2021—Exports rise amid strong world demand and commodity prices

Strong but uneven global recovery

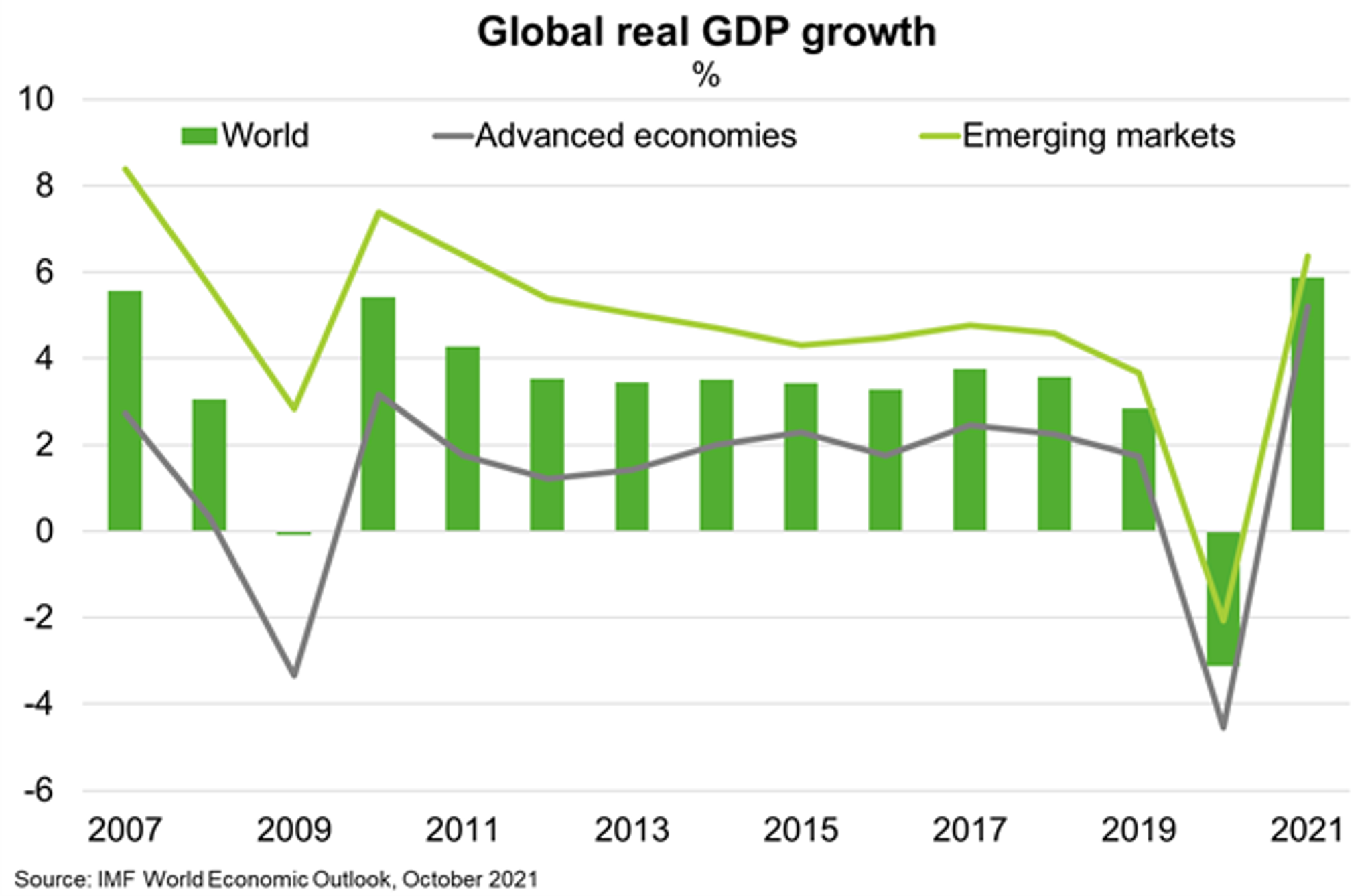

The robust global economic recovery in 2021 (Chart) was supported by vaccination progress, easing mobility restrictions and continued stimulus from governments and central banks. In particular, large stimulus packages, including to boost infrastructure investment, improved US economic performance and demand for manufactured goods from export-oriented emerging markets. Chinese authorities eased monetary settings to spur lending to SMEs and support ongoing expansion. The IMF also provided foreign exchange to countries for external debt servicing and import payments, including for vaccines. Such measures helped avoid bankruptcies that might otherwise have occurred.

