Thailand

Thailand

Last updated: January 2024

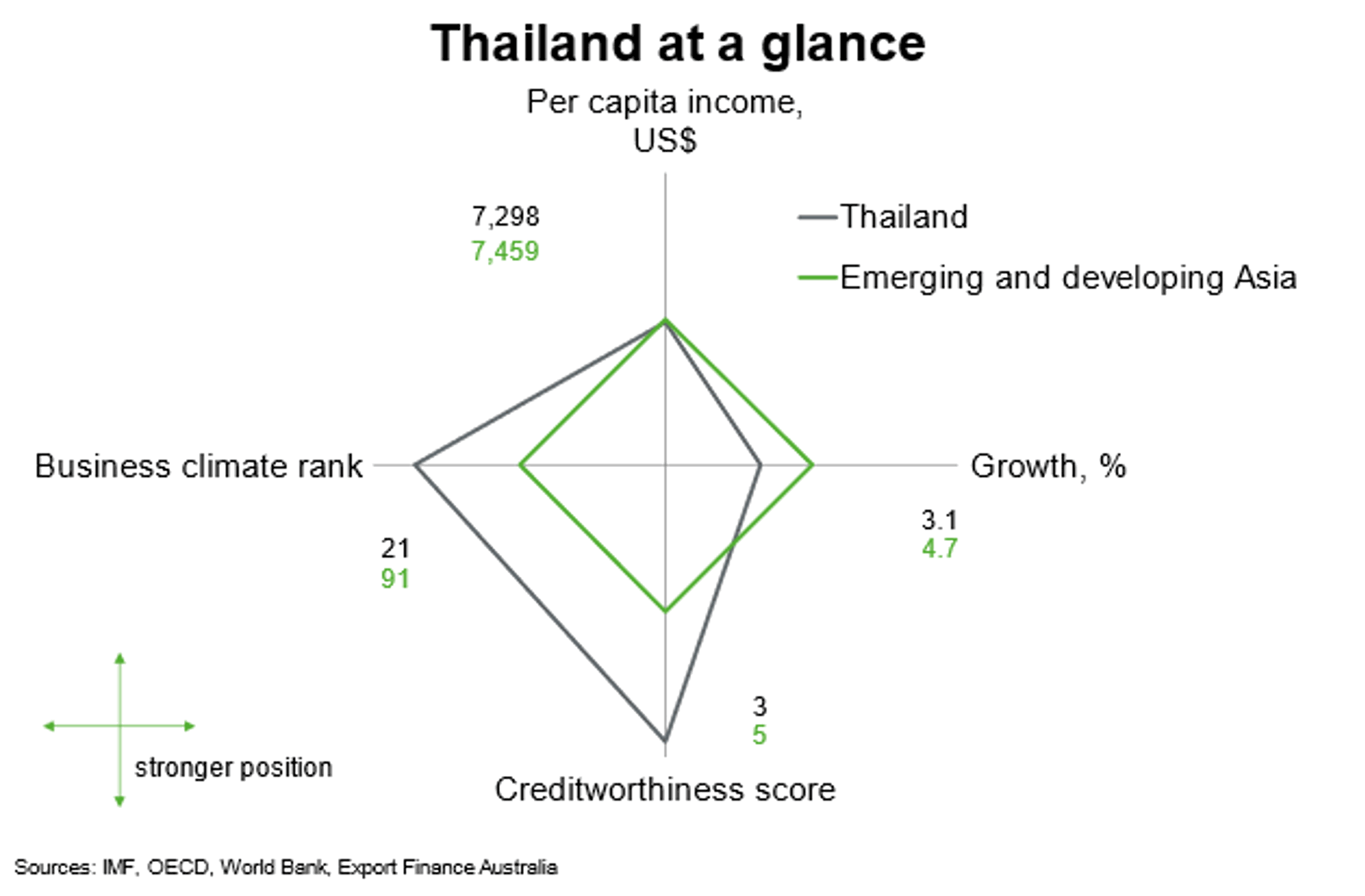

Thailand outperforms most of emerging and developing Asia on measures of creditworthiness and the business climate. Per capita incomes are in line with the emerging Asia average while GDP growth lags. Longer-term structural challenges related to an ageing society, labour skills shortages and political risks weigh on Thailand’s income and growth potential relative to emerging Asian peers. As an export-led and tourism-reliant economy, developments in global demand and international travel will shape Thailand’s prospects.

This chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other regional countries.

