Australia—World net zero path underpins demand for critical minerals

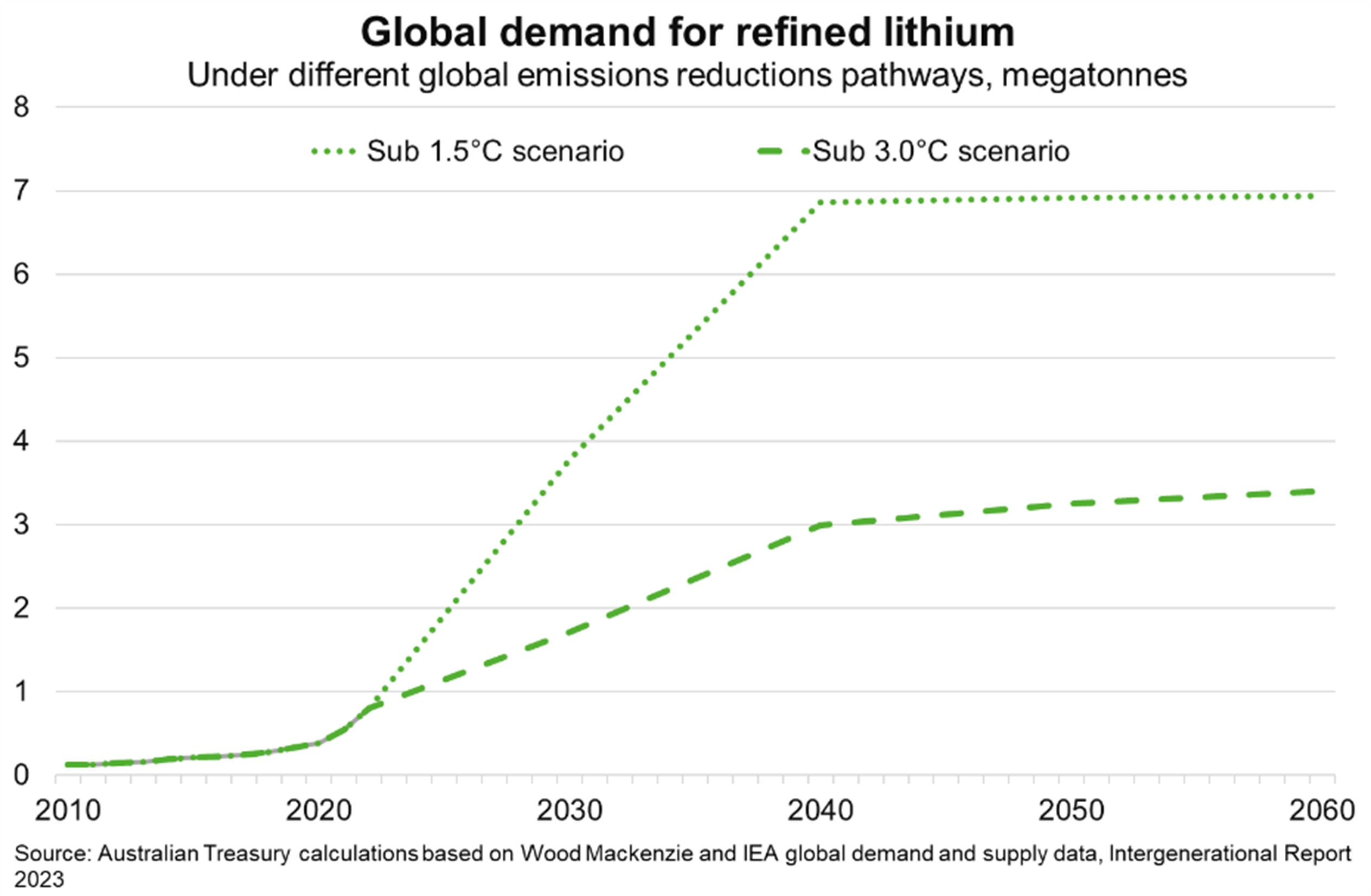

Australia’s 2023 Intergenerational Report highlights significant potential for minerals exports, particularly critical minerals. To meet the world’s net zero by 2050 emissions goals, global demand for critical minerals needs to increase by around 350% between today and 2040, according to the International Energy Agency (IEA). Meanwhile, global demand for lithium could be eight times higher in 40 years’ time if actions limit temperature increases to 1.5 degrees Celsius. Even if such actions are less effective, global demand for lithium is projected to quadruple (Chart).

As the world’s largest producer of lithium, Australian exporters are well positioned to facilitate this demand. Indeed, Australia produces 9 of the 10 minerals used in lithium-ion batteries1, and has projects seeking to develop refineries for the tenth (graphite). Australia also has high geological potential in critical minerals, and the potential to find undiscovered deposits, considering around 80% of the country’s land mass has been under-explored. New clean energy technology exports could also present significant opportunities for Australia.

By contrast, carbon-intensive exporters face growing challenges as the global energy transition continues. The IEA now sees global demand for coal, oil and gas peaking in the 2020s due to a rise in renewable technologies, increasing electrification of ground transport and a shift in major economies, including China, away from coal. Prices and volumes of Australia’s thermal coal exports have begun to decline: indeed Australia’s thermal coal exports are forecast to drop sharply to around $38 billion in 2023-24 and $30 billion in 2024-25, from $64 billion in 2022-23. Meanwhile, exports of clean energy metals and minerals are poised to remain over $40 billion over the next two years, having doubled since 2021-22.

1This includes lithium, nickel, cobalt, manganese, alumina, tin, tantalum, magnesium and vanadium.