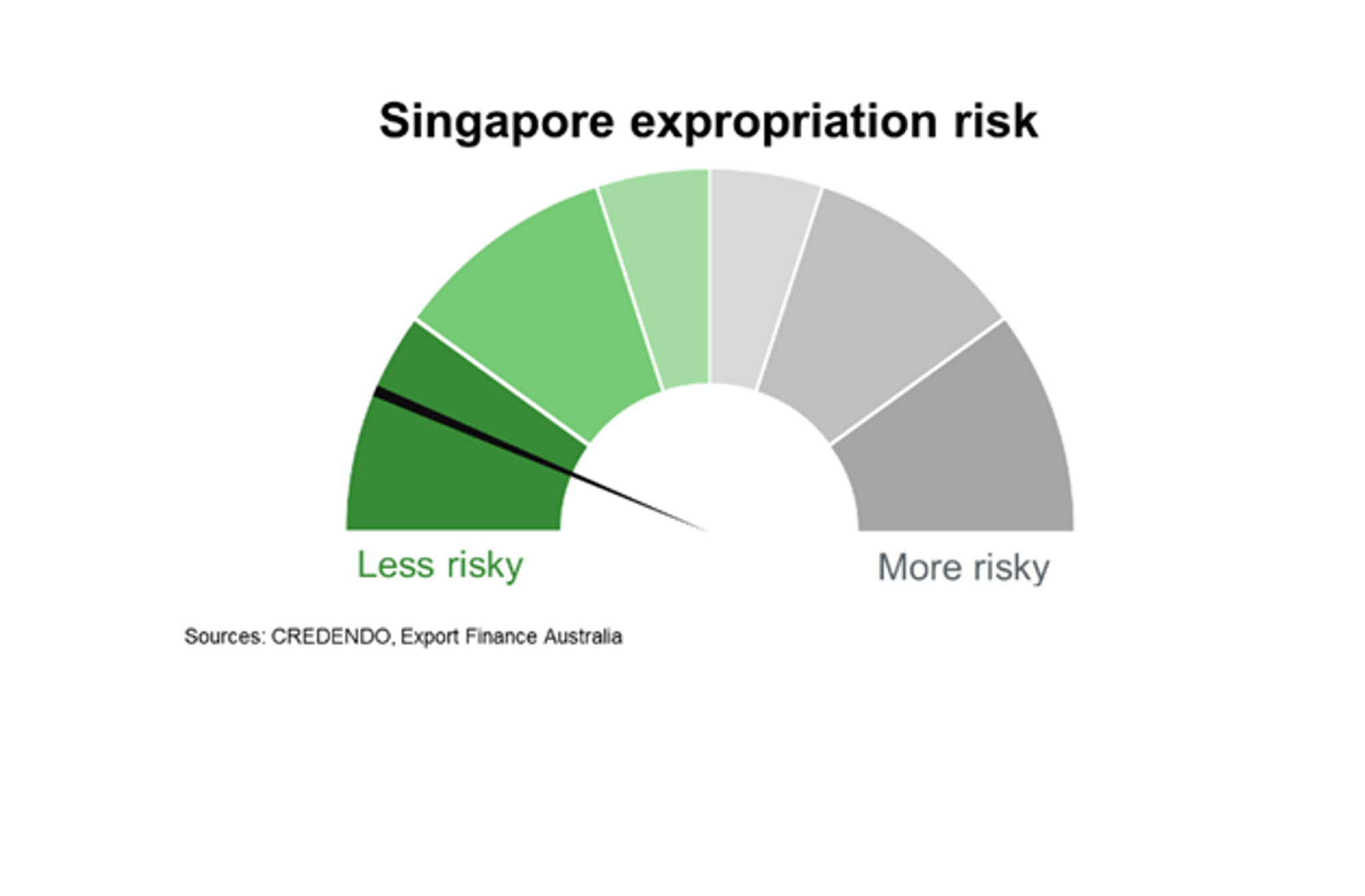

Expropriation risk is low. Singapore has an efficient and business-friendly regulatory environment for investment.

