US — Economic resilience delays monetary easing as trade risks rise

US economic activity remains solid. The OECD expects real GDP growth to rise to 2.6% in 2024, an upward revision of 0.5 ppts between February and May forecasts. Job gains remain strong and the unemployment rate remains low, supporting consumer spending. Amid robust economic momentum, inflation has eased but remains elevated, at 3.3% year-over-year in May. As such, while the Bank of Canada and the European Central Bank became the first major central banks to cut interest rates this month, the Federal Reserve’s median projection now implies a single rate cut this year, down from three implied in March. The IMF forecasts GDP growth to moderate to 1.9% in 2025, but annual average growth is still expected to outpace all other major advanced economies over the five years to 2029.

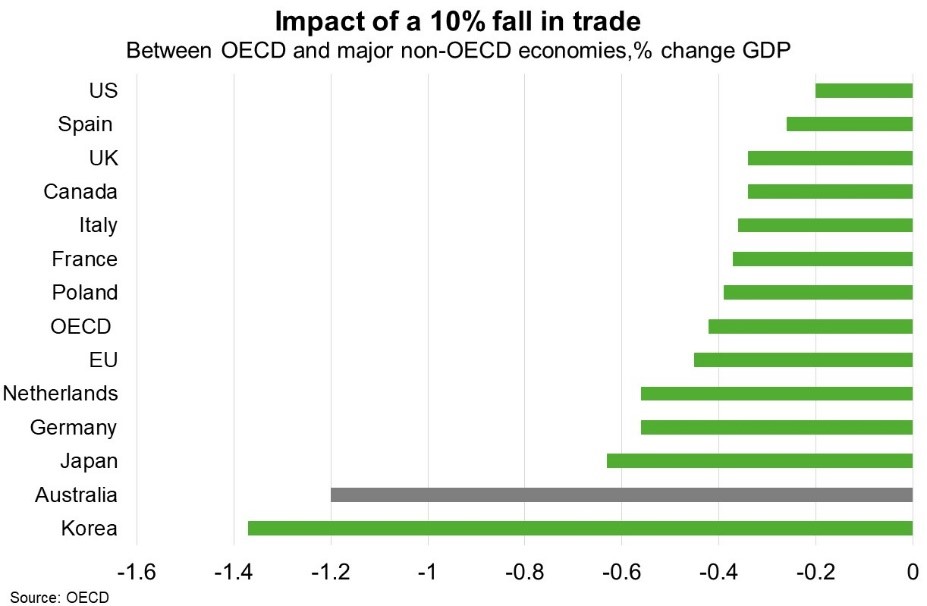

That said, large budget deficits and high debt imply the need for sustained fiscal consolidation. The Congressional Budget Office estimates that under current policies, public debt will rise from 99% of GDP in 2024 to 166% of GDP in 2054. If re-elected in November, Donald Trump has promised additional tariffs, of 60% against Chinese goods and 10% against goods from all other countries. It remains unclear whether this would be on top of President Biden’s recent tariffs on China, including a 100% tariff on electric vehicles. Heightened geopolitical and trade tensions present downside risks to growth. OECD research suggests Australia would be disproportionately impacted by a 10% reduction in bilateral trade flows between major economies, largely due to the decrease in trade with China, with a loss of 1.2% of GDP (Chart). This reflects the importance of China as Australia’s largest trading partner and key export market for Australian resource exports.