China—Record imports from Australia, but economic headwinds mount

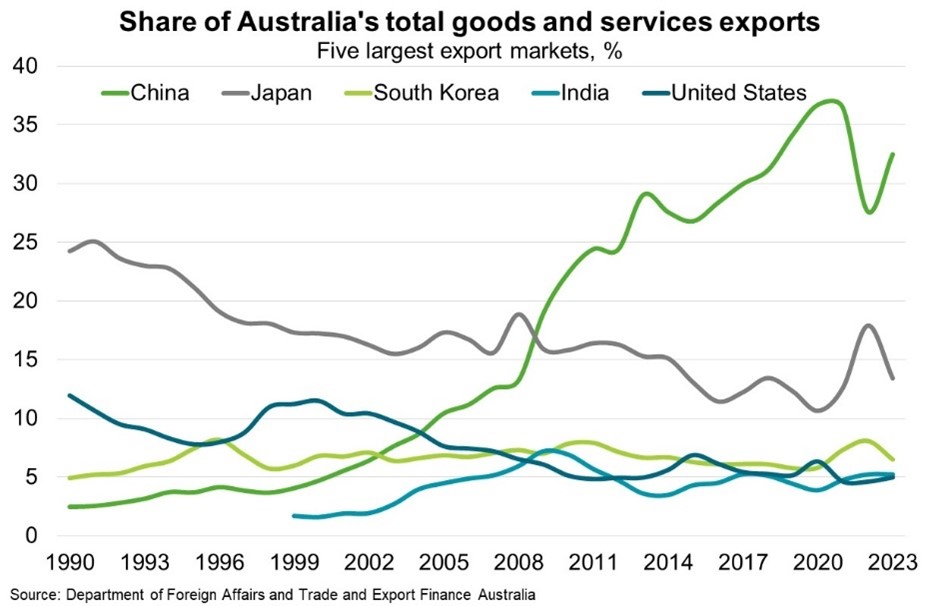

Australia’s exports to China rose 18% to a record $219 billion in 2023, or 32% of total exports (Chart) driven by strong resources export volumes and commodity prices. Indeed, iron ore accounted for almost 60% of Australian goods exports to China over the year to May 2024. Services exports to China—concentrated in tourism and education—are improving but are yet to return to pre-pandemic levels. While tourism remains significantly behind, education exports were 91% of the 2019 level in 2023.

The progressive removal of trade disruptive measures imposed by China in 2020 will see local industries increasingly benefit from renewed access to the China market. For instance, wine exports to China reached $228 million in the two months following the removal of bottled wine duties—almost four times the value of wine exports to China in 2021, 2022 and 2023 combined. Only live rock lobsters remain subject to the trade restrictions since 2020, which targeted a number of Australian agricultural and mineral products.

However, China’s economic growth fell to 4.7% year-over-year in Q2, lower than expected and down from 5.3% in Q1. Recent IMF forecasts suggest economic growth will continue to decelerate, from 5% in 2024 to 4.5% in 2025 and 3.3% by 2029, amid a declining population and slowing productivity growth. Weak consumer confidence and retail sales pose headwinds for Australian services exports while China’s property overhang will weigh on demand for commodities. New home prices slid 4.5% year-over-year in June—the steepest drop in nine years—despite support measures announced in May. That said, the Communist Party’s third plenum communique emphasised the need to resolve risks in the property sector and local government debt. It also reaffirmed a strategic focus on substantial state-directed investments into high-tech manufacturing capabilities that have driven recent rapid export growth. This should support some Chinese imports of Australian commodities, assuming China’s continued access to global markets.