GCC—Diversification efforts increase Australian export opportunities

Policymakers in the Gulf Cooperation Council (GCC)—Bahrain, Kuwait, Qatar, Oman, the United Arab Emirates (UAE) and Saudi Arabia—are implementing reforms to diversify their economies away from hydrocarbon production^.

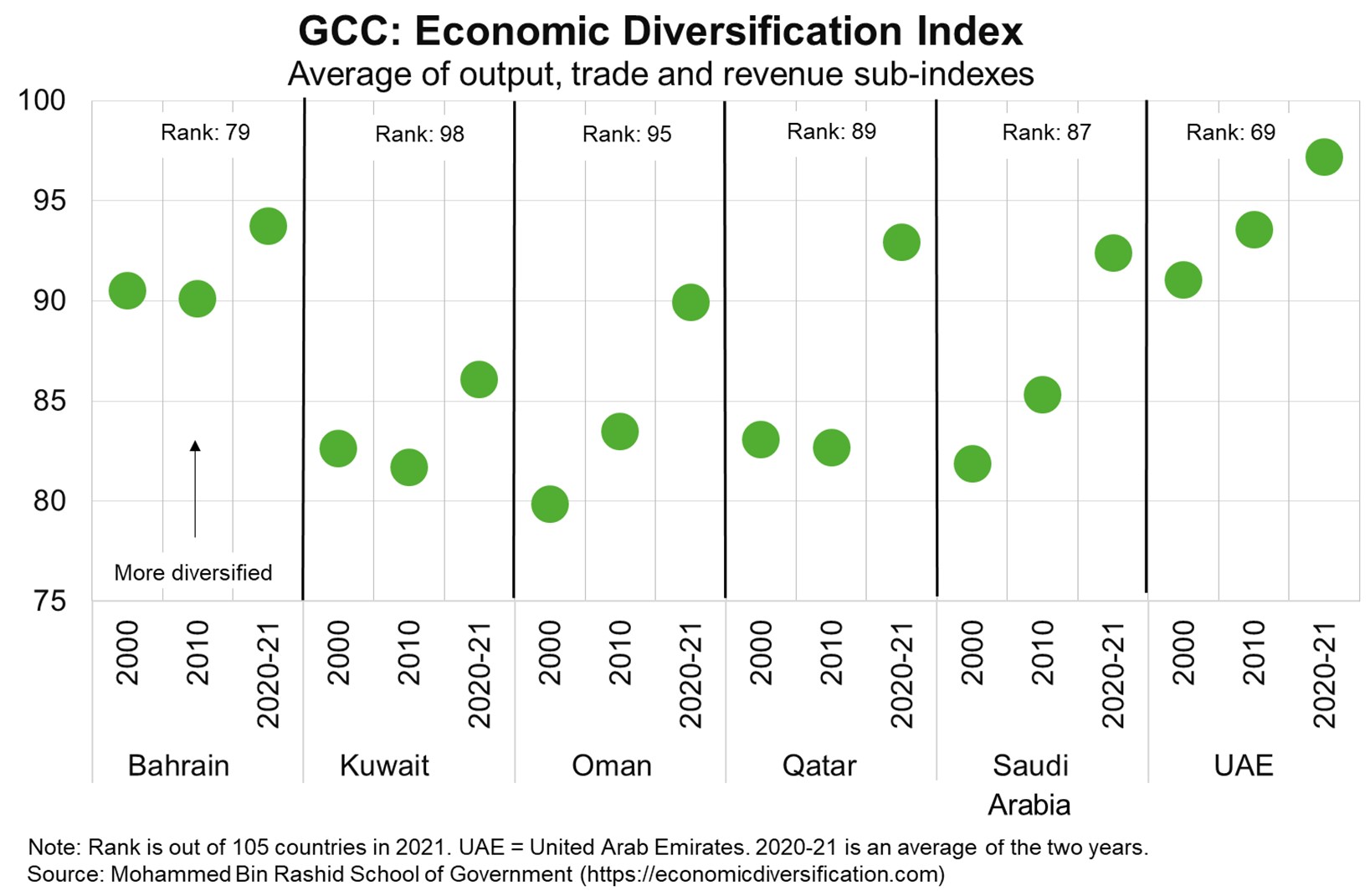

Indeed, GCC countries have improved significantly on the new Global Economic Diversification Index (EDI) since 2010 (Chart). This reflects: a) development of the digital economy, including easing regulations for fintech firms, allowing 100% foreign ownership in some non-oil sectors and increasing investments in new sectors (electric vehicles manufacturing in Saudi Arabia); b) privatisation of state-owned assets to raise government revenues and attract foreign investment; c) plans for new corporate taxes (UAE) and potentially income taxes (Oman) or increases in existing taxes (Saudi Arabia value-added tax) to raise non-oil revenue; and d) labour market reforms like long-term residency and remote visas to enhance labour mobility and attract skilled foreign workers.

Australia’s exports to the GCC are small, at $10.3 billion in 2021-22 (2% of total exports). But the GCC’s push for economic diversification offers increasing opportunities. Demand for higher-quality Australian proteins and grains should rise as economic diversification makes household incomes more resilient to shocks, building on an established agriculture export market. Service operators like engineering consulting, architecture, landscaping, finance and event management could benefit from growing GCC tourism and infrastructure development. Enhanced local education and training should also boost opportunities for Australian education providers.

^ In 2018, hydrocarbon production contributed over 40% of GDP in most GCC economies, except for the UAE (about 30%) and Bahrain (about 20%). Hydrocarbon and related exports accounted for over 90% of total exports in Qatar and Kuwait, over 80% in Saudi Arabia and Oman and over 50% in the UAE. Meanwhile, hydrocarbons accounted for around 70% or more of government revenue in most GCC economies, except for the UAE (about 35%).