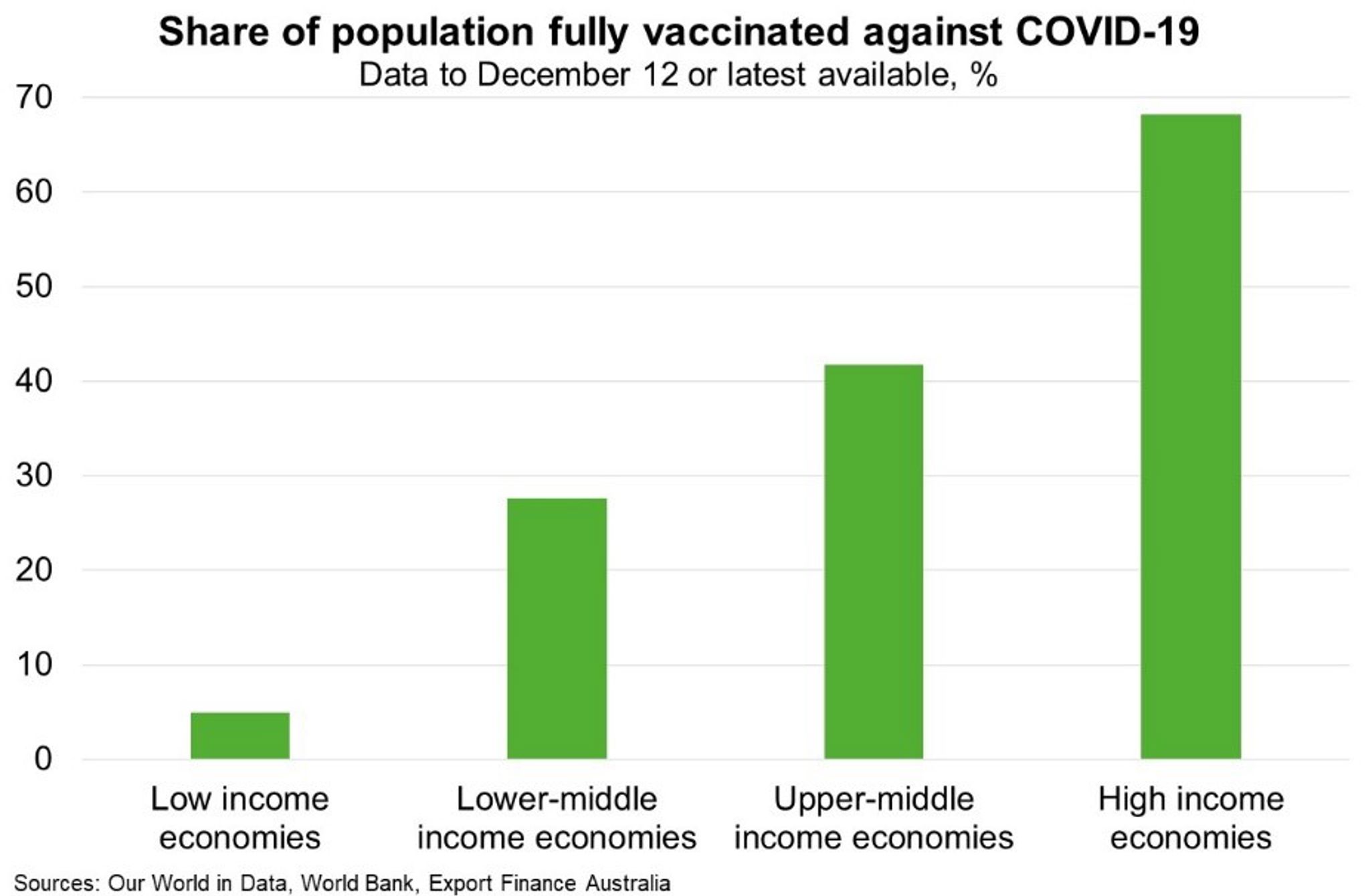

But the recovery has been uneven, including due to lopsided vaccine distribution. Around 68% of the population in high income economies have been fully vaccinated—supporting faster recovery in domestic demand—against just 5% in low-income economies (Chart).

