Australia—Education export rebound boosted by China reopening

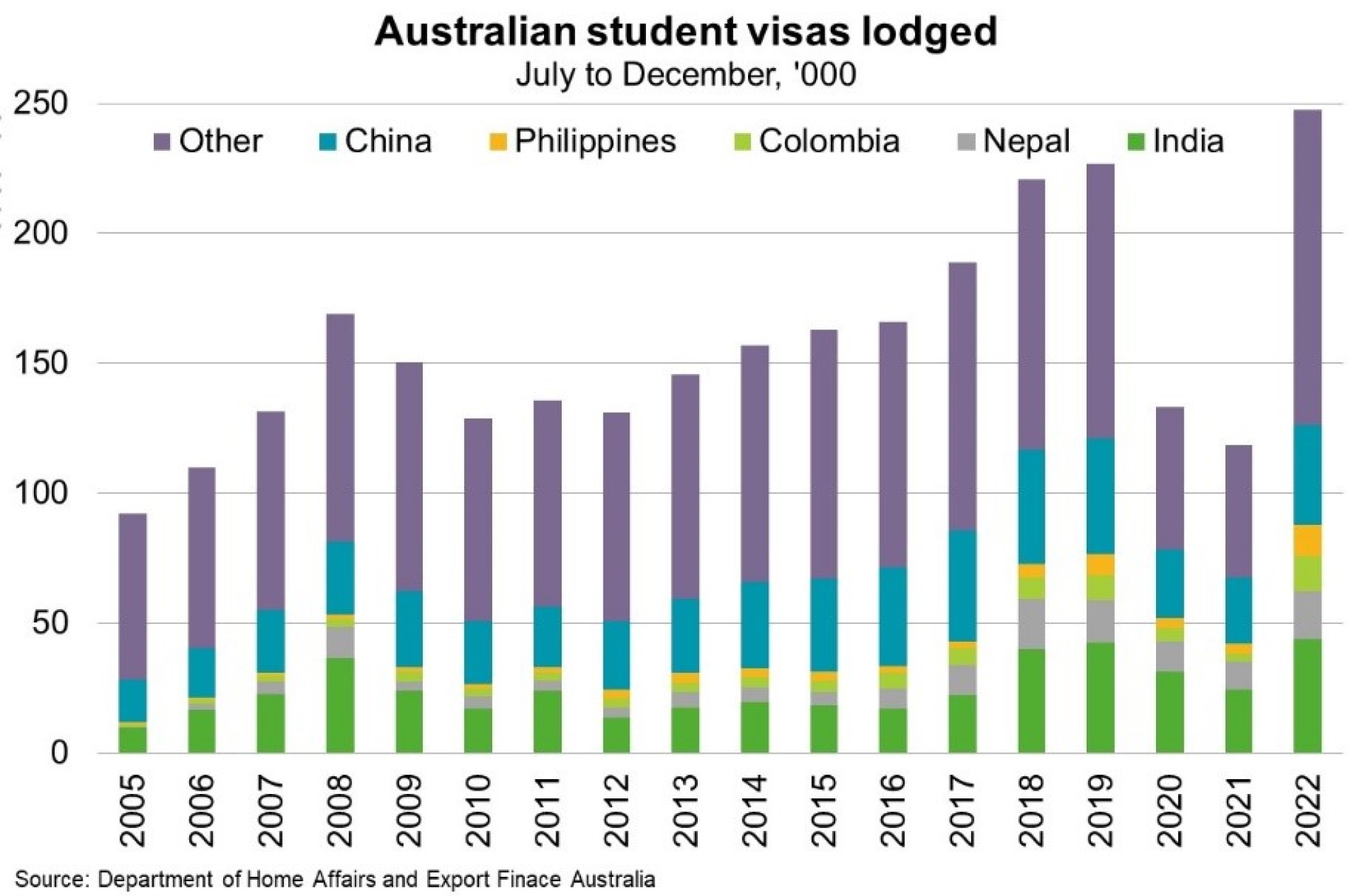

Education related travel was Australia’s fourth largest export in 2019 ($40 billion or 8% of total). While COVID-related restrictions saw education exports fall to $22 billion in 2021, a resurgence is now underway. In the six months to December 2022, 247,000 student visa applications were lodged, up 9% on the same (record) period in 2019 (Chart). A global stock of excess savings, tight labour markets and solid wages growth are supporting global consumption. Meanwhile, a weaker Australian dollar, positive perceptions of Australian safety, heavy discounting of fees, and a healthy domestic job market (with uncapped work hours), are boosting Australia’s competitiveness in the international education market. Demand from Indian students is unprecedented; India comprised the largest source of student visa applications in H2 2022 (43,925), followed by China (38,701), Nepal (18,405), Colombia (13,321) and the Philippines (11,879).

China’s reopening and Beijing’s announcement that degrees from foreign universities will no longer be recognised if they were undertaken online boosts Australia’s service exports outlook. Epidemiologists estimate that at least 80% of China’s population have been infected with COVID-19 since zero-COVID restrictions were suddenly abolished, and business activity is already improving. China’s official services purchasing managers’ index jumped from 41.6 in December to 54.4 in January, the second largest increase on record. Unlike previous recoveries that were driven by investment, China’s current rebound will be led by consumer spending. Households are unusually liquid; amassing a record ¥18 trillion of new bank deposits in 2022, 80% more than in 2021. While many of these deposits are funds reallocated from financial investments and housing, they also owe to increased savings during the pandemic. As Chinese incomes rise in line with a stronger economic recovery, these savings may fuel ‘revenge spending’.