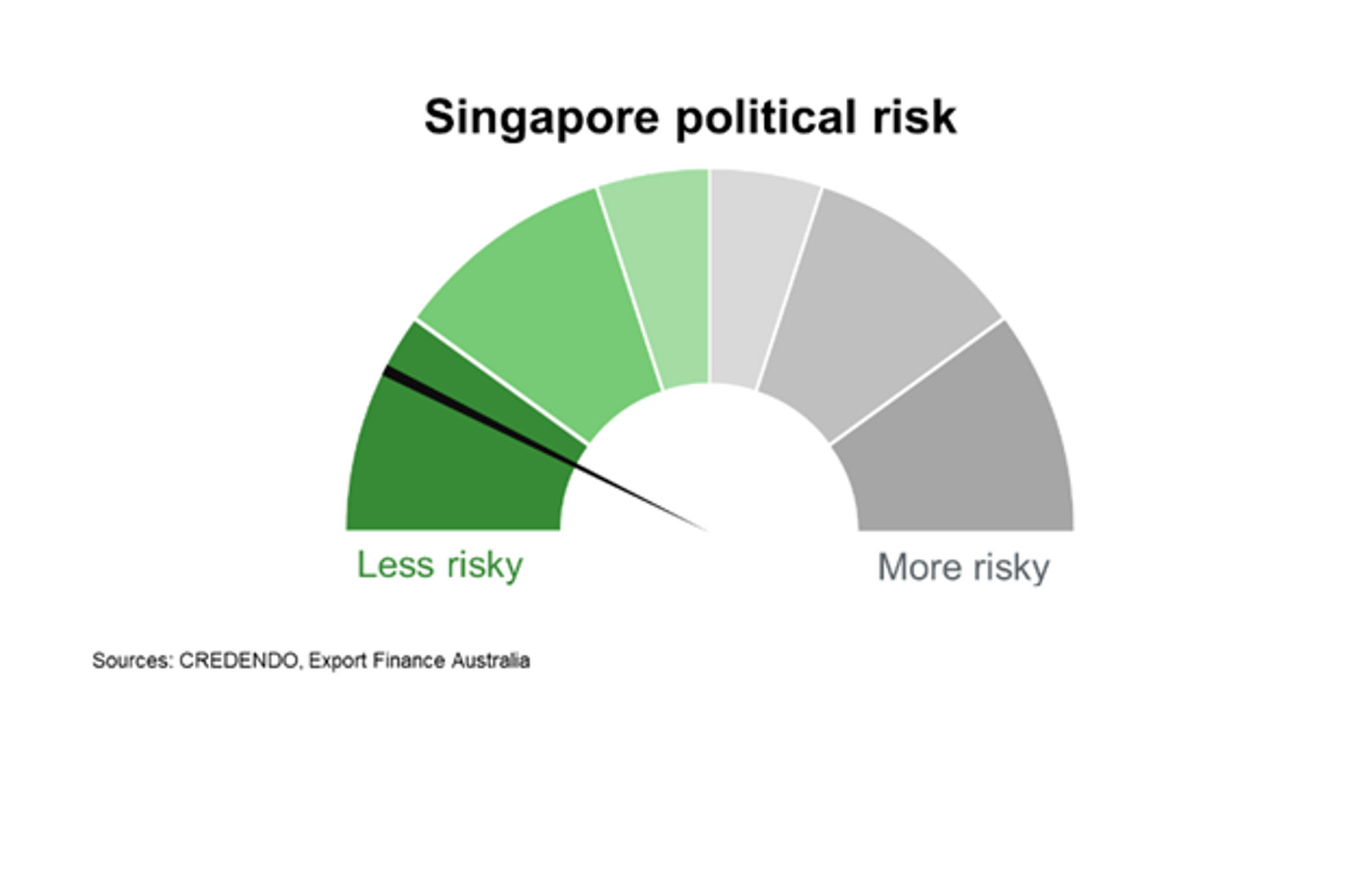

Political risk is low. Singapore’s political system is stable; the People’s Action Party (PAP) has been the main governing party since 1959. Policies are predictable and governance is very high.

Bilateral Relations

Singapore is Australia’s largest trade and investment partner in ASEAN. Singapore was Australia’s 5th largest bilateral trading partner overall in 2022. Australia and Singapore have a bilateral free trade agreement and are both also member countries of the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA), the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP).