Economic outlook

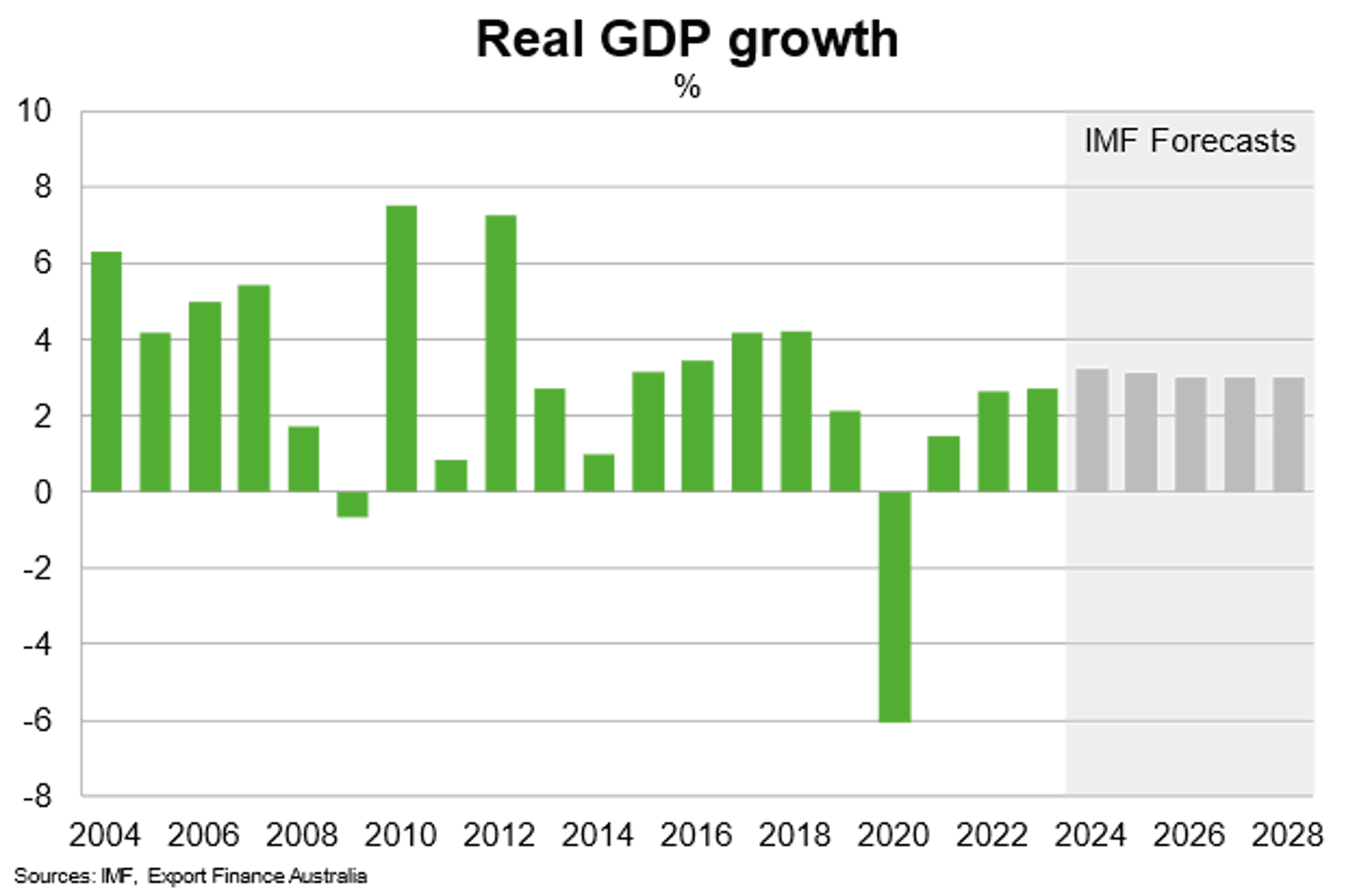

Thailand’s real GDP growth of 2.7% in 2023 lagged that of other Southeast Asian nations in 2023, where ASEAN economies grew 4.2%, on average. Robust private consumption, aided by favourable government policies, and a recovery in tourism supported growth. But slowing global demand, including from China, hurt merchandise exports and investment. Political uncertainty also weighed on investment. Tight monetary policy helped control inflation and support financial stability. Lower inflation also reflected the government’s implementation of cost-of-living subsidies.

The IMF expects growth to pick up to 4.4% in 2024 on the back of improvements in external demand and robust private consumption, including support from fiscal stimulus. In May 2023, the government announced a stimulus package of around US$14 billion (about 3% of GDP) to support domestic demand. Continued recovery in tourism should also support growth.

Risks to growth include high interest rates squeezing household budgets given Thailand’s high household debt. Slower than expected global growth would hit exports hard. Geopolitical tensions generate risks of higher commodity prices, which would hurt Thailand’s trade balance through a rising import bill. Meanwhile, high public debt and expansionary fiscal policy leaves the government’s balance sheet vulnerable to external shocks.

Thailand’s 20-Year National Strategy (2017-2036) continues to underpin growth prospects over the longer term; the IMF expects growth to average 3% per annum from 2025 to 2028. A cornerstone of this initiative is the ongoing implementation of projects in the flagship US$50 billion Eastern Economic Corridor (about 10% of GDP) to support higher private and public investment. Greater infrastructure development should aid foreign investment and enhance the international competitiveness of high-potential growth industries, including next-generation automobiles and artificial intelligence. But an ageing society, moderate competitiveness levels and labour skills shortages, if left unaddressed, will weigh on economic growth potential over time. According to the IMF, a growth-friendly medium-term fiscal consolidation plan, if it is implemented, could help facilitate investment in infrastructure and skills while contributing to a decline in public debt.

