Asia—e-commerce boom opens new export opportunities

Despite trade frictions with Washington and the domestic economic slowdown, China’s e-commerce retail imports rose 54% y/y to US$10b in the first 10 months of last year. Yet there is still tremendous room for growth. In particular, rising demand for higher-quality products in rural and inland regions, China’s penchant for foreign brands, and more favourable policy settings will see new export opportunities. For instance, from 1 January 2019, the annual tax-free quota for cross-border e-commerce purchases for individual buyers rose to RMB26,000 (from RMB20,000), while the tax-free limit on single transactions increased to RMB5,000 (from RMB2,000). Another 63 items made the list of 1,142 products covered by the scheme—including more high-demand consumer goods like electronics, food and healthcare. In addition, 22 new cities—including Beijing, Nanjing and Shenyang—were approved as venues for cross-border e‑commerce pilot zones last July.

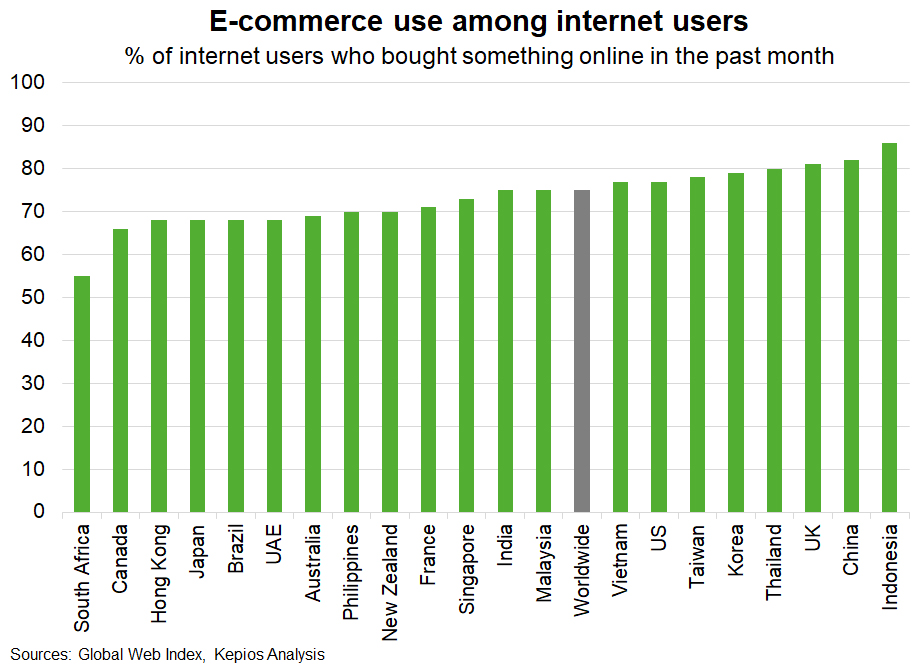

Over 40% of the world’s e-commerce transactions now take place in China. But the digital revolution has made the wider South East Asia region one of the world’s most powerful growth drivers. Over 400 million South East Asians have internet access, up from 380 million a year ago. The region’s internet economy is expected to more than triple to US$240b in 2025 from US$72b in 2018. Indonesia tops the world in e‑commerce usage—86% of its internet users in a recent survey bought something online over the past month (Chart). Exporting online can help niche Australian exporters implement a scalable business model and provide a more equal playing field for small businesses.