Asia—Elevated borrowing costs increase risk of corporate defaults

Asia is proving the world’s most dynamic region; expected to contribute 70% of global growth this year. But persistent above-target inflation will likely keep interest rates higher for longer. This raises the risk that highly leveraged businesses are unable to service their debts, as rising interest payments exceed earnings.

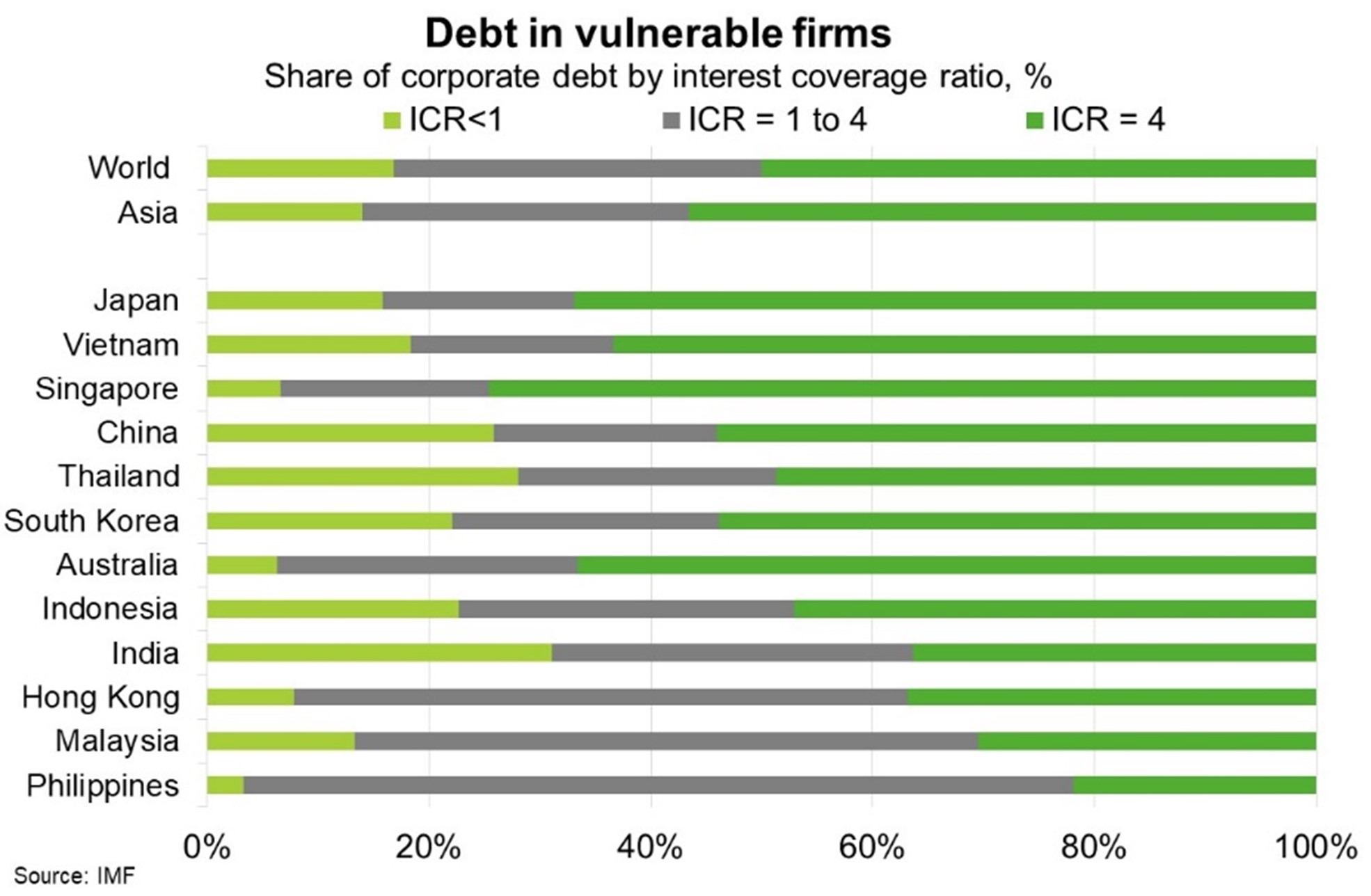

Corporates rapidly increased leverage when interest rates were low. As a result, corporate debt in Asia now exceeds pre-GFC levels. Worse, Asia’s corporate debt is concentrated in businesses with low-interest coverage ratios (ICR, the extent to which corporate earnings cover debt interest payments). According to the IMF, as of mid-2022, 17% of Asia’s corporate debt was held by firms with ICRs below one (Chart), suggesting a higher risk of insolvency. India, Thailand, China and Indonesia had the highest concentrations of corporate debt in firms with ICRs below one. Another third of Asia’s corporate debt was held by firms with ICRs between one and four—concentrated in the Philippines, Malaysia, and Hong Kong. A significant share of Asian firms in the property and construction sector have ICRs close to or below one. Cash buffers can provide temporary reprieve against higher borrowing costs, but in India, Indonesia and Vietnam, the cash holdings of vulnerable firms are particularly low. Moreover, tighter credit conditions could exert significant repayment pressure in Asia given a high share of short-term debt.

The risk of corporate debt distress spilling into systemic economic risk has increased sharply, according to the IMF. And economies in Asia are more likely to be deemed “high risk”. Corporate debt distress could see weaker economic growth, rising unemployment, volatile asset prices and spiking non-performing loans. Such challenges in some of Australia’s largest export markets could increase non-payment risks and weigh on demand for exports.