2024—Economic prospects are uncertain and more likely to disappoint

The world economy has been battered by consecutive negative supply shocks in recent years. Risks to the global economic outlook remain tilted to the downside. If realised, the six major risks described in this section could tip the global economy into recession and/or keep inflation higher for longer. However, upside risks could result to the extent that inflation falls, or domestic demand recovers, faster than expected.

Geopolitical tensions could significantly disrupt commodity markets, trade routes and financial conditions

The Hamas attack on Israel and subsequent war in Gaza, in conjunction with Russia's invasion of Ukraine, has heightened geopolitical tensions and uncertainty about the near term outlook. Recent conflict in the Middle East has not yet materially impacted oil supplies, but escalation into a regional war, or a worsening in other geopolitical tensions, could drive prices higher. While the global economy has become less oil-intensive, particularly in advanced economies, macroeconomic modelling suggests a US$10 per barrel rise in oil prices could raise global inflation by 0.2 percentage points and lower growth by 0.1 percentage points in the first year. Disrupted trade flows via the Strait of Hormuz and Suez Canal could also increase shipping, energy and food prices. The Baltic Exchange Dry Index—which measures the cost of shipping goods worldwide—more than doubled in November, though it has eased this month. A proliferation of export restrictions on agricultural products that aim to reduce domestic prices, and geoeconomic fragmentation that constrains commodities trade across regions, has the potential to exacerbate price volatility. Heightened geopolitical tensions could also see risk repricing in financial markets, leading to asset price falls and losses for exposed businesses and investors.

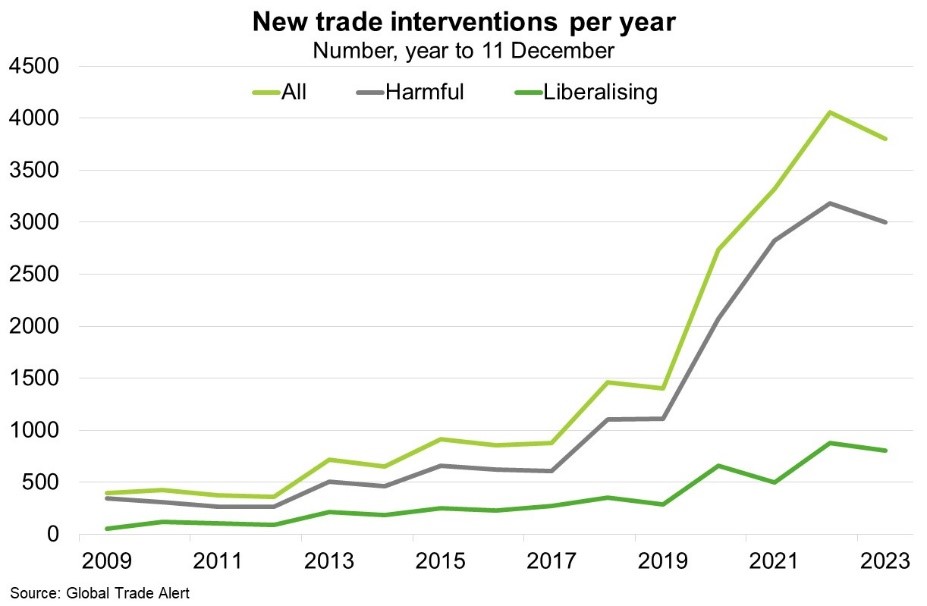

Trade restrictions and the restructuring of global value chains could prolong global trade weakness

World trade growth is expected to remain well below the historical average over the forecast horizon. A long term decline in the trade intensity of growth has been driven by structural factors, exacerbated by geopolitical tensions and increasingly inward looking trade and investment policies (Chart). A mild forecast upturn in 2024 could be weaker than expected if the investment recovery in advanced economies underperforms or tighter financing conditions raise the cost of trade credit. Structural forces could also intensify, posing risks to trade over the longer term, and thereby stifling competition and productivity growth. The IMF estimates that more international trade restrictions could reduce global economic output by up to 7% over the long term, or about US$7.4 trillion—the combined size of the French and German economies.

