Sri Lanka

Sri Lanka

Last updated: January 2024

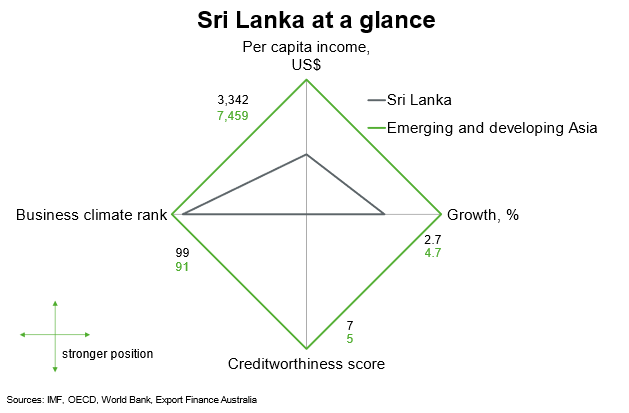

Sri Lanka remains a lower-middle-income country; GDP per capita is well below the average for emerging Asian countries. Measures of the business climate, growth and creditworthiness are also below the regional average. Public debt and balance of payments problems, political risks, security and geopolitical issues and environmental risks all remain prominent challenges. Amid these challenges, the country has a highly literate population, diversified economy and moderately strong institutions.

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic outlook

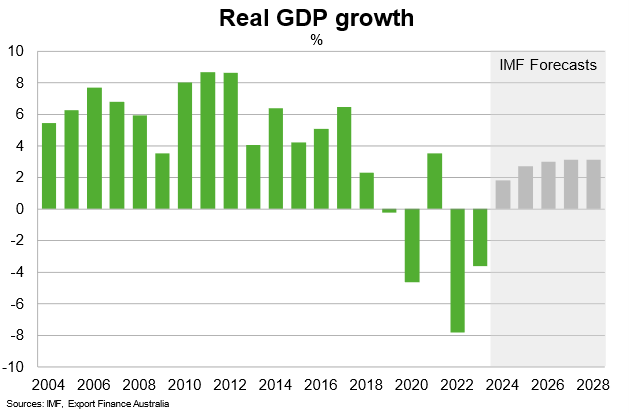

Real GDP contracted 3.6% in 2023, easing from a 7.8% decline in 2022. Output in construction, manufacturing, financial services, insurance and real estate all contracted amid supply chain disruptions, shrinking private credit and a shortage of inputs because of import restrictions (that said, some restrictions have eased, particularly for essentials such as fuel and food). Increased taxes to consolidate public finances and elevated energy prices continue to exert downward pressure on consumption and investment. On the positive side, lower interest rates and increasing tourism are helping to support a gradual economic recovery. Inflation declined sharply to 4% in December 2023 after peaking at 70% in September 2022, easing the squeeze on household budgets. Lower imports have contributed to a contraction in the merchandise trade deficit and support the Sri Lankan rupee. Continued suspension of external debt repayments, strong remittance inflows and stronger tourism earnings are helping to fortify the stock of foreign exchange reserves.

The IMF projects a return to GDP growth, of 1.8% in 2024, supported by accommodative monetary policy conditions and continued relaxation of import restrictions. Tourism earnings and remittance inflows are likely to remain robust, providing benefits across the wider economy. However, revenue-based fiscal consolidation in line with the IMF program weighs on public consumption and investment.

The continued implementation of the four-year US$3 billion IMF Extended Fund Facility (EFF), approved in March 2023, will help restore fiscal health and external stability, whilst supporting a broader economic recovery. The IMF forecast economic growth to average 3% per annum between 2025 and 2028, but growth prospects in the next few years depend on effective debt restructuring and fiscal reforms. Progress has been made on this front. Sri Lanka reached a preliminary debt restructuring deal with Paris Club creditors in November 2023, paving the way for further IMF loan disbursements and progress on reform. The deal follows an announcement in October 2023 that the Export-Import Bank of China had agreed preliminary terms to restructure its own loans. These agreements helped Sri Lanka secure the next US$330 million of its US$3 billion IMF lending package that had stalled because of disagreements among lenders over restructuring terms.

Risks to growth are significant and tilted to the downside. A slow debt restructuring process, including with external private creditors, the potential for limited external financing support and the scarring effects of prolonged economic contraction could extend economic and financial distress. Any backsliding on IMF-led reforms would jeopardise recovery in economic growth and public and external finances. External risks also remain, related to geopolitical tensions and commodity price volatility.

