World—Economic recovery resilient but slow, with persistent risks

The global economy proved more resilient than expected in the first half of 2023. Indeed, new IMF forecasts are increasingly consistent with a ‘soft landing’, where unprecedented global monetary tightening sees inflation decelerate (from 8.7% in 2022 to 5.8% in 2024) without recession. Labour markets in advanced economies are slowing but remain buoyant, with historically low unemployment supporting economic activity.

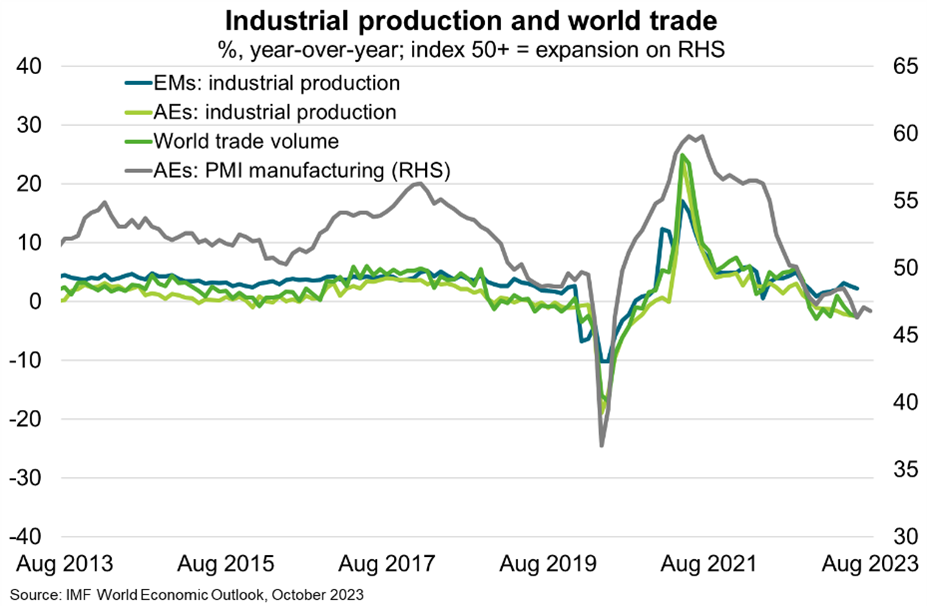

That said, the economic rebound is fading (Chart). This reflects diminishing pandemic-era savings, the slowing catch-up in services (including travel) and persistent manufacturing slowdown. The IMF forecasts global GDP growth will fall from 3.5% in 2022 to 3.0% in 2023 and 2.9% in 2024, well below the historical (2000-2019) annual average of 3.8%. Medium term growth forecasts are at their lowest in decades, at 3.1% per annum. By 2028, the global economy is expected to be 5.0% smaller than was forecast prior to COVID-19, equivalent to US$6.4 trillion. Meanwhile, world trade growth is forecast to decline from 5.1% in 2022 to 0.9% in 2023 and 3.5% in 2024, well below the historical average of 4.9%. Underperformance reflects weaker global demand, shifting consumption toward domestic services, the effects of USD appreciation, and rising trade barriers.

Risks to the global economy remain manifold. Commodity prices could become more volatile amid the ongoing El Nino phenomenon and geopolitical shocks, particularly in the Middle East. The IMF estimate that a 30% rise in oil prices could reduce global GDP by 0.5% and raise inflation by 1.3 percentage points. China’s economy could slow further if Beijing’s policy response fails to preserve financial stability by supporting the property sector, with Asian and commodity-producing economies hardest hit. Tight labour markets and wage demands could contribute to persistent inflation. Last, higher-for-longer interest rates could lead to a surge in corporate, household and sovereign defaults.