Underlying inflation and tight financial conditions could expose financial vulnerabilities

While headline inflation is moderating in almost every economy, core inflation (excluding food and energy) has proven sticky and services inflation remains elevated relative to pre COVID. New upside inflation surprises could see central banks keep interest rates higher for longer than expected. This could transpire through multiple channels. First, persistent inflation increases the risk of embedding higher inflation expectations among corporates and households, leading to higher realised inflation. Second, still tight labour markets and wage demands could keep core inflation elevated. Third, escalating geopolitical confrontations could drive up food and energy prices. Fourth, ongoing climate change, exacerbated by the current El Niño phenomenon, could see a higher incidence of extreme weather events and negative supply shocks. For instance, prolonged drought conditions have increased vessel congestion and transit fees in the Panama Canal, one of the world's main maritime trade routes. Further, European Central Bank calculations suggest that El Niño has typically raised global food prices by more than 6% in a year.

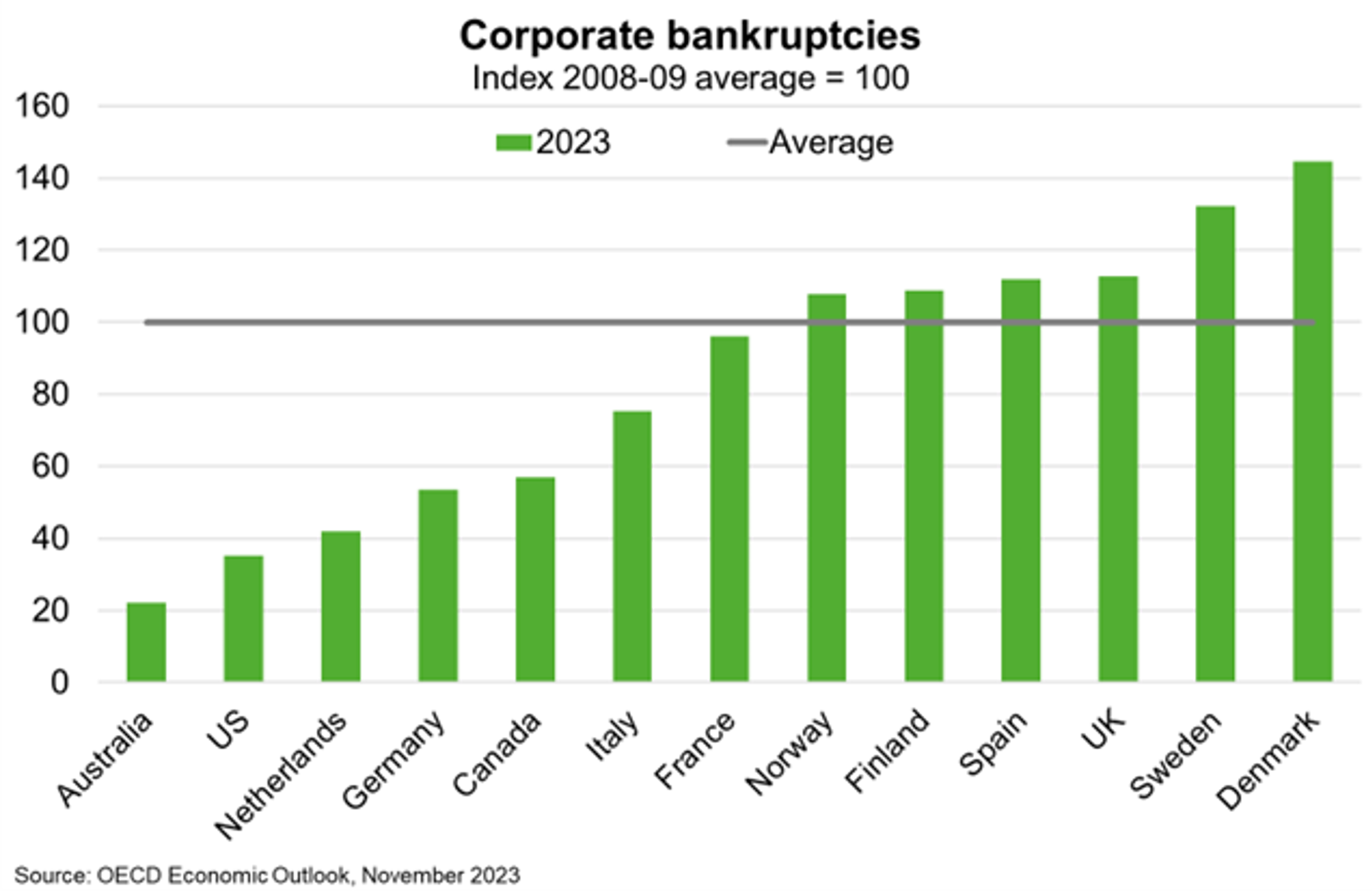

The debt servicing capacity of some households and corporates would deteriorate if interest rates rise further or if the impact of unusually fast rate hikes during 2022 and 2023 prove stronger than anticipated. While still low by historical standards, mortgages in arrears have begun rising across several advanced economies. Corporate bankruptcies have risen more sharply and now exceed 2008-09 levels in some countries (Chart). The risk of large corrections in property prices could also strain household and corporate balance sheets. In particular, post-COVID structural changes associated with remote working are compounding the impact of higher financing costs on commercial property. Financial institutions face higher credit losses and are also vulnerable to liquidity and interest rate risks.

