US-China trade dispute—New round of escalation

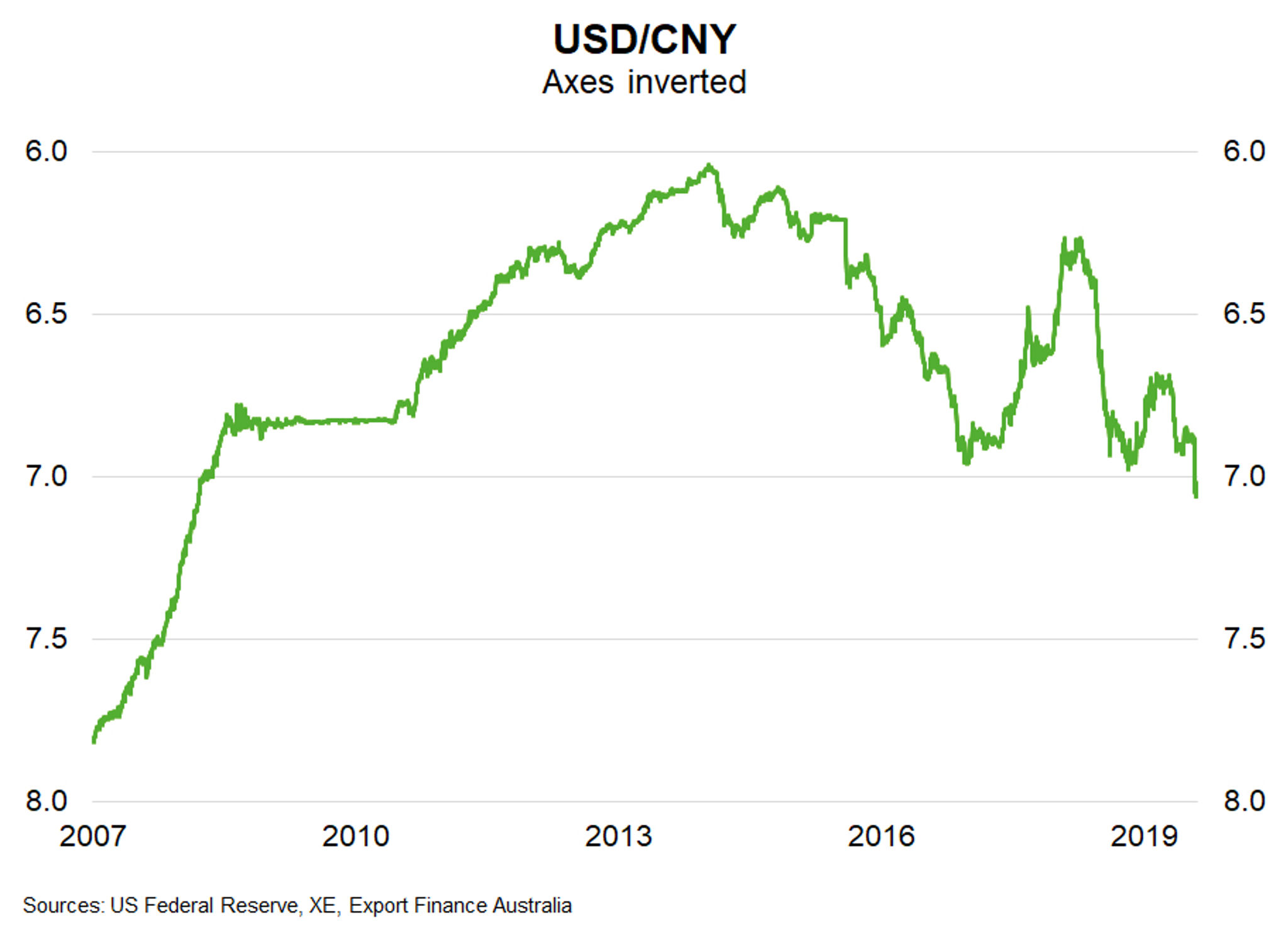

The US and China trade dispute escalated in recent weeks, with the People’s Bank of China allowing its currency to fall below 7 yuan per US dollar – a key threshold that hasn’t been passed since the global financial crisis (chart – USD/CYN). This prompted the US Treasury to call it a ‘currency manipulator’. China’s devaluation follows the announcement of US plans to implement a 10% tariff on a further US$300 billion worth of Chinese imports, which would mean almost all Chinese exports to the US were subject to tariffs. A subsequent US announcement clarified that the new tariff would be implemented in two tranches – in effect a partial delay – which was welcomed by markets.

The decision to let the yuan depreciate is being seen as an attempt by Beijing to neutralise the handicap American tariffs put on Chinese exporters. But, is it also currency manipulation? The People’s Bank has intervened in currency markets to weaken the Renminbi – it did so over 2000-2014. But since 2014 it has been intervening to strengthen the currency until the recent decision to stop. Since then, market forces have pushed the currency down. China currently meets only one of three characteristics of a manipulator set down in the 2015 Trade Facilitation & Trade Enforcement Act – it runs a trade surplus with the US above US$20 billion.

The latest escalation has sharply depressed equity prices and bond yields in developed countries. Investors are reportedly worried about more than just a stalemate or further worsening of relations. Fears have also emerged that instability could ripple through currency markets as yuan depreciation places strain on other countries’ competitive positions.