Asia—Supply chain reconfiguration benefits parts of the region

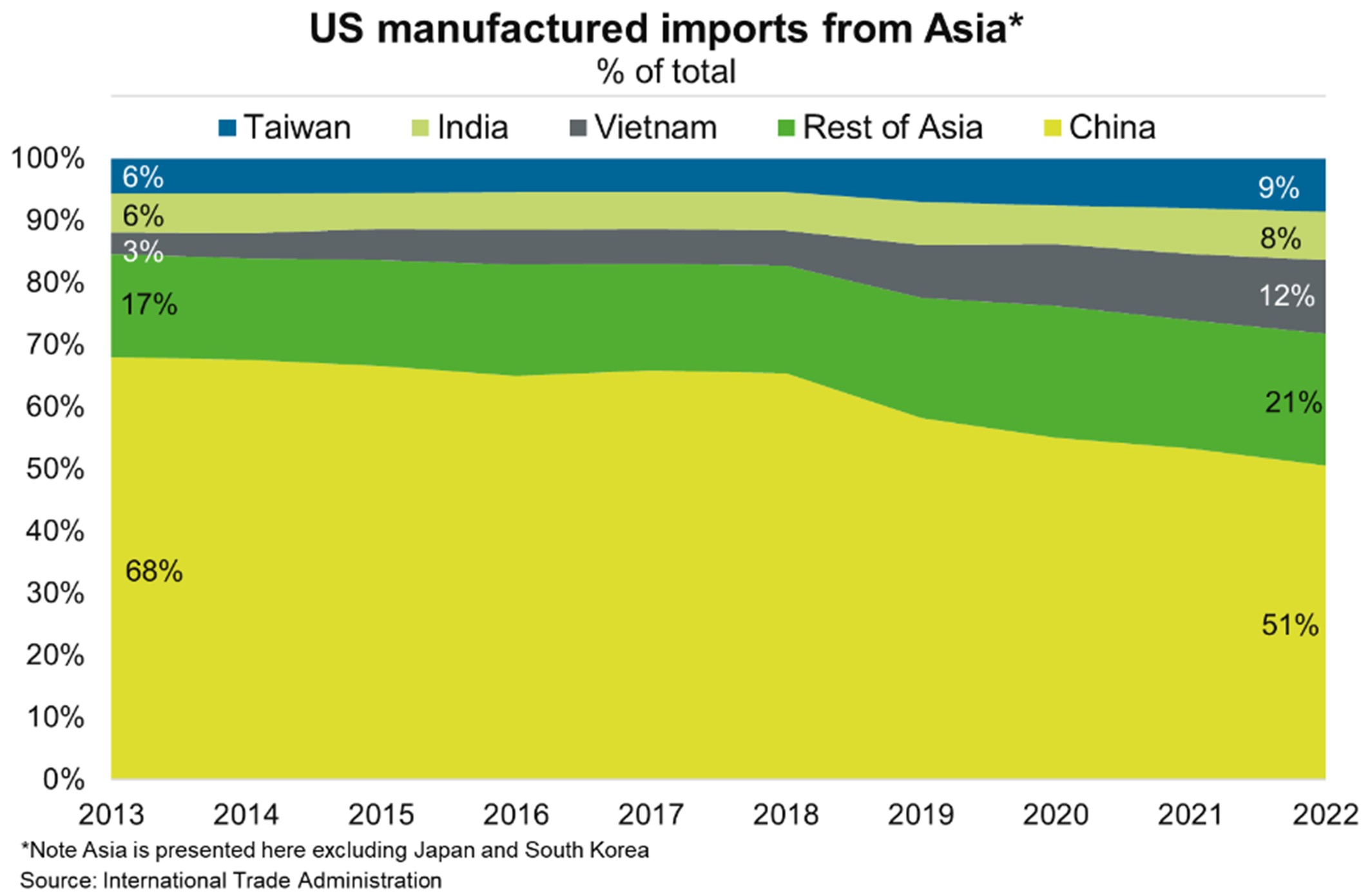

Rising geopolitical tensions and international trade disruptions are driving companies to enhance the resilience of their supply chains. This includes diversifying global supply chains to trusted and reliable suppliers (so-called “friendshoring”) or moving manufacturing production and sourcing inputs closer to end delivery markets (so-called “nearshoring”). Relocation of manufacturing outside of China also reflects ongoing US tariffs on goods and rising labour costs. Chinese goods made up about 50% of US manufactured imports from Asian countries (excluding Japan and South Korea) in 2022, well down from nearly 70% in 2013 (Chart).

The reconfiguration of global manufacturing supply chains is benefitting other Asian countries. Deutsche Bank estimated in 2019 that 95% of the 719 products for which the US relied on China could be supplied from elsewhere in Asia. Indeed, US manufactured imports from Vietnam grew nearly six-fold in the past ten years; as a result, Vietnam has increased its share of US manufactured goods imports from 3% in 2013 to 12% in 2022. India, Taiwan and Malaysia have also contributed a greater share of US imported goods from Asia.

Australian businesses may also diversify their supply chains in Asian manufacturing hubs to help limit risks of production disruptions, increase efficiency and cost competitiveness. At present, Australia relies on ASEAN, India and Taiwan for 22% of all imported goods. Moreover, growing foreign investment in Asia—from Australia, the US and the rest of the world—will help lift economic activity and incomes across the region, supporting already-strong export opportunities for Australian energy and resources, agriculture, education and tourism. This bodes well given the Asian region, outside of China, accounted for over 50% of Australian exports in 2021-22.