World—increased uncertainty sees global economy lose momentum

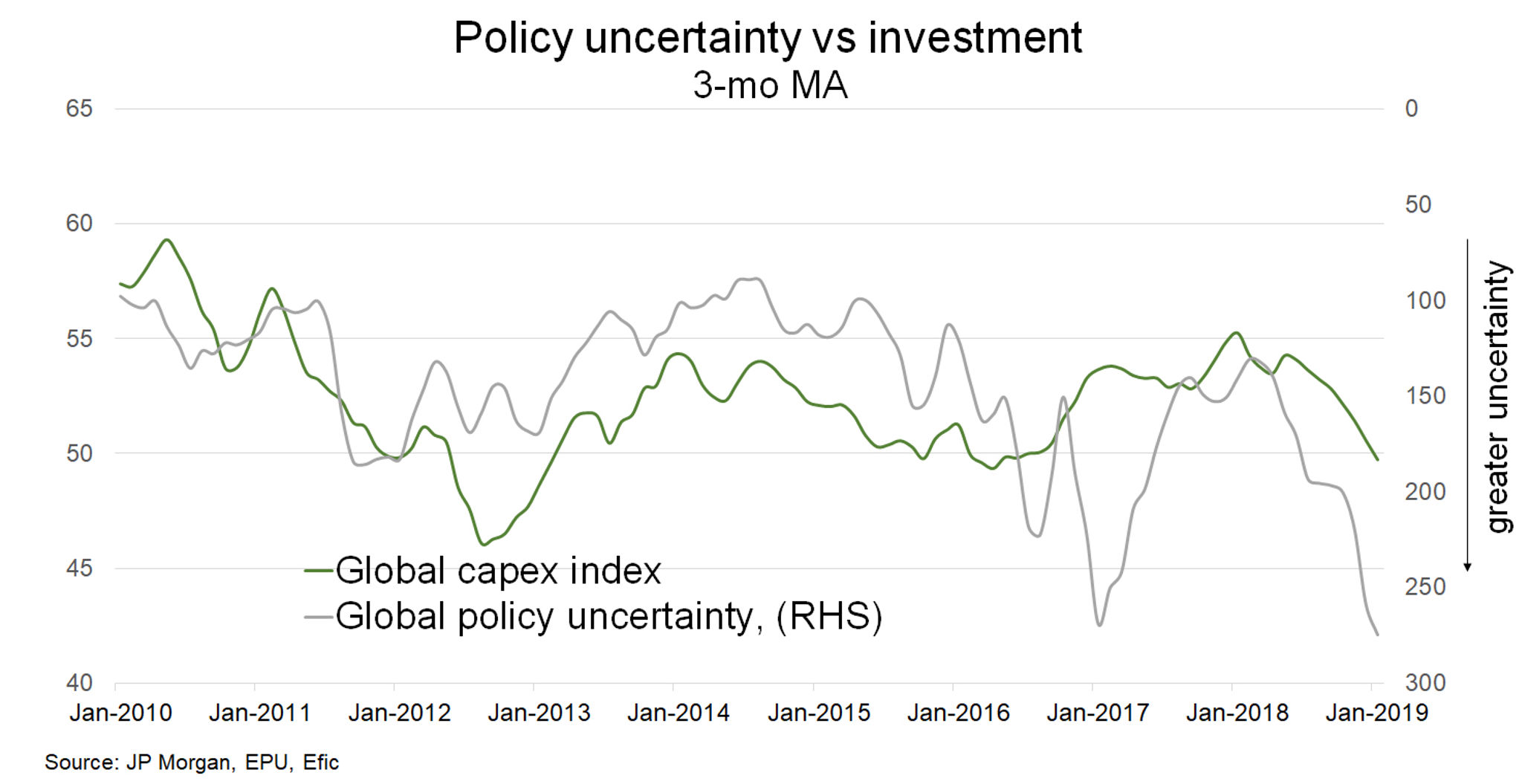

Increased policy uncertainty stemming from the ongoing US-China trade stoush, other geopolitical disturbances, and tighter credit conditions at the back end of 2018 are sapping both trade and investment (Chart). High-frequency indicators confirm the slow start to the year—for instance, Purchase Managers’ Index (PMI) data (a proxy for manufacturing output) is trending lower across most countries.

Economic forecasters are also gloomier. The IMF have revised their 2019 growth projections down to 3.5%—from 3.7% estimated in October and 3.9% in January 2018. Further downward revisions to the outlook are possible given the ongoing risk of escalating trade tensions; uncertainty over the terms of Brexit; Italy’s banking struggles, which threaten the broader Eurozone; and the risk of a sharper than expected slowdown in the Chinese economy. Amid the more subdued growth backdrop, major central banks have become increasingly dovish. Monetary policy in China has been relaxed to encourage credit growth, the US Federal Reserve has indicated a less aggressive pace of interest rate hikes, while India’s central bank cut rates 25 bps in early February. Australian exports trended higher in 2018 supported by steady commodity prices. But to the extent that lower interest rates are unable to stimulate softening investment and trade, the weaker global outlook could sap demand for Australian goods and services.