Persistent high global interest rates are also a source of risk for emerging markets with elevated sovereign debt, a larger share of foreign currency denominated debt, and a high share of short term debt. This exposes borrowers to refinancing risk, particularly when coupled with low foreign exchange reserves.

A further slowdown in Chinese growth could result from property market turmoil

China’s real GDP growth is forecast to have rebounded to 5.2% in 2023 on the back of modest stimulus but is expected to slow to 4.7% in 2024 and 4.2% in 2025. Economic growth could slow even further if Beijing’s policy response fails to preserve financial stability by supporting China’s large property sector and empower private sector activity. China’s consumer prices fell by 0.5% year on year in November, the sharpest decline in three years. A broad deflationary trend compounds wider economic pressures and makes it harder for China to bear its debts. Indeed, in part reflecting this, Moody’s cut the outlook on China’s A1 sovereign credit rating to negative this month. In their decision, Moody’s cited persistently lower economic growth and a growing need of financial support for cash-strapped local governments that poses downside risks to China’s fiscal, economic and institutional strength.

Domestic financial stress in China would hurt the global economy. OECD modelling suggests that an unanticipated one-year fall of 3 percentage points in China’s domestic demand growth could lower global GDP growth by 0.6 percentage points, and potentially by over 1 percentage point in the event of a significant tightening of global financial conditions. Hardest hit would be countries that are dependent on trade with China; particularly Asian and commodity-producing economies.

