China was the only major economy to avoid a contraction last year, growing 2.3% following a sharp “V-shaped” recovery. Recent data suggest the recovery will continue in 2021. Industrial output rose 7.3% in December year-on-year, the ninth straight month of growth as the manufacturing sector benefits from rising demand for Chinese exports. However, the consumption recovery is lagging. Retail sales rose just 4.6% cent in December from a year earlier, and for all of 2020, sales shrank 3.9%. Noting China's economic recovery as "uneven and unstable", officials at the annual Central Economic Work Conference in December indicated that the tapering of stimulus policies this year would be smooth and gradual.

The annual conference outlined Beijing’s 14th Five Year Plan (2021–25), emphasising greater reliance on the domestic economy and local innovation. China aims to lift household income and strengthen the social safety net to boost domestic demand. Indeed, a consumption recovery is likely in 2021 as the labour market stabilises and consumer confidence strengthens. Innovation will be targeted in areas such as agriculture and technology to raise domestic food supply and reduce risk from geopolitical tensions and disruptions to global supply chains. Authorities will increase their focus on climate change and delivering more sustainable growth, including through accelerating investment in green technology to become carbon neutral by 2060.

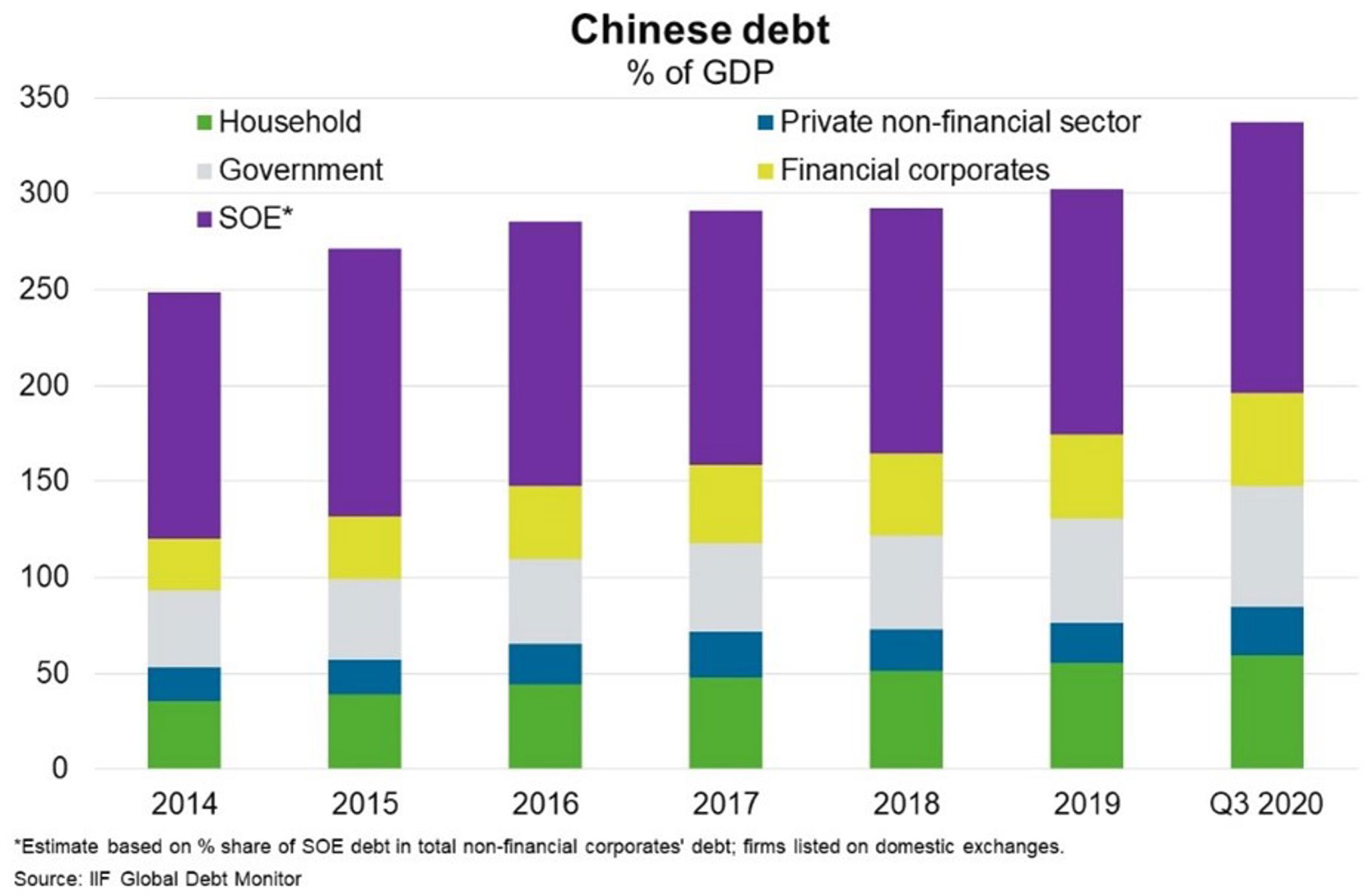

Policies to promote technological advancements, protect the environment and drive self-sufficiency will likely require additional government spending. Although this could raise productivity and make economic growth more resilient, the potential for increasing debt-fuelled spending risks exacerbating financial stress among state-owned enterprises (SOEs), local governments and banks. China’s economy-wide debt burden is nearly 350% of GDP (Chart) and corporate bond defaults, particularly among SOEs, have been increasing in recent years, underscoring rising debt risks.