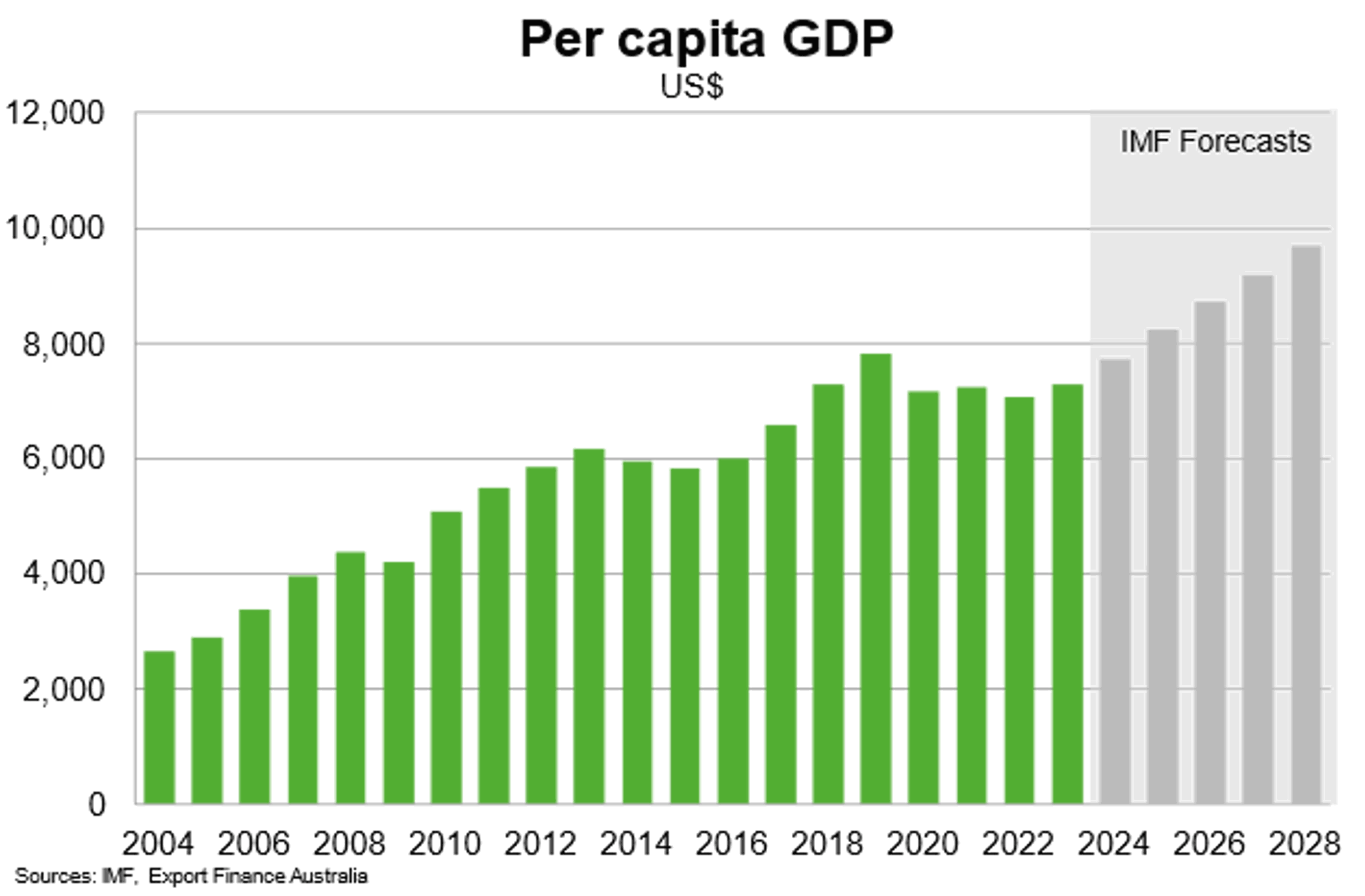

The IMF estimates GDP per capita of around US$7,300 in 2023 and expects incomes to reach about US$9,700 by 2028. Unemployment declined in 2023 on the back of rising tourism and accommodative fiscal policies supporting low-income earners. But GDP per capita has remained broadly stagnant since 2020, partially attributed to a slow recovery in goods exports and GDP growth following the pandemic. Authorities’ plans to raise investment in infrastructure, education and training, if effectively implemented, can help Thailand expand production in higher value-added industries and lift productivity and household incomes.