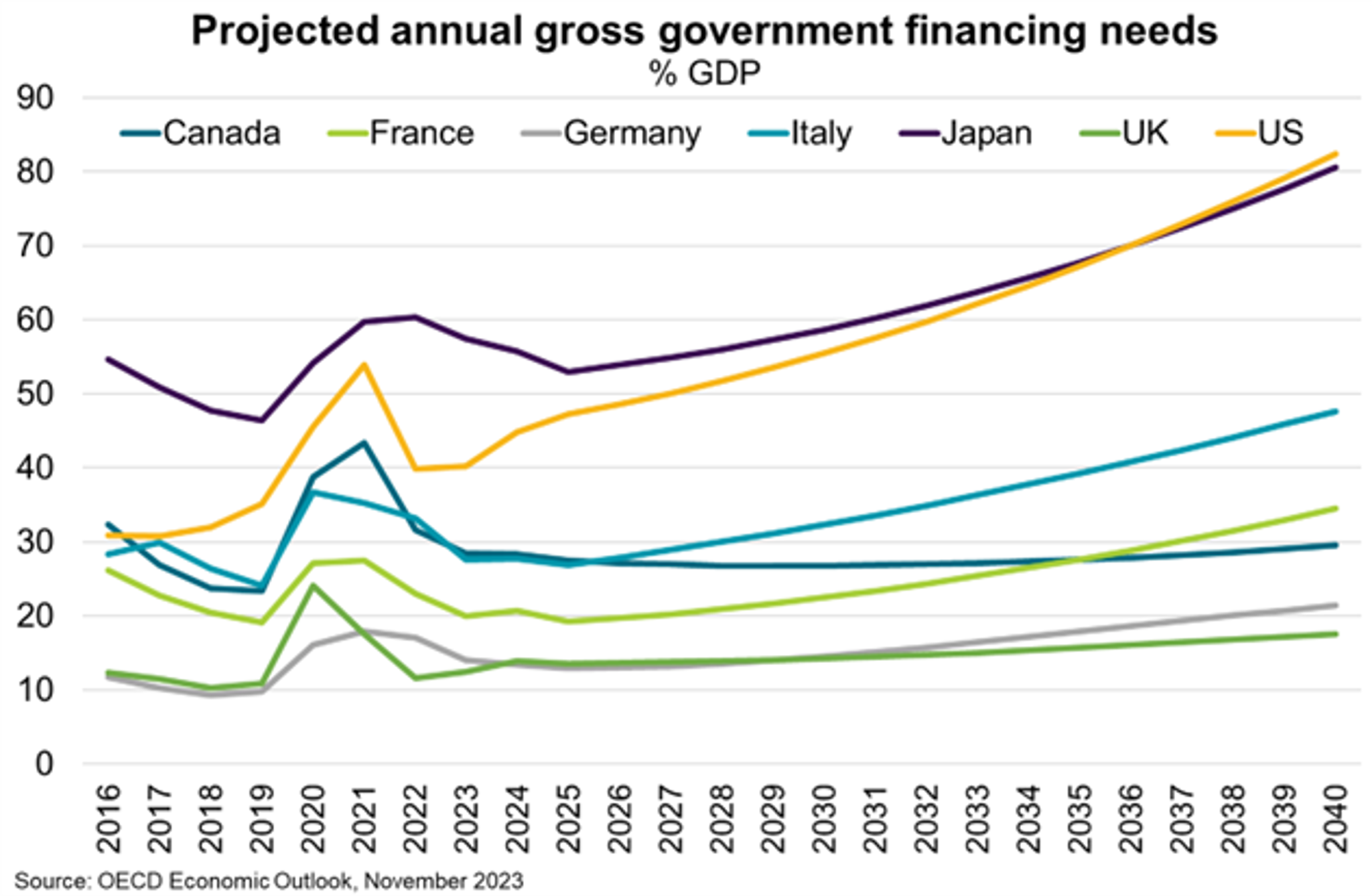

Public financing pressures from record public debt, high interest rates and increasing budget demands

Risks in advanced economies emanate from higher public debt, wider fiscal deficits, higher for longer interest rates and slowing economic growth that will increase government financing needs (Chart). Because governments issued long term debt when rates were low, the IMF forecasts average GDP growth in advanced economies to continue to exceed interest rates on public debt until 2028. But governments must refinance eventually. S&P estimates the annual interest bill for G7 countries will rise to US$1.5 trillion by 2026, from US$905 billion in 2018. Other demands on government budgets are also mounting—amid ageing populations and the need to finance the green transition, defence capabilities and industrial resilience. In a shock-prone world, few countries may have the fiscal space to support their economies.

Social tensions amid inflation pressures, political division, limited fiscal buffers and a record election year

