© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Philippines—Economic growth resilient as geopolitical risks persist

The Philippines economy is growing steadily in the face of a challenging global economic backdrop, benefitting from strong government spending, particularly on infrastructure. First-half GDP growth averaged 6%, putting the economy on track to meet authorities’ full-year 2024 growth target of 6%-7%. Lower borrowing costs should further support growth, after the Philippines central bank cut interest rates by 25 basis points to 6.25% in August. Fiscal support is also forthcoming following approval of the 2025 financial year budget, which forecasts a 10% uplift in expenditure on 2024. The proposed budget continues to fund the implementation of the Philippine Development Plan (PDP) 2023-2028, which is focused on increasing spending on infrastructure in the Build Better More program, education and healthcare. The government is also committed to raising investment in clean energy technologies under its new Philippine Energy Plan 2023-2050, a positive for Australia’s critical minerals exports and renewable energy partnerships.

Downside risks to the outlook are prominent, especially the potential for a sharper slowdown in major export markets, such as the US, and ever-present climate risks. Recent incidents in the South China Sea have also heightened geopolitical tensions and raise risks of a disruption in foreign trade; an estimated 21% of global trade transits through the South China Sea. However, absent major shocks, a large and youthful population and increasing public investment bolsters long term growth potential. The IMF forecasts GDP growth of 6.3% per annum, on average, over the next five years.

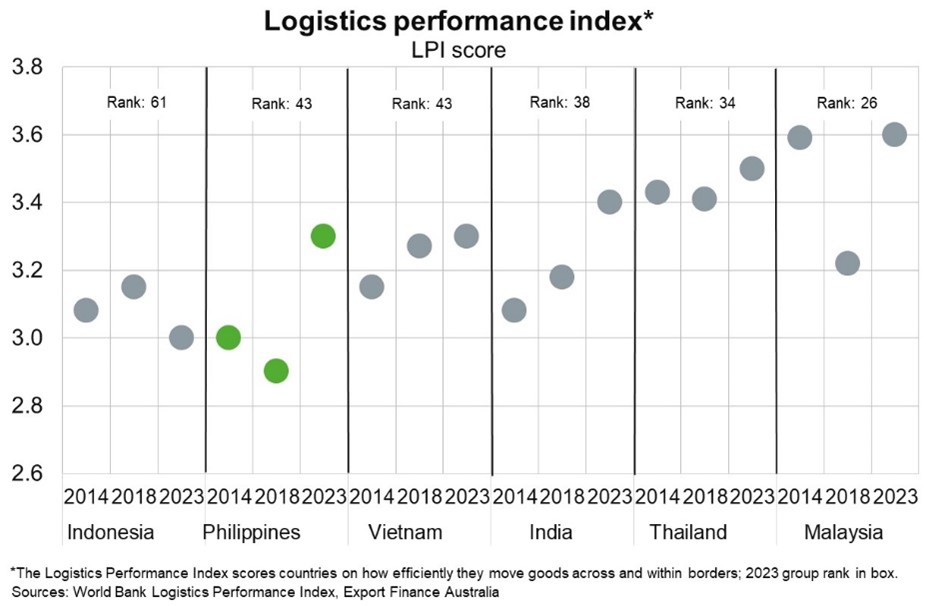

Strong infrastructure investment over the past five years has helped improve the business climate (Chart), providing benefits to Australian exporters. Goods and services exports to the Philippines have more than doubled from $3.1 billion in 2018 to $7.6 billion 2023, now becoming Australia’s 15th largest export market (18th in 2018).