Western Australia—Iron ore exports stagnate with LNG taking the lead

Western Australian merchandise exports grew 18% in 2018, the second fastest increase of any state or territory. Unlike recent years, this gain was not driven by Western Australia’s large iron ore sector, which remained relatively flat in 2018 despite higher prices towards the end of the year. Instead, more than three-quarters of the state’s export growth came from ‘confidential items’. This group of items includes liquefied natural gas (LNG) exports, which have increased sharply in 2018 as production ramps-up at the Gorgon and Wheatstone projects off the state’s north-west coast.

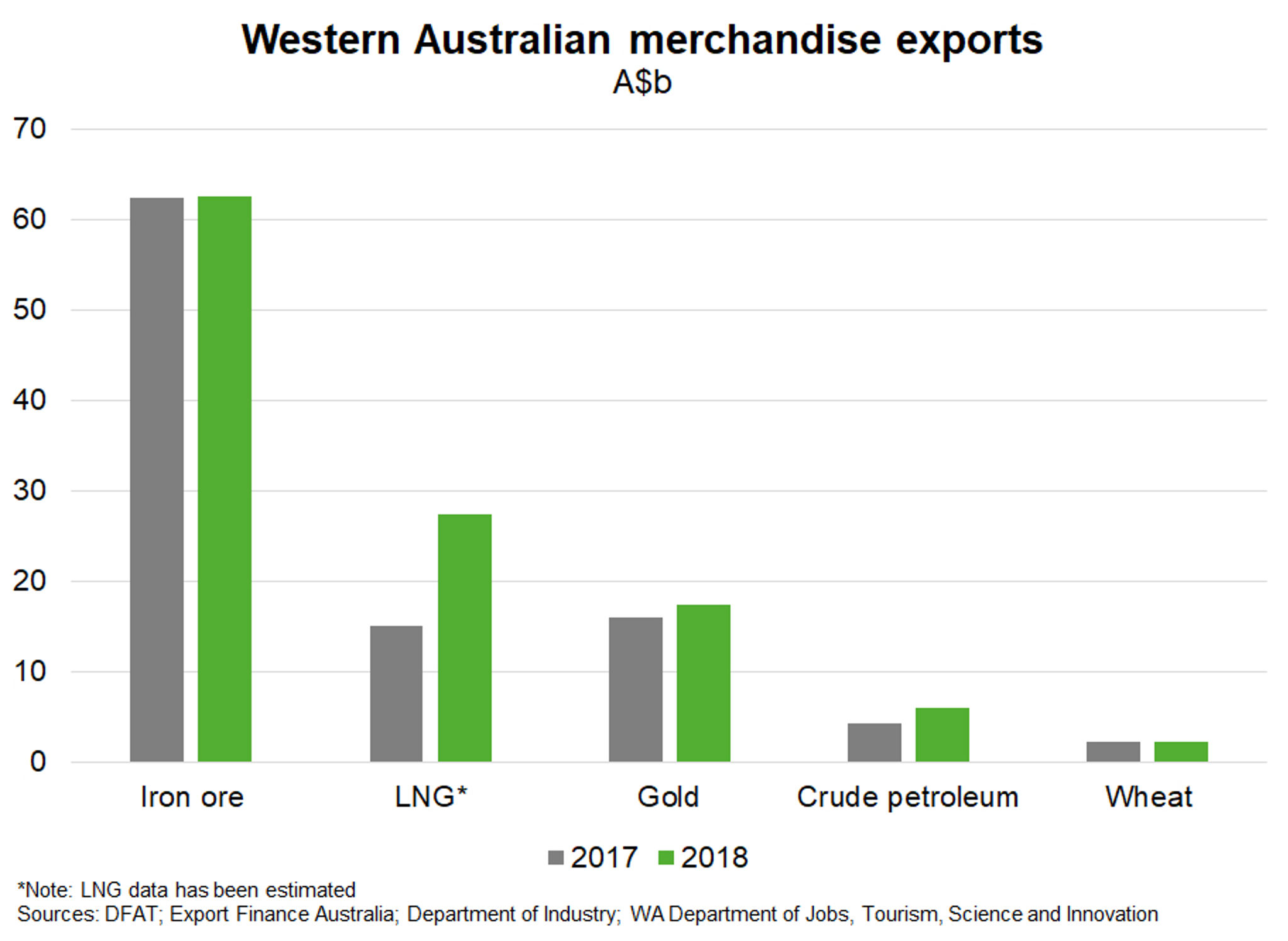

The majority of Western Australia’s LNG is exported to Japan, but China, South Korea and India remain key growth markets. Data on the value of Western Australian LNG exports is unavailable, but the state accounted for around three-fifths of the total volume of Australian LNG exported in 2018. Assuming a similar share of export value, Western Australia exported approximately A$27b worth of LNG in 2018. This would make LNG the second largest export in Western Australia behind iron ore at A$63b (Chart).

LNG exports are expected to continue growing in 2019 as production at the Prelude floating LNG platform comes online. But according to the Department of Industry, prices are set to gradually moderate in the coming years as oil prices ease—weighing on long-term LNG contracts linked to the oil price—and additions to global supply outstrip growth in demand. Despite this, LNG is set to remain a key driver of export growth for both Australia and Western Australia in 2019.