Australia—Higher global inflation and interest rates add risks to exports

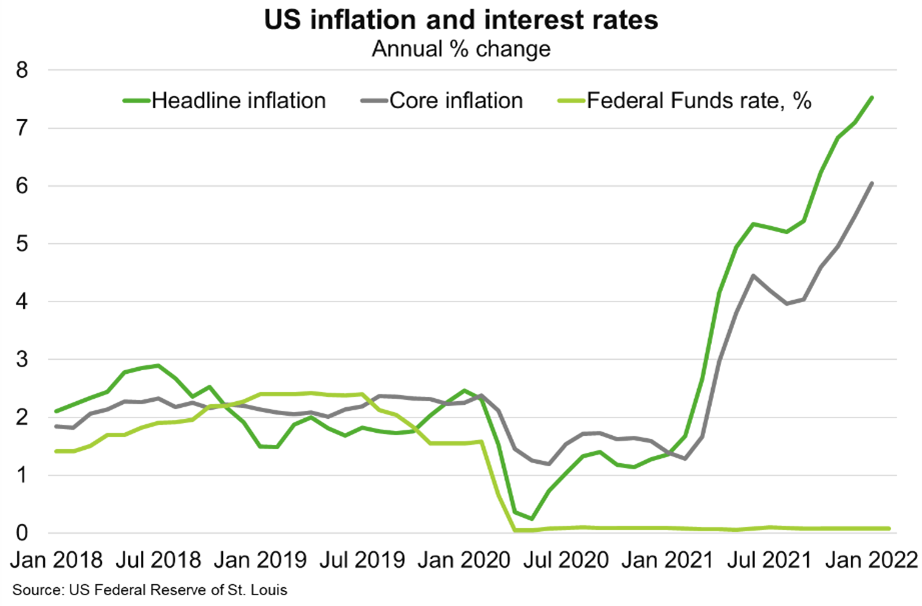

Rising energy prices, supply disruptions and localised wage pressures are driving broad-based inflation, most notably in the US and many emerging markets. In response, many central banks have either begun tightening monetary policy or are poised to remove monetary and liquidity support to their economies. Notably, the US Federal Reserve is likely to begin hiking interest rates in March, after inflation reached a new 40-year high of 7.5% year-on-year in January 2022 (Chart).

Australia’s commodity exporters benefit from high global prices; resources and energy exports are forecast to reach a record $379 billion in 2021-22 before lower but still high commodity export receipts of $311 billion in 2022-23. However, labour shortages that put upward pressure on wages, along with higher global shipping and imported goods prices, are contributing to cost pressures in several sectors, including mining, manufacturing, transport and agriculture. Given many Australian businesses, especially small and medium-sized operators, have limited scope to raise prices on global markets, higher cost pressures could squeeze firms’ profit margins.

The IMF assumes global inflation will gradually wane in 2022 as supply chain disruptions ease, demand normalises and monetary policy in major economies tightens. But if inflation in the US and globally remains higher for longer, monetary tightening could be more aggressive than is currently expected. Such a scenario poses significant downside risk to global GDP growth forecasts and could rattle global financial markets. These developments could lower demand for, and prices of, resources, energy and agricultural products that dominate Australia’s export basket. Higher US interest rates may also lead to capital outflows and currency depreciation in emerging markets that raises economic and financial instability in some of Australia’s largest export partners.