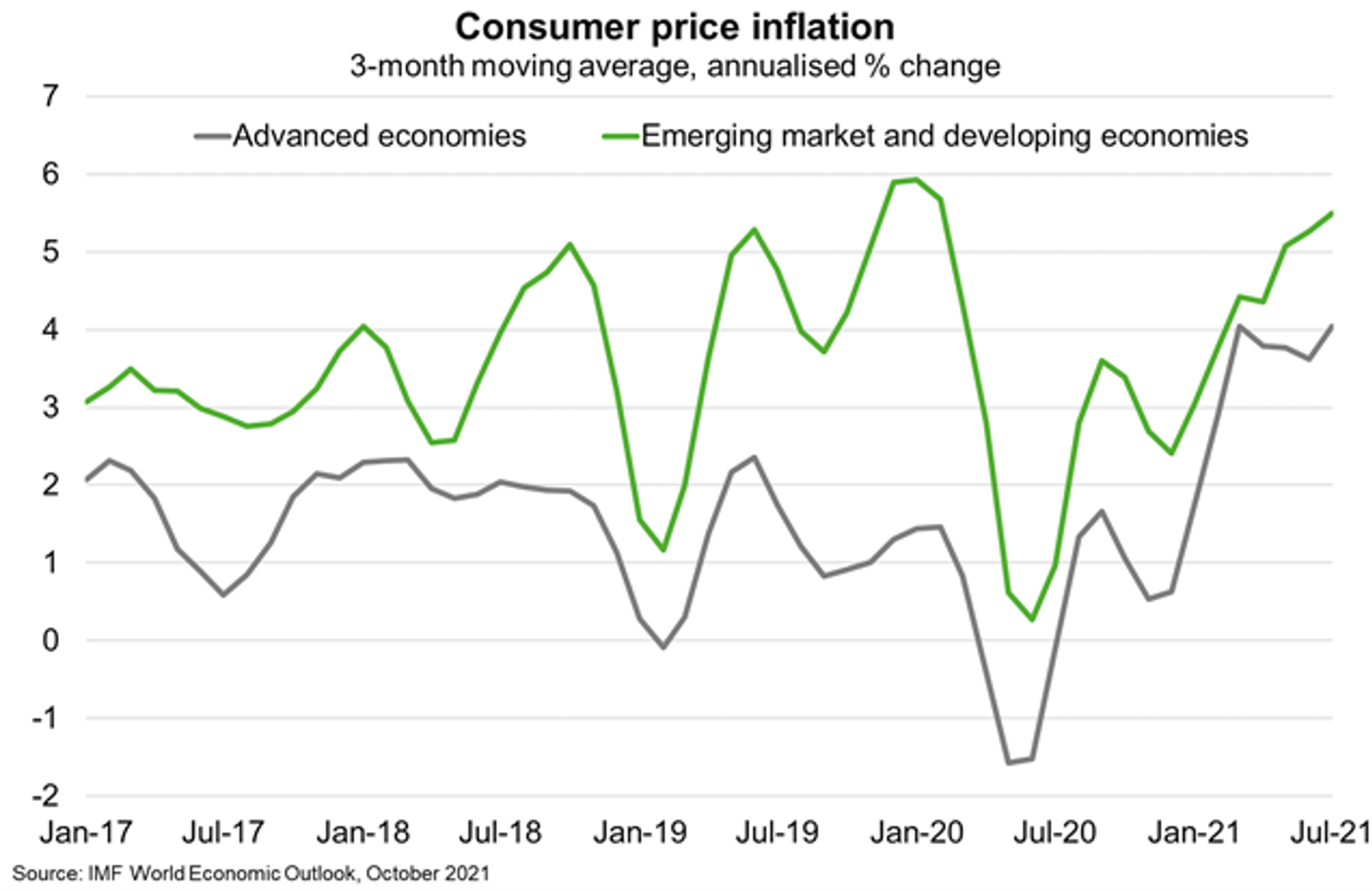

Rising commodity prices supported export growth in some emerging markets, including Indonesia, Chile, Peru and Mongolia. But reliance on services, particularly tourism, and functioning global supply chains challenged the recovery in other countries, such as Thailand, Fiji and the Philippines. India, Brazil, and many countries in Southeast Asia battled surging infections from mid to late 2021 due to the Delta variant. Cases even surged in Chile despite its high vaccination rate. This led to renewed lockdowns in many countries that punctured economic recoveries. High and rising public debt meant many emerging markets had limited space to provide additional fiscal stimulus. Meanwhile, a sharp rise in inflation (Chart) prompted central banks in several large emerging markets—including Hungary, Russia, Brazil, Mexico and Chile—to start hiking interest rates.

Surging goods demand meets supply constraints

World trade grew strongly in 2021 alongside rising global demand. The World Trade Organisation estimates goods trade expanded 10.8% in 2021 after contracting 5.3% in 2020. The global shift in consumption to goods—as mobility restrictions hindered services spending—alongside rebounding global industrial production, sharply lifted demand for household goods, manufacturing and industrial products, boosting exports from countries such as South Korea, China and Australia. However, while international travel has improved, services trade remains below pre-pandemic levels.

Global production and logistics systems are not suited to such sudden and sharp shifts in demand, given they operate on a just-in-time basis. Factory and port closures amid COVID-19 outbreaks, new distancing and quarantine requirements, labour shortages and capacity constraints resulted in severe disruptions to global supply chains. This led to sharp increases in global shipping costs and longer delivery times, a fall in inventories and shortages of components (for instance, semiconductors), and surging raw materials prices, including energy.

