Asia—Despite resilience, weak FDI to weigh on sustainable recovery

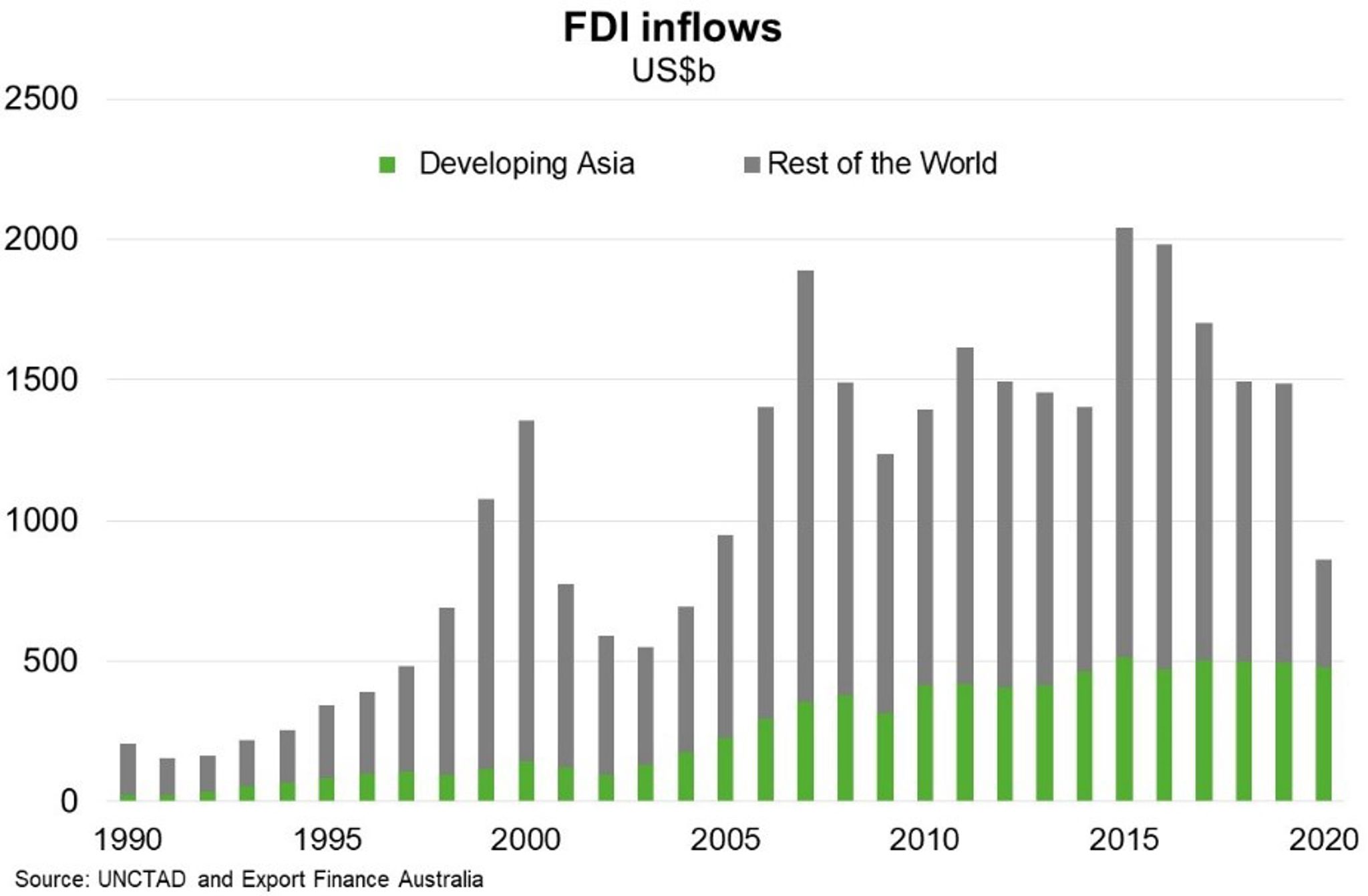

Amid weak demand and tremendous uncertainty, global foreign direct investment (FDI) collapsed in 2020. FDI inflows fell 42% from US$1.5 trillion in 2019 to an estimated US$859 billion; their lowest level since the 1990s and more than 30% below the investment trough that followed the global financial crisis. The United Nations Conference on Trade and Development (UNCTAD) expect an FDI recovery will not start before 2022, as further waves of the pandemic and developments in investor screening regimes globally affect uncertainty.

On the positive side, Asia outperformed the rest of the world. China overtook the US as the largest recipient of FDI—with flows rising 4% to US$163 billion—facilitated by an early return to economic growth and the government’s targeted investment facilitation program. India also received more FDI (up 13%), boosted by investments in the digital sector. Overall, developing countries attracted 72% of global FDI, their highest share on record. Developing Asia on its own accounted for more than half of global cross-border investment (Chart). Resilient FDI in developing Asia suggests firms are keen to own strategic assets and access growing markets. It also supports the World Bank’s assertion that supply-chain disruptions aimed at nearshoring or diversifying production ‘may be driven more by rhetoric than reality’. This bodes well for Asian export markets; FDI is a key source of finance and driver of economic growth.

That said, UNCTAD expect a further 5-10% fall in FDI in 2021 from 2020 levels. Greenfield project announcements fell by 38% in developing Asia in 2020, suggesting an industrial turnaround is not yet in sight. These investments are crucial for productive capacity and infrastructure development, and thus for a sustainable recovery.