LNG—Chinese demand on the rise

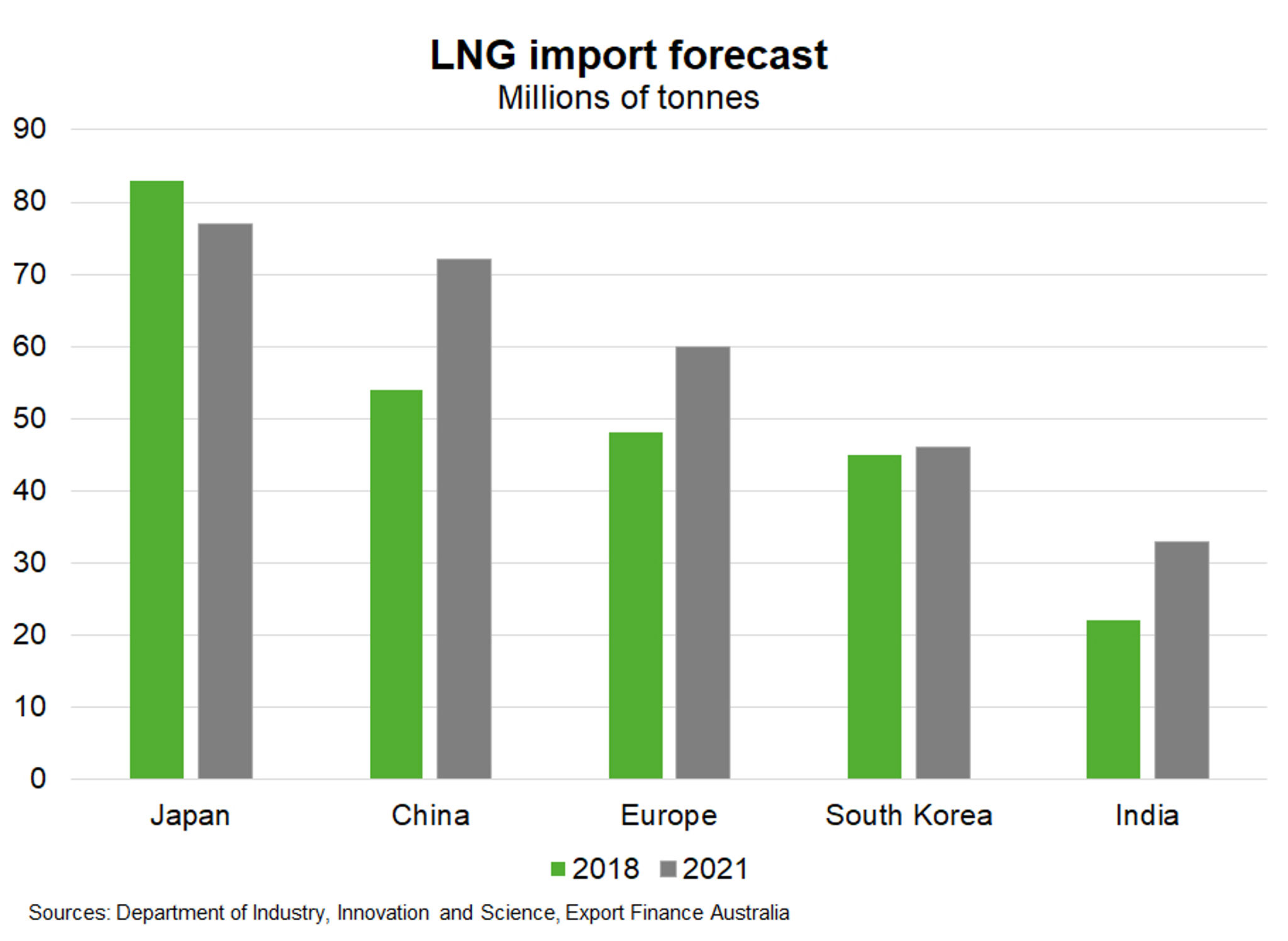

China is expected to become the world’s largest importer of liquefied natural gas (LNG) in the early 2020s. Growth in demand for LNG is being driven by a desire to reduce air pollution, with China aiming for gas to account for 8.3% to 10% of its overall energy mix by 2020. China’s LNG imports are forecast to reach 72 million tonnes in 2021, a 33% increase from 2018.

Japan is currently the world’s largest importer of LNG. However, Japanese LNG imports are forecast to fall from 83 million tonnes in 2018 to 77 million tonnes in 2021 as a number of nuclear power plants restart (9 of 42 nuclear reactors have gained approval to restart). There are still a number of counter-terrorism measures that must be met before more reactors are brought back online, and public opposition to nuclear energy could delay further restarts.

Australia is expected to overtake Qatar as the world’s largest LNG exporter in 2019-20, with the value of exports forecast to increase from $31b in 2017-18 to $54b in 2019-20. Exports from Australia will reach 78 million tonnes in 2019 and 81 million tonnes in 2020. Risks to Australian exporters stem from the internationalisation of LNG trade, with both Qatar and the US to add significant new supply by the mid-2020s. This exposes Australian exporters to greater competition, particularly from relatively cheap US gas exports.