World—Housing slump weighs on economic activity, but risks contained

House prices are typically closely associated with the business cycle. In the boom phase, strong labour markets, credit supply and economic growth boost property demand and prices. This raises household wealth, which in turn boosts consumption, and creates expectations of further price increases, feeding back into even higher demand. Bust phases are characterised by the opposite; property downturns lower investment and pressure household balance sheets, dragging on economic activity and increasing financial contagion. Housing downturns can also lower productivity because property is important collateral for SME loans.

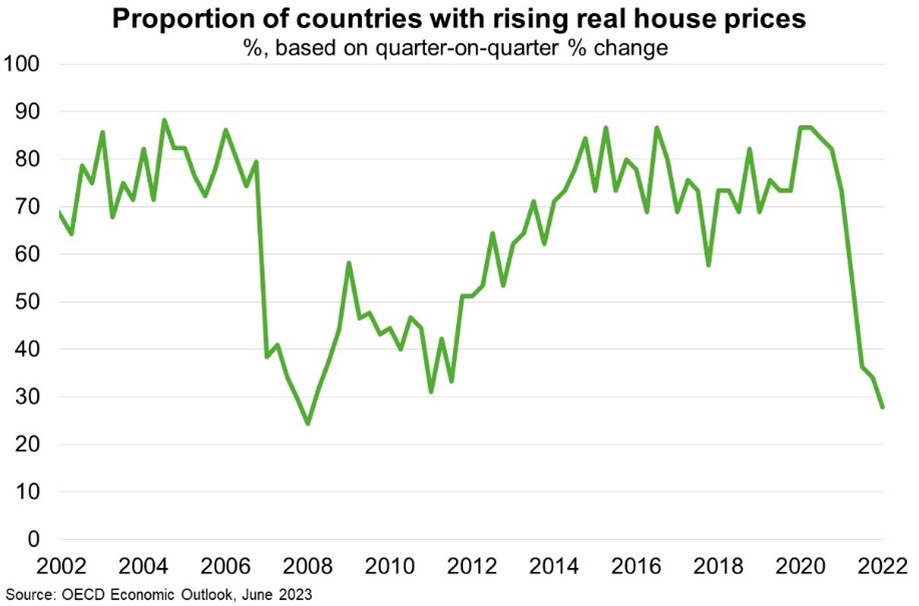

In March 2022, when the US Federal Reserve started raising interest rates, house prices were 41% higher in advanced economies than five years earlier. Since then, rapid monetary policy tightening has made mortgages costlier and slowed global economic activity. House prices are now declining in most economies (Chart) and mortgage delinquency rates are rising. The OECD warns that severe stress in property markets could exacerbate household and corporate solvency risks, leading to large losses for banks. In particular, a fall in commercial real estate prices could weigh heavily on US regional banks given their outsized share of lending to the sector.

That said, given the scale of economic disruption caused by multiple shocks in recent years, house price declines have been relatively muted. Indeed, real global house prices remain well above pre-pandemic levels. This resilience owes to record migration in advanced economies, strong household finances, and changing preferences (favouring larger houses and smaller household sizes). Further, housing markets may be bottoming out. After reaching a record low last year, consumer confidence in advanced economies is rising. A structural shortage of housing also persists. And households still have ‘excess savings’ accumulated during the pandemic. In contrast with previous slumps, lower house prices may spare widespread economic upheaval.