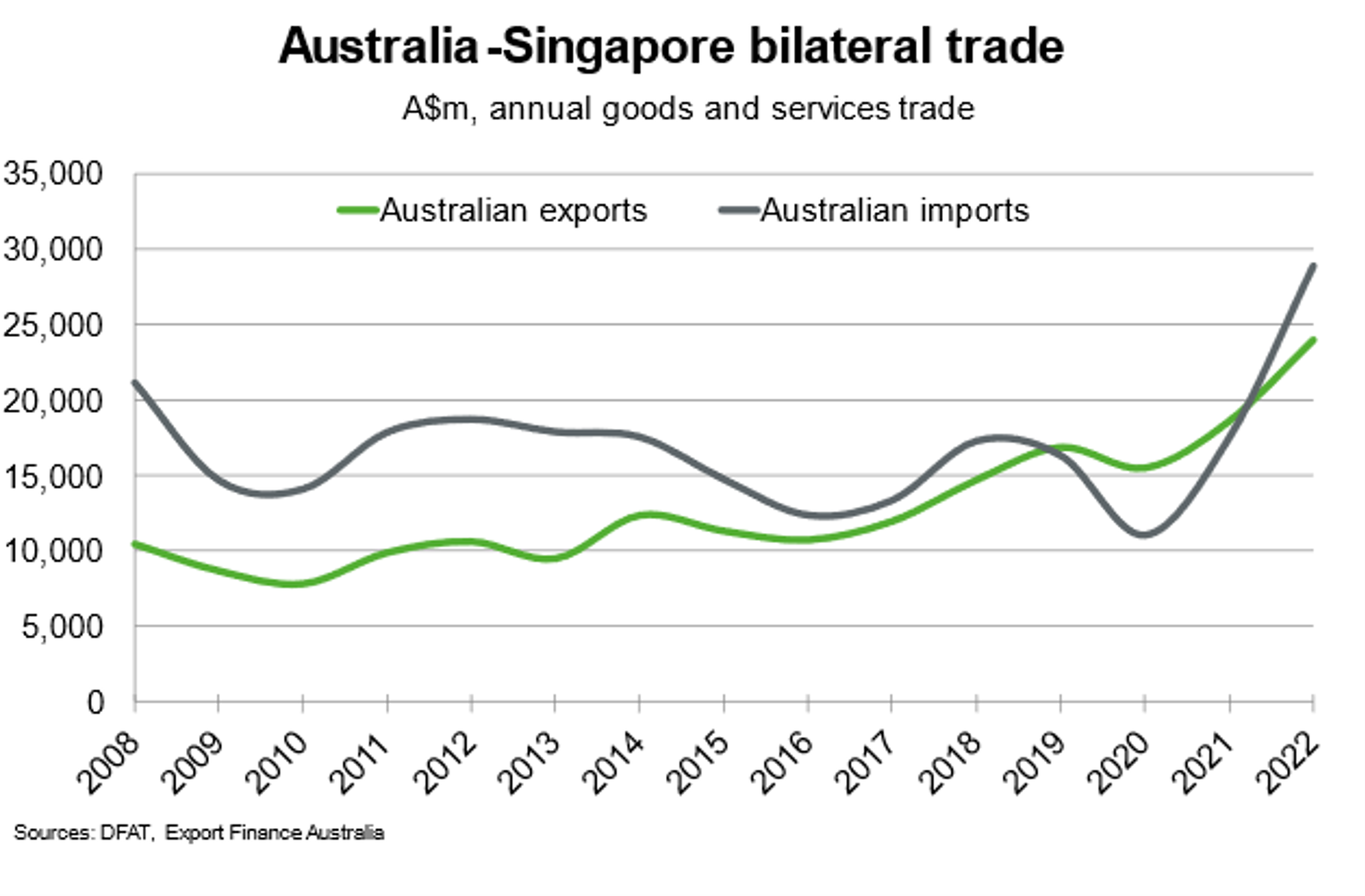

Total goods and services trade between Singapore and Australia rose 46.5% in 2022 and amounted to around $36 billion. Major Australian exports to Singapore in 2022 included natural gas, gold, animal oil and fats, and financial, professional tech and other business services. Goods imports from Singapore rose significantly to roughly $19.5 billion in 2022 from $12.8 billion in 2021. Around half of all imports are refined petroleum products. Services imports more than doubled between 2021 and 2022, attributed to increased transport and travel-related services in the wake of the pandemic.

Singapore is a large net importer of food and beverages. Given the pandemic has pressured supply chains, Singapore may look to further diversify its imports. This provides increasing opportunities for Australian food exporters to sell into Singapore and to expand logistics and transhipment arrangements to the Southeast Asian region.