Country Risk

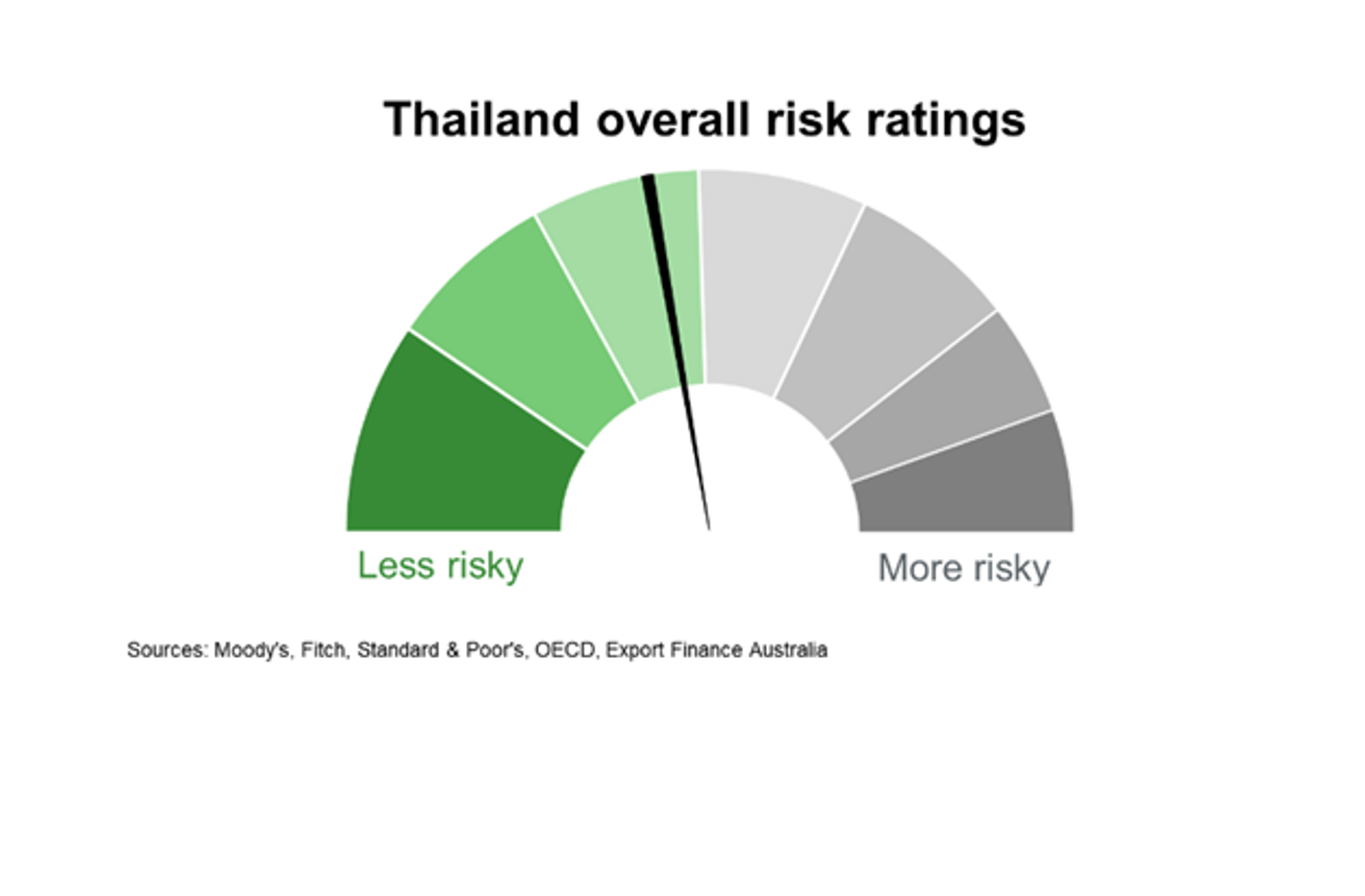

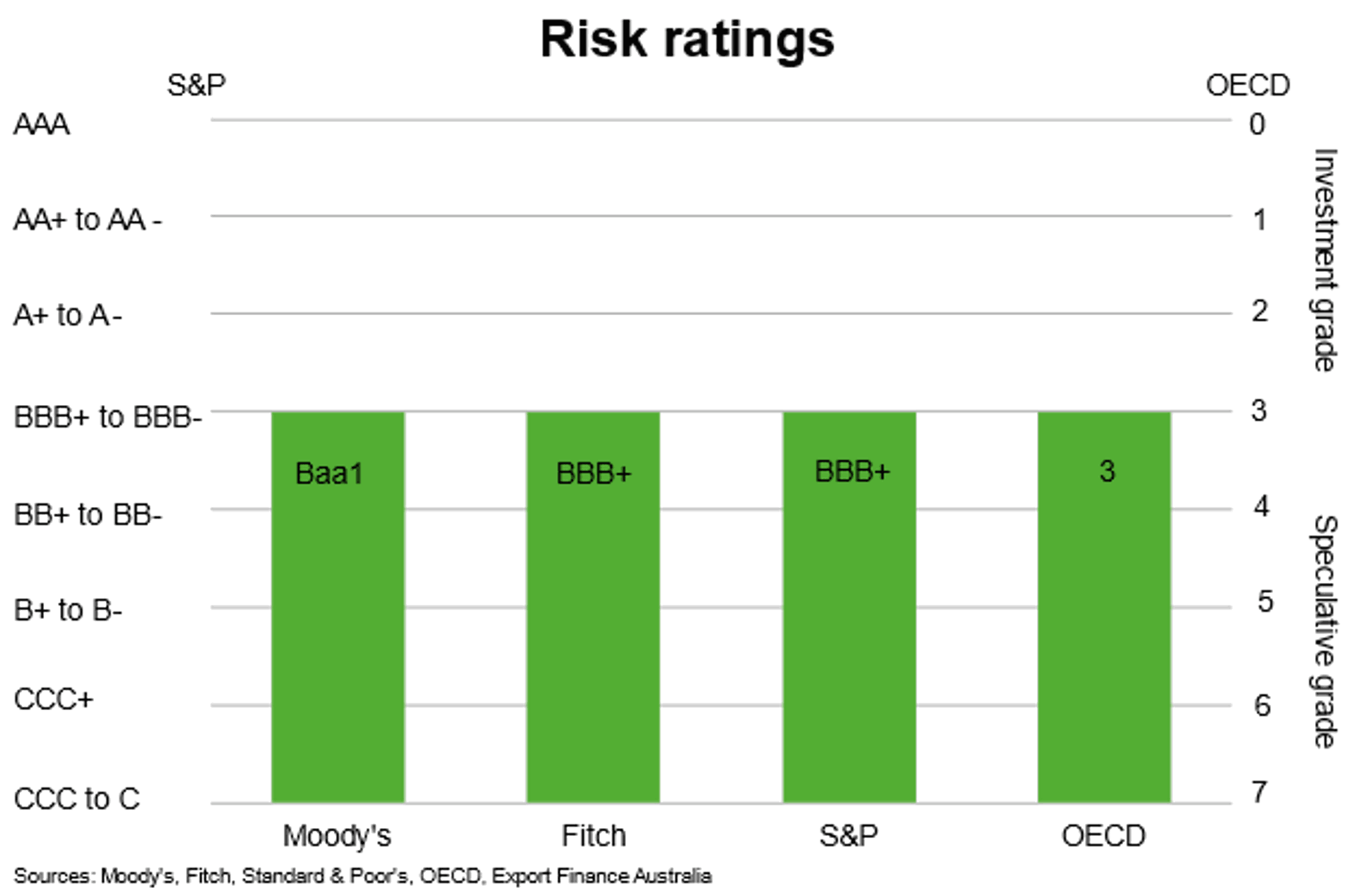

Country risk in Thailand is low to moderate. The OECD has a country credit grade of 3; comparable with the Philippines, India and Indonesia. This indicates a relatively low to moderate likelihood that Thailand will be unable and/or unwilling to meet its external debt obligations.

