Australia—Climate goals lift base metals and critical minerals exports

Australia’s resources and energy exports are forecast to set a fresh record-high of $464 billion in 2022-23 according to the Department of Industry, Science and Resources, surpassing last year’s record of $422 billion. Solid performance reflects a) the war-driven spike in energy prices in 2022, b) China’s easing of COVID-restrictions and infrastructure investment, and c) growing demand for base metals and critical minerals used in low-emission technologies. Export earnings are forecast to ease back towards pre-COVID levels after 2023–24. Energy prices are expected to fall and China’s economic rebalancing towards consumer spending and services will weigh on export receipts for iron ore and other traditional resource commodity exports.

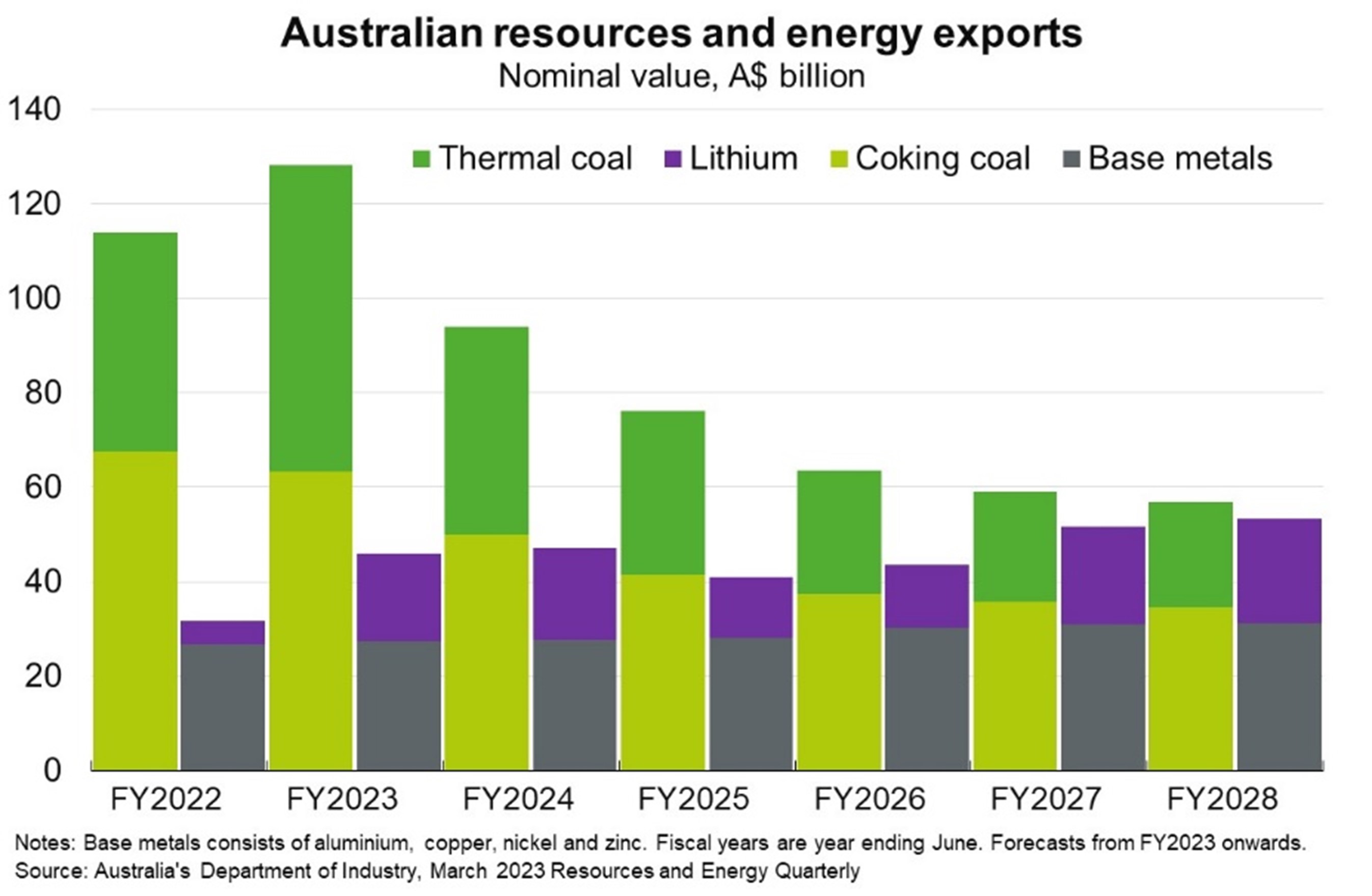

Australia aims to become a key materials supplier for the global clean energy transition. The rise in base metals and critical minerals exports is being driven by growth of electric vehicles (EVs). A typical EV battery pack needs lithium, nickel, manganese and cobalt, while charging stations require substantial amounts of copper. Australia has high geological potential in all these minerals. In particular, lithium exports are forecast to triple to $19 billion in 2022-23 and match that of thermal coal by 2027-28, as demand for clean energy rises and fossil fuel prices and usage declines (Chart). Base metals and lithium exports combined are forecast to be as large as the value of all coal exports in 2027-28. The longer term outlook is similarly bright. The IMF forecasts that in a global net-zero emissions scenario, the global combined production of copper, nickel, cobalt, and lithium could climb from US$130 billion in 2020 to more than US$700 billion in 2040—well above the estimated US$400 billion production value of oil in 2040. For Australia, the average annual value of lithium production could climb to US$70 billion (A$104 billion), more than five times the value of forecast lithium exports for 2022-23.