Global — Trade accelerating but geopolitical tensions remain a threat

Global trade growth is poised to pick up in 2024 and 2025 alongside steady economic growth as easing inflation and eventual reductions in interest rates boost consumption and demand for manufactured goods. The OECD forecasts global trade in goods and services to rise 2.3% in 2024 and 3.3% in 2025, compared to just 1% in 2023 (but still well below the historical average of 4.9%). The World Trade Organisation expects Asia to contribute 45% of all growth in world exports and over 80% of all growth in world imports in 2024. This is positive for Australian exporters, given Asia takes more than 80% of our goods and services.

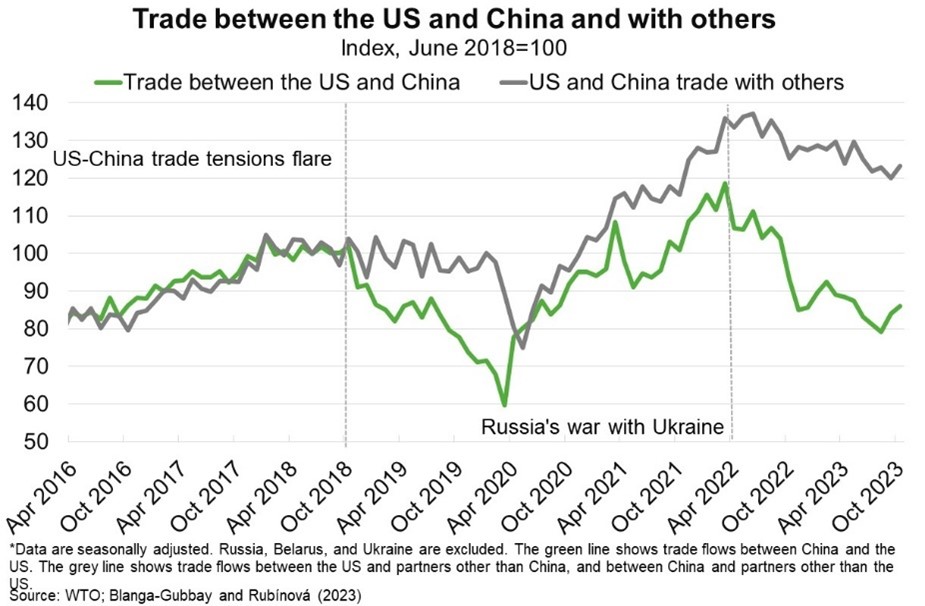

But global trade faces significant headwinds, most notably from regional geopolitical conflicts that could add to energy costs, disrupt global trade routes and slow global growth. Particularly, food and energy prices could again surge if Red Sea shipping disruptions and Middle East tensions escalate; some sectors, such as autos and fertilisers have already faced shipping delays and sharply higher freight costs. Trade reorienting along geopolitical lines is also increasing geoeconomic fragmentation. For instance, bilateral trade between the US and China has grown 30% less than their trade with the rest of the world since trade tensions flared in 2018 (Chart). IMF research suggests that intensified geoeconomic fragmentation could reduce investment flows, slow the pace of innovation and technology adoption, and constrain the flow of commodities across fragmented blocs, resulting in large output losses and commodity price volatility. In addition, protectionist economic policies have risen, as governments focus on national security, supply chain resilience and support for domestic industries; new trade restrictions have more than tripled since 2019. Most recently, the US raised tariffs on around US$18 billion of Chinese imports. If these trends persist, global trade could be lower than forecast, hitting export-oriented economies in Asia (and Australia).