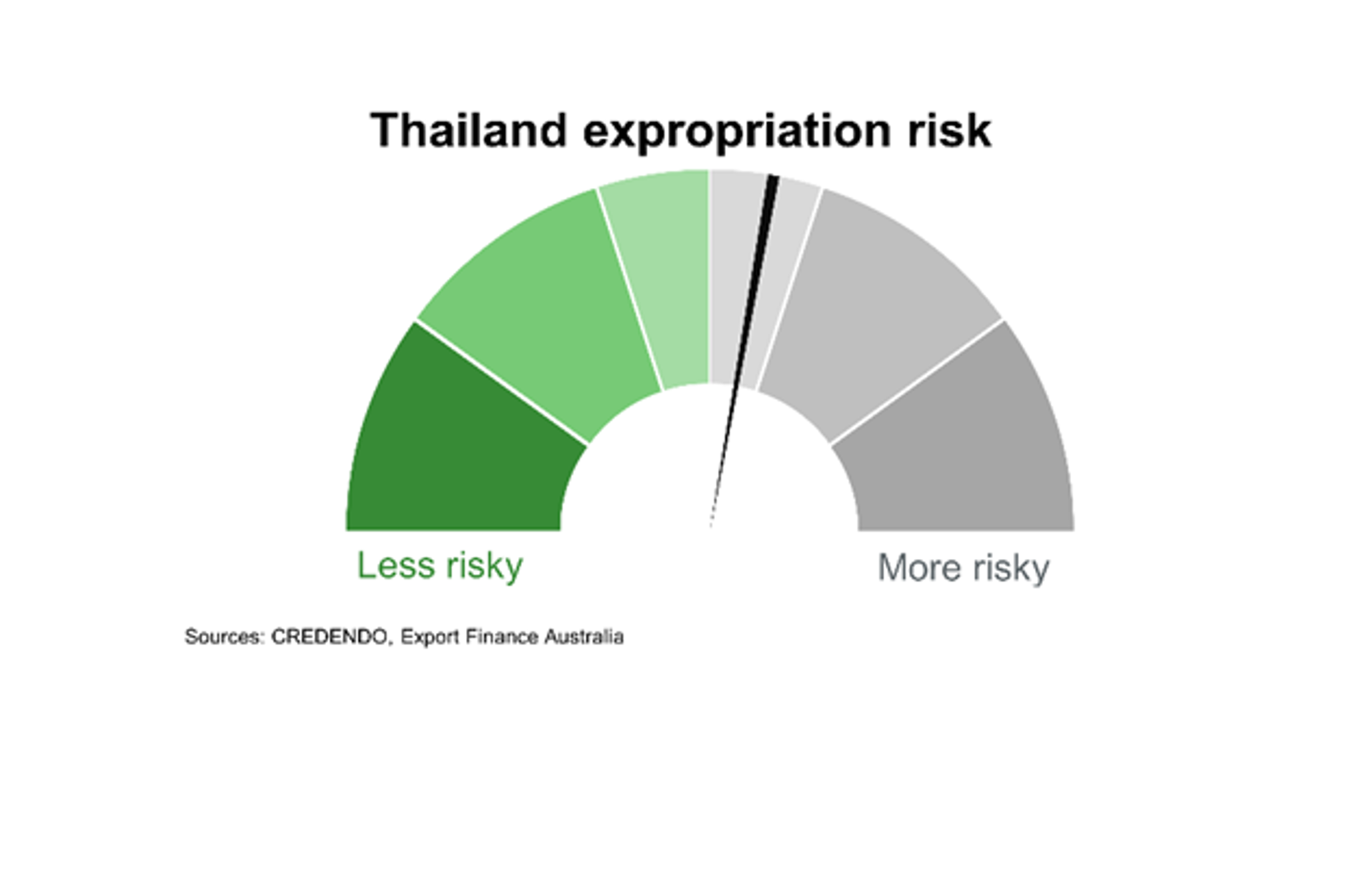

Risk of expropriation in Thailand is moderate. According to the US investment climate statements, Thai laws provide guarantees regarding protection from expropriation without compensation and non-discrimination for some, but not all, investors. Thailand allows the government to carry out expropriation for the purpose of promoting public interest, with reasonable compensation being offered to the expropriated private party.

