© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

World—Prolonged financial turbulence could undermine ‘soft landing’

Global financial markets saw significant turbulence this month. On August 5, the VIX index—which measures the market’s expectations for volatility—hit levels seen only during the COVID-19 pandemic and Lehman Brothers collapse in 2008. Japan’s benchmark index fell 12% that day, its biggest one-day drop since 1987, while the tech-dominated NASDAQ index fell 13% from its peak in mid-July. The selloff reflected a combination of factors—waning enthusiasm for artificial intelligence, monetary tightening by the Bank of Japan, and geopolitical uncertainties in the Middle East—exacerbated by an unexpectedly weak US jobs report that stoked fears of recession in the world’s largest economy. Markets calmed quickly; by mid-August the NASDAQ had recovered to July levels. But risks will persist given stocks remain historically expensive relative to firms’ underlying earnings.

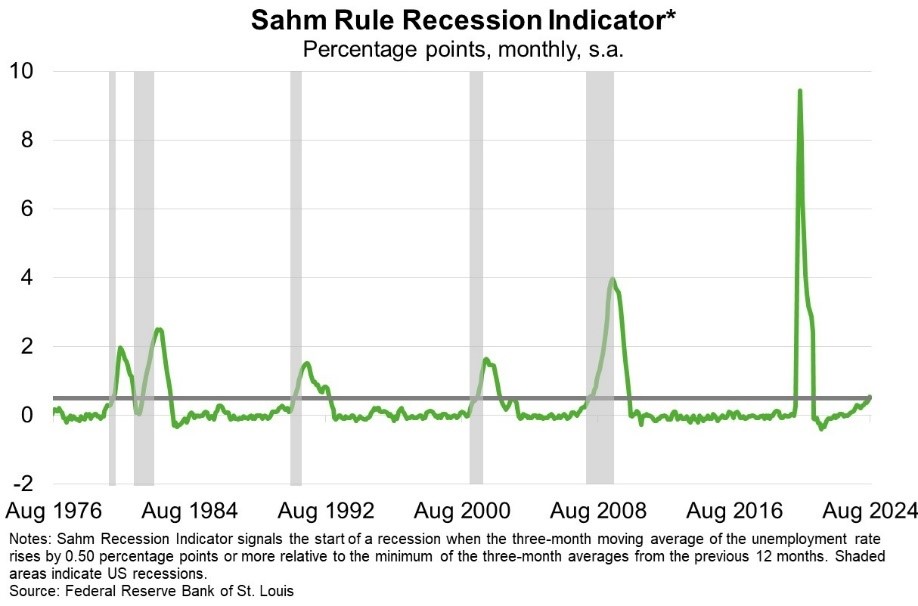

Renewed financial volatility could become self-fulfilling and trigger an economic downturn; given falling stock markets weigh on household consumption and business investment. But for now, the assumed ‘soft landing’—where inflation returns to target without a recession—remains intact. The US unemployment rate has risen from a record low of 3.4% in April 2023 to 4.3% in July—the magnitude of which has historically accompanied a recession (Chart). However, during this cycle, the uptick reflects a loosening of the extraordinarily tight labour market following COVID-19 and high labour force participation rates. Resilient labour markets have fostered continued strong employment and wages growth. Retail sales and the US Federal Reserve’s weekly economic index remain steady as inflation improves. Annual US headline inflation fell to 2.9% in July, increasing expectations for interest rate cuts from September. More broadly, about a quarter of OECD countries have reduced inflation to central banks’ targets of 2% or below. The expected soft landing supports export conditions, absent renewed financial volatility.