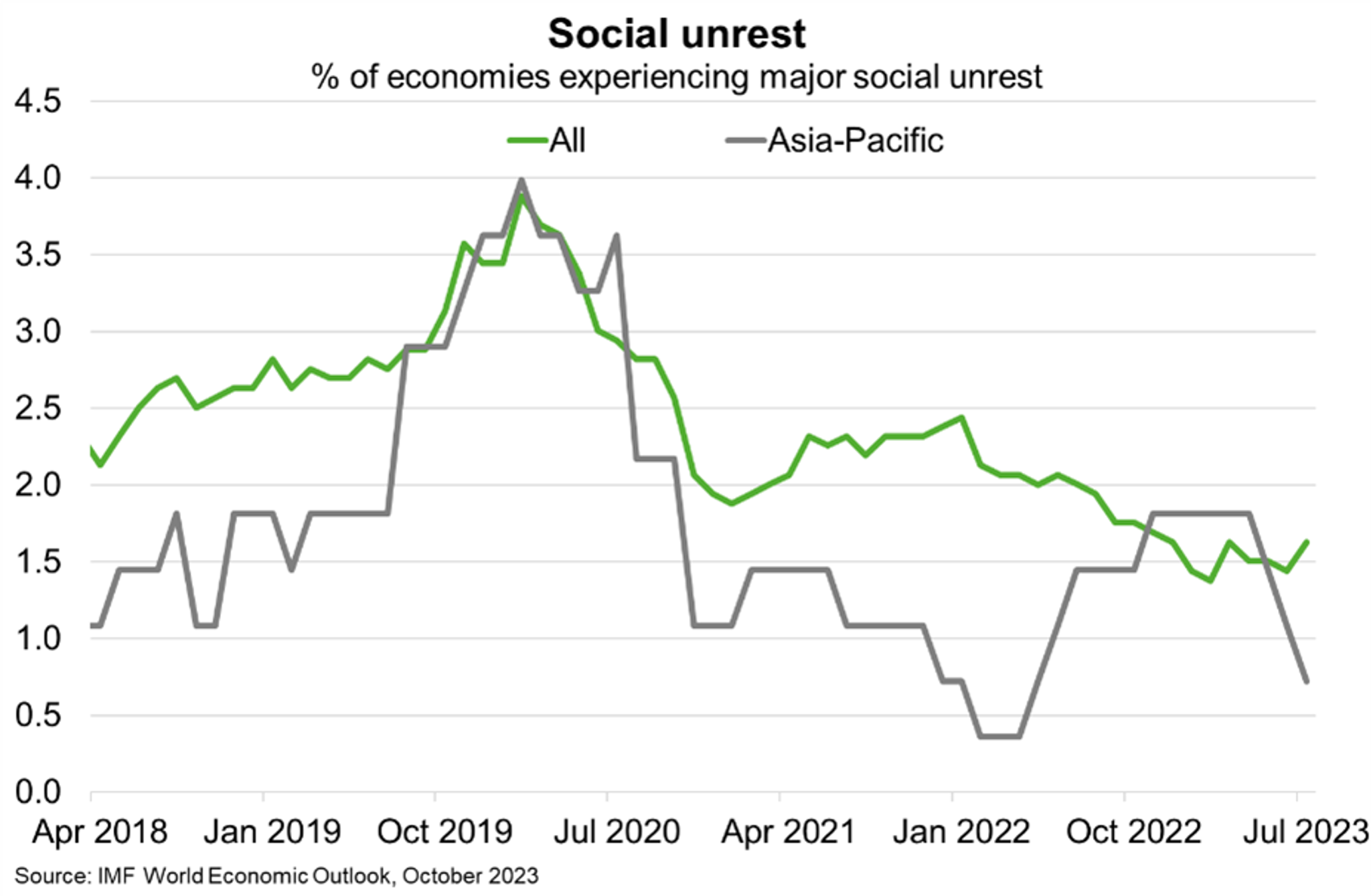

Social unrest has declined since reaching elevated levels in late 2019 (Chart). However, prolonged economic hardship and cost of living pressures could see a resumption of social turmoil, particularly in countries with more limited fiscal space to cushion the impact. Unrest could undermine political and policy stability and the implementation of necessary reforms.

Social and political risks will remain prominent in 2024—a record electoral year. Elections in which all voters can cast a ballot are scheduled in 76 countries next year, home to over half the global population. In democratic countries, elections will decide the next government, test fiscal discipline and potentially prompt substantial public policy changes. Among Australia’s largest export markets, influential elections will occur in South Korea, India, Taiwan, Indonesia and the US and UK. The crowded election outlook will likely keep the Global Economic Policy Uncertainty Index elevated.

Upside risks could improve global growth prospects while also helping with disinflation

More favourable outcomes for the global economy could result from two key transmission mechanisms.

- Inflation falls faster than expected. For instance, if recent OPEC+ oil output cuts are reversed, or continued strong labour force growth and declining job vacancies further ease labour markets and limit cost pressures, thereby reducing the need for further monetary tightening.