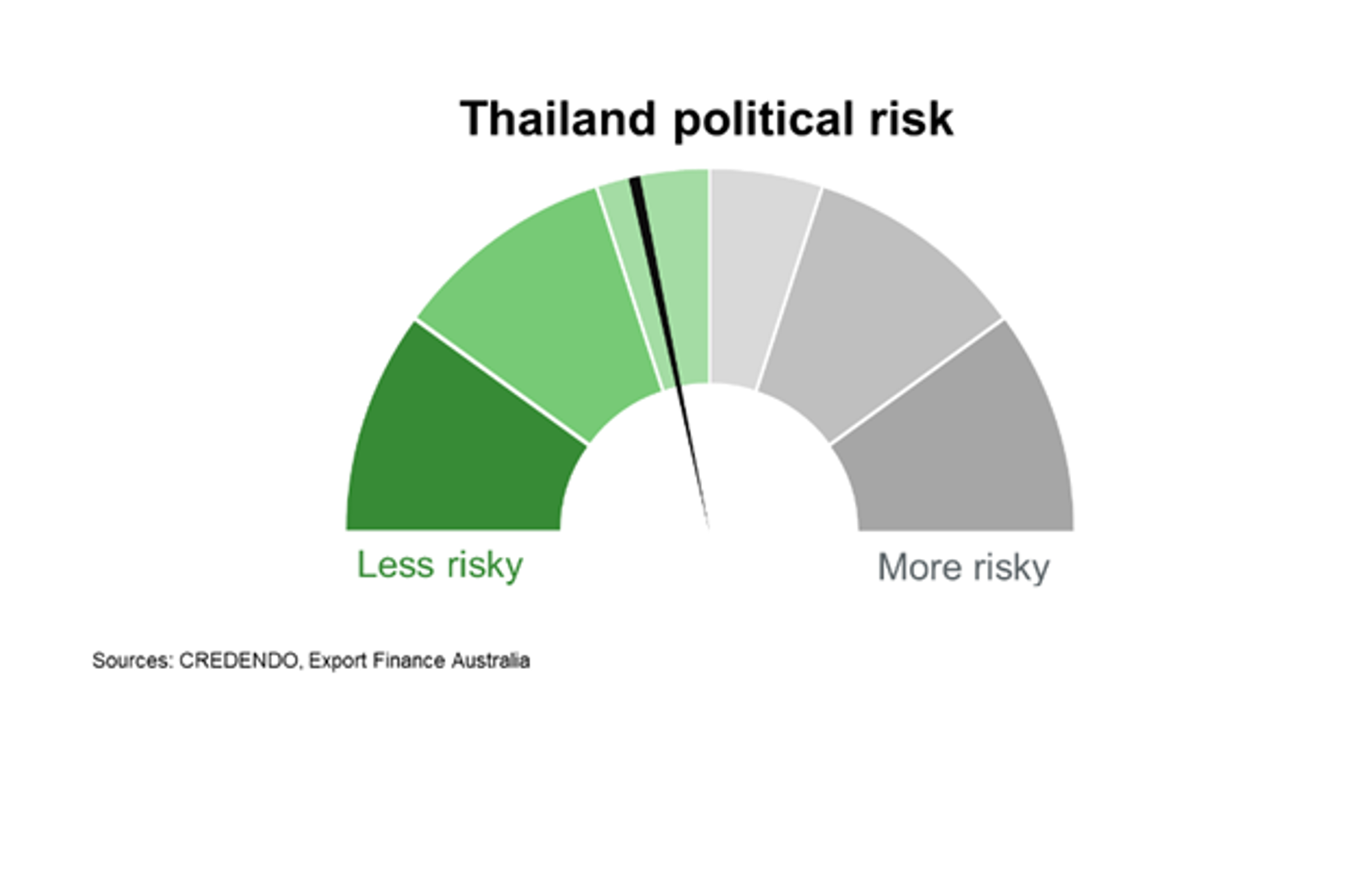

Political risk is moderate. Tensions within the ruling coalition and between opposition parties and the public characterises the political environment. There remains some risk that domestic political stress and civil unrest could hinder the effectiveness of policymaking, inflows of foreign investment and economic recovery. Risk of political violence remains prominent because of Thailand’s long history of military coups.

Governance indicators are broadly stronger than most other emerging Asian economies, except for control of corruption and political stability and absence of violence. Thailand has a demonstrated track record of transparent and predictable fiscal and monetary policies that have maintained economic and financial stability through political cycles.

Bilateral Relations

Thailand was Australia’s 11th largest trading partner in 2022, making up 2.3% of Australia’s total trade. More than 3,000 Australian businesses export to Thailand and around 200 have an on the ground presence, supported by the Thailand-Australia Free Trade Agreement (TAFTA).

Exports amounted to $9 billion in 2022, up from about $7.3 billion in 2021, consisting mostly of natural gas, gold, coal, aluminium and education and tourism. Australian agriculture and consumer-oriented exporters could benefit from the strong growth in Thailand’s e-commerce market and fast-growing retail food sector, due to greater Thai demand for premium Australian food products. Thailand’s plans to develop railways, roads and port infrastructure also offers opportunities for Australian exporters of energy, transport, telecommunications and mining services and equipment.

Imports from Thailand amounted to $18.7 billion in 2022. Goods imports are dominated by goods vehicles, passenger motor vehicles, heating and cooling equipment and household equipment. Services imports are dominated by Australian tourism to Thailand.

