Emerging Markets—heightened corruption challenges the export environment

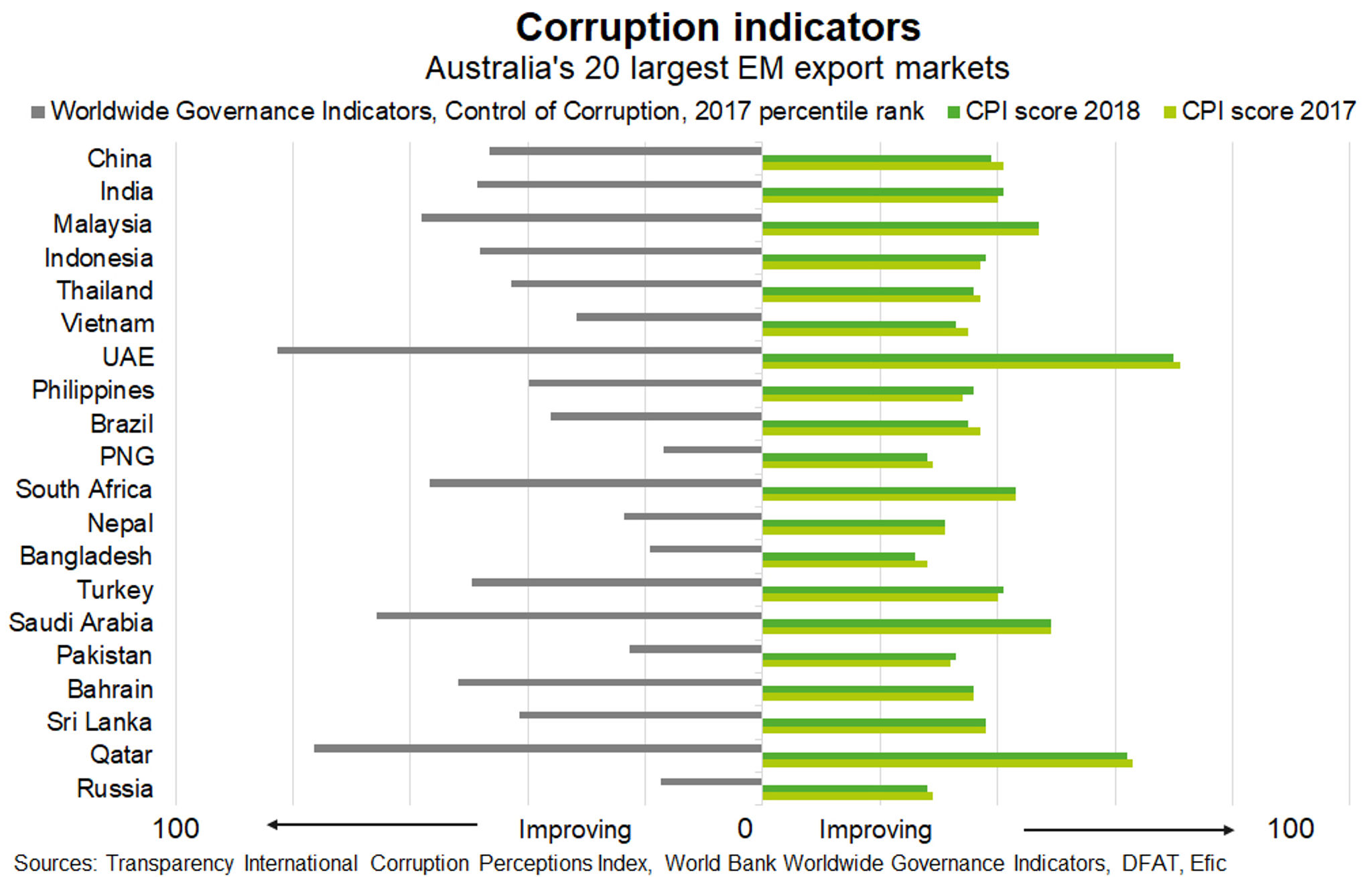

Transparency International’s recent Corruption Perceptions Index (CPI) found that perceived levels of public sector corruption have improved in just five of Australia’s top 20 emerging market (EM) export destinations over the last year—India, Indonesia, Philippines, Turkey and Pakistan (Chart).

Despite China’s Communist Party declaring a ‘crushing victory’ in the fight against corruption last December, Australia’s largest export market scored worse on perceived corruption for the first time in five years, pushing it down 10 places to 87 of 180 countries. Other countries important to Australian exporters which fared worse over the year included Thailand, Vietnam, the United Arab Emirates, Bangladesh, Brazil, Papua New Guinea, Qatar and Russia. Common factors counteracting anti-corruption efforts in many of these countries are a lack of strong and independent institutions that can deliver checks and balances, a lack of laws and enforcement mechanisms, and a strong-handed central government that limits free and active media and citizen participation. Overall, when weighted by the scale of exports in FY2018, the average ranking of Australia’s major EM export markets fell from 81 to 87 of 180 countries. This suggests a more challenging set of conditions in which to enhance Australia’s export business activity.