Turkey—Electoral setback a test to Erdogan’s economic strategy

In an unprecedented setback to President Erdogan’s AKP party, opposition parties secured significant victories in the local elections held on 31 March. Turkey has shifted to a presidential system of government, which grants the executive wide-ranging powers and weakens parliament. But the latest results were widely seen as a referendum on the President’s leadership during Turkey’s first recession since Erdogan took power 16 years ago.

Ankara (the capital), Istanbul (Turkey’s financial and economic hub), and several other major cities all fell to the opposition. But President Erdogan still controls funding to the municipalities. There is a risk he could restrict funding to cities where the AKP is no longer in control. This would make it difficult for the opposition parties to deliver on their election promises and maintain popular support.

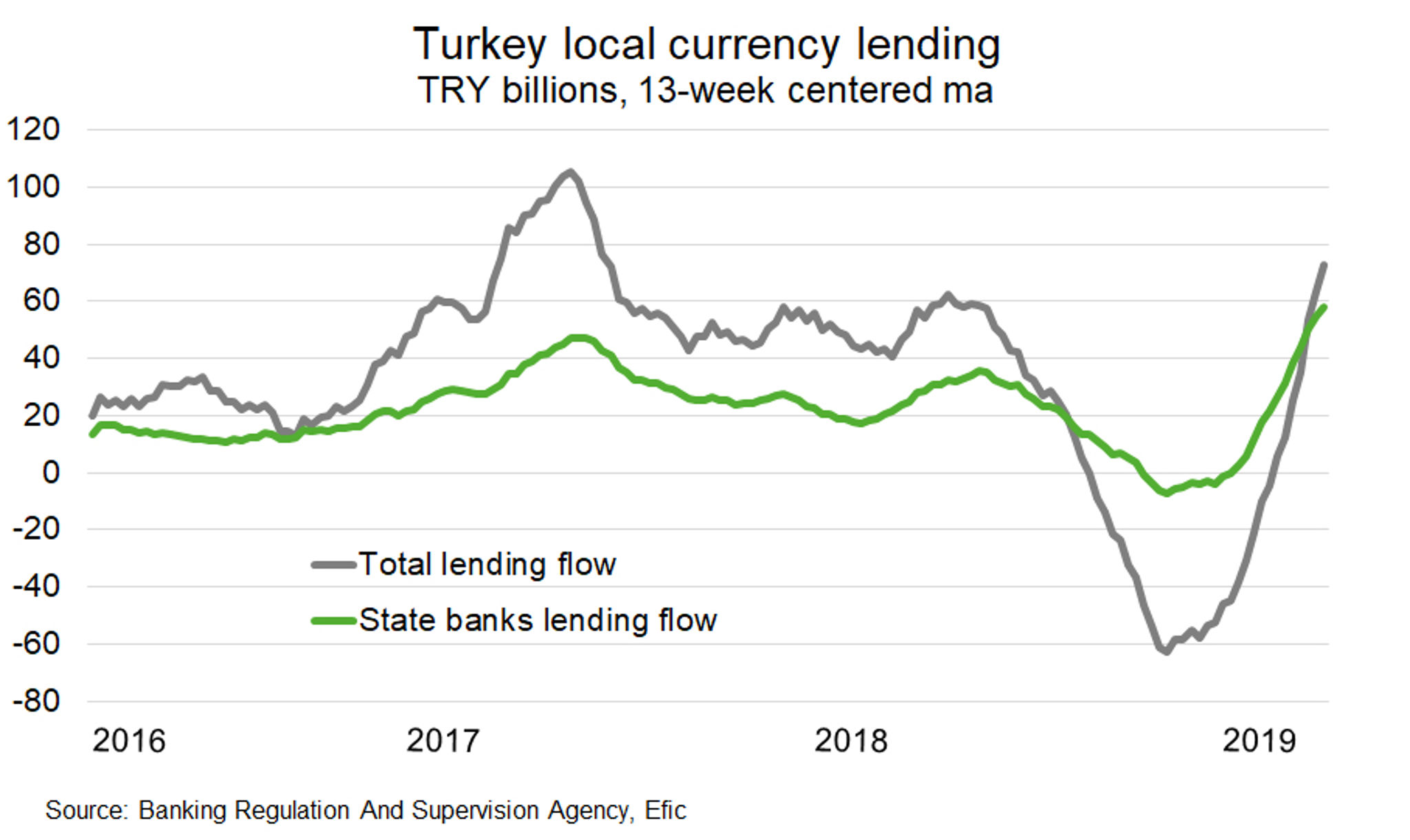

After last year’s currency crisis led to a credit squeeze, and with the local elections date approaching, the government pumped more credit to stimulate the economy (Chart). This was a risky bet given Turkey’s heavy reliance on foreign capital flows to fund its large borrowing needs. In a post-election address, the Finance Minister unveiled a plan to recapitalise the banking sector, which includes the issuing of government bonds worth US$4.9 billion and to support further lending. Despite pledging to respect fiscal discipline, much-needed reforms around pensions and improved tax collection were largely absent. Not surprisingly, analysts are sceptical about the credit-fuelled growth strategy. The IMF, in its April World Economic Outlook, expect Turkey’s economy to contract 2.5% this year.