Asia—Growth outperformance buffers Australian exports

The IMF expects the Asian region to grow 4.6% in 2023, up from 3.8% in 2022—contributing to more than 70% of global growth this year. Declining global food and energy prices are gradually reducing headline inflation while supply chain disruptions—including for labour and materials—are also easing as people and businesses operate more freely in the wake of the pandemic. This has prompted some central banks (in India, South Korea and Malaysia) to pause interest rate hikes. The newly entered into-force Regional Comprehensive Economic Partnership further supports regional investment and manufacturing.

China’s consumer demand is recovering following the relaxing of COVID-19 restrictions and fresh stimulus is supporting investment. Indeed, real GDP growth beat expectations at 4.5% y/y in Q1 driven by a rebound in retail consumption and property prices. Strong private consumption and infrastructure investment will also drive growth in domestic-led economies in India, Indonesia, and the Philippines. Continued recovery in international tourism should further support growth in these economies, and also in Thailand. Vietnam continues to attract an increasing share of foreign direct investment, reflecting its growing competitiveness as a manufacturing and exports hub. But there are pockets of weakness, particularly in Asia’s advanced economies. Large export-oriented economies such as South Korea and Taiwan are more exposed to the global slowdown. Reflecting this, South Korea’s exports fell in year-on-year terms in March for the sixth month in a row.

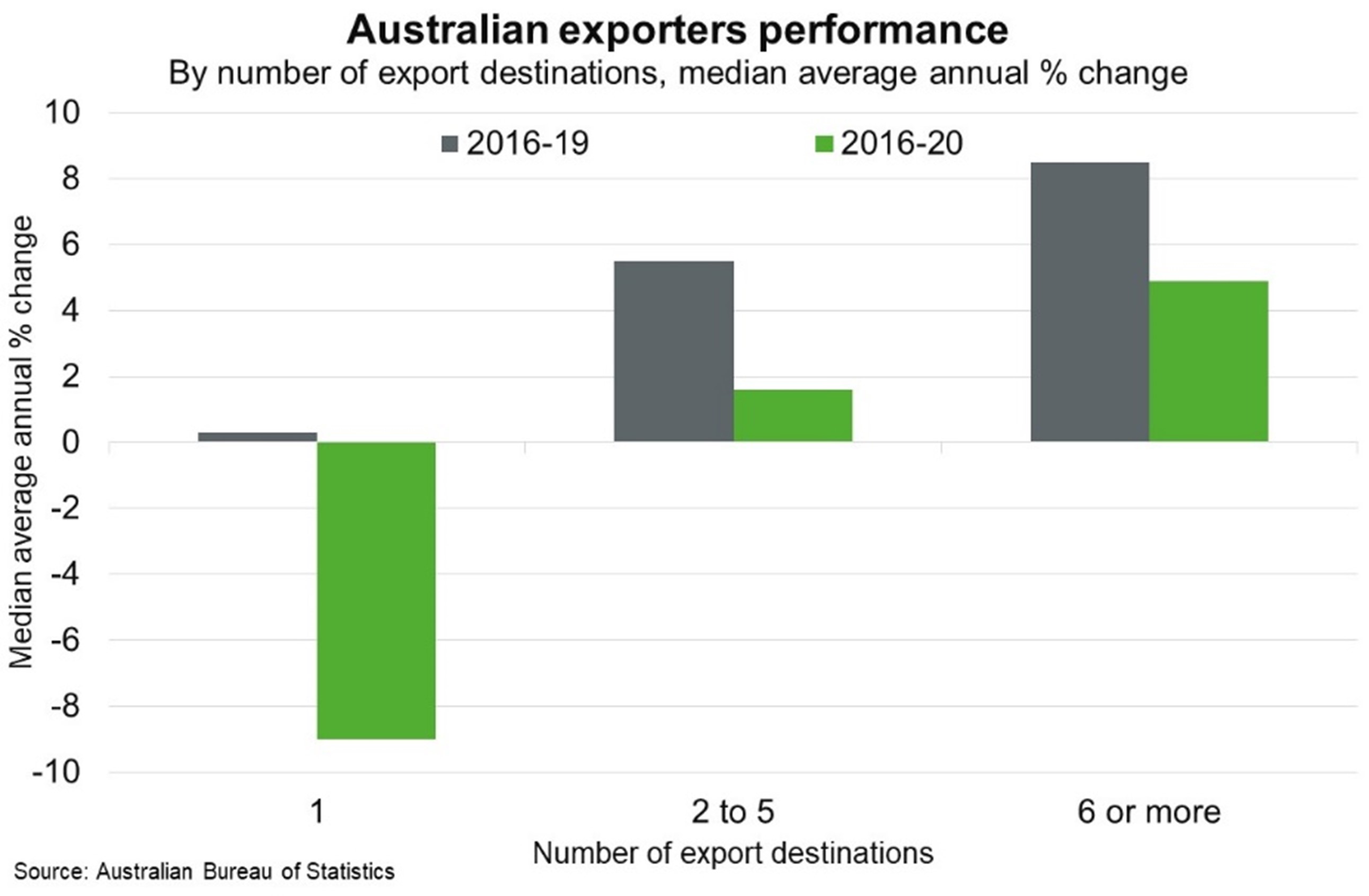

For many countries in Asia, growth will be at or near robust pre-pandemic rates through 2023 and 2024. This bodes well given Australia sent more than 80% of its exports to Asia in 2021-22. Further, recent data from the Australian Bureau of Statistics suggests that the most resilient exporters are those that export frequently and have diversified export markets (Chart).