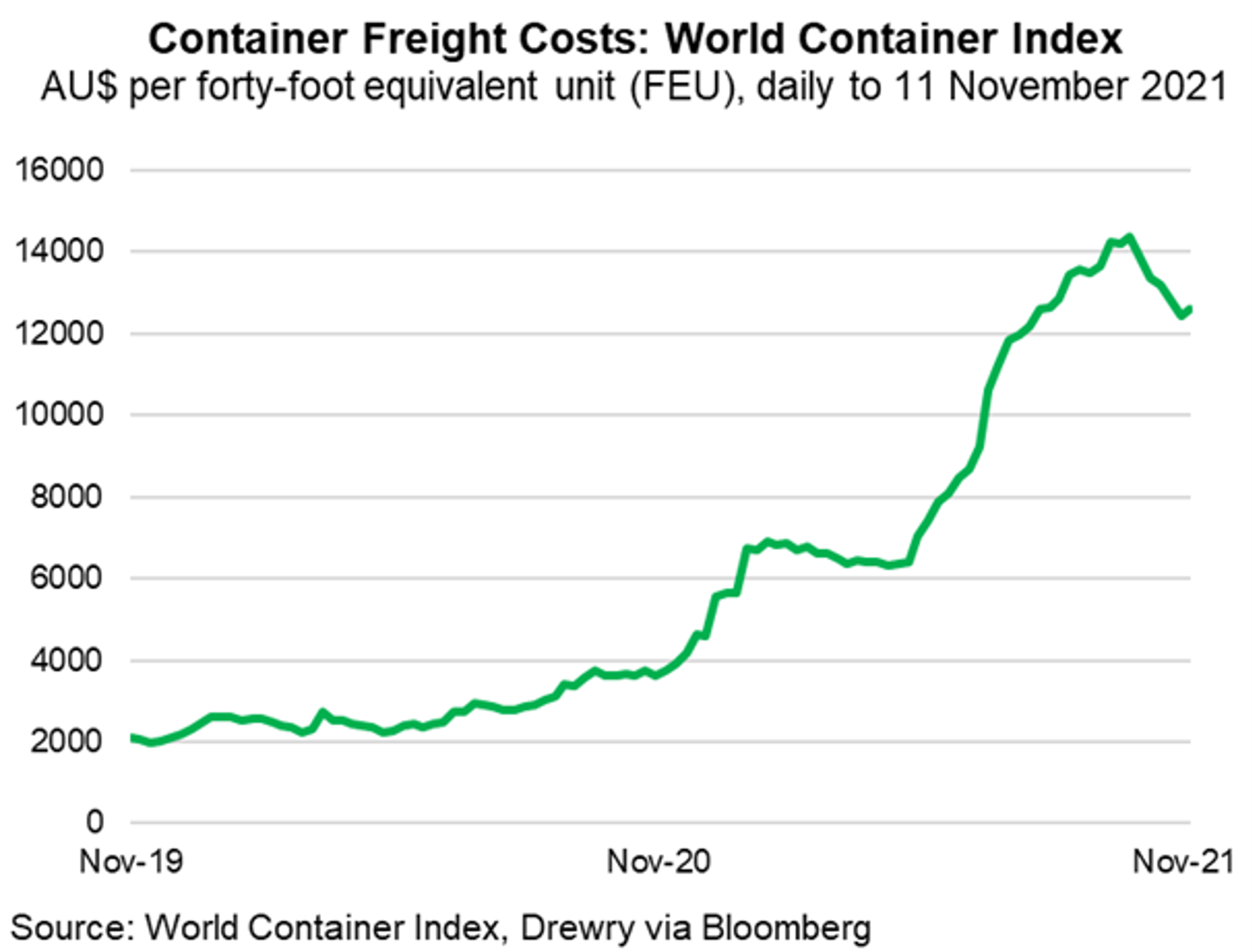

Persistent global supply chain disruptions are creating shortages of components and goods, and volatile raw materials prices, denting the global recovery. High shipping costs and global port congestion are placing additional pressure on Australian importers and exporters. Despite some recent easing, bulk shipping freight indices remain double the levels of this time last year (Chart). Even at these rates, on-time delivery is rare. Container ports in Southern California reported a record 111 ships waiting to berth this month, up from a pre-pandemic record of 17 ships. One Australian port terminal reported just 10% of vessels arriving in their designated berth windows in FY2021. Some exporters are struggling to meet their contractual obligations, while others are being squeezed out altogether, according to the ACCC.

These disruptions are partly due to an unprecedented bounce in global demand for consumer goods as economies recover from the impacts of COVID-19, and as consumers have had reduced opportunities to spend on services. The demand for goods has been exacerbated by fiscal and monetary fiscal stimulus, and in some cases elevated household savings. At the same time, supply is being hampered by factory and port closures amid COVID-19 outbreaks, new distancing and quarantine requirements, and labour shortages. This demand and supply mismatch is exacerbated by the relatively little slack built into the system. Complex and decentralised cross-border supply chains and shipping movements normally run lean and just-in-time, thereby aiming to maximise efficiency.

As such, in contrast to the aftermath of the GFC, the current global economic recovery is being constrained by supply instead of demand. These headwinds should begin to ease with increased vaccine coverage and new COVID-19 treatments. Likewise, a withdrawal of fiscal stimulus and redistribution of consumer spending from goods to services will likely ease pressure on global logistics demand. An investment boost in production capacity should eventually translate into more capacity and higher productivity. However, significant risks remain surrounding the path of COVID-19, global financing conditions and continued fiscal support.