2020 — Precarious and muted global economic recovery

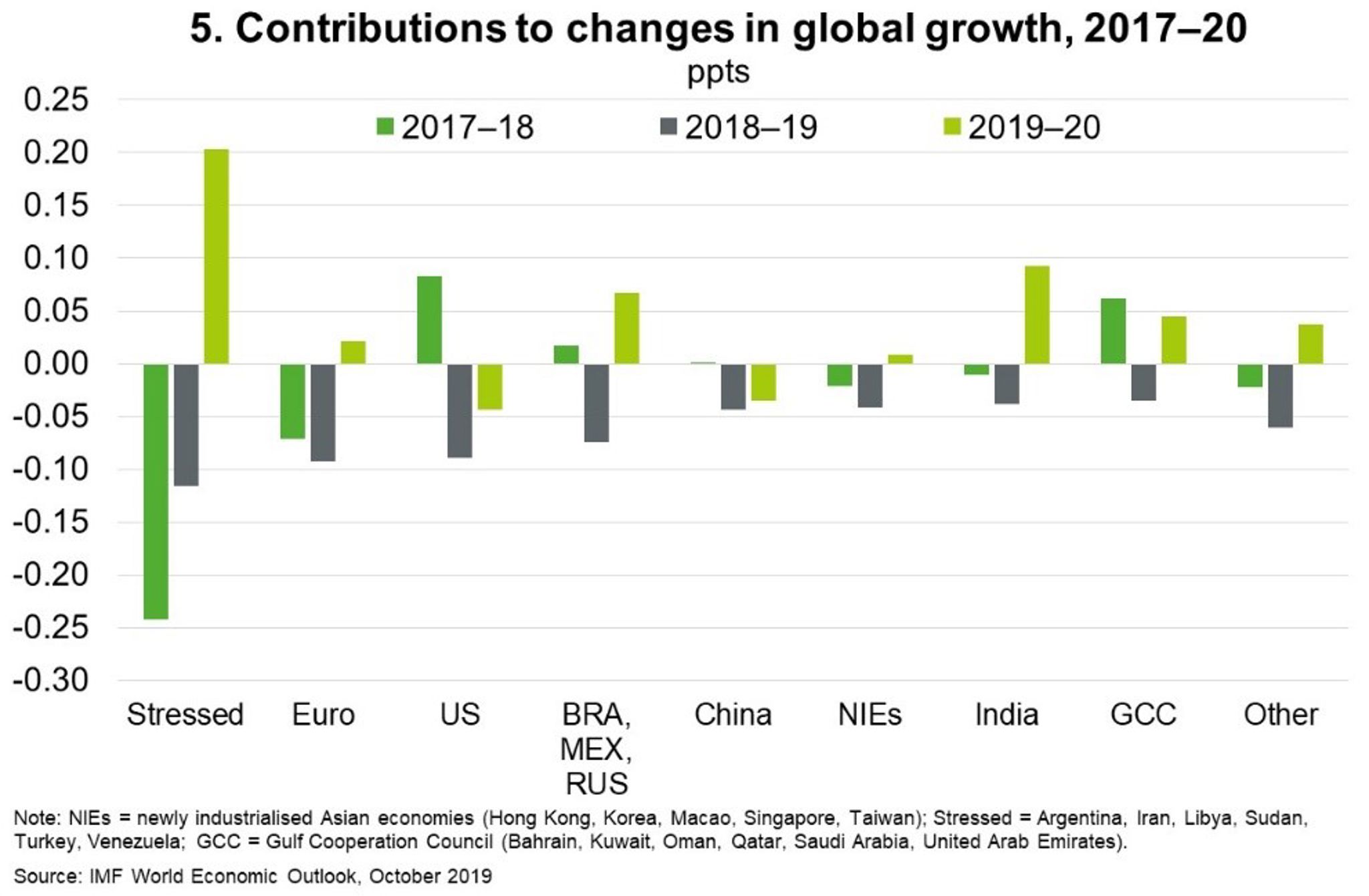

The global economy is expected to be more conducive to international business in 2020; the IMF expects growth will pick up to 3.4% next year. But this remains well below the 2000-17 average rate (3.9%) and risks to the outlook are significant. In particular, about 70% of the projected 2020 growth uptick depends on improvement in a small number of emerging economies currently underperforming or experiencing severe strains (Chart 5). A more subdued pace of global activity could well materialise given uncertain prospects for some of these ‘stressed’ countries—including Argentina, Iran, Turkey, Venezuela, Libya and Yemen—and a projected slowdown in China and the United States, the world’s two economic behemoths. An escalation of trade and investment protectionism, continued Brexit uncertainty, abrupt declines in financial market risk appetite, a sharper-than-expected China downturn, or ratcheting up of geopolitical and social tensions adds to downside risks.

Worse, the ability to deploy monetary stimulus to offset any negative growth shocks is constrained—interest rates in most advanced economies are at or close to their effective lower bounds—and fiscal policy remains constrained by politics and high debt. As such, the IMF estimate about a 1 in 10 chance that global growth will fall below 2.5%. The UN recently warned global ‘recession in 2020 is now a clear and present danger’. Climate change, pervasive inequality and anaemic productivity will pose risks to growth in the medium term.