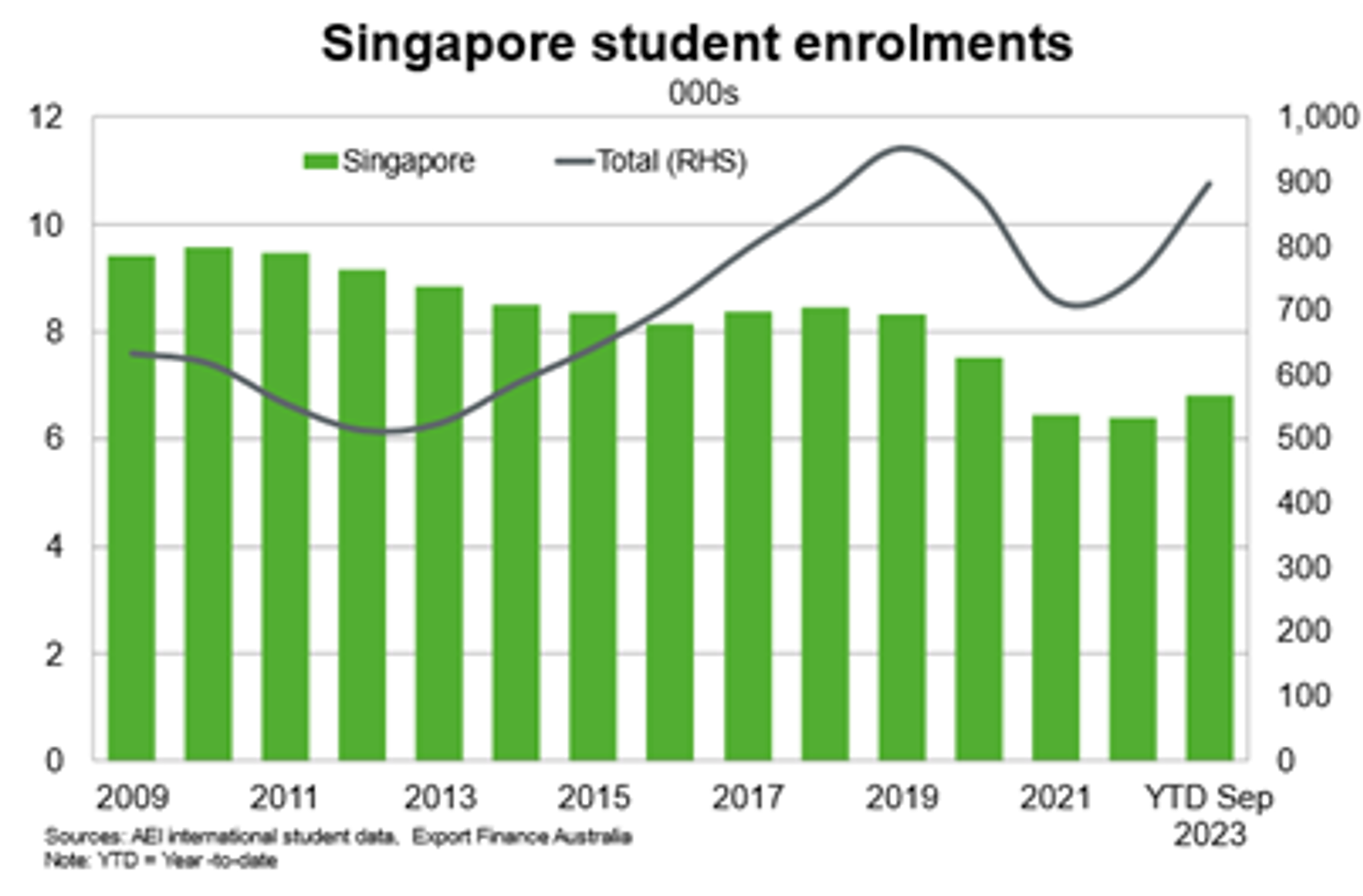

Singapore is Australia’s 22nd largest source of international student enrolments. Notwithstanding a slight rise in 2023, Singaporean student enrollments have been on a declining trend over the past decade, in part due to students’ increasing preference to study in other established markets such as the US and UK and new markets such as China, Japan and South Korea.

