Türkiye

Türkiye

Last updated: January 2024

Türkiye performs broadly in line with emerging European countries on measures of creditworthiness, per capita incomes, growth and business climate. Growth has remained weak in the past few years in the face of political instability, an ongoing currency crisis and external financing pressure exacerbated by the COVID-19 pandemic.

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic outlook

Economic growth fell to an estimated 4% in 2023 from 5.5% in 2022. Despite soaring inflation (of 65% year-on-year in December 2023) and the rise in interest rates from 9% to 42.5% between January and December 2023, household spending remained robust amid multiple rises in the minimum wage through the year; a 55% increase in January 2023 and 34% raise in July 2023. Robust tourism receipts helped exports eke out a gain in 2023. The weak Turkish lira continued to put upward pressure on inflation through higher import prices.

Beyond human tragedy, Türkiye faces large recovery costs following earthquakes in February 2023; the World Bank direct losses from the quakes at US$34.2 billion and reconstruction costs are likely to be significantly higher. The quake adds upward pressure on government spending and budget deficits. But the need to increase investment and public spending on reconstruction will provide a substantial economic boost in 2024 and beyond. The IMF expects growth to rise to 3% in 2024 as a result. A further 49% increase in the minimum wage for 2024 should support private consumption, though the gains are likely to be limited by a combination of persistent inflation and monetary policy tightening.

IMF projects growth to average 3.2% per annum between 2025 and 2028. Plans to increase investment over the next decade should help to improve productivity in the manufacturing sector, including incorporating advanced technology solutions. National development programs are focused on boosting human capital through raising skills and job creation. Recent improvements in macroeconomic policymaking, including through credible fiscal and monetary policy responses to economic conditions, should also help improve investor sentiment and support sustainable growth over the longer term.

Risks to the outlook are high and tilted to the downside. Climate shocks remain an-ever present risk. Large external financing needs and low reserve buffers leave the economy vulnerable to global shocks. Further currency depreciation remains a significant risk, given it adds to Türkiye’s large external debt burden and debt servicing costs, as well as pushing up inflation. A still-high unemployment rate remains a risk to household incomes and consumption, despite continuous wage increases. An even sharper downturn in the global economy that weighs on Türkiye’s major trading partners would hurt exports more than expected. There is also a risk that inflation could worsen if monetary policy were to ease, and higher commodity prices put upward pressure on the import bill.

GDP per capita has steadily risen since 2019 on the back of significant increases in the minimum wage, including a sharp jump in 2023. Amid authorities’ continued efforts to strengthen human capital, the IMF forecasts GDP per capita to continue rising, in turn helping to reduce poverty.

Country risk

Country risk in Türkiye is moderate to high. The OECD country grade is 5. This is akin to a sub-investment grade rating which implies a moderate likelihood that Türkiye will be unable/unwilling to meet its external debt obligations.

The risk of expropriation is high. According to the US Investment Climate Statements, the Turkish government occasionally expropriates private real property for public works or for state industrial projects, and there have been scenarios of expropriation in the past.

Türkiye’s scores on several measures in Worldwide governance indicators are broadly in line with emerging European countries. However, scores are particularly low on measures of voice and accountability and political stability and absence of violence. Domestic and external political tensions could hinder Türkiye’s ability to implement economic policies or benefit from international trade. The recent shift toward the more orthodox setting of monetary policy in response to economic conditions, if it continues, would bolster the effectiveness of policymaking institutions.

Bilateral relations

Türkiye was Australia’s 35th largest trading partner in 2022. Total goods and services trade amounted to around $3.4 billion in 2022, more than $700 million higher than in 2021. Coal, cotton, fruits and nuts, and medicine were Australia’s chief exports to Türkiye in 2022. Fruits and nuts, limes, cement and construction materials, goods vehicles, and jewellery were Australia’s main goods imports.

Turkish student enrolments grew sharply in 2023, reflecting strong demand for English Language Intensive Courses for Overseas (ELICOS) in Australia. A competitive Australian dollar and another year of recovery in international travel should support further demand for Australian education, and broader services exports in 2024.

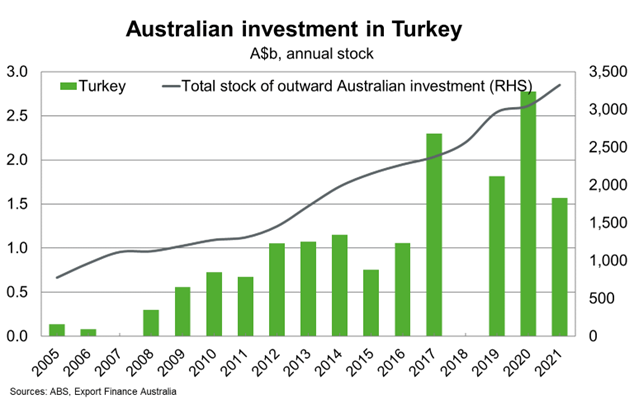

Bilateral investment between Türkiye and Australia is modest. Australian companies have invested in Türkiye’s infrastructure, mining, construction services, agri-business, and digital services. Turkish investment in Australia is very small. Investment between Türkiye and Ausstralia is supported by a bilateral Investment Promotion and Protection Agreement.

Useful links

Department of Foreign Affairs and Trade

Austrade