Longer term, growth potential hinges on Sri Lanka attracting more foreign investment, diversifying trade, reviving tourism, and increasing agricultural productivity. Sri Lanka's strategic location on key shipping routes, as well as its expanded port capacity, position it well to benefit from increased trade, particularly in South Asia. Effective implementation of IMF-led structural reforms to restore debt sustainability and boost trade and investment would support longer-term growth.

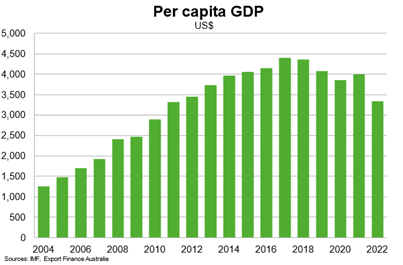

GDP per capita has fallen from above US$4,000 in 2017-18 to an estimated $3,200 in 2022 due to severe economic contraction, high food inflation and job losses. The World Bank estimates the poverty rate increased to 25.6% in 2022 from 11.3% in 2019 due to the economic and financial crisis, a trend that likely persisted in 2023. As a result, much of the income gains over the past decade have been reversed. Income prospects hinge on the path of GDP growth moving forward.

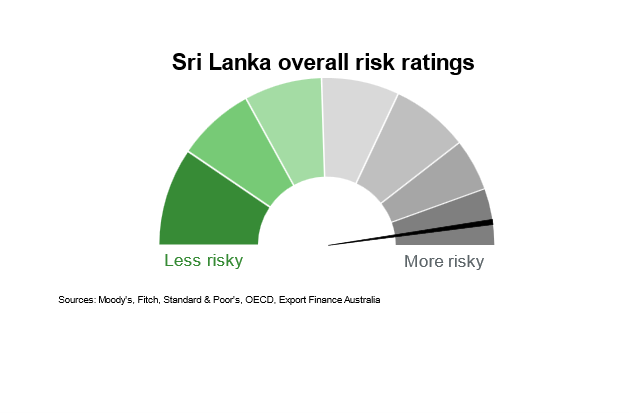

Country risk

Country risk in Sri Lanka is high. The OECD has a country credit grade of 7. The government suspended debt servicing on all public external debt in April 2022, pending debt restructuring to restore debt sustainability.

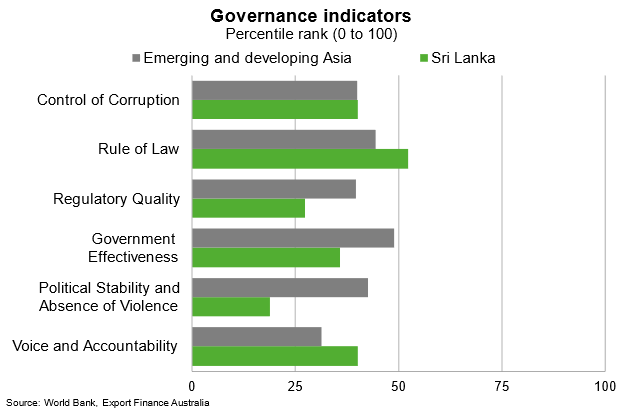

Sri Lanka lags behind emerging and developing Asian economies on Worldwide Governance indicators of regulatory quality, government effectiveness, and political stability and absence of violence. However, Sri Lanka outperforms the region on rule of law and voice and accountability and is in line with the region on control of corruption. Still, most indicators rank in the bottom half of all countries. Implementation of IMF-led reforms could, over time, enhance governance and the effectiveness of economic, political and fiscal institutions.

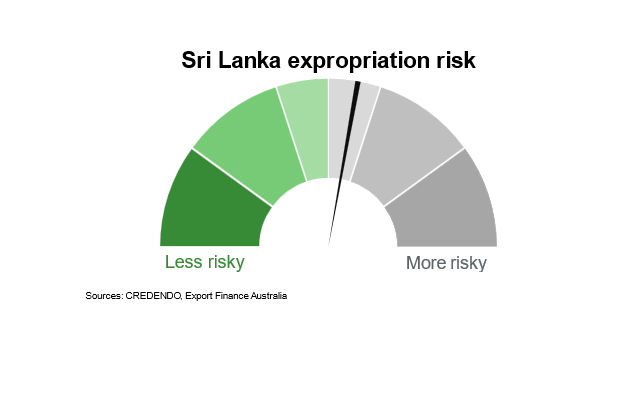

The risk of expropriation in Sri Lanka is moderate. According to the US Investment Climate Statements, the Sri Lankan land acquisition law empowers the government to take private land for public purposes with compensation based on a government valuation. Since economic liberalisation policies began in 1978, the Sri Lankan government has not expropriated a foreign investment.

