Low income countries—Increased debt levels raise vulnerabilities

Public debt in the 36 countries that secured US$99b in debt relief via the Heavily Indebted Poor Country (HIPC) Initiative has risen to its highest level since 2007. Average public debt across 36 post-HIPC countries—30 of which are in Africa—has risen from 38% of GDP in 2010 to over 53% in 2018. Similarly, highlighting budget vulnerabilities, the Institute of International Finance finds that public debt has risen sharply as a percentage of revenue in over 60% of these countries. As of 2018, over half of post-HIPC countries had debt/revenue levels above 250% of GDP—one of the qualifying thresholds for HIPC eligibility in the first place. Worse still, the creditor base has changed dramatically with more borrowing now undertaken at commercial rates. The steady build-up of public debt, particularly non-concessional debt held by private creditors, makes these markets more vulnerable to global financial volatility. The greater dominance of debt to private investors would also complicate the debt restructuring process for any country that incurs payment difficulties.

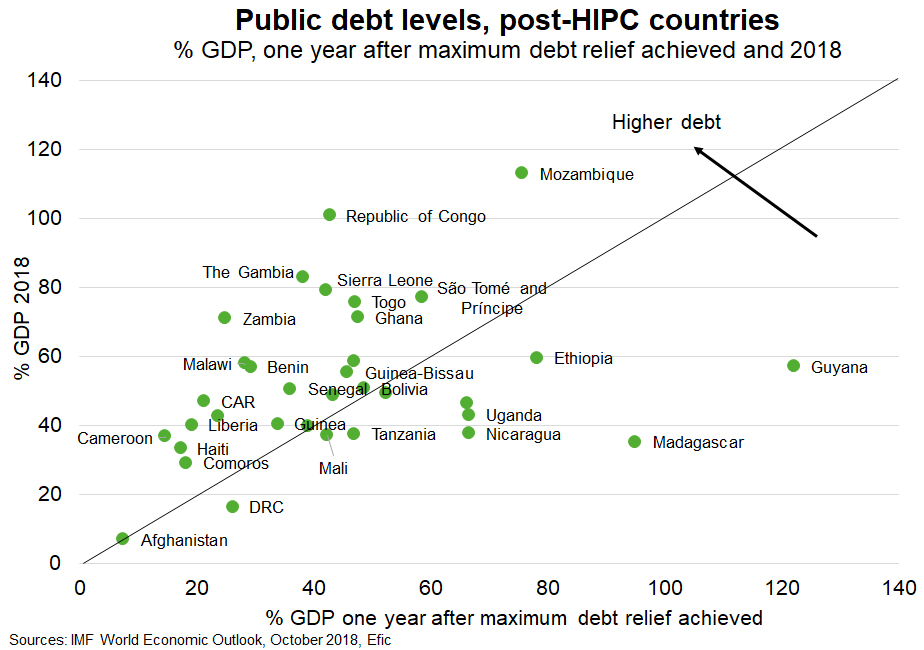

However, in the wake of HIPC-debt relief, not all post-HIPC countries have succumbed to the debt vice. For instance, Ethiopia, Madagascar, Nicaragua, Uganda, Tanzania and Guyana have been able to reduce government debt below the levels achieved after HIPC treatment (Chart). This is in contrast to public debt in Congo, Zambia, The Gambia, Mozambique, and Sierra Leone, each of which is over 30ppts higher than post HIPC treatment. But reporting of public debt data has been found to be inadequate in many low income and developing countries, while data on increasingly prevalent bilateral loans from China are opaque and patchy.