China—New stimulus amid economic slowdown sees longer-term risks

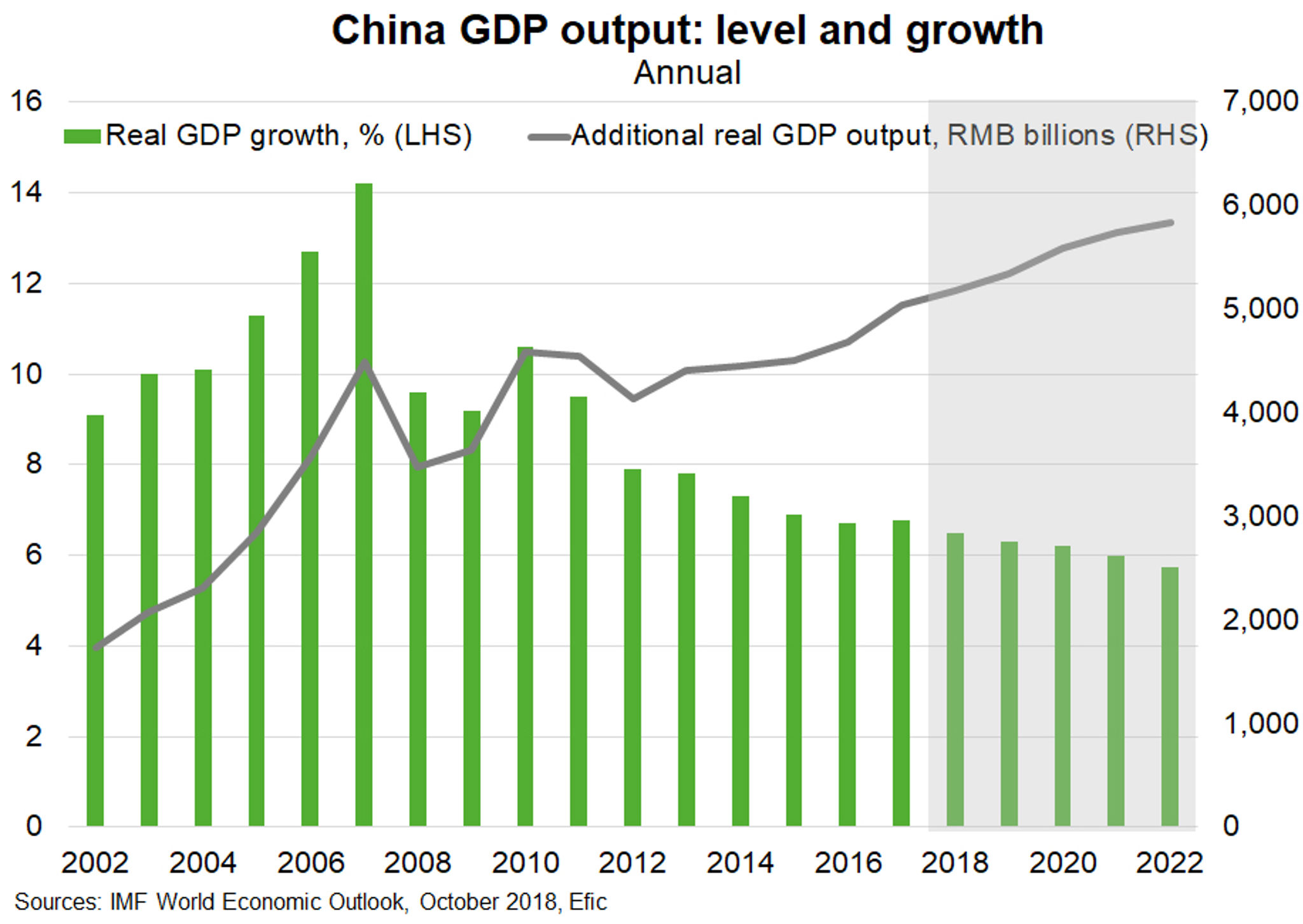

Chinese Premier Li Keqiang set China’s GDP growth target between 6% and 6.5% this year, down from 6.6% in 2018. Though still strong, given China’s increased economic size (Chart), this rate would be the slowest in nearly three decades. And many economists accuse official figures of exaggeration. Recent high-frequency data highlight the slowdown—for instance, industrial production hit a decade-low of 5.3% y/y in January–February as ongoing trade tensions weigh on the manufacturing sector.

While China’s leadership is warier of stimulus amid elevated levels of debt in its economy, the commitment to double real GDP by 2020 over its level in 2010 requires 6.2% average annual growth in 2019-20. As such, mini-stimulus measures are being implemented to invigorate the economy. First, lending to the private sector has been encouraged by lowering bank reserve requirements. Banks issued US$477b of new loans in January, the most ever in a single month. Second, government spending has increased. Since December 2018, 16 new infrastructure projects worth US$163b have received fast-tracked approvals—a tenfold increase from the 12 months prior. Authorities will continue to deploy fiscal firepower. Mr Li announced sweeping tax cuts, mostly for firms, equivalent to RMB 2t (US$298b, or more than 2% of forecast GDP), while the 2019 fiscal target was increased to 2.8% of GDP from 2.6% in 2018. While still a far cry from China’s previous penchant for ‘flood-style stimulus’, to the extent that new measures see public and corporate debt increase faster than GDP, they will elevate longer term economic risks and erode growth potential.