Political tensions have hindered the effectiveness of policymaking institutions. A narrow victory for President Erdogan’s party in Turkey led to a new wave of fiscal stimulus that raised the risk of a balance of payments crisis and led to credit rating downgrades. A new government in Sri Lanka proposed large tax cuts, exacerbating risks to debt sustainability and violating its IMF program. A poor result by President Mauricio Macri in electoral primaries in August led to a rapid outflow of capital and major devaluation of the Argentine peso against the USD. The introduction of emergency currency controls reduced volatility, but economic stability remains fragile. Newly elected president, Alberto Fernandez, has indicated his government will seek to restructure Argentina’s debt as an early priority.

3. Growing debt vulnerabilities

Many central banks lowered interest rates in 2019 to shore up growth. The availability of cheap credit and increased fiscal spending has increased debt vulnerabilities. The IIF indicate global debt exceeded US$250 trillion in the second quarter of 2019, equal to about 380% of global GDP. Emerging market debt topped US$71 trillion, reaching a fresh-record high of 220% of emerging market GDP.

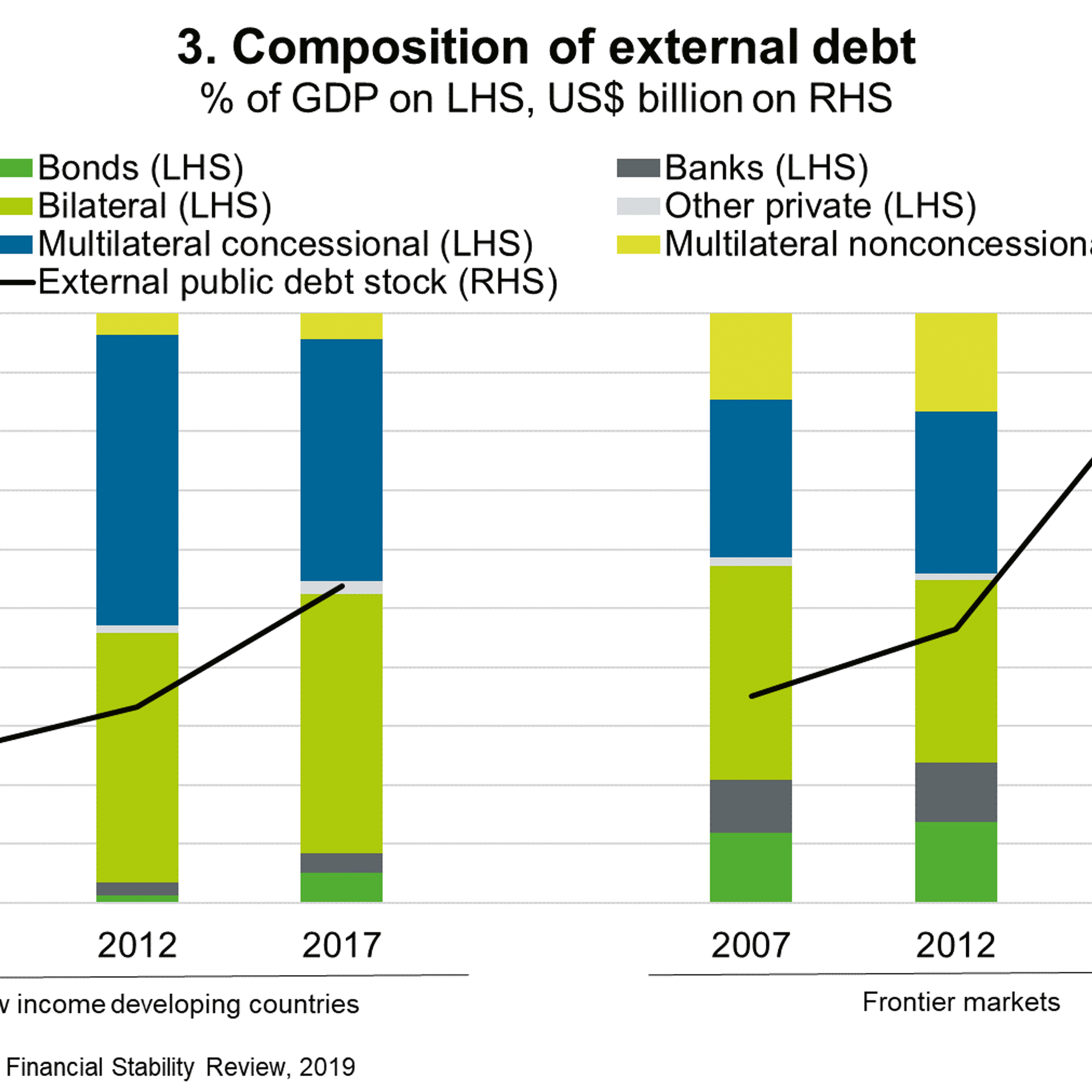

An increased reliance on external market borrowing raised vulnerabilities in heavily-indebted poor countries (Chart 3). Corporate sector vulnerabilities also rose in several economies amid growing debt, slowing economies and weakening revenues and profits. In particular, higher corporate bond defaults in China heightened financial stability risks. Household debt remains high in developed markets, weighing on consumer confidence in Australia, Norway, Switzerland and Denmark.