Social and political unrest weighs on investment climates

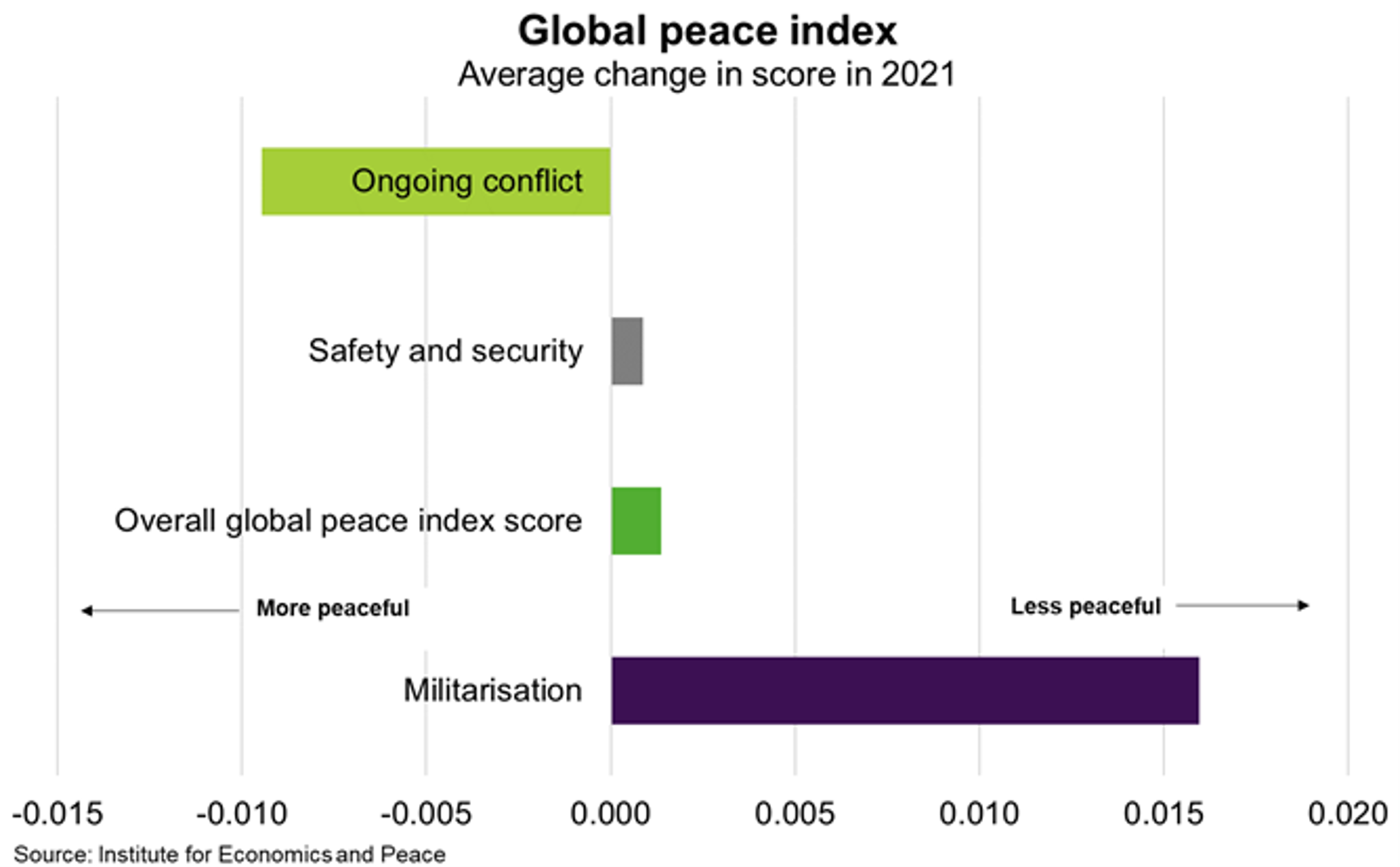

Economic recovery and investment remained vulnerable to political upheaval, including in Myanmar and Guinea. Indeed, the latest Global Peace Index (based on 2020 data) found a decline in peacefulness reflecting higher militarisation (Chart). Political uncertainty, for instance in Nepal and Malaysia, exacerbated challenges at a time of economic weakness. Rising civil unrest and violent demonstrations were seen in Colombia and South Africa, driven by income inequality and economic hardship, worsened by the pandemic. Geopolitical tensions also manifest in increased risk for many Australian exporters. That said, better governance and reform efforts in some major export markets supported economic prospects and institutional strength.

