India—Infrastructure push may increase growth potential

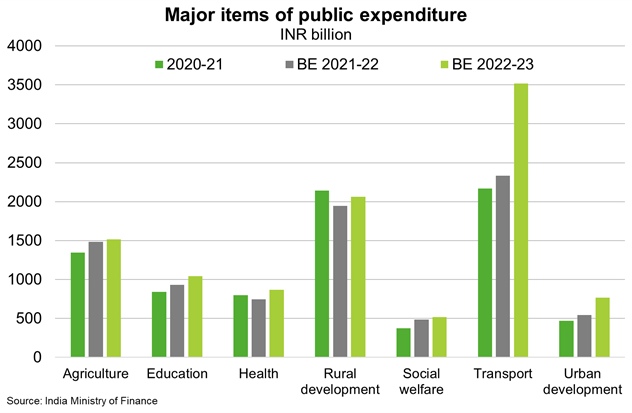

Finance Minister Nirmala Sitharaman recently unveiled the budget for the fiscal year 2022/23 (April to March). The expected fiscal deficit of 6.4% of GDP indicates only a moderate narrowing compared with 2021/22. While the rise in total government spending is modest, the budget specifies a sharp 35% increase in public capital expenditure (capex) from the 2021/22 target (Chart). This ambitious outlay will remain geared towards infrastructure, including a large highway expansion plan and allocations for railways, airports, mass transport, waterways and logistics infrastructure. Affordable housing, renewable energy and the telecommunications sectors will also benefit from the announced government schemes. The budget’s focus on expanding domestic infrastructure (Chart) strives to encourage greater private investment and position India as an alternative for global companies seeking to diversify their supply chains. India ranked 70th of 141 countries in the World Economic Forum’s 2019 gauge of infrastructure, significantly lagging China (ranked 36th).

The pro-growth budget is expected to sustain the recovery of India’s pandemic-hit economy, despite curtailed spending on subsidies and fewer measures to directly support consumption and rising unemployment. The IMF expects India’s economy to expand 9% in 2022 and 7.1% in 2023—the highest across all country forecasts. This is despite headwinds from a surge in Omicron infections, elevated energy prices, persistent supply disruptions, high and rising inflation, and tighter global financing conditions. While macroeconomic and pandemic risks are tilted to the downside, conservative revenue assumptions in the latest budget leave scope for the government to counter any potential shocks. Australian exporters should benefit from India’s strong economic performance, particularly as the international border re-opens to fully vaccinated travellers from February 21. India was Australia’s fastest-growing source of international visitors prior to the pandemic. Direct opportunities also abound for Australian commodities, construction and logistics companies to execute infrastructure upgrades.