India — Bond inclusion to boost capital inflows and economic growth

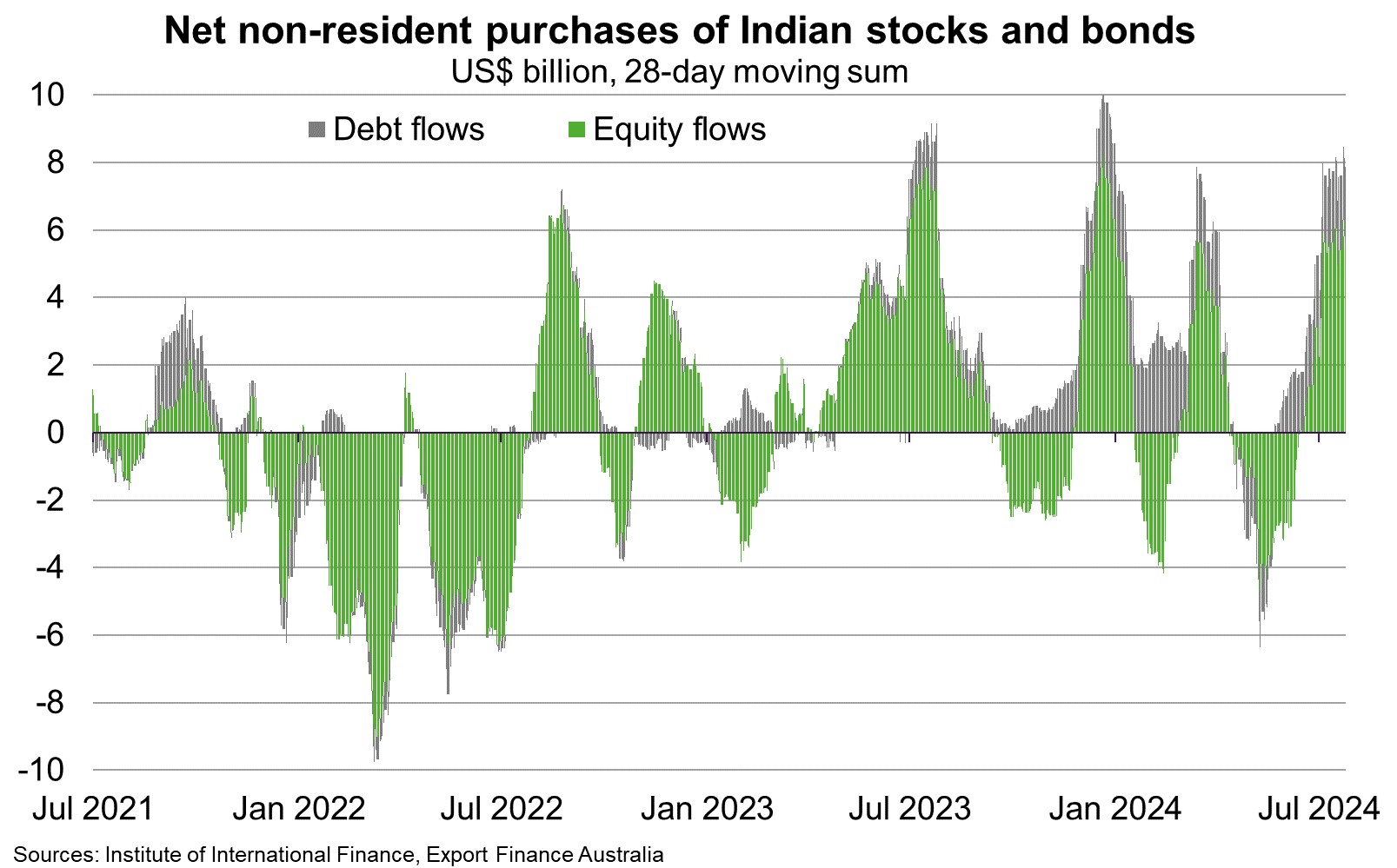

The inclusion of India’s sovereign bonds into the JP Morgan Emerging Market Index on June 28, after its announcement in September 2023, is helping boost foreign capital inflows into India. Over the past 10 months, India has seen foreign inflows of about US$15 billion (0.4% of GDP) into its bond market, compared to US$8.5 billion in all of 2023 and an outflow of US$2 billion in 2022 (Chart). Growing demand for Indian bonds should, over time, help lower government borrowing costs and thereby ease high public debt servicing costs. This, in turn, should support the government’s plans to increase spending on physical infrastructure and social needs, a positive for Australian exporters. Greater foreign participation in India’s bond market could also allow domestic banks to reduce their holdings of Indian government debt (which is above their prescribed limits) and allow them to lend more to households and businesses.

India’s equity market is also increasingly attractive amid robust economic fundamentals. The IMF now expects India’s economy to expand 7% in 2024, up from 6.8% forecast in April, in part because of stronger consumer spending in rural areas. Robust corporate earnings, election results that reinforced broad policy continuity, and a young and growing population are also drawing investors into Indian equites; the MSCI India index has risen more than 90% since the start of 2021 to become the fourth largest stock market in the world by market capitalisation. India’s relative economic and financial stability has made it a viable investment alternative to China, where the Shanghai Composite index has fallen 17% since 2021. The growing global presence of India’s stock and bond markets can enhance investors’ confidence, boost wealth for households and businesses and, in turn, drive greater domestic consumption and investment in Australia’s fourth largest export market.