© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

GCC—Reforms and investment support diversification efforts

Policymakers in the Gulf Cooperation Council (GCC)—Bahrain, Kuwait, Qatar, Oman, the United Arab Emirates (UAE) and Saudi Arabia—are implementing reforms to create a more attractive business environment for investors. For instance, Saudi Arabia’s new civil code aims to make it easier for foreign companies to navigate the judicial system. Building on this, Saudi authorities have updated an investment law, to be implemented in 2025, that introduces protections for foreign investors, including easier and quicker transfer of funds within or outside the country and simpler project registration processes.

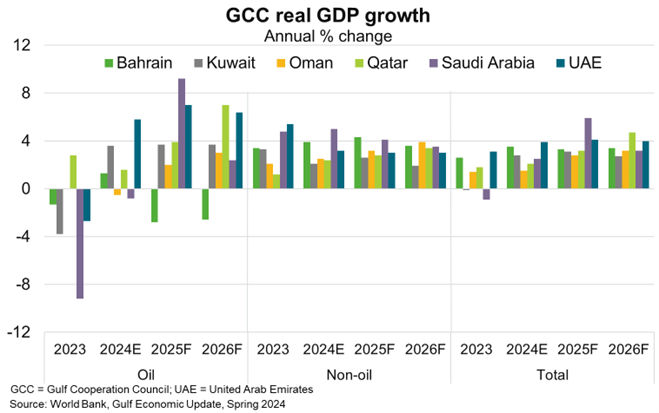

Reforms are bearing fruit, as rising investment helps GCC economies diversify away from volatile hydrocarbon production. Qatar’s hosting of the 2022 World Cup has accelerated its economic diversification, as massive public infrastructure investment since 2011 helped build ports, roads, rail and airports, a trend that is poised to continue. Saudi Arabia is on a path of lifting net foreign direct investment inflows above US$100 billion by 2030 (nearly 6% of GDP) from a low US$20 billion in 2023. As a result, more resilient non-oil sectors are poised to drive GCC economic growth (Chart).

Australia’s exports to the GCC are small, at $9.3 billion in 2023, and have maintained a relatively steady share of 1.5% of total exports over the five years to 2023. But the GCC’s push for economic diversification offers increasing opportunities for Australian exporters, particularly for services. Firms in engineering, architecture, landscaping, finance and event management could benefit from growing GCC infrastructure development and tourism. The GCC’s focus on advancing local skills to grow the region’s workforce should also boost opportunities for Australian education providers. Negotiations on a potential free trade agreement between Australia and the UAE, which commenced in December 2023, could further boost exports to the UAE and wider region.