France—Political stalemate increases risk of EU financial stress

France’s snap parliamentary election resulted in no political group securing an absolute majority. Formation of a new government will likely entail lengthy negotiations and governance will remain fragile given substantial differences in the ideologies and economic policies of major political parties. Absent viable prospects to form a coalition government, President Macron may nominate a technocratic cabinet until new elections can be called in July 2025 (or earlier if Macron resigns). Either way, more political fragmentation will likely increase policy uncertainty and reduce reform prospects.

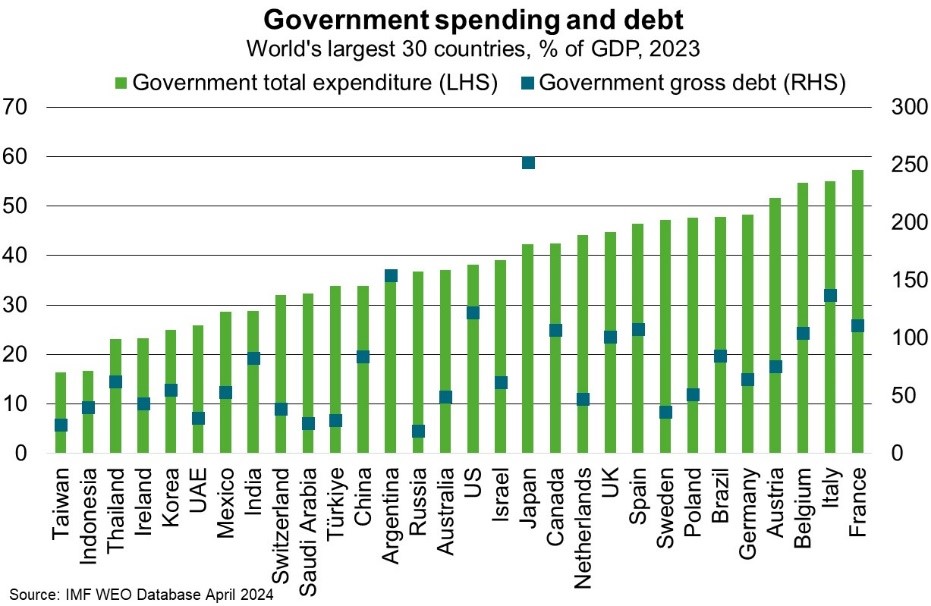

Amid record government spending (Chart), the European Commission recommends “excessive deficit procedures” against France to bring the budget deficit within the European Union’s 3% of GDP limit. However, left-wing coalition New Popular Front (NFP), which won the most seats in parliament, favours substantially higher government spending and minimum wages, repealing pension reforms, and price freezes for basic goods. Macron’s centrist Ensemble coalition, which won the second most seats in parliament, aims to reduce the fiscal deficit from 5.5% of GDP in 2023 to below 3% by 2027. However, any coalition government will likely struggle to implement fiscal austerity measures.

This risks a spike in French borrowing costs and contagion to other euro area markets. The broader region’s underlying budget dynamics are increasing investors’ concerns. Borrowing needs are high and ongoing spending pressures arise from defence amid Russia’s invasion of Ukraine, pensions and health amid ageing populations, and decarbonisation. Budget deficits are also likely to remain larger than pre-pandemic levels, as many COVID-related support measures remain in place. High debt levels and lax fiscal policies make the euro area vulnerable to shocks, especially given weak productivity and other structural headwinds to growth. This challenges Australian exports to the EU, which were worth $25.5 billion or 3.8% of total exports in 2023.