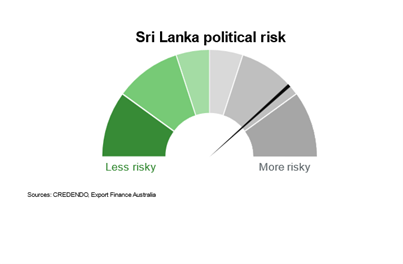

Political risk in Sri Lanka is high. Ongoing economic and financial stress continues to raise risks around political stability and social unrest. Political and policy uncertainty could rise in the lead up to and beyond the 2024 elections.

Bilateral relations

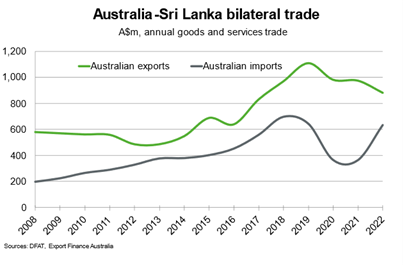

Sri Lanka is Australia’s 48th largest trading partner. Total goods and services trade amounted to $1.5 billion in 2022. Exports to Sri Lanka consist mostly of education-related travel, vegetables, and wheat; Sri Lanka’s import restrictions likely hurt demand for Australian products in 2022. Australian imports from Sri Lanka are made up mostly of tourism, clothing, textiles and tea and mate. The increase in imports was largely driven by a rise in Australia outbound tourism following the removal of pandemic-related international border restrictions.

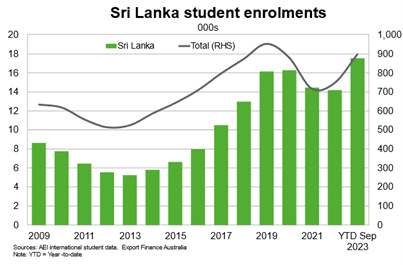

Student enrolments surpassed pre-pandemic levels in 2023. High levels of student mobility, close government-to-government relationships and a significant diaspora support Sri Lankan demand for Australian education. Australian education providers are also expanding their presence in Sri Lanka, including through the new Edith Cowan University campus that allows students to study Australian university undergraduate programs.

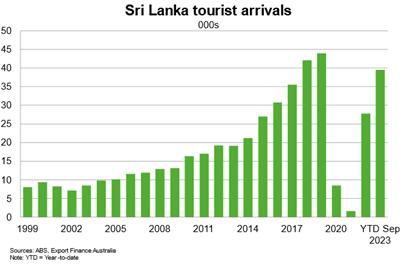

Like in education, Sri Lanka had been a growing market for Australian tourism before the pandemic. Tourist arrivals are still below pre-pandemic levels, in part due to difficult economic and financial conditions in Sri Lanka. Recovery in Sri Lanka’s economy, a competitive Australian dollar and another year of increasing international travel should support further demand for Australian education, and broader services exports in 2024.

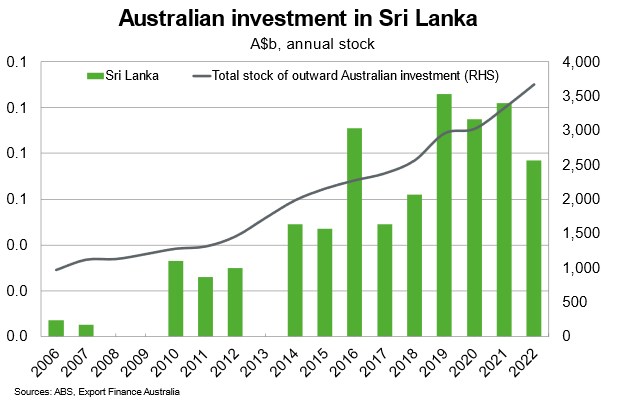

Bilateral investment between Sri Lanka and Australia remains small. Australia’s development program will support Sri Lanka’s efforts to enhance health security and advance economic development. In the near term, difficult economic and financial conditions hinder investors’ appetite in Sri Lanka.

Useful links

Department of Foreign Affairs

Austrade