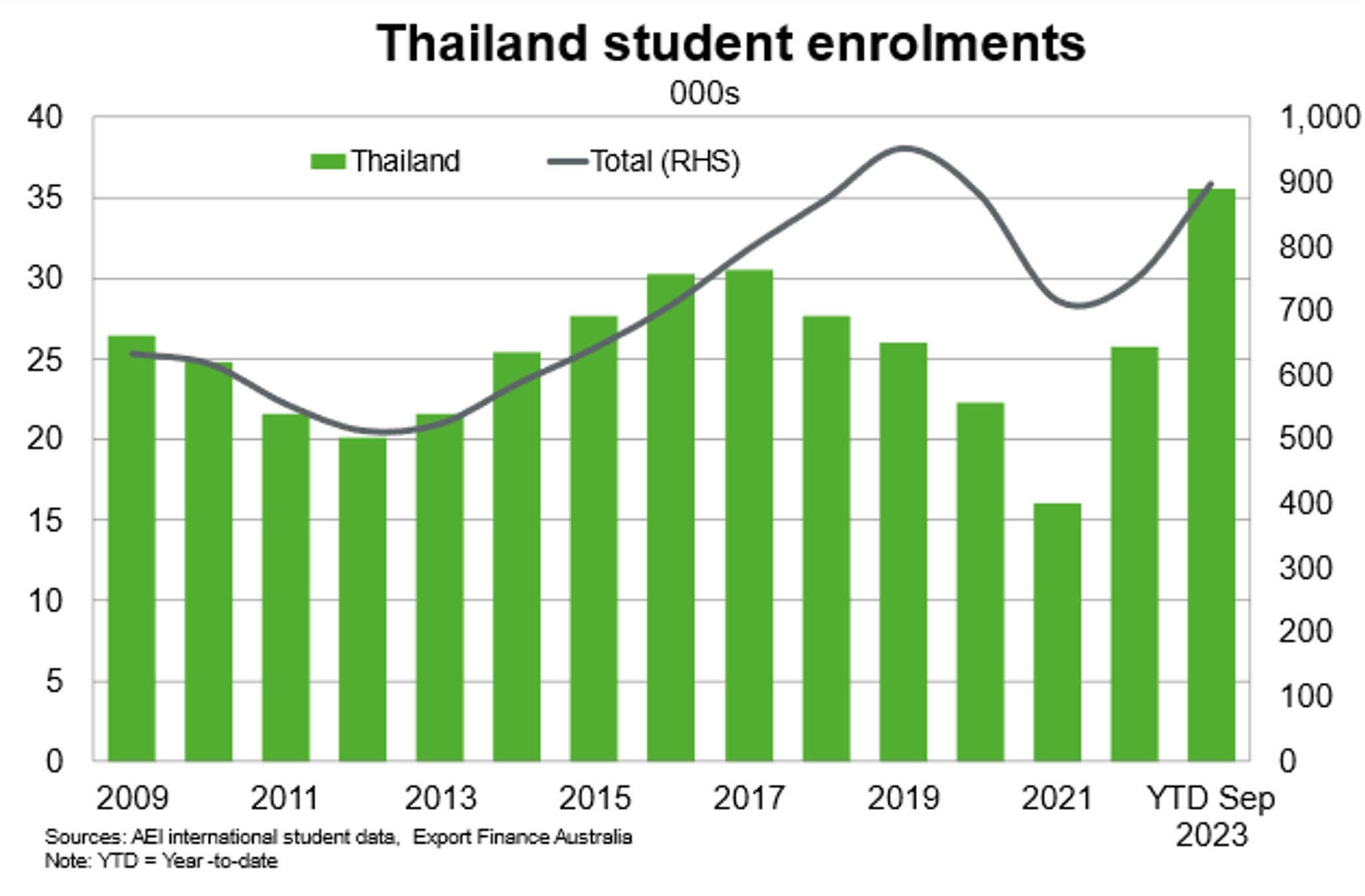

Thailand is Australia’s 6th largest source of student enrolments as of October 2023, and should continue to be an important market for international students in Australia. Thailand’s plan to raise education outcomes and upskill its labour force opens up opportunities for Australian education, training, upskilling and reskilling programs. Already, there are over 200 partnerships between Australian and Thai universities. Thailand’s status as a priority partner country for Australian education institutions underscores a robust outlook for student enrolments.