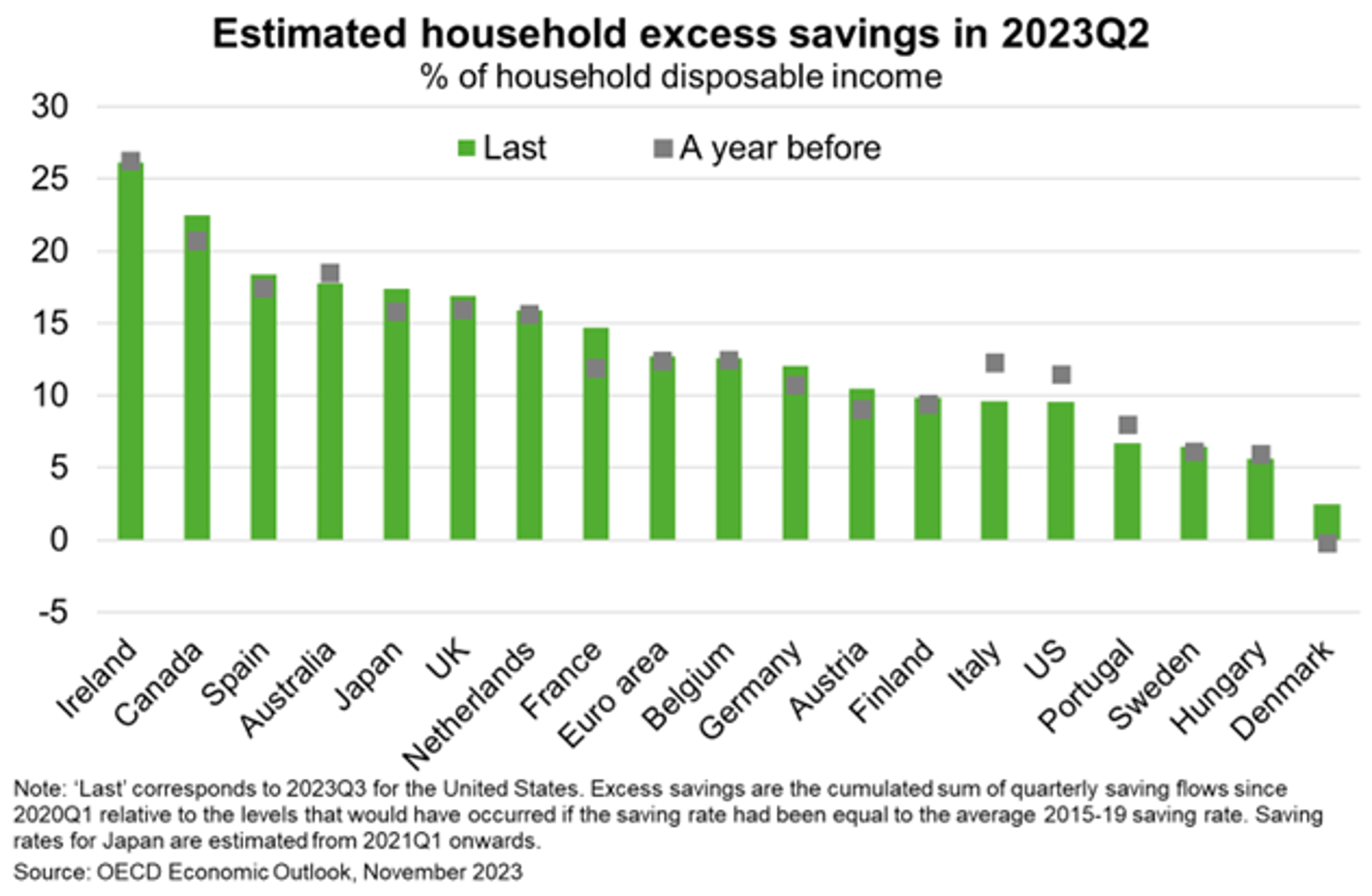

- Domestic demand recovers faster than expected. In many advanced economies, the estimated stock of excess savings accumulated during the pandemic remains high (Chart). To the extent that these savings are drawn down faster than expected, the consumption recovery will be faster than expected. While this would improve global GDP growth outcomes, it would also slow disinflation. Similarly, the US labour market could again prove tighter than expected, supporting more resilient consumption but slower disinflation. Stronger Chinese policy support—particularly if targeted to households—could also bolster the global recovery. As could recent breakthroughs in artificial intelligence and green technologies which could boost productivity and investment.