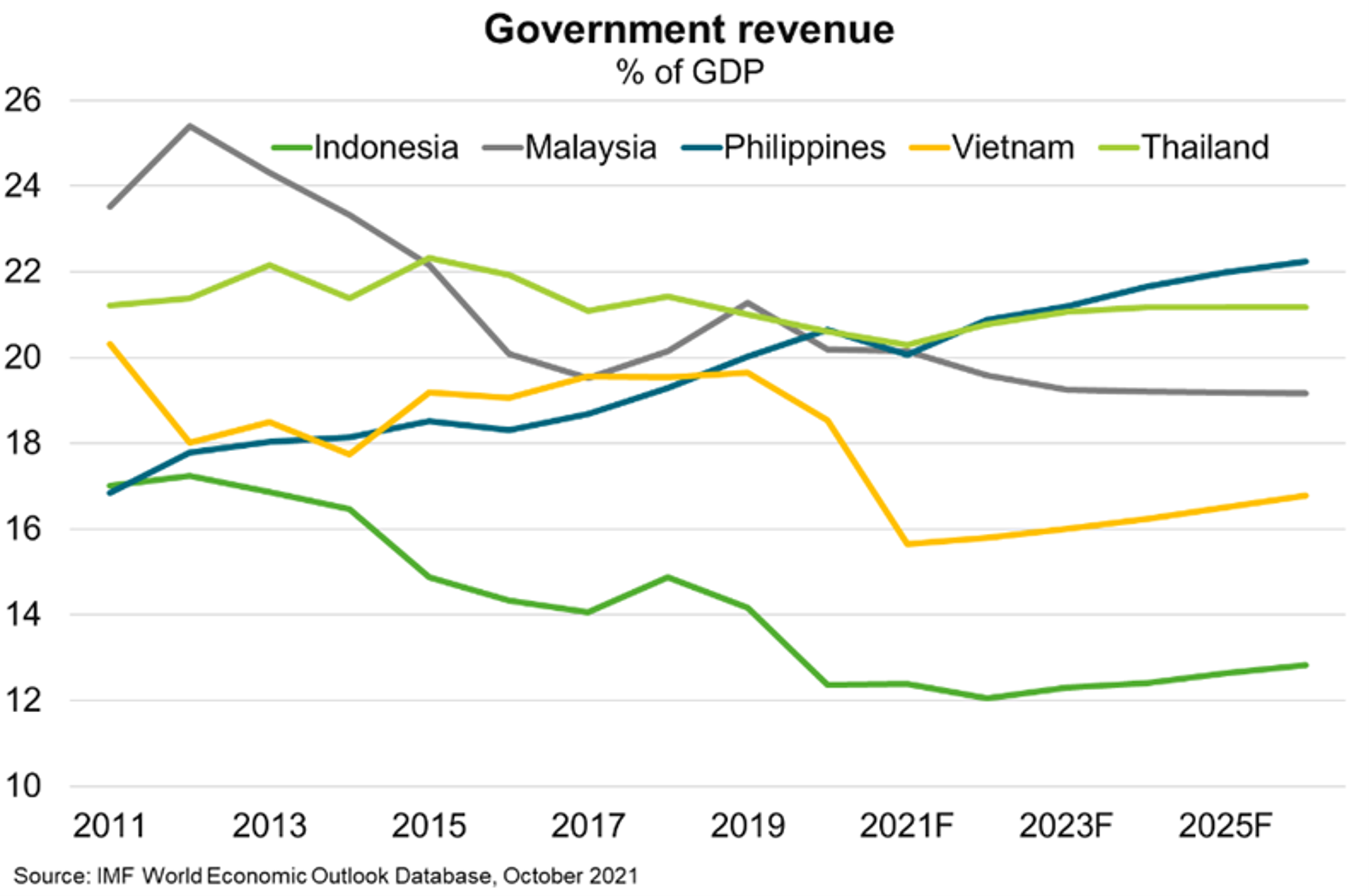

Indonesia's parliament approved a new tax law in October, including raising the value-added tax to 11% from 10% in 2022, adding a new higher personal income bracket, implementing a carbon levy and freezing corporate tax rates at 22%. According to the Ministry of Finance, the new tax laws will generate IDR139 trillion in additional government revenue next year (about 1% of GDP) and support greater tax compliance and revenue growth over time. Indonesia’s sharp rise in public debt in the wake of the pandemic has made it even more important to raise government revenue, which as a share of GDP is substantially lower than most other emerging markets, including in Asia (Chart).

Boosting revenue will be key to supporting government spending on education, infrastructure, health, and social safety nets, thereby sustaining the economic recovery beyond the pandemic. Major reforms to remove bureaucratic and regulatory obstacles to investment, address labour market rigidities, make it easier to do business and spur foreign investment are advancing with an online system for risk-based business licensing. Government transformation plans in energy, infrastructure, health and education provide new opportunities for growth, trade and investment.

Effective implementation of policies could strengthen growth over time. The Indonesian economy is forecast to grow 4.8%-5.9% in 2022[1] buoyed by high commodity prices, low cost of capital and recovery from the pandemic. With COVID-19 under control for now and increasing economic reform, a growing Indonesian economy is positive for Australian exporters and investors. Indonesia is Australia’s 13th largest export partner, taking $7.1 billion of goods and services exports in 2020 (1.6% of total exports). Risks to the outlook include a commodity price reversal and rising global interest rates.

[1] Range of forecasts published by IMF, World Bank, OECD and ADB.