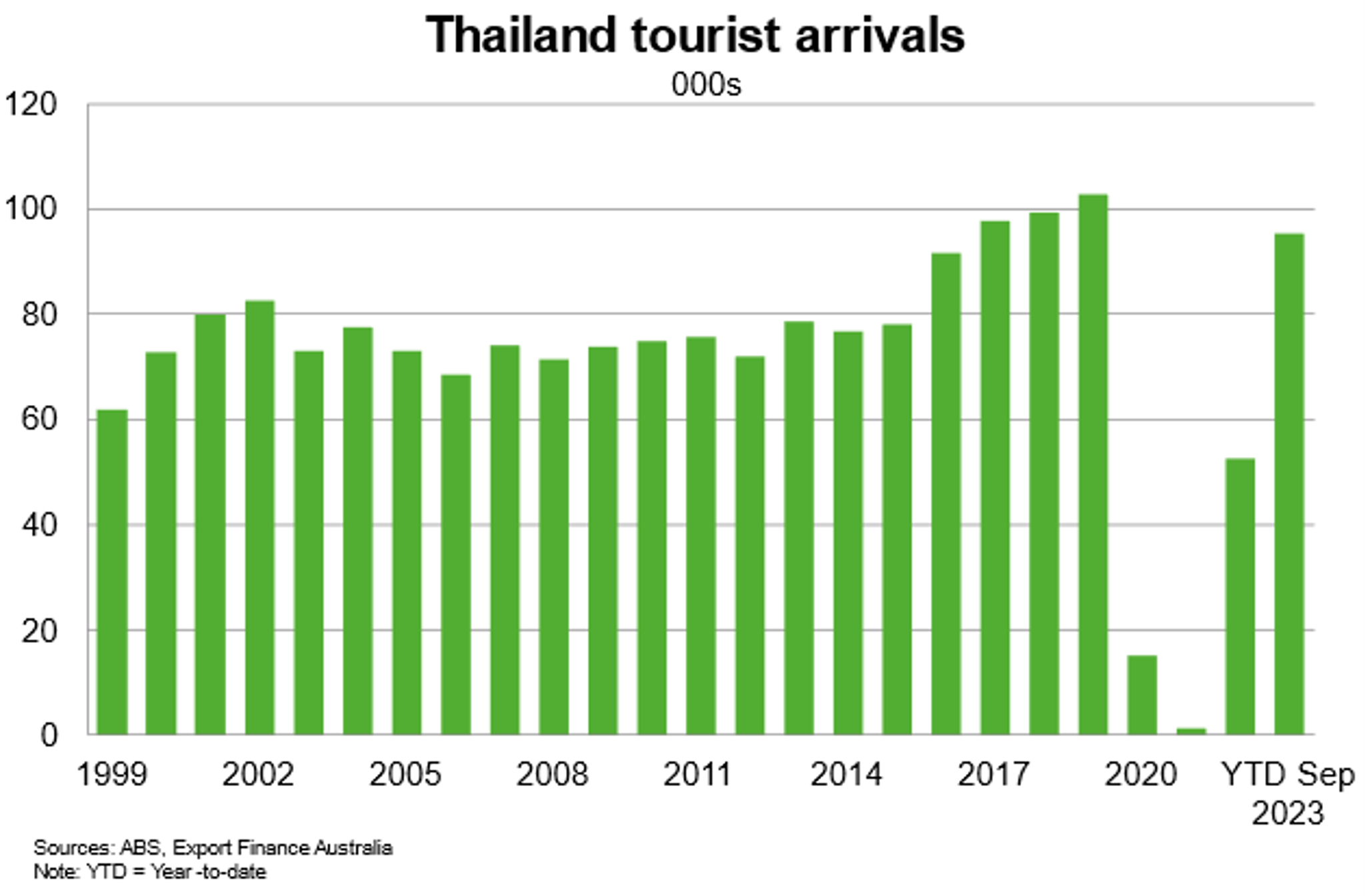

Meanwhile, a competitive Australian dollar and another year of recovery in international travel should support further demand for Australian tourism, and broader services exports, in 2024; Thailand is Australia’s 18th largest source of tourism arrivals as of September 2023.

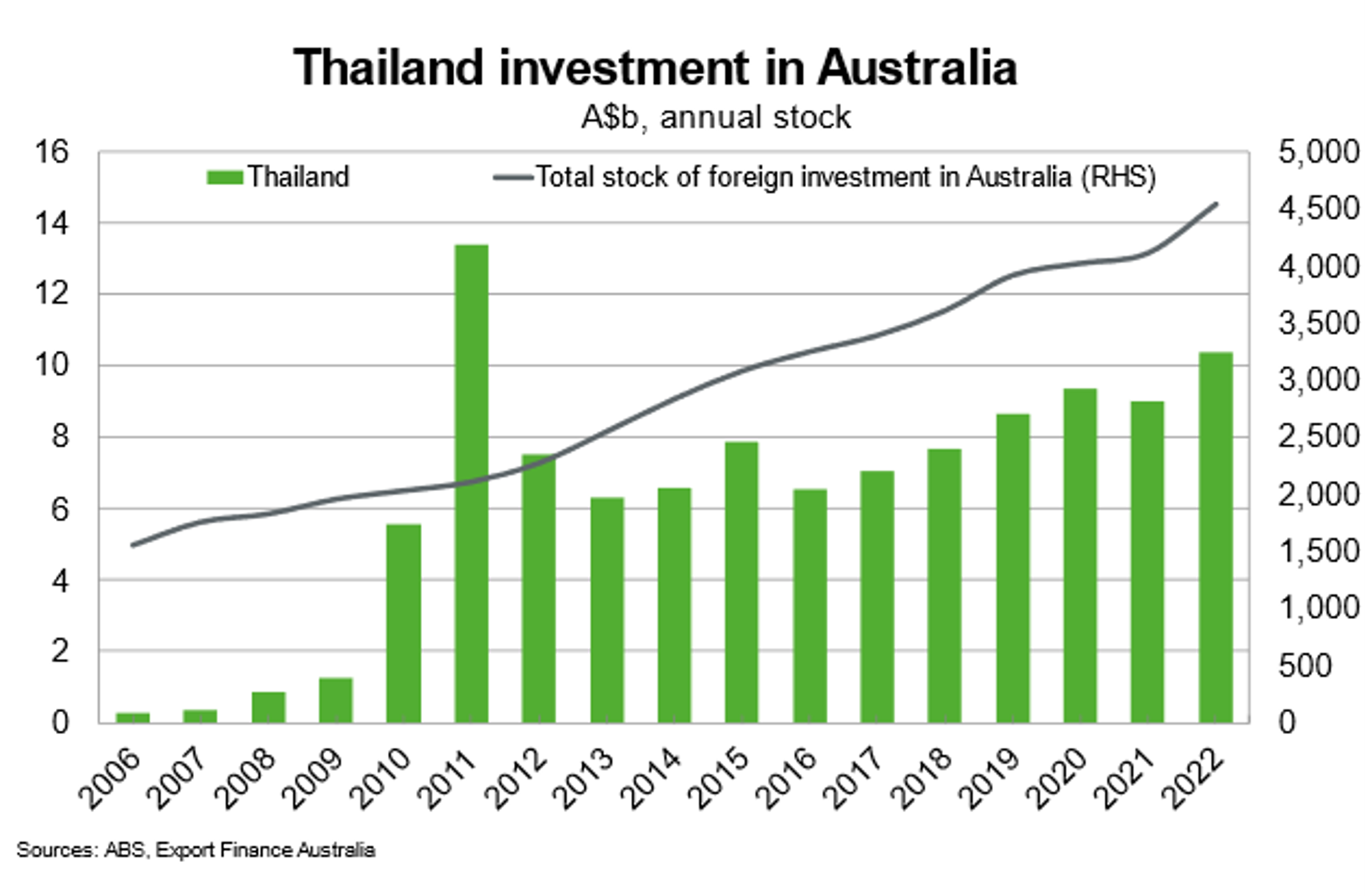

Thai investment in Australia has grown significantly, from $200 million in 2005 to $10.4 billion in 2022, predominantly in energy and resources, tourism infrastructure, hospitality, and agribusiness.

Australian investment in Thailand has also grown, largely in the automotive, logistics, advanced manufacturing, technology and services industries. However, Australian investment in Thailand fell in 2022 in line with trends in the global economy and foreign investment.

Useful Links

Department of Foreign Affairs and Trade

Thailand Australia Free trade agreement

Austrade