© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

China—Property and consumer troubles raise Australian exports risk

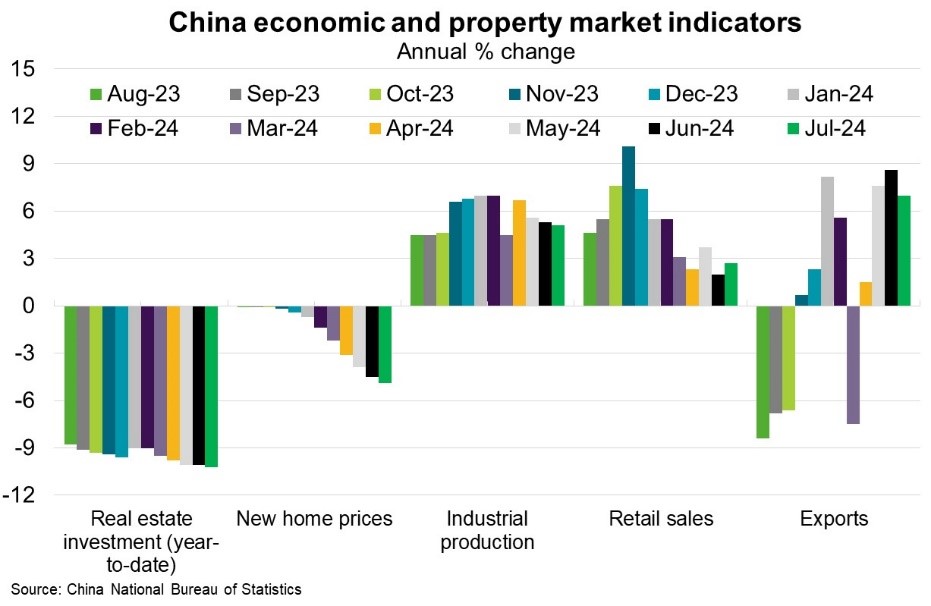

China’s worsening property slump, slowing industrial production and sluggish consumption, leave exports as the primary driver of growth (Chart). Declining house and equity prices and high youth unemployment are squeezing incomes, household wealth and consumer demand.

- China’s Shanghai Composite Indexhas fallen around 10% over the past 12 months and 25% over the past three years, while new home prices fell 4.9% from a year earlier in July—the sharpest drop since June 2015—following a 4.5% slide in June.

- The youth unemployment rate hit 17.1% in July, up from 13.2% in June.

These factors are contributing to an underutilised services sector, which at 50% of GDP is well below the average of 75% of advanced economies. Risks are also rising that manufacturing and exports could lose steam, given increasing trade barriers on Chinese companies from the US and Europe. Beijing’s past fiscal and monetary easing has yet to materially lift business and consumer confidence, putting this year’s 5% growth target at risk.

As China’s economic challenges rise, so too does the outlook for Australian exports. The trend of rising resources and energy exports, which contributed to record Australian exports to China in 2023, is likely to fade. Iron ore prices have fallen about one-third since January to around US$100 per tonne, amid weakening Chinese steel demand and ample supply. Steel production fell 9% year-over-year in July, steel margins have remained negative since mid-April 2024, and iron ore inventories at Chinese ports are high and rising. 2024 has also seen greater market access for Australian wine and meat products while recovering outbound Chinese travel has lifted demand for Australian education and tourism. But in the absence of more aggressive policy support measures from Beijing, these discretionary exports are vulnerable to faltering Chinese consumer demand ahead.