Russia—Potential new US sanctions mar the muted outlook

US Congress is considering stiff new restrictions on Russia’s financial and energy sectors. The ‘Defending American Security from Kremlin Aggression Act’ (DASKAA) was reintroduced by a bipartisan group of senators in February. Specifically, DASKAA prohibits US persons dealing in new Russian sovereign debt, bans investments in energy projects outside Russia if they have Russian state backing, and tightens restrictions on state-developed oil projects within Russia. DASKAA also targets 24 agents of the Federal Security Service complicit in the Kerch Strait incident, as well as Russia's entire shipbuilding sector if Moscow continues to violate freedom of navigation. Further, DASKAA allows the designation of Russian banks for interfering in democratic processes abroad, and persons deemed to ‘facilitate illicit and corrupt activities…on behalf of Putin’. While Washington’s political impetus toward new sanctions is strong, it remains to be seen whether this translates into new sanctions being enacted into law.

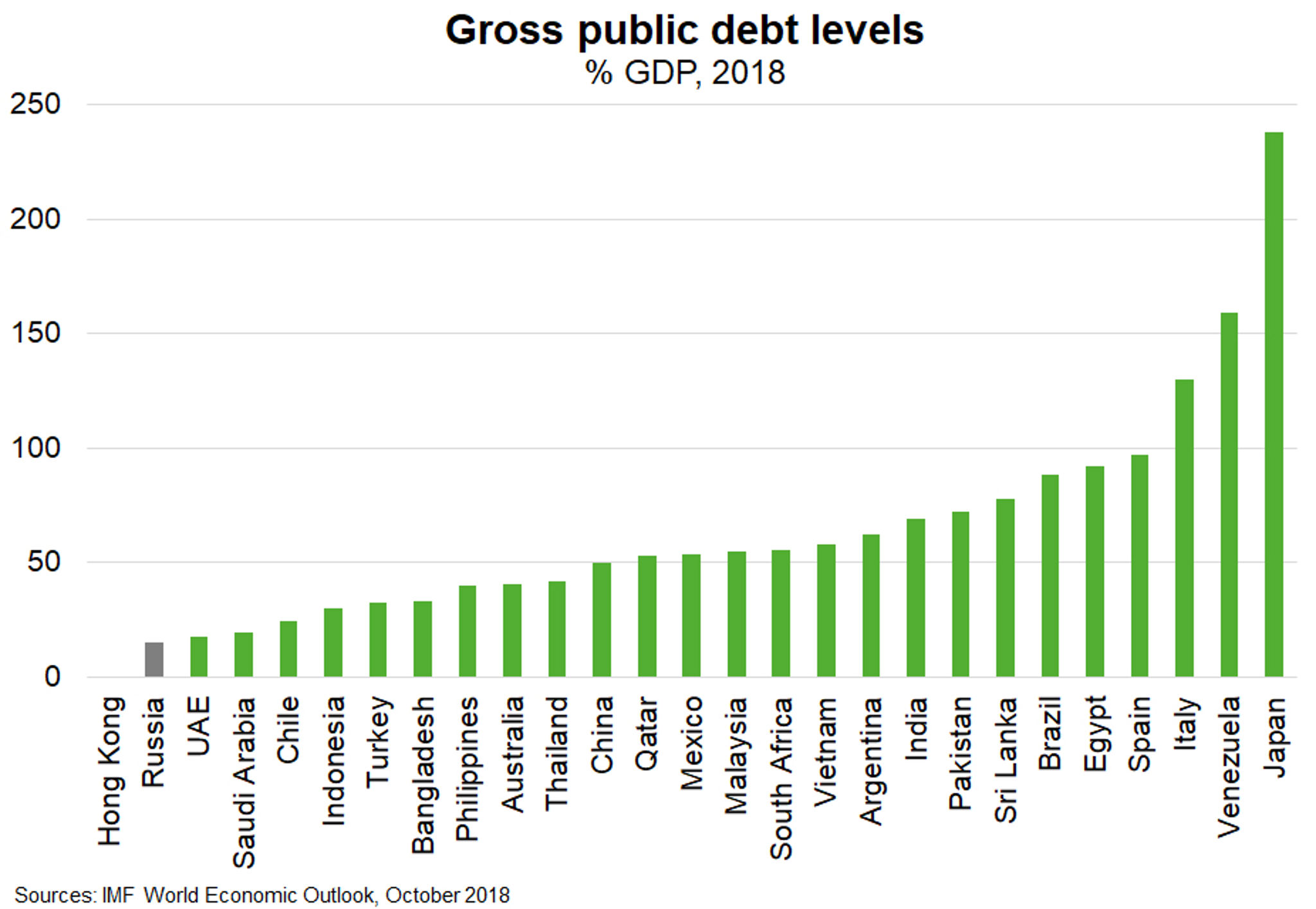

The Russian economy has proven itself resilient and macroeconomic buffers remain robust. In particular, sovereign debt is low (15% of GDP, Chart) and FX reserves are equivalent to US$482b. Moreover, Moscow is reducing its reliance on the USD to provide some fiscal protection. Nonetheless, sanctions would hurt. Restrictions on the oil and gas sector, which constitutes about 40% of public revenues, could disrupt Russia’s ability to maintain long term output from mature deposits and tap hard-to-reach new reserves. Structural underinvestment would frustrate efforts to accelerate sluggish GDP growth, while sovereign debt sanctions would raise the government’s funding costs. Slower growth and ongoing international tensions may continue to affect the market for Australian exports to Russia—mainly live animals, tourism and education—which have already contracted on average 6% p.a. over the six years to FY18.