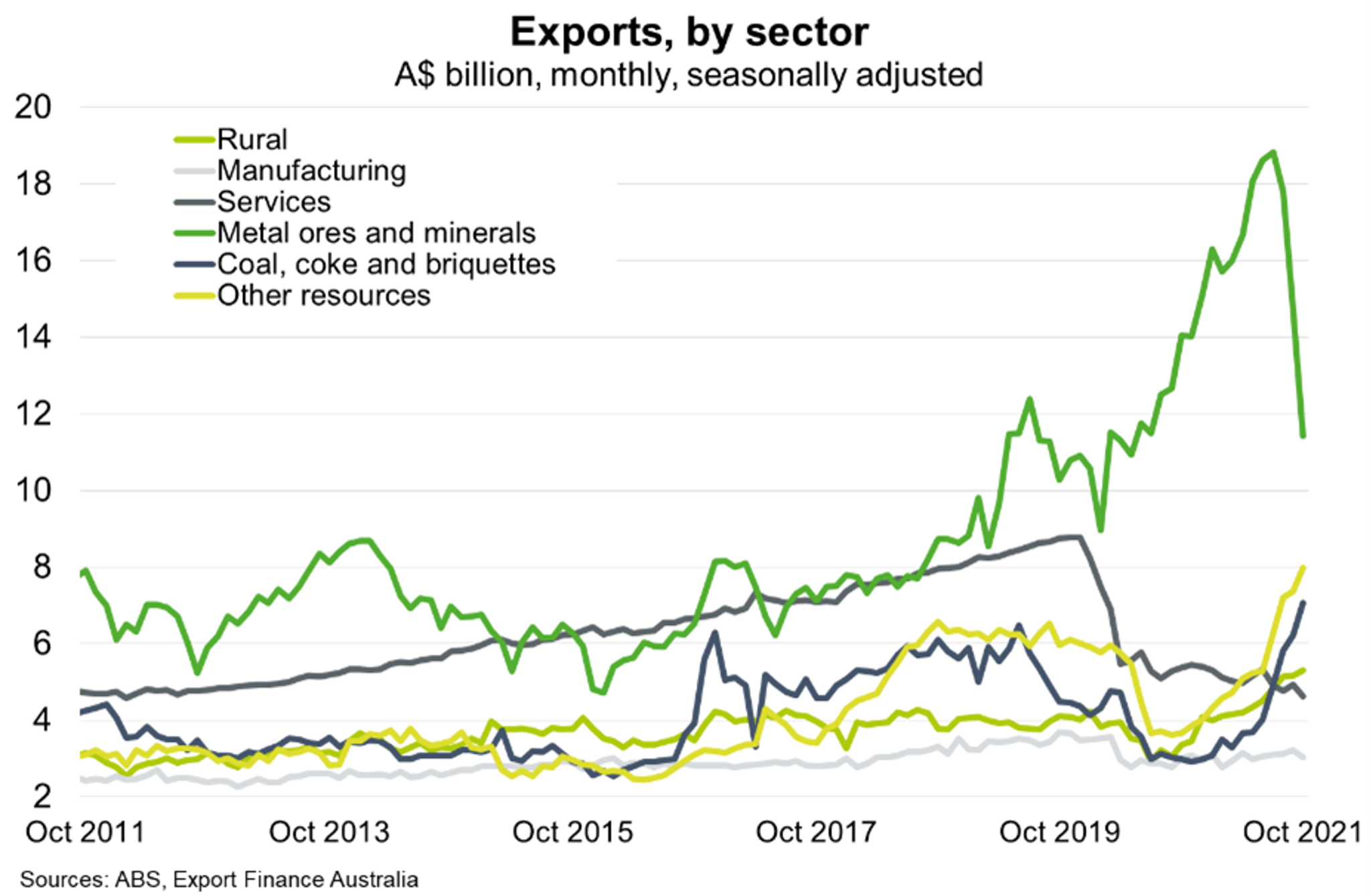

Despite global decarbonisation efforts, rising commodities exports offset services weakness

Against this backdrop, higher commodity prices and rising Chinese industrial demand helped drive stronger export earnings in 2021 (Chart). Exports rose 37% on a year-ago basis in Q3 2021. While record iron ore exports moderated in the back end of the year, energy exports surged on strong demand from Europe and China and significant supply shortages related to bad weather, labour disruptions, transport bottlenecks and low investment before the pandemic. The surge in energy prices came despite the increasing global shift away from fossil fuels, as countries aim to reach net-zero carbon emissions targets.

In agriculture, grains farmers benefitted from a bumper local harvest and generally stable global demand for food. Drought in large grain producing nations sharply increased world prices, boosting export returns. Ongoing global economic recovery boosted wool prices and demand for beef and veal exports, while the high cost of livestock feed in China lifted demand for Australian dairy products. But certain exporters faced significant headwinds; for instance, notwithstanding some success in diversifying into new and existing markets, Chinese tariffs have impacted wine exports.

Strength in commodities exports have been particularly important during a sustained period of low international travel. Services export volumes remained 48% below pre-COVID levels in Q3 2021, reflecting ongoing border restrictions. Manufacturing exports remained broadly stable through 2021, balancing growing global demand against high shipping costs and delays.