China—Extreme weather events compound economic challenges

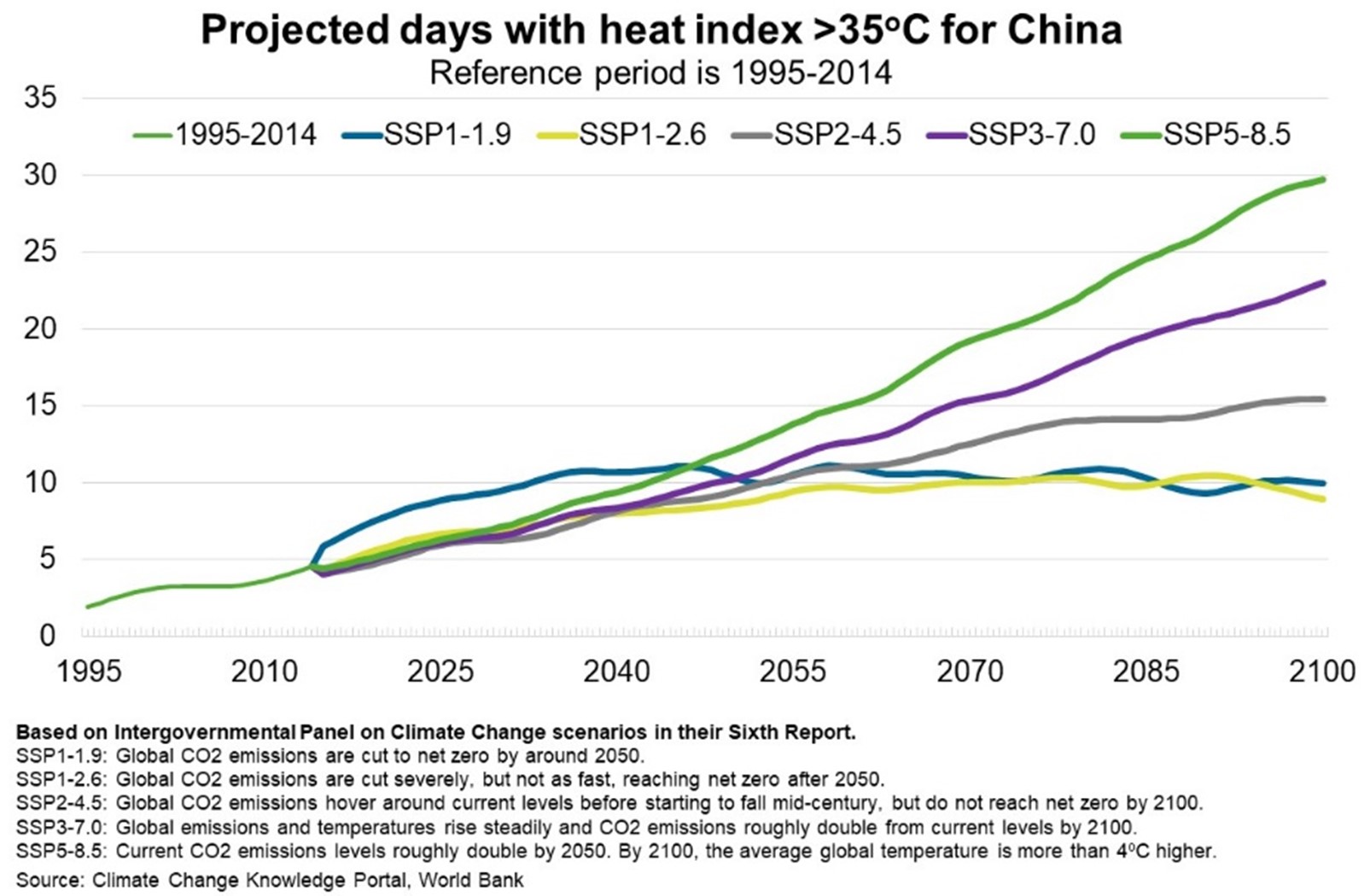

Severe heatwave and drought in Southern China (and heavy rainfalls in the North) add to the challenges facing the world’s second largest economy from COVID-19 restrictions, property market stress and slowing external demand. The heatwave is the most intense in over 60 years with almost half of China’s land area experiencing temperatures above 35°C. According to the World Bank, the extent to which China experiences more excessively hot weather hinges on global efforts to curb carbon emissions (Chart).

Prolonged heatwave and drought have disrupted water and electricity supply. China’s Southern and South-western provinces rely heavily on hydropower. They also export hydropower-generated electricity to Eastern provinces. Local governments, particularly in the Sichuan province, have rationed power to factories, disrupting production among global manufacturers such as FoxxConn, Toyota and Volkswagen. This has added to already adverse conditions facing producers. The August Purchasing Manager Index indicated a contraction in the manufacturing industry for a second consecutive month. Damage to crops from extreme heat and water shortages also weighs on agriculture production and related industries (sectors which contributed an estimated 16.5% of 2020 GDP).

Energy shortages have prompted an increase in Chinese demand for thermal coal, consistent with the experience in heat-stricken Europe. Strong global demand and weak supply exacerbated by the Russia-Ukraine crisis have pushed thermal coal prices to a record high US$440 per tonne in late-September. That will benefit Australia’s already strong energy exports. But on the downside, electricity shortages and lower levels of property construction are curbing Chinese steel demand and dragging on iron ore prices (down 30% over the last six months to US$100 per tonne). As the world's largest agricultural importing nation, China’s increasing food demand could put further upward pressure on global food prices. That is likely to lead to an increase in Australia’s agriculture export values, which are forecast to hit a record high in 2022-23.