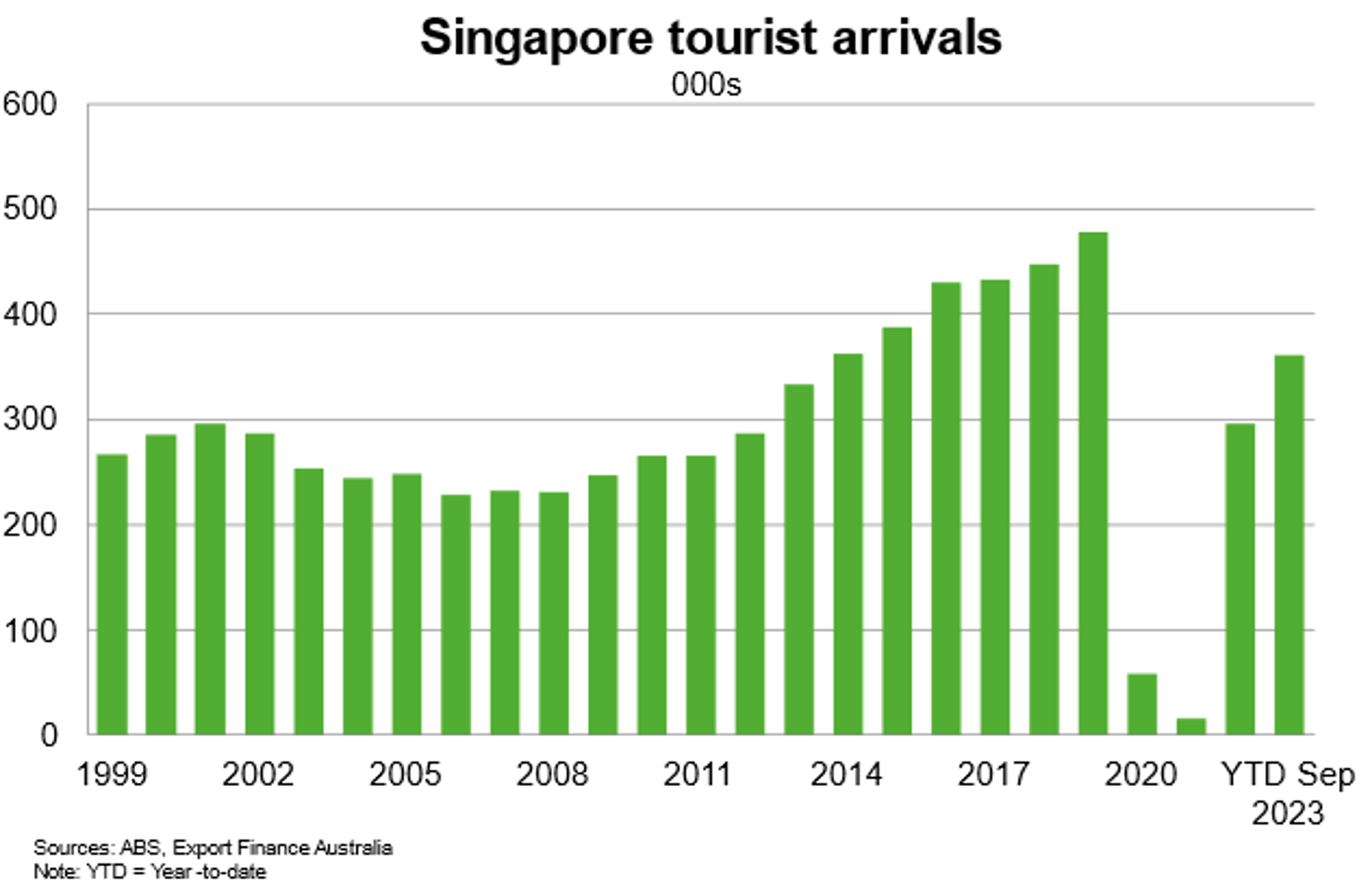

Singapore tourism arrivals to Australia continued to recover in 2023, though they remain below pre-pandemic levels. A competitive Australian dollar and another year of recovery in international travel should support further demand for Australian tourism, and broader services exports, in 2024.

Singaporean investment in Australia rose to $149 billion in 2022 (representing 3.3% of the total stock of foreign investment), up from $121 billion in 2021. Singaporean investment is concentrated in real estate, manufacturing, energy and services sectors.

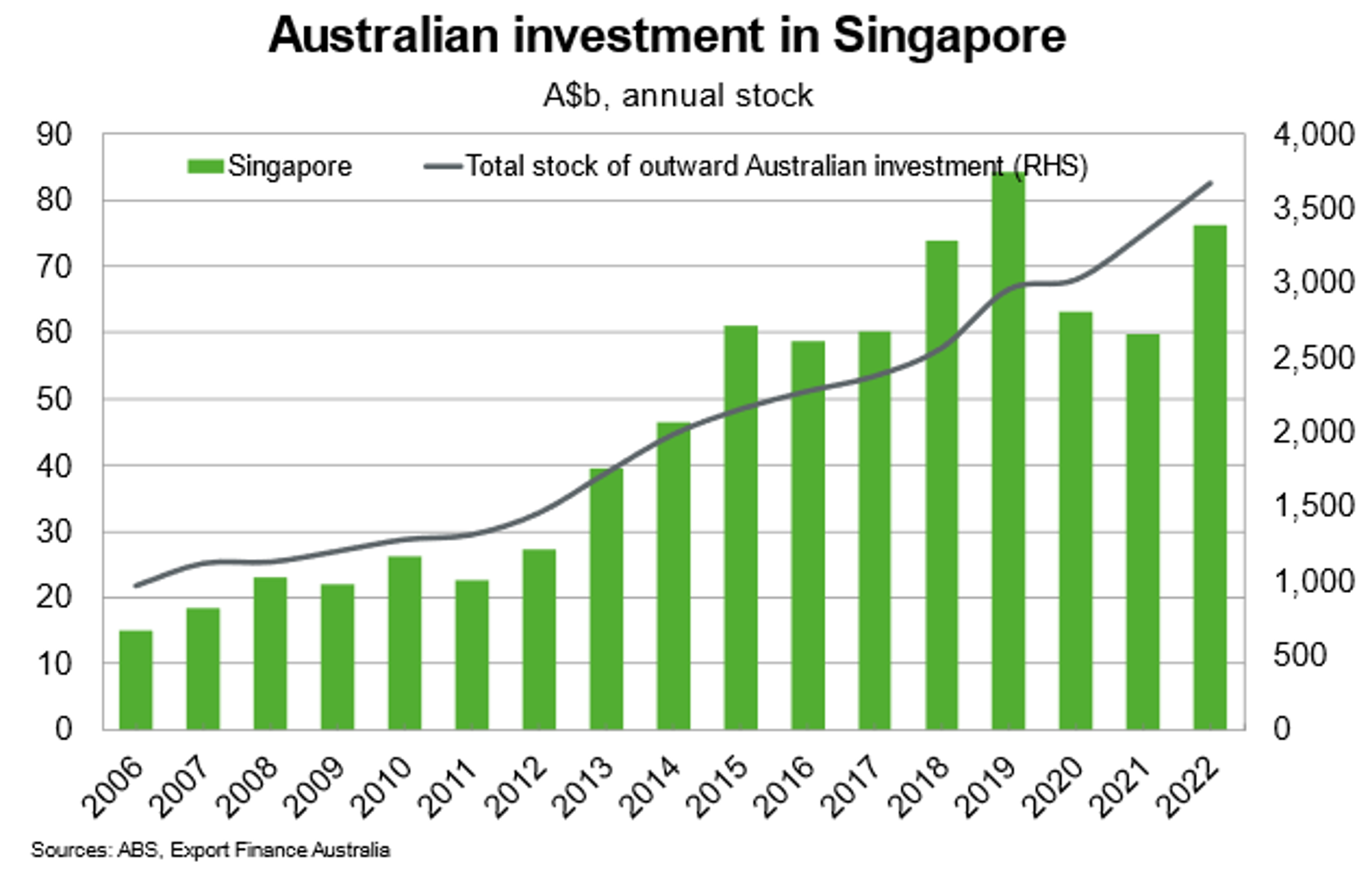

Australian investment in Singapore reached $76 billion in 2022, an increase from $60 billion in 2021 (accounting for 2.1% of Australia’s foreign investment portfolio). Businesses invested in Singapore include major Australian banks; engineering design and construction firms such as Lend Lease Asia Holdings and CIMIC Group and logistics groups such as Toll Holdings. BHP Billiton and Rio Tinto are among other Australian corporates that have some business functions based in Singapore.

Critical minerals present an opportunity for increased trade and investment between Australia and Singapore. In December 2020, the Australia-Singapore Digital Economy Agreement (DEA) came into force. The DEA updates the Singapore-Australia Free Trade Agreement to provide increased market access and certainty for exporters in both countries. Singapore and Australia agreed to further the bilateral partnership through the $30 million Green Economy Agreement (GEA) in 2021. The GEA is expected to facilitate trade and investment specifically in the environmental goods and services sector and build capacities in the two countries to tackle climate change through collaboration on low emissions technologies.

Useful links

Department of Foreign Affairs and Trade

ASEAN-Australia-New Zealand Free Trade Area

Austrade