China—Cyclical upturn could fade as structural challenges persist

China’s exit from its COVID-zero strategy is helping boost consumption and services activity and will drive an acceleration in real GDP growth to 5.2% in 2023 from 3% in 2022, according to IMF forecasts. But April’s high-frequency indicators missed market expectations, which alongside slowing manufacturing and investment activity, suggests the cyclical upturn is losing steam. Even retail sales—an economic bright spot—rose less than expected in April, and youth unemployment increased to a record 20.4% suggesting slower consumer spending ahead.

Growth will be slower in the coming decade than previously, reflecting a few key trends. First, a declining working-age population reduces income and economic output. China’s population peaked in 2022 and was recently overtaken by India’s. Policies to raise China’s birth rates appear insufficient to reverse the declining trend; the UN expects China’s working-age population could fall by nearly one-quarter, to some 700 million, by mid-century. Second, after decades of rapid investment in houses, roads and railways, spending on infrastructure now faces diminishing returns. Third, productivity growth is slowing. State-owned enterprises and banks have built up high levels of debt and face lower returns on assets relative to private firms—suggesting funds for China’s economic development are being allocated to less productive firms. Moreover, geopolitical tensions are prompting foreign investors to diversify their supply chains to other countries and US bans on exporting key technologies to Chinese firms may slow innovation.

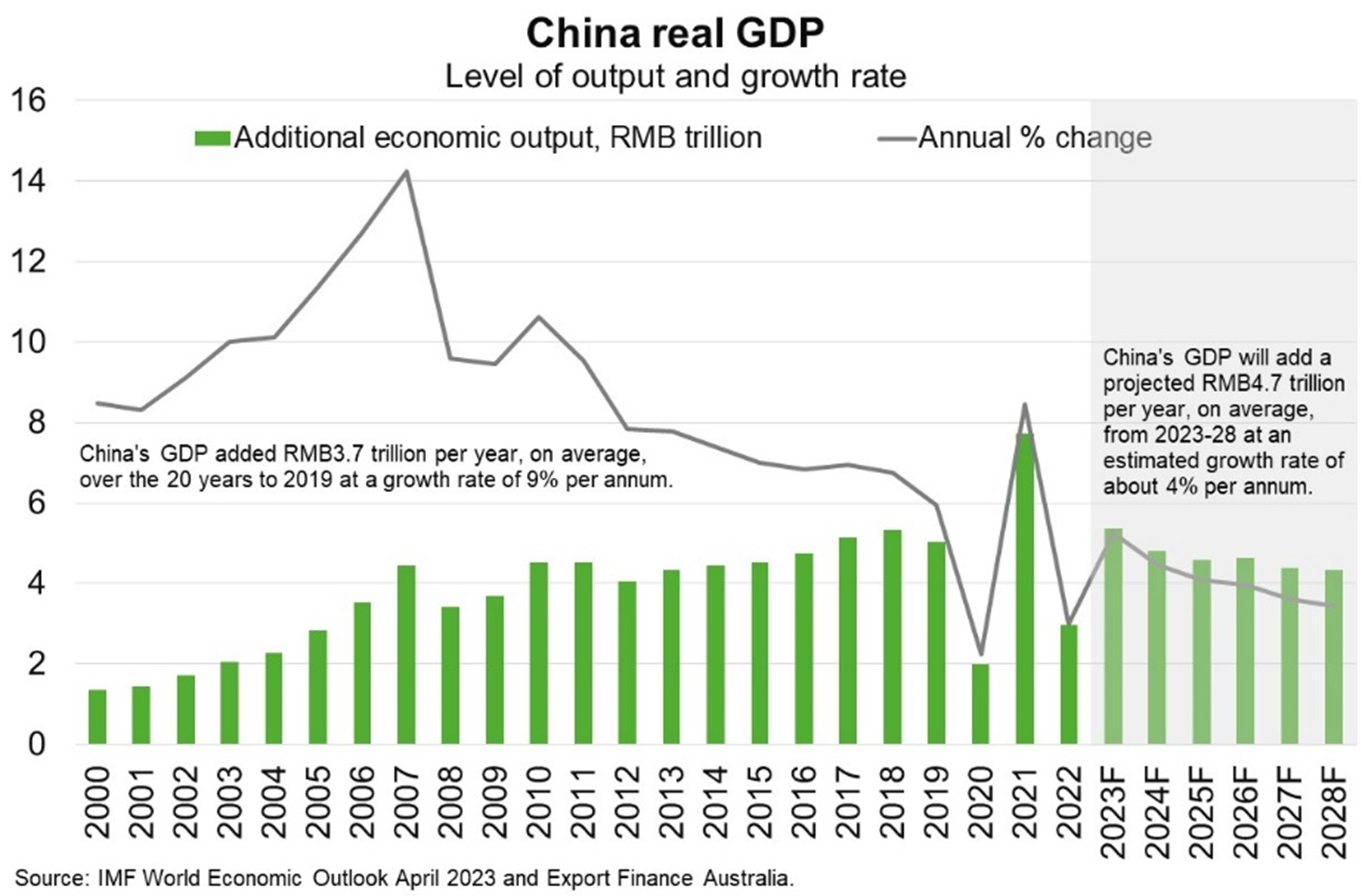

Without reforms to lift labour supply, enhance productivity and reduce financial vulnerabilities, the IMF estimates annual Chinese GDP growth will fall below 4% from 2027 (from an average 9% over the 20 years to 2019). That said, given the economy’s increased size, additional economic output generated each year would still outperform the historical average, creating